DAILY MORNING NOTE | 15 August 2022

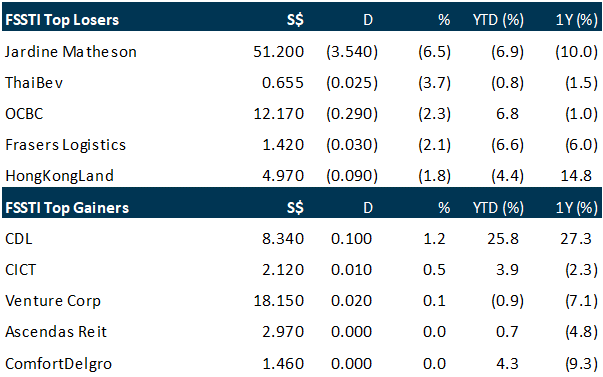

Markets went topsy-turvy again as doubt returned on the second day after the release of cooler-than-expected US inflation data, leading the Straits Times Index (STI) to fall 1 per cent on last Friday (Aug 12), erasing the week’s gains. This time, it was on sentiment, including that of Federal Reserve officials, that the US central bank is unlikely to pivot from its hawkish interest rate hikes despite softening inflation data. The STI closed 32.69 points lower at 3,269.27. Among STI constituents, the biggest losers for the day were Jardine Matheson, which tumbled 6.5 per cent to US$51.20, and Thai Beverage, which fell 3.7 per cent to S$0.655. The trio of local banks all ended down, with OCBC losing the most, closing 2.3 per cent lower at S$12.17. DBS lost 0.4 per cent to S$33.35, while UOB fell 0.3 per cent to S$27.32. Only 3 constituent stocks managed to post gains – City Developments Limited, CapitaLand Integrated Commercial Trust and Venture Corporation, which closed 1.2 per cent, 0.5 per cent and 0.1 per cent higher, respectively.

Wall Street closed higher on last Friday (Aug 12) as signs that inflation may have peaked in July increased investor confidence that a bull market could be under way and spurred the S&P 500 and the Nasdaq to post their fourth straight week of gains. The S&P 500 is up 17.7 per cent from a mid-June low, with the latest gains coming from data this week showing a slower-than-expected rise in the consumer price index and a surprise drop in producer prices last month. The S&P 500 crossed a closely watched technical level of 4,231 points, indicating the benchmark index has recouped half its losses since tumbling from the all-time peak in January. A 50 per cent retracement for some signals a bull market. The Dow Jones Industrial Average rose 424.38 points, or 1.3 per cent, to 33,761.05, while the S&P 500 gained 72.88 points, or 1.7 per cent, to 4,280.15 and the Nasdaq Composite added 267.27 points, or 2.1 per cent, to 13,047.19.

SG

Straits Trading has declared a special dividend, distributing either ESR shares or Straits Trading shares to entitled shareholders. This special dividend comes after a strong H1 2022 results driven by the divestment of ARA Asset Management to ESR Group. The divestment value was recognised at S$1.1 billion, an internal rate of return of 18.2 per cent or 3.7 times equity multiple of the original cost of investment. Entitled shareholders may elect to receive 145 ESR shares or 180 new Straits Trading shares for every 1,000 Straits Trading shares owned. The distribution rate is about S$0.50 per share based on the HK$19.86 closing price of ESR shares on Aug 12. Shareholders will have to approve the distribution in an extraordinary general meeting which will be convened. Shares of Straits Trading last closed up 1.3 per cent or S$0.04 to S$3.06 last Friday (Aug 12).

Q&M Dental reported a 45 per cent drop in H1 2022 earnings to S$9.8 million from S$17.8 million due to lower revenue. Revenue for the period fell 4 per cent to S$90.9 million from S$94.6 million the year prior, due to 28 per cent lower revenue contribution from the medical laboratory and dental equipment & supplies segment. This was partially offset by a 2 per cent increase in revenue from dental and medical clinics. “The revenue contributions from other business segment was significantly impacted by the opening up of the economy and the relaxation of Covid-19 management measures for travellers,” said Dr Ng Chin Siau, chief executive officer, Q&M Dental. Q&M Dental plans to continue to expand its dental clinics in Singapore as well as its team of dentists. Similarly, the company aim to continue expanding its dental clinics in Malaysia, with the limiting factor of an increasingly tight labour market. Regionally, Q&M is also looking to open more dental clinics in South-east Asia, depending on available opportunities, pertinent market conditions and the evolving Covid-19 situation. Shares of Q&M Dental closed down 2 per cent or S$0.01 to S$0.48 on Friday (Aug 12).

Union Gas has reported revenue of $68.3 million for 1HFY2022, up 11.6%, due to higher prices. However, the company says it did not pass on higher costs incurred to its customers in a bid to retain customers and gain market share. As such, earnings for the same period was down 83% y-o-y to $2.4 million. The company plans to pay an interim dividend of 0.2 cent per share, equivalent to a payout ratio of 26% of its 1HFY2022 earnings. The company is optimistic that its industry prospects remain positive due to the essential nature of its business as well as the potential to further exploit opportunities within the LPG supply chain of which it has full control ranging from procurement to retailing. The company says remains on the lookout for further diversification and strategic opportunities to expand into complementary businesses both locally and overseas. Union Gas shares closed at 67 cents, down 1.47% last Friday (12 Aug).

US

The dollar rallied on last Friday (Aug 12) but was set for a weekly drop as traders weighed improving US inflation data against comments from Federal Reserve officials who cautioned that the battle against rising prices was far from over. US import prices declined for the first time in 7 months in July on lower costs for both fuel and non-fuel products, data showed on Friday, in the third report during the week to hint that inflation may have topped out. Another 2 key inflation measures, for consumer prices and producer prices, cooled in July, data showed, prompting traders to pare back views that the Fed will raise interest rates by 75 basis points for a third consecutive time when it meets in September. After 4 straight down days, including a more than 1 per cent drop on Wednesday, the dollar rallied against its major rivals on Friday, but was still on track for a decline of around 0.84 for the week. The greenback’s turnaround followed a steady drumbeat from Fed officials who made clear they would continue to tighten. Traders were pricing in around a 42.5 per cent chance of a 75 bps Fed rate hike in September and a 57.5 per cent chance of 50 bps. The dollar was up 0.39 per cent against Japan’s currency, with the greenback at 133.495 yen.

Oil prices plunged around 2 per cent last Friday (Aug 12), on expectations that supply disruptions in the US Gulf of Mexico would be short-term, while recession fears clouded the demand outlook. Futures, however, were still on track for a weekly gain. Brent crude futures fell US$1.45, or 1.5 per cent, to settle at US$98.15 a barrel, while US West Texas Intermediate (WTI) crude fell US$2.25, or 2.4 per cent, to settle at US$92.09 a barrel. Both contracts gained more than 2 per cent last Thursday.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

CapitaLand Investment Limited – Fee-related business support revenue

Recommendation: Accumulate (Maintained), Last done: S$3.87

TP: S$4.12, Analyst: Glenn Thum

• 1H22 revenue of S$1,354mn (+29% YoY) was in line, forming 50% of our forecast.

• RE investment revenue grew 44% YoY, driven by a broad-based recovery. Fee-related revenue was up 9% YoY, lifted by PE fund management (+15%) and lodging management (+37%).

• Maintain ACCUMULATE with an unchanged SOTP TP of S$4.12. Our FY22e estimates remain unchanged. The pick-up in travel and lifting of lockdowns in China are immediate catalysts for CLI.

Thai Beverage PLC – Recovery except for spirits

Recommendation: BUY (Upgraded); TP S$0.80, Last close: S$0.655; Analyst Paul Chew

• Results are in line, with 9M22 revenue and EBITDA at 77%/76% of our FY22e forecasts.

• Spirits volumes contracted 14% YoY and margins were weaker. Beer recovered on both volume and price increases.

• We upgrade to a BUY with an unchanged target price of S$0.80 due to recent share price weakness. Our target is pegged at 18x FY22e earnings, its 5-year average. No change to our FY22e forecast. The re-opening of entertainment venues in Thailand on 1 Jun22 and softer commodity prices should support earnings in 4Q22. Separately, the company announced the deferment of the BeerCo spin-off due to challenging market conditions.

PropNex Ltd – Strength from revenue diversity

Recommendation: NEUTRAL (Maintained); TP S$1.74, Last close: S$1.67; Analyst Paul Chew

• 1H22 revenue and PATMI were within expectations at 62%/62% of our FY22e forecast. We expect further weakness in earnings, especially from new project revenue.

• Rental was the fastest growing segment in 2Q22, rising 23% YoY, followed by HDB. Project marketing revenue fell 29% YoY due to a decline in new launches.

• We maintain our FY22e forecast. Our expectations are a further decline in earnings in 2H22 due to a lagged revenue recognition from limited project marketing sales in 1H22 of around 1,548 units. New launches planned in 2H22 are expected to pick up to 5,183 units. Rising HDB prices and interest rates may lead to some additional tightening measures. We worry the current TDSR stress test interest rate of 3.5% may be raised. Without a BTO supply lever to dampen prices, other direct intervention by HDB is also possible. Our FY22e target price of S$1.74 and NEUTRAL recommendation is maintained.

HRnetGroup Limited – Faster growth outside Singapore

Recommendation: BUY (Maintained); TP S$1.18, Last close: S$0.79; Analyst Paul Chew

• Results were within expectations. 1H22 revenue and PATMI was 51%/48% of our FY22e forecast. 1H22 PATMI grew 12% YoY to S$32.6mn, excluding fair value losses and one-off reversal of trade accruals.

• Revenue growth of 14% was from both permanent recruitment (+19% YoY) and flexible staffing (+13% YoY). Maiden interim DPS of 3 cents was announced.

• Growth in 1H22 was a mixture of pricing and volumes driven by a 30% revenue growth in Rest of Asia. Expanding the franchise outside Singapore is a key growth driver. Rest of Asia is now 40% of revenue from 28% in FY20. We maintain our FY22e forecast. Our BUY recommendation and target price of S$1.18 is maintained, 12x PE FY22e ex-cash. Flexible staffing demand is driven by new geographies.

Upcoming Webinars

Guest Presentation by First REIT

Date: 18 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3BqQe3q

Guest Presentation by Audience Analytics

Date: 23 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3P3eBYR

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Guest Presentation by Marathon Digital Holdings

Date: 26 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by Halcyon Agri Corporation Limited [NEW]

Date: 31 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3pjErMM

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Research Videos

Weekly Market Outlook: AirBnb, Apple, Amazon, DBS, OCBC, First Sponsors, Starhub, SG Weekly & More

Date: 8 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials