DAILY MORNING NOTE | 15 July 2022

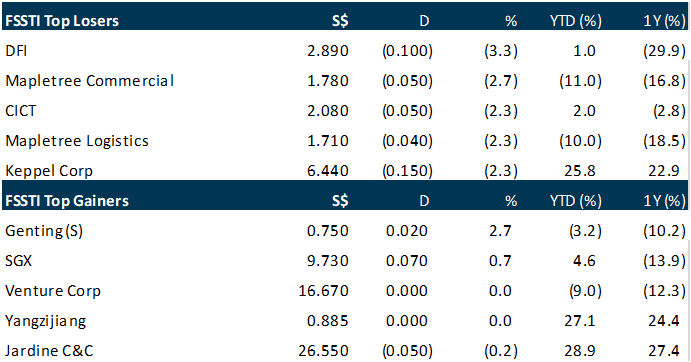

Singapore stocks extended losses into Thursday (July 14) on yet another off-cycle monetary tightening move this year, with the city state having recorded slower-than-expected economic growth. The Straits Times Index (STI) tumbled 1.2 per cent or 38.06 points to 3,090.63 at the closing bell. Losers beat gainers 297 to 180 in the broader market, with 987.7 million securities worth S$935.4 million changing hands. In an unscheduled tightening move, the Monetary Authority of Singapore (MAS) upped its full-year inflation forecast for 2022, on the back of expectation that overall inflationary pressures “will remain elevated in the months ahead”. Regional indices delivered a mixed response to the grim US inflation report late Wednesday, in which consumer prices surged to a 40-year high of 9.1 per cent. The Shenzhen component index was up 0.75 per cent, the Jakarta Composite Index closed 0.72 per cent higher, while the Japan’s Nikkei index and Kuala Lumpur Composite Index each climbed 0.62 per cent.

Wall Street stocks finished mostly lower on Thursday following another troubling inflation report as disappointing banking earnings set a downcast tone about the second-quarter earnings season. For the second day in a row, US indices tumbled after data showed an acceleration in wholesale prices instead of the hoped-for moderation. But markets rallied somewhat from session lows as some investors grabbed a bargain-hunting opportunity. The Dow Jones Industrial Average lost 0.5 per cent, or about 140 points, to finish at 30,630.17 after falling more than 600 points earlier in the day. The broad-based S&P 500 dropped 0.3 per cent to 3,790.38, while the tech-rich Nasdaq Composite Index edged up less than 0.1 per cent to 11,251.19. The Labor Department reported that US producer prices rose 1.1 per cent, topping expectations, on a 10 percent surge in energy prices, more than double the increase in May.

SG

Jardine Cycle & Carriage has made an unconditional voluntary take-over offer for the nearly 10 per cent stakes it does not already own in Malaysia-listed Cycle & Carriage Bintang at RM2.70 a share. Currently, the Singapore-listed offeror holds about 89.994 per cent of Cycle & Carriage Bintang, a Mercedes-Benz dealer listed on Bursa that operates 11 outlets for retail vehicles and provides after-sales services in Malaysia. The offer at RM2.70 a share would translate to RM27.2 million for the stakes Jardine Cycle & Carriage wants to acquire, said the investment holding company in a bourse filing on Thursday (Jul 14). The offer, not conditional upon the receipt of any minimum level of valid acceptances, will be funded by internal resources and/or external borrowings. It is not expected to have a material impact on the net tangible assets or earnings per share of Jardine Cycle & Carriage group. Jardine Cycle & Carriage shares closed S$0.05 lower at S$26.55 on Thursday, while Cycle & Carriage Bintang shares dropped 1.5 per cent to RM2.56, before the offer was announced.

InnoTek issued a profit guidance for its financial performance for the first half of FY2022 to June, as higher operating costs and customers’ operations disrupted by Covid-19 prevention measures hit its bottom line. The precision metal components firm stated it would likely report a net loss when it releases its financial results in mid-August, according to a bourse filing on Thursday (Jul 14). InnoTek attributed the loss to soaring costs of labour and manufacturing, as well as higher cost of raw materials due to disruptions to the global supply chain. It also said its turnover was hit by a drop in demand from its major customers operating in China, as the country imposed movement restrictions to stamp out Covid-19. InnoTek shares rose 3 per cent or S$0.015 to S$0.52 on Thursday, before the announcement.

Mainboard-listed Pavillon Holdings has been asked to hold an extraordinary general meeting (EGM) for the purpose of ousting the executive chairman and an independent director from the board. Previously named Thai Village Holdings, the company said in a bourse filing on Thursday (Jul 14) that a letter from Seven Star Capital, signed off by Zheng Fengwen, is requisitioning the meeting to strip the executive chairman John Chen Seow Phun and independent director Ko Chuan Aun of their directorships. The letter is also calls for the company, which is in the business of restaurant operations, franchising and financial leasing, to appoint Zheng, the largest shareholder and former executive director of Pavillon, and major shareholder Teo Kiang Ang as director and executive chairman respectively at the EGM. Teo, the founder of taxi operator Trans-Cab and bottled cooking gas supplier Union Gas, owned 8.9 per cent of Pavillon as at Jul 5; Zheng held 25.8 per cent of the company as of March, said the Singapore Exchange website. Pavillon said the company is consulting lawyers on the validity of the request. Its share price closed flat at S$0.041 on Thursday before this announcement.

US

JPMorgan Chase reported a drop in second-quarter profits on Thursday (Jul 14), reflecting the impact of a weakening macroeconomic outlook that led it to set aside funds in case of bad loans. The big US bank’s earnings came in at US$8.6 billion for the quarter, down 28 per cent from the year-ago period in results that missed analyst expectations. Chief executive Jamie Dimon said key elements in the US economy remained healthy, but that macroeconomic headwinds including inflation “are very likely to have negative consequences on the global economy sometime down the road”. The bank temporarily suspended share buybacks with Dimon saying that the pause was needed to quickly meet higher capital requirements and “allow us maximum flexibility to best serve our customers, clients and community through a broad range of economic environments”. The results offer the first look at how Wall Street fared in a tumultuous 3 months characterised by changing outlooks on prospects for the economy.

Morgan Stanley’s revenue from investment banking plummeted as capital markets seized up, underlining a slow quarter for Wall Street as a dour outlook for the economy muddles the path forward. The firm’s investment-banking group posted US$1.07 billion in revenue, down 55 per cent from a year earlier, a bigger decline than the 47 per cent drop analysts had predicted. The bank also reported an additional US$413 million hit driven by mark-to-market losses on corporate loans held for sale as credit spreads widened. Morgan Stanley’s trading unit helped pick up the slack as fixed-income revenue surged amid heightened volatility and clients scrambled to reposition their books. Surging inflation and Federal Reserve efforts to help combat it have put investors on watch for a recession and the spillover effect an economic contraction can have for financial firms. Banks’ capital-markets units, which have lifted fortunes across the industry over the past 2 years, were hurt by a sharp slowdown in the second quarter. “It was a very solid quarter in the face of market volatility,” chief financial officer Sharon Yeshaya said in an interview. “Market activity and client activity should help support the level in equities and fixed-income businesses. But the volatility delays some of the pipeline to convert on the investment-banking side, especially on the M&A side.” Morgan Stanley shares slumped 23 per cent in the first 6 months of the year, its worst performance for 2 consecutive quarters in more than a decade. The stock slipped 2.7 per cent to US$72.94 at 9.52 am in New York.

The US dollar resumed its relentless rise on Thursday (Jul 14), charting new 24-year highs against the yen and pinning the euro close to parity, as investors bet on the US Federal Reserve ratcheting up interest rates to combat soaring inflation. Global economic turmoil has put a rocket under the safe-haven US dollar, pushing the dollar index that tracks the greenback against 6 counterparts up more than 13 per cent this year. It was last up 0.3 per cent on the day at 108.580. The greenback strengthened more than 1 per cent against the yen, pushing it above 139 yen per US dollar for the first time since 1998. It was last up 1.1 per cent at 138.92 yen. The euro was hovering just above parity with the US dollar — a day after breaking below the key level for the first time in almost 2 decades. The single currency remained under pressure on Thursday, weighed by downgraded official economic forecasts for the eurozone and political strife in Italy.

Oil prices settled lower on Thursday, but pared nearly all losses after falling more than US$4 earlier in the session as investors focused on the prospect of a large US rate hike later this month that could stem inflation but at the same time hit oil demand. Brent crude futures for September settled down 47 cents, or 0.5 per cent to US$99.10 a barrel and finished a third session in a row below US$100. US West Texas Intermediate crude for August delivery settled down US$95.78 a barrel, or 0.5 per cent, down 52 cents. Both contracts hit lows on Thursday which were below the Feb 23 close, the day before Russia invaded Ukraine, with Brent reaching its lowest level since Feb 21. The US Federal Reserve is seen ramping up its battle with 40-year high inflation with a supersized 100 basis-point rate hike this month after a grim inflation report showed price pressures accelerating. The Fed policy meeting is scheduled for July 26-27.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

FAANGM Monthly June 22 – Attractive despite recession fears

Recommendation: OVERWEIGHT (Maintained); Analyst: Jonathan Woo

– The FAANGM declined 7.9% in June, modestly better than the Nasdaq’s drop of 9.0%. The S&P 500 also dropped 8.4% for the month. META was the laggard, down 16.7%, with GOOGL the best performer, losing only 4.2%.

– High inflation, weakening consumer sentiment, tightening fiscal policy, and the increased fear of a recession continues to place downward pressure on the overall market as investors remain cautious. However, we remain optimistic on FAANGM. Long-term secular tailwinds from digital advertising, increasing cloud adoption, and increasing global digitalisation remain intact.

– We remain OVERWEIGHT on FAANGM as they continue to remain at attractive valuations, trading at the lower quartile of their historical valuations at 27x forward PE. We lowered our target prices as we raised WACC assumptions.

Upcoming Webinars

Strategy & Stock Picks (US, HK & CN)

Date: 16 July 2022

Time: 1pm – 3.30pm

Register: https://bit.ly/3acvOQm

Guest Presentation by Keppel DC REIT

Date: 28 July 2022

Time: 2.30pm – 3.30pm

Register: https://bit.ly/3uLBo3f

Guest Presentation by Pan-United Corporation Limited

Date: 5 August 2022

Time: 11am – 12pm

Register: https://bit.ly/3OFbJ41

Guest Presentation by A-Sonic Group

Date: 11 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3PmoIrl

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Research Videos

Weekly Market Outlook: The Place Holdings, Uni-Asia Group Ltd, SG Banking Monthly, SG Weekly

Date: 4 July 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials