DAILY MORNING NOTE | 15 March 2023

Trade of the Day

Analyst: Zane Aw

(Current Price: S$2.38) – TECHNICAL BUYBuy price: S$2.35 Stop loss: S$2.29 Take profit 1: S$2.55 Take profit 2: S$2.60

Analyst: Zane Aw

Current Price: US$39.86) – TECHNICAL BUYBuy price: US$39.86 Stop loss: US$38.40 Take profit: US$44.00

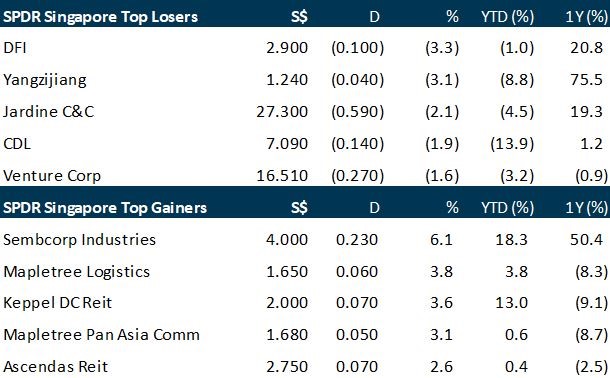

Local real estate investment trusts (Reits) booked healthy gains on Tuesday (Mar 14) despite overall weakness in markets across the Asia-Pacific region. Singapore stocks fell 0.1 per cent or 2.62 points to close at 3,129.75. Six of the top seven gainers were Reits, including Mapletree Logistics Trust, Keppel DC Reit and Mapletree PanAsia Commercial Trust, which rose 3.8 per cent, 3.6 per cent and 3.1 per cent respectively.

US and European stock markets rebounded on Tuesday amid easing worries over bank industry turmoil, while oil prices fell sharply on recession risks. Shares of banks recovered after markets were rocked earlier this week by the collapse of two US regional lenders, which forced authorities to launch emergency measures aimed at preventing contagion across the sector. Big jumps by First Republic Bank and other regional banks lent support to major US indices, with the S&P 500 piling on 1.7 per cent.

SG

Soilbuild Construction Group’s subsidiary Soil-Build was on Monday (Mar 13) ordered by the Singapore Mediation Centre to pay a subcontractor almost S$1 million within seven days, and borne S$20,000 in costs in relation to the adjudication application. This is the outcome of the application which the subcontractor had lodged in respect of a claim for about S$1.28 million. Singapore Mediation Centre is a provider of alternative dispute resolution services. Addressing the next steps, the company on Tuesday said Soil-Build, among other things, intends to seek recovery of the adjudicated amount from the subcontractor, and is working with its legal advisers, Allen & Gledhill, to initiate the appropriate dispute resolution process.

Construction engineering company Huationg Global has come out to say that it had no part in an incident on Monday (Mar 13), when a lorry crane operated by Huationg Holdings toppled. In a bourse filing on Tuesday, Catalist-listed Huationg Global said it is a separate entity from Huationg Holdings. It also said Huationg Holdings does not form part of the group and is not associated with or affiliated with the group.

Singapore’s business outlook for Q2 2023 has continued to deteriorate, dragged down by poor sentiment in manufacturing and trade. Singapore Commercial Credit Bureau’s (SCCB) business optimism index (BOI) for Q2 2023 fell further to +4.6 percentage points from +4.73 percentage points the previous quarter, and from +5.35 percentage points for Q2 2022. SCCB is a subsidiary under credit and risk information solutions provider, Credit Bureau Asia. Its BOI is released quarterly as a measure of business confidence in the economy. On Tuesday (Mar 14), SCCB said this represented the fifth consecutive quarter of declining local business sentiment, albeit slight.

Sub-sale volumes, a key indicator of speculative buying in Singapore’s private residential market, rose in 2022 to their highest level since 2013 with 765 transactions, a 34.7 per cent jump from the year-ago period. While still a fraction of the 4,862 sub-sale deals recorded during the housing market’s peak in 2007, the rising numbers point to a return of trading momentum in a market where buying activity has been damped by cooling measures. A sub-sale is recorded when a buyer resells a property bought directly from the developer, before the project is completed.

Wing Tai Holdings’ Hong Kong-based associate company, Wing Tai Properties, has issued a profit warning, stating that the group may report a loss for the financial year ended Dec 31, 2022. This is despite the company making HK$854.4 million (S$146.7 million) in profit in the previous FY. This comes as the group’s share of results of joint ventures may be a loss of about HK$50 million for the financial year, versus a profit of HK$242.9 million in FY2021.

US

US consumer prices increased in February amid sticky rental housing costs, but economists are divided on whether rising inflation will be enough to push the Federal Reserve to hike interest rates again next week after the failure of two regional banks. The Consumer Price Index (CPI) rose 0.4 per cent last month after accelerating 0.5 per cent in January, the Labor Department said on Tuesday (Mar 14). That lowered the year-on-year increase in the CPI to 6.0 per cent in February, the smallest annual gain since September 2021. Excluding the volatile food and energy components, the CPI increased 0.5 per cent after rising 0.4 per cent in January.

The Federal Reserve is seen raising its benchmark rate a quarter of a percentage point next week and again in May, as a government report showed US inflation remained high in February, and concerns of a long-lasting banking crisis eased. Prices of fed funds futures after the report reflected solid bets on an increase in the benchmark rate to a 4.75 per cent-5 per cent range at the Fed’s March 21-22 meeting, with about a 15 per cent chance seen of no change. By May the benchmark rate is seen rising further to a range of 5.00 per cent-5.25 per cent. Until late last week financial markets had been pricing in a bigger half-point rate hike to stem persistently high inflation.

Some of the world’s top money managers are sitting on a windfall after the collapse of Silicon Valley Bank (SVB) spurred the biggest rally in US Treasuries since the early 1980s. Schroders, Fidelity International and M&G Investments are among funds which initiated bullish bets on Treasuries before the failure of several US lenders forced a rethink of the Federal Reserve’s rate-hike path. Now, they are gearing up for even more gains as rising risks of a downturn fuel demand for havens.

Meta Platforms said on Tuesday (Mar 14) it would cut 10,000 jobs, just four months after it let go 11,000 employees, the first Big Tech company to announce a second round of mass layoffs. “We expect to reduce our team size by around 10,000 people and to close around 5,000 additional open roles that we haven’t yet hired,” chief executive officer Mark Zuckerberg said in a message to staff. The move underscores Zuckerberg’s push to turn 2023 into the “Year of Efficiency” with promised cost cuts of US$5 billion in expenses to between US$89 billion and US$95 billion.

Tiktok’s leadership is discussing the possibility of separating from ByteDance, its Chinese parent company, to help address concerns about national security risks. A divestiture, which could result in a sale or initial public offering, is considered a last resort, to be pursued only if the company’s existing proposal with national security officials doesn’t get approved, according to people familiar with the matter. Even then, the Chinese government would have to agree to such a transaction, the people said.

US carriers on Tuesday (Mar 14) tried to reassure worried investors about the strength of travel demand, a day after United Airlines forecast an unexpected loss in the current quarter. Delta Air Lines, which reaffirmed its first-quarter outlook, said travel demand is “strong” and getting “stronger.” Its CEO Ed Bastian said in the past 30 days, the airline has recorded 10 highest sales days in its history.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Del Monte Pacific Limited – FX and weak festive spend a drag

Recommendation: BUY (Maintained); TP S$0.40, Last close: S$0.255; Analyst Paul Chew

– 3Q23 earnings were below expectations. 9M23 revenue and PATMI was 73%/67% respectively of our forecast. Gross margins contracted much larger than expected.

– The weakness in earnings was due to a 12% decline in the Philippine peso and disappointing festive demand in China and the Philippines.

– We cut our F23e earnings by 18% to adjusted US$101mn. Del Monte remains a market leader in multiple consumer products in the US and the Philippines. Gross margins will remain subdued. Price increases have slowed and higher-priced inventory is hurting margins. The huge inventory post-festive period of $1bn raises the risk of write-offs. We maintain our BUY recommendation and cut our target price to S$0.40 (prev. S$0.67), pegged to 6x FY23e P/E, a 50% discount to the industry valuation due to its smaller market cap and higher gearing. Del Monte valuations remain attractive at 4x PE FY23e and an 8% dividend yield.

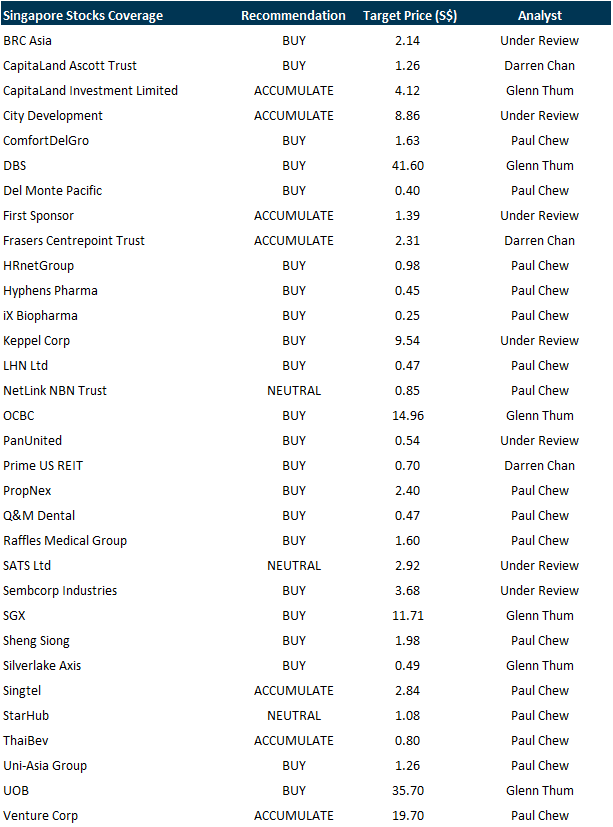

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Luminor Financial Holdings Ltd [NEW]

Date: 15 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3kj6LjP

Guest Presentation by Meta Health Limited [NEW]

Date: 16 March 2023

Time: 3pm – 4pm

Register: https://bit.ly/41oikGX

Guest Presentation by Keppel Pacific Oak US REIT (KORE) [NEW]

Date: 23 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3XY2n7v

Research Videos

Weekly Market Outlook: Salesforce, Sea Ltd, TDCX, Hyphens Pharma, Q&M, Tech Analysis & More…

Date: 13 March 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials