DAILY MORNING NOTE | 15 November 2022

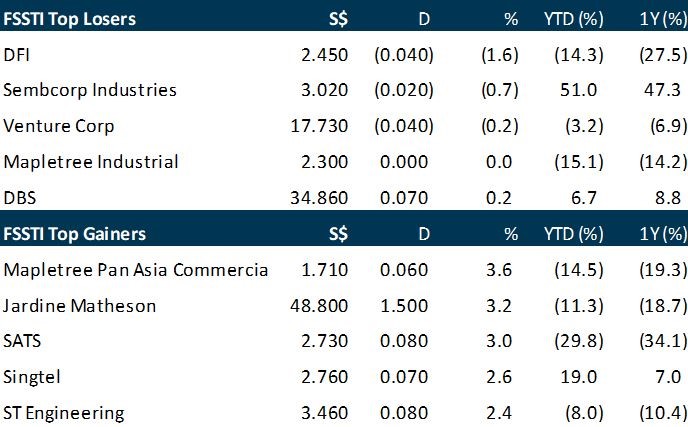

The Straits Times Index (STI) climbed 1 per cent or 32.47 points to close at 3,260.80 on Monday, while regional markets were mixed. In the broader Singapore market, gainers beat losers 358 to 251, with 2.05 billion securities worth $1.79 billion traded. The best performer on the STI was Mapletree Pan Asia Commercial Trust, which climbed 3.6 per cent or six cents to close at $1.71. Meanwhile, DFI Retail Group came in at the bottom of the table, falling 1.6 per cent or four US cents to US$2.45. The trio of banks were in the black on Monday. DBS gained 0.2 per cent or S$0.07 to close at S$34.86, while OCBC gained 0.4 per cent or S$0.05 to close at S$12.32, and UOB gained 1.5 per cent or S$0.45 to close at S$29.95.

Wall Street stocks ended lower on Monday, stumbling after last week’s rally fueled by hopes the Federal Reserve would ease its interest rate hikes, and as fresh policymaker comments failed to reassure markets. The Dow Jones Industrial Average dipped 0.6 per cent to close at 33,536.70. The broad-based S&P 500 dropped 0.9 per cent to 3,957.25, and the tech-rich Nasdaq Composite Index fell 1.1 per cent to 11,196.22. Equities jumped late last week after official data showed US inflation logged its lowest annual jump since January, boosting hopes the Fed might ease off its aggressive interest rate increases, and perhaps not raise rates as much as anticipated. Fed Vice Chair Lael Brainard said on Monday it would likely be “appropriate soon” for the central bank to slow the pace of rate hikes. However, with inflation still hovering at its highest level in recent decades, Brainard said the Fed still has “additional work to do both on raising rates” and tamping down prices.

SG

China-focused real estate investment trust Dasin Retail Trust on Monday (Nov 14) reported a 7.8 per cent drop in revenue to S$70.7 million for the nine months ended September (9M2022), from S$76.7 million the year before. Net property income for 9M2022 slipped 8.3 per cent to S$55.2 million, from S$60.3 million in the corresponding period last year. The trustee-manager said the declines were due to the temporary closure of some malls and trade sectors by the government due to Covid-19-related restrictions. Rental rebates to tenants in 9M2022 were about three times higher than the previous year, the trustee-manager said. It added that strict travel restrictions and social distancing measures also caused “stifling spending in China’s consumer market and weak consumer sentiments”, resulting in lower revenue contribution from all its properties. The trustee-manager said it has been working closely with its lenders for the refinancing exercise and exploring potential proposals, including the disposal of certain assets, partnership with strategic investors, and alternative fundraising activities. It added that it has commenced discussions with more than one leading Chinese enterprise for potential strategic investments. Dasin Retail Trust has some S$756.4 million of facilities due by the end of this year. Its gearing ratio stood at 40.4 per cent as at end-September. Units of Dasin Retail Trust closed flat at S$0.27 on Monday, before the announcement.

Mainboard-listed Asian Pay Television Trust (APTT) has declared a distribution per unit (DPU) of 0.25 Singapore cent for the third quarter ended Sep 30, unchanged from the DPU declared in the corresponding year-ago period. The company has also reaffirmed a distribution guidance of 0.25 Singapore cent per unit for the fourth quarter of 2022, the trustee-manager said in a bourse filing on Monday (Nov 14). The Q3 distribution of 0.25 Singapore cent will be paid out on Dec 23, after books closure on Dec 16, 5pm. It added that the distribution in 2023 will increase by 5 per cent, with guidance at 1.05 cents per unit for 2023. Distribution in 2023 will be paid in half yearly instalments of 0.525 cent per unit, subject to no material changes in planning assumptions, it said. Profit after income tax for the quarter rose to S$13.5 million, almost tripling from S$4.6 million the year before. Revenue dropped 5.7 per cent to S$71.2 million, down from S$75.5 million in the previous year. This was due to a drop in revenue for its segments of premium digital cable television and premium digital cable television, which fell by 9.8 and 9 per cent to record S$51.9 million and S$2.9 million in revenue respectively for the quarter. On the other hand, its broadband segment rose 11.1 per cent to record a revenue of S$16.4 million for the quarter. The trustee-manager attributed this growth to cable TV operator Taiwan Broadband Communications Group’s broadband strategy, which targets the broadband-only segment, partner with mobile operators, and offer higher speed plans at competitive prices.Units of APTT were trading at S$0.107, up S$0.001 cent or 0.9 per cent before the results release.

Golden Agri-Resources on Monday (Nov 14) reported a 148 per cent increase in earnings to US$285 million for the third quarter ended September, from US$115 million in the corresponding period last year. This brought earnings for the first nine months of FY2022 (9M FY2022) up 151 per cent year on year to US$675 million. Earnings before interest, taxes, depreciation, and amortisation (Ebitda) for 9M FY2022 was 62 per cent higher at US$1.3 billion, while underlying profit grew 88 per cent to US$726 million. The company attributed the improved performance to higher palm oil prices, with market prices for crude palm oil (CPO) rising 23 per cent in the nine-month period. While partially offset by lower sales volume, the increase in palm oil prices drove 9M FY2022 revenue up 18 per cent to US$8.6 billion. The company noted that palm product output grew 21 per cent in Q3, while the sales volume of its downstream business rose 34 per cent quarter on quarter after the temporary export ban was lifted. Golden Agri-Resources said that it remains “cautious” of uncertainties affecting the market – including changes in trade policies and a potential global recession – but added that the outlook for the palm oil industry is expected to remain favourable. The counter closed 3.6 per cent or S$0.01 higher at S$0.285 on Monday, before the announcement.

US

OPEC on Monday (Nov 14) cut its forecast for 2022 global oil demand growth for a fifth time since April and also trimmed next year’s figure, citing mounting economic challenges including high inflation and rising interest rates. Oil demand in 2022 will increase by 2.55 million barrels per day (bpd), or 2.6 per cent, the Organization of the Petroleum Exporting Countries (Opec) said in a monthly report, down 100,000 bpd from the previous forecast. This report is the last before Opec and its allies, together known as Opec+, meet on Dec 4 to set policy. The group, which recently cut production targets, will remain cautious, Saudi Arabia’s energy minister was quoted as saying last week. Next year, Opec expects oil demand to rise by 2.24 million bpd, also 100,000 bpd lower than previously forecast. Despite commenting on the rising challenges, Opec left its 2022 and 2023 global economic growth forecasts steady and said while risks were skewed to the downside, there was also upside potential. “This may come from a variety of sources. Predominantly, inflation could be positively impacted by any resolution of the geopolitical situation in Eastern Europe, allowing for less hawkish monetary policies,” Opec said. Oil maintained a decline after the report was released, trading around US$95 a barrel. For October, with oil prices weakening on recession fears, the group made a 100,000 bpd cut to the Opec+ production target, with an even bigger reduction starting in November.

Boeing Co got a glimmer of hope after US President Joe Biden and his Chinese counterpart Xi Jinping called for a cooling of tensions at a face-to-face meeting on Monday (Nov 14). After a three-hour meeting in Bali, Indonesia, Biden committed to send US Secretary of State Antony Blinken to China for a visit, and the countries pledged to continue talks on a range of issues. While aircraft sales didn’t come up as a topic, any improvement in relations is a welcome sign for Boeing. It has been three and a half years since a mainland Chinese airline took delivery of a Boeing 737 Max aircraft – a wait brought on by a pair of fatal crashes, a global pandemic and simmering tensions between the world’s two most powerful countries. China used to take a quarter of the cash-cow jets that the US planemaker built each year, and the beleaguered aerospace company could use a lift. Still, the first signs of a thaw this week could lead to upside for Boeing. The company isn’t counting on Chinese orders in its plan to restore cash flow, reduce its US$57 billion in debt and emerge from crises that wiped out US$150 billion in market value in the past three years. But they sure wouldn’t hurt. Boeing shares fell less than 1 per cent just before 10.30 am in New York following Biden’s meeting with Xi. The stock had declined 12 per cent so far this year through Friday’s close. Jetliners have been a barometer of US-China diplomacy since Richard Nixon first flew to Beijing on a Boeing 707 a half-century ago. Shock-and-awe aircraft orders have been a staple of head-of-state visits over the decades, underscoring China’s growing clout. In fact, Xi unveiled a splashy 300-jet deal worth US$38 billion with his first official tour of the US in 2015. American presidents get to use such orders as political wins, helping shore up the US trade deficit and create work for hundreds of thousands of people, between Boeing and its suppliers. China is one of the last nations that hasn’t returned the workhorse 737 Max to commercial service following two fatal crashes in 2018 and 2019. That milestone has slipped repeatedly amid Covid flare-ups and lockdowns. It is a big reason why Boeing twice pared its annual target for 737 deliveries this year to 375 planes, after initially aiming to hand over nearly 500 aircraft.

The world’s biggest cryptocurrency platform Binance on Monday pledged to establish a liquidity fund to curb sector fallout from the collapse of rival FTX, boosting the value of bitcoin. Cash-strapped FTX filed for bankruptcy Friday (Nov 11) after Binance scrapped a takeover bid, sending chills across the cryptocurrency world. “To reduce further cascading negative effects of FTX, Binance is forming an industry recovery fund, to help projects who are otherwise strong, but in a liquidity crisis,” Binance chief executive Changpeng Zhao said on Twitter. He said further details would appear soon. Bitcoin climbed 2.5 per cent to US$16,773 in reaction. The world’s most popular digital currency last week tumbled to a two-year low at US$15,574 as speculation grew over the health of FTX. Bitcoin remains 20 per cent lower than it was on Nov 6, when FTX’s troubles began to weigh on markets. As recently as 10 days ago, FTX was considered the world’s second-largest cryptocurrency platform with a valuation of US$32 billion. “FTX held US$900 million in liquid assets the day before it went down, compared to US$9 billion in liabilities,” said SwissQuote analyst Ipek Ozkardeskaya. “This is something that could’ve never happened in a traditional, regulated financial institute.” FTX is headquartered in the Bahamas, a tax haven with looser regulation than most other jurisdictions. Police there have said they are investigating the company. On the same day that FTX filed Chapter 11 bankruptcy proceedings in the United States, its high-profile founder and chief executive Sam Bankman-Fried resigned.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Sembcorp Industries – Acquisition of another 1.38GW of renewable assets

Recommendation: BUY (Upgraded), Last Done: S$3.02

Target price: S$3.68, Analyst: Terence Chua

• Sembcorp Industries (SCI) announced the acquisition of 1.38GW of renewable assets in China and India.

• The acquisition of BEI Energy and Vector Green will be accretive to earnings upon completion in 1Q23 as it will be funded by debt and internal cash.

• China and Indian assets supported by mid- to long- term power purchase agreements (PPAs) that will ensure stability in earnings and cash flows.

• We upgrade to BUY from ACCUMULATE with unchanged target price of $3.68. Our earnings is unchanged and our target price are maintained at $3.68, still based on 1.2x P/BV, the average of its peers. But we upgrade to BUY due to the recent pull back in its share price.

Upcoming Webinars

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc [NEW]

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by iWoW Technology [NEW]

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: PayPal, CLI, SATS, PropNex, Singtel, Starhub, Technical Analysis & More…

Date: 14 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials