DAILY MORNING NOTE | 16 March 2023

Singapore stocks rebounded on Wednesday (Mar 15), tracking gains across the region and overnight on Wall Street. It rose 1.4 per cent or 43.17 points to close at 3,172.92.

Shares of US lenders endured another walloping on Wednesday on worries of more bank failures, although the Nasdaq eked out a gain following assurances from the Swiss central bank about Credit Suisse. Major indices spent most of the day deep in the red, but the Nasdaq popped into positive territory at the end of the day after the Swiss National Bank said Credit Suisse had adequate capital, but that it was ready to make liquidity available to the institution if needed. The Dow Jones Industrial Average ended at 31,874.57, down 0.9 per cent, but nearly 450 points above its session low. The broad-based S&P 500 declined 0.7 per cent to 3,891.93, while the tech-rich Nasdaq Composite Index added 0.1 per cent at 11,434.05.

SG

ValueMax Group’s significant loans and borrowings of S$610.5 million in the 2022 financial year caught the attention of the Singapore Exchange Securities Trading (SGX-ST), which asked why this increased by S$167.9 million from the previous FY. The rise in loans and borrowings were reported earlier this month, against a 16.8 per cent drop in its earnings for the second half of 2022 to S$19.2 million, from S$23.1 million in the corresponding period in 2021. Addressing its queries on Wednesday (Mar 15), the mainboard-listed company said the loans and borrowings were taken to mainly finance its pawning and moneylending businesses.

Capitaland Integrated Commercial Trust’s (CICT) wholly-owned subsidiary CMT MTN has issued HK$755 million (S$130 million) worth of fixed rate notes to institutional or sophisticated investors. The notes will mature on Mar 15, 2033, and will bear interest at a rate of 4.85 per cent per annum, payable annually in arrears. Proceeds from the notes issue will be used to finance or refinance eligible green projects undertaken by CICT and its subsidiaries in accordance with the group’s green finance framework, the real estate investment trust (Reit) said on Wednesday (Mar 15).

All outstanding Singapore Interbank Offered Rates (Sibor) retail loans will automatically be converted to reference Singapore Overnight Rate Average (Sora) in June 2024, said the steering committee for Sor & Sibor transition to Sora (SC-STS) on Wednesday (Mar 15). Prior to that, customers have the option to switch their loans to the banks’ prevailing packages or to the Sibor-Sora conversion package – determined each month as the average spread between Sibor and compounded Sora over the preceding three months. This will occur during the transition period between Aug 1, 2023, and Apr 30, 2024. Those with a Sibor-pegged retail loan and do nothing during this period will have their loans automatically converted to reference Sora in June 2024.

Singapore’s total employment growth was at an all-time high in 2022, driven largely by the return of foreign workers following the relaxation of border controls in the first half of the year, the Labour Market Report indicated on Wednesday (Mar 15). Total employment grew by an unprecedented 227,800 last year, reaching 2.9 per cent above its pre-pandemic level in 2019. Non-resident employment constituted 88 per cent of the increase, amounting to 201,600. This was primarily due to the hiring of work-permit holders in sectors such as construction and manufacturing, said the Ministry of Manpower (MOM). Even so, non-resident employment is still 0.8 per cent lower than 2019 levels.

Sales of new private residential units gained momentum in February, led by an increase in sales in the prime core central region (CCR). However, total sales were still down on a year-on-year basis. Data from the Urban Redevelopment Authority (URA) on Wednesday (Mar 15) showed that developers sold 432 units, excluding executive condominiums (ECs), in February – up 9.9 per cent from the 393 units moved in the previous month. New home sales rose despite the number of units launched dipping in February, when there were 2.2 per cent fewer properties launched than the 410 units launched for sale in January.

US

Crypto exchange Coinbase remains bullish about its prospects in Asia as it embarks on international growth. This is despite a turbulent year marred by a slowing economy, as well as a series of scandals that tarnished the once-booming crypto industry. With the rise of blockchain gaming in markets such as the Philippines, and with companies warming up to building on Web3 infrastructure, Asia presents interesting opportunities for Coinbase to tap, said Singapore country director Hassan Ahmed. He was speaking to The Business Times on the back of Coinbase’s launch of upgrades to its retail platform in Singapore, meant to ease investments in digital assets, even as investors lick their wounds from the crypto market plunge.

US importers bore almost the entire burden of tariffs that President Donald Trump placed on more than US$300 billion in Chinese goods, raising the cost of goods bought by American companies, a report by an independent US government agency found. The US International Trade Commission (ITC), a bipartisan entity that analyses trade issues, found an almost one-to-one increase in the price of US imports following the so-called section 301 tariffs, it said in a report on Wednesday (Mar 15). The report came in response to a directive from Congress as part of a law passed last year. The conclusions back the long-time assertion of US Chamber of Commerce and independent academic economists that the cost of the tariffs hurt American firms rather than those in China, and contradict Trump’s claim that his trade partner paid the ultimate cost of the duties.

US retail sales fell in February as purchases of motor vehicle purchases and other goods slumped, payback after the prior month’s outsized increase, but consumer spending continued to show underlying strength. The Commerce Department said on Wednesday (Mar 15) that retail sales dropped 0.4 per cent last month. Data for January was revised higher to show retail sales rising 3.2 per cent instead of 3.0 per cent as previously reported. Economists polled by Reuters had forecast sales would fall 0.3 per cent, with estimates ranging from a 1.0 per cent decline to a 0.5 per cent increase. Retail sales are mostly goods and are not adjusted for inflation.

US producer prices unexpectedly fell in February and the rise in prices in January was not as large as initially thought, offering some hopeful signs in the fight against inflation. The producer price index for final demand slipped 0.1 per cent last month, the Labor Department said on Wednesday (Mar 15). Data for January was revised down to show the PPI increasing 0.3 per cent instead of 0.7 per cent as previously reported. In the 12 months through February, the PPI increased 4.6 per cent after rising 5.7 per cent in January. Economists polled by Reuters had forecast the PPI gaining 0.3 per cent on the month and advancing 5.4 per cent year-on-year.

US business inventories fell for the first time in nearly two years in January, potentially setting up inventory investment to be a drag on economic growth in the first quarter. Business inventories dropped 0.1 per cent, the Commerce Department said on Wednesday (Mar 15). That was the first decline and also the weakest reading since April 2021 and followed a 0.3 per cent gain in December. Economists polled by Reuters had expected inventories, a key component of gross domestic product, would be unchanged. Inventories increased 11.1 per cent on a year-on-year basis in January. Inventory accumulation surged in the fourth quarter, mostly reflecting an unwanted piling up of goods, as growth in consumer spending decelerated because of higher interest rates.

A major purchase by Saudi Arabia caps sales of almost 200 Dreamliners over the past four months, handing Boeing major industrial and political wins in lucrative widebody sales against European rival Airbus. Now the US aerospace giant will face the difficult task of producing and delivering those 787s in a time of unprecedented supply chain pressures, analysts said. On Tuesday, Boeing announced orders for 78 Dreamliners, split between state-owned Saudi Arabian Airlines (Saudia) and new national airline Riyadh Air. The US$37 billion sale, which Boeing called its fifth-largest commercial order by value, followed a deal with United Airlines in December for 100 Dreamliners and a purchase by Air India that included 20 787s.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

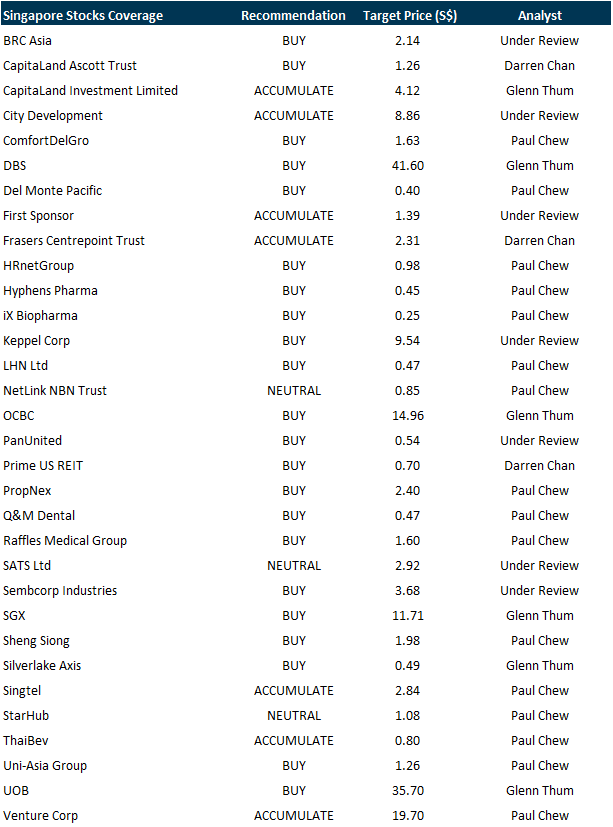

RESEARCH REPORTS

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Meta Health Limited [NEW]

Date: 16 March 2023

Time: 3pm – 4pm

Register: https://bit.ly/41oikGX

Guest Presentation by Keppel Pacific Oak US REIT (KORE) [NEW]

Date: 23 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3XY2n7v

Research Videos

Weekly Market Outlook: Salesforce, Sea Ltd, TDCX, Hyphens Pharma, Q&M, Tech Analysis & More…

Date: 13 March 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials