DAILY MORNING NOTE | 16 January 2023

Week 3 equity strategy: The positive news is inflation continues to trend lower. US core-CPI in December rose 0.17% mom, trending at a pace similar to 2019 when core inflation was around 2%. We expect a choppy week. The release of US PPI (est. -0.1% MoM) on Wednesday can further cement the soft landing narrative over the US economy. However, upcoming speeches by Fed FOMC members Williams (Tuesday) and Brainard (Thursday) could spook the market with more hawkish comments. In Singapore, the release of Mapletree Logistics Trust (Thursday p.m.) and Suntec REIT (Friday a.m.) results can provide an early glimpse into downside risk to REIT asset valuations.

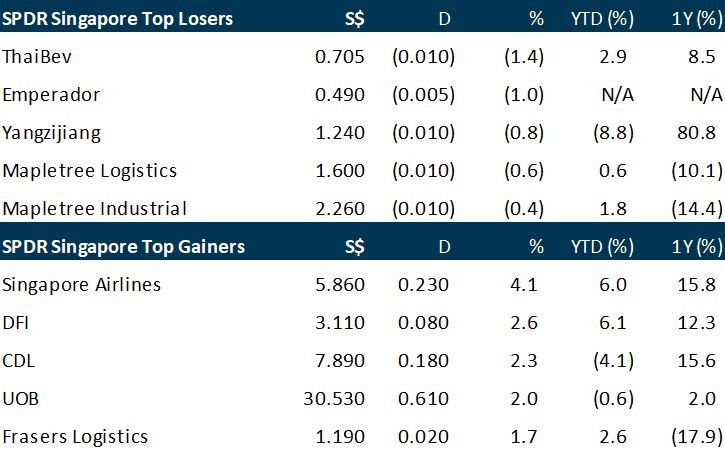

The Straits Times Index (STI) rose 0.8 per cent or 25.97 points to close at 3,293.75 points on Friday (Jan 13), as slowing inflation in the US lifted investor sentiment. In the wider Singapore market, gainers outnumbered losers 304 to 222 after 855.7 million securities worth S$1.08 billion changed hands. Friday’s gains brought the STI up 0.5 per cent for the week. Most key Asian markets finished higher on the wave of optimism. Hong Kong’s Hang Seng Index, the Shanghai Composite Index, South Korea’s Kospi and the FTSE Bursa Malaysia KLCI rose between 0.4 per cent and 1 per cent.

The S&P 500 and Nasdaq finished at their highest levels in a month on Friday (Jan 13), with shares of JPMorgan Chase and other banks rising following their quarterly results, which kicked off the earnings season. All three major indexes also registered strong gains for the week, leaving the S&P 500 up 4.2 per cent so far in 2023, and the Cboe Volatility index – Wall Street’s fear gauge – closed at a one-year low. The Dow Jones Industrial Average rose 112.64 points, or 0.33 per cent, to 34,302.61, the S&P 500 gained 15.92 points, or 0.40 per cent, to 3,999.09 and the Nasdaq Composite added 78.05 points, or 0.71 per cent, to 11,079.16.

SG

Twitter’s potential exit from its office space at CapitaGreen will have an “immaterial” impact on CapitaLand Integrated Commercial Trust’s (CICT) portfolio revenue, said the real estate investment trust on Friday (Jan 13) in response to queries from The Business Times (BT). Based on reports from 2015, Twitter holds an office space of 22,000 square feet in CapitaGreen, a 40-storey Grade A office tower located in the central business district (CBD). The company had reportedly expanded, leasing an additional floor in the building in Q4 2021. Twitter is one of CapitaGreen’s top three tenants by gross rental income, according to CICT’s website. A spokesperson from CICT told BT on Friday that CapitaGreen contributed about 6.7 per cent to the Reit’s H1 2022 net property income. In its Q3 2022 business update, CICT said no single tenant contributes more than 5.1 per cent of its total gross rental income. The report showed that the percentage of CICT’s total gross rental income generated by its top 10 tenants that quarter – such as RC Hotel, WeWork Singapore, Temasek and BHG – ranged from 1 per cent to 5.1 per cent. This puts Twitter’s contribution to the Reit’s total gross rental income at less than 1 per cent in Q3 2022.

ST Telemedia Global Data Centres (STT GDC), a company backed by Singapore investment company Temasek, is exploring a potential initial public offering (IPO) that could raise more than US$1 billion, according to people with knowledge of the matter. The Singapore-based data centre operator has held discussions with potential advisers on an offering that could value the firm at over US$5 billion, the people said. STT GDC is considering Singapore and the US among possible listing venues, said the people, who asked not to be identified as the information is private. A share sale could take place as soon as the end of this year if it decides to proceed, they added. Deliberations are at an early stage and details of the IPO could still change, according to the people. The company could also opt to stay private for longer, they said.

This year’s first new residential launch Sceneca Residence met with firm demand on its first day of sales. Househunters bought up 60 per cent or 160 units of the 268-unit project in eastern Singapore, with units transacted at an average of S$2,072 per square foot (psf) on Saturday (Jan 14), said joint developers MCC Singapore, Ekovest Development and The Place Holdings. The bulk of the 99-year-leasehold units sold – 75 per cent – consisted of one and two-bedroom units. Prices started from S$958,000 for a one-bedroom unit and from S$1.33 million for a two-bedder. The largest unit in Sceneca Residence, a 2,756 sq ft four-bedroom penthouse, was also sold on launch day. Business Times understands that the penthouse was sold at between S$5 million and S$6 million. The project has three other penthouses of 2,400 sq ft each.

iFast Corp has maintained its guidance for FY2023 to FY2025 for now, even though recent reports that the Hong Kong ePension platform’s roll out schedule has fallen behind by eight months. According to the Hong Kong Provident Fund, the Hong Kong pension platform is still aimed to be up and running by end of 2025. The platform’s main contractor is Hong Kong’s communication technology firm, PCCW Solutions, owned by Richard Li, son of tycoon Li Ka Shing. PCCW Solutions said the delay was caused by manpower shortage amid the pandemic. iFast is a subcontractor appointed to help build the platform. As the largest public retirement scheme in Hong Kong with some 4.5 million members, the fund manages some HK$1.05 trillion (US$134.6 billion) of assets. The ePension platform is to help cut administrative costs by more than half. As indicated by iFast last April, it had targeted profit before tax of more than HK$100 million from this Hong Kong project in 2023; more than HK$250 million in 2024 and more than HK$500 million in 2025.

US

Citigroup reported a decline in fourth-quarter profit on Friday (Jan 13) as it hiked provisions to prepare for a worsening economy, and investment-banking revenue fell on a sharp drop in dealmaking activity. This came after fears of a potential recession prompted the bank to add US$640 million to its reserves in the fourth quarter. In 2021, when pandemic-related loan losses failed to materialise, it released US$1.4 billion from its reserves. Citi’s investment-banking revenue plunged 58 per cent, after merger and acquisition activity slowed dramatically in 2022. Companies shunned deals last year, amid higher interest rates, the war in Ukraine, and growing economic uncertainties.

Wells Fargo on Friday (Jan 13) reported a 50 per cent decline in profit for the fourth quarter as the bank racked up more than US$3 billion in costs related to a fake accounts scandal and boosted loan loss reserves for a potential economic slowdown. Provision for credit losses was US$957 million in the quarter, compared with a US$452 million release a year earlier. Overall, non-interest expenses rose to US$16.2 billion from US$13.2 billion a year earlier. In the fourth quarter, the bank posted US$3.3 billion in operating losses related to litigation, customer remediation and regulatory matters associated with the scandal over its sales practices. The fourth-largest US lender reported a profit of 67 cents per share for the quarter ended Dec 31, compared with US$1.38 per share a year earlier.

Blackrock reported an 18 per cent drop in fourth-quarter profit on Friday (Jan 13), hit by a global market rout that squeezed fee income. The world’s largest asset manager posted adjusted earnings of US$1.36 billion, or US$8.93 per share, in the three months to Dec 31, down from US$1.65 billion, or US$10.68 per share, a year earlier. Assets under management (AUM) stood at US$8.59 trillion at the end of the quarter, down from a little more than US$10 trillion a year earlier but up from US$7.96 trillion in the third quarter. Full-year revenue declined by 8 per cent last year, “primarily driven by the impact of significantly lower markets and US dollar appreciation on average AUM and lower performance fees”, a BlackRock statement said. The company registered US$146 billion in long-term net inflows in the fourth quarter. For the whole of 2022 BlackRock inflows reached more than US$300 billion.

JPMorgan reported a 6 per cent rise in fourth-quarter profit on Friday (Jan 13), as a better-than-expected performance from the bank’s traders more than offset a hit from a slump in dealmaking. The bank said it had reserved US$1.4 billion in loan loss provisions. JPMorgan’s profit for the three months ended Dec 31 was US$11 billion, or US$3.57 per share, compared with US$10.4 billion, or US$3.33 per share a year earlier. The investment banking unit’s poor run continued in the quarter, with revenues down 57 per cent as corporate executives battened down the hatches to prepare for a potential recession, instead of spending on deals.

Bank of America Corp reported a better-than-expected fourth-quarter profit on Friday (Jan 13) as rate hikes helped it charge more interest on loans to customers. The US Federal Reserve and other major central banks raised rates aggressively last year to tame decades-high inflation. The ‘higher-for-longer’ rate environment has underpinned profits at consumer banks, with analysts expecting those gains to peak in 2023. This helped partially offset sluggish dealmaking and larger provisions for loan losses. Bank of America’s revenue, net of interest expense, increased 11 per cent to US$24.5 billion in the fourth quarter. The bank earned 85 cents per share in the quarter.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

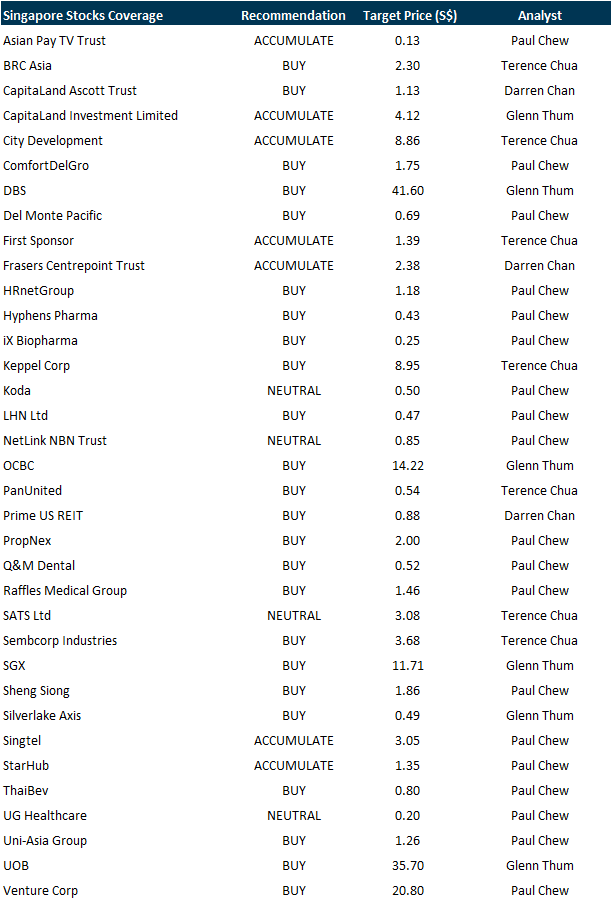

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Civmec

Date: 20 January 2023

Time: 12pm – 1pm

Register: https://bit.ly/3iwhMx1

Guest Presentation by Comba Telecom Systems Holdings Limited

Date: 31 January 2023

Time: 11am – 12pm

Register: https://bit.ly/3GuS5VK

Research Videos

Weekly Market Outlook: SG 2023 Equity Strategy, Technical Analysis

Date: 9 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials