DAILY MORNING NOTE | 17 August 2022

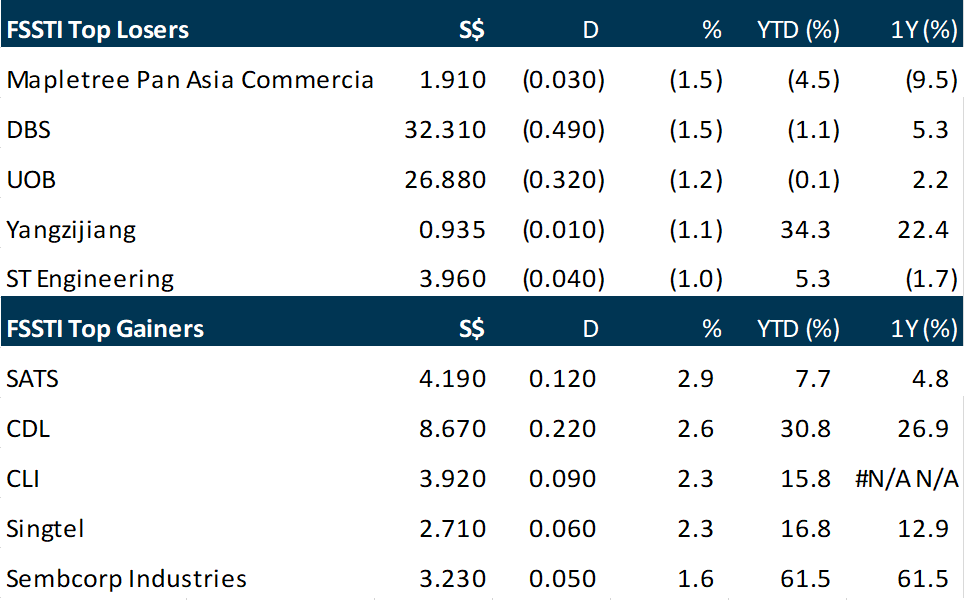

SINGAPORE shares fell for the second consecutive trading day on Tuesday (Aug 16), as worries of the usual suspects – interest rate hikes and inflation – continue to plague markets. The Straits Times Index (STI) fell 0.1 per cent or 3.03 points to finish the day at 3,253.79. Across the broader market, decliners outpaced advancers 264 to 234, after 1.6 billion securities worth about S$1.4 billion changed hands. The trio of local lenders were among the biggest losers on Tuesday. DBS fell 1.5 per cent or S$0.49 to S$32.31, UOB was down 1.2 per cent or S$0.32 at S$26.88, while OCBC shed 0.2 per cent or S$0.02 to S$12.18. Sembcorp Marine was the most heavily traded counter by volume for the day, with some 136.5 million shares changing hands. The counter gained 0.9 per cent or S$0.001 to S$0.108.

US equities went for a ride Tuesday (Aug 16), ending the day mixed after bouncing around for most of the session as investors digested solid retail company earnings but disappointing housing data. Shares started the day in the doldrums after data showed new US home construction dove in July, but were buoyed when Walmart reported a jump in revenues, with the retail giant also saying its annual profit would not be as bad as it predicted 3 weeks ago. The Dow Jones Industrial Average gained 0.7 per cent to finish the day at 34,152.01, while the broad-based S&P 500 was up 0.2 per cent to 4,305.2. Meanwhile, the tech-rich Nasdaq Composite Index retreated, falling 0.2 per cent to end at 13,102.55 after recovering from the low point of the day. The weak housing data – new US home construction projects started in July tumbled 9.6 per cent – gave rise to more fears about the economy since the real estate market drives a lot of other spending. But manufacturing rebounded, according to Federal Reserve data.

SG

Ascott Residence Trust (ART) has closed its private placement at S$1.12 per stapled security to raise S$170 million, the stapled hospitality group’s managers announced on Tuesday (Aug 16) before the market open. ART had launched the placement on Monday to raise S$150 million, part of which would be used to acquire 9 serviced residences, rental housing and student accommodation properties from its sponsor. The trust has since exercised the upsize option to raise an additional S$20 million. The issue price represents a 4.5 per cent discount to ART’s volume-weighted average price of S$1.1733 per stapled security. Some 151.8 million new stapled securities will be issued to raise the S$170 million in gross proceeds. Of the S$170 million in proceeds, ART will use S$122.3 million to partly fund its purchase of interests in serviced residence properties in France, Vietnam and Australia, rental housing properties in Japan and a student accommodation property in South Carolina, the US. Another S$45.1 million will be used to partially fund any potential future acquisitions, while S$2.6 million will go towards professional fees and other expenses for the placement. ART was trading at S$1.14, down 3.4 per cent or S$0.04, as of 3.44pm on Tuesday.

Thai Beverage (ThaiBev) and Frasers Property have established a 50:50 joint venture (JV) company in Thailand with an initial registered capital of 50 million baht (S$1.9 million). Among others, the JV company will explore a potential 2.2 billion baht share subscription for a 50 per cent stake in BetterBe Marketplace, a wholly-owned indirect subsidiary of Thailand-listed The Siam Cement Public Company Ltd. This will be subject to satisfactory due diligence and the requisite approvals with no certainty or assurance that the potential investment will materialise, said both companies in their respective bourse filings on Tuesday (Aug 16). Named Must Be Company Ltd, the JV entity is 50 per cent-owned by 2 of Frasers Property’s subsidiaries in Thailand, Frasers Property Holdings (49.9 per cent) and Frasers Property Technology (0.1 per cent). The remaining 50 per cent of Must Be Company is held by 2 wholly-owned subsidiaries of ThaiBev, Open Innovation (49.99 per cent) and Mee Chai Mee Chok (0.01 per cent, or 1 ordinary share in the JV company). Frasers Property is an associated company of ThaiBev, with both companies having certain common directors. The 2 companies said they have incorporated Must Be Company with an aim to “collaborate in the advancement of technologies and digitisation” of both parties. This includes investing in third-party technologies and businesses that are complementary to the groups’ key businesses. Shares of ThaiBev ended Monday S$0.005 or 0.8 per cent higher at S$0.66, while Frasers Property closed at S$1.04, down S$0.01 or 1 per cent.

Recruitment and consulting business HRnetGroup announced on Tuesday (Aug 16) that it has registered a new branch in Kaohsiung under its subsidiary RecruitFirst (Taiwan) (RFT), as part of its “strategic initiative to further accelerate the rapid growth of RFT in the flexible staffing space”. Together with RFT’s 3 business leaders cum co-owners, HRnetGroup will also commit another S$1 million to fund further expansion in RFT. When RFT was first incorporated in March 2019, the initial share capital stood at S$700,000 comprising 700,000 ordinary shares contributed by HRnetOne. The group said that its RFT business was profitable within its first year of operations and achieved a compound annual growth rate of 113 per cent in revenue. Following the addition of a new branch, HRnetGroup intends to “capitalise on its existing strengths and work with clients in Kaohsiung on their needs for call centre operators, technicians and engineers”. HRnetGroup ended Monday down 0.6 per cent or S$0.005 at S$0.785 on Monday.

US

Ford Motor is taking advantage of a credit-market rally to sell green bonds. The vehicle maker is issuing a 10-year unsecured green bond with early pricing discussions suggesting a yield of about 6.4 per cent, according to a person familiar with the matter. That compares to an average yield of 5.97 per cent for debt in the BB tier. Ford will use the proceeds to help finance new existing green projects, the person said. Ford expects to allocate the net proceeds from this offering exclusively to Clean Transportation projects and specifically to the design, development and manufacture of its battery electric vehicle portfolio. The company expects to fully allocate the net proceeds of this offering by the end of 2023, said the person. This is the first junk-rated green sale since June 1st and Ford’s first green issuance since its debut green bond last year, according to data compiled by Bloomberg. The deal is being led by Barclays. There has been somewhat of a revival in junk-bond markets this week as a market-rally pushes yields lower, drawing issuers off the sidelines to sell debt.

Apple laid off many of its contract-based recruiters in the past week, part of a push to rein in the tech giant’s hiring and spending, according to people with knowledge of the matter. About 100 contract workers were let go in a rare move for the world’s most valuable company, said the people, who asked not to be identified because the situation is private. The recruiters were responsible for hiring new employees for Apple, and the cuts underscore that a slowdown is underway at the company. Workers laid off were told the cuts were made due to changes in Apple’s current business needs. Bloomberg first reported last month that the company was decelerating hiring after years of staffing up, joining many tech companies in hitting the brakes. Chief executive officer Tim Cook confirmed during Apple’s earnings conference call that the company would be more “deliberate” in its spending – even as it keeps investing in some areas. Apple is still retaining recruiters who are full-time employees, and not all of its contractors were fired as part of the move. An Apple spokesperson declined to comment on the decision. The move to lay off workers is unusual for the Cupertino, California-based technology giant, which employs more than 150,000 people. But it’s far from alone in taking such a step. In recent months, Meta Platforms, Tesla, Microsoft., Amazon.com and Oracle have all eliminated jobs in the face of a tech spending slowdown.

Production at US factories increased more than expected in July as output rose at motor vehicle plants and elsewhere, pointing to underlying strength in manufacturing despite ebbing business confidence. Manufacturing output rebounded 0.7 per cent last month after declining 0.4 per cent in June, the Federal Reserve said on Tuesday (Aug 16). Economists polled by Reuters had forecast factory production would rise 0.2 per cent. Output increased 3.2 per cent compared to July 2021. Manufacturing, which accounts for 11.9 per cent of the US economy, remains supported by strong demand for goods even as spending is gradually shifting back to services. But risks are rising, with retailers sitting on excess inventory, especially of apparel. A strong US dollar as a result of tighter monetary policy could make US exports more expensive. The US central bank has hiked its policy rate by 225 basis points since March. The aggressive monetary policy tightening has raised fears of a recession, hurting business sentiment. Production at auto plants surged 6.6 per cent last month. Excluding motor vehicles, manufacturing rose 0.3 per cent. Output of long-lasting manufactured consumer goods increased 3.5 per cent, while that of nondurable consumer goods fell 0.3 per cent. Mining production increased 0.7 per cent, continuing to be underpinned by oil and gas extraction. Output at utilities fell 0.8 per cent. The rise in manufacturing and mining output helped to lift overall industrial production by 0.6 per cent. Industrial output was unchanged in June. Capacity utilisation for the manufacturing sector, a measure of how fully firms are using their resources, increased half a percentage point to 79.8 per cent in July. It is 1.6 percentage points above its long-run average. Overall capacity use for the industrial sector rose to 80.3 per cent last month from 79.9 per cent in June. It is 0.7 percentage point above its 1972-2021 average. Officials at the Fed tend to look at capacity use measures for signals of how much “slack” remains in the economy – how far growth has room to run before it becomes inflationary.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Sembcorp Industries – Conventional Energy and Renewable Energy lift 1H22 profits

Recommendation: NEUTRAL (Maintained), Last Done: S$3.22

Target price: S$3.27, Analyst: Terence Chua

• 1H22 profit ahead of our expectations, at 99% of FY22e as Conventional Energy and Renewable Energy beat. One-off hedging gain of $92mn also lifted overall profits.

• Renewables profit continue to grow, +217% YoY lifted by performance in key markets and new acquisitions. Its gross renewables capacity stands at 7.1GW as at 1H22.

• Management continued to guide for stronger 2H22, despite this, we expect energy markets to moderate slightly in 2H22 before reaching normalisation in FY23e.

• We maintain NEUTRAL with higher target price of $3.27 (prev. $2.96). We raise FY22e and FY23e PATMI by 86% and 61% as we bake in higher profits from Conventional Energy and Renewable Energy. Our target price is raised to $3.27, still based on 1.2x FY22e P/BV, the average of its peers.

Asian Pay Television Trust – Stable with early signs of 5G

Recommendation: ACCUMULATE (Maintained); TP S$0.15, Last close: S$0.118; Analyst Paul Chew

• Results met our expectations. 1H revenue and EBITDA were at 49%/48% of our FY22e estimates. 2Q22 distribution was maintained at 0.25 cents per unit.

• Broadband remains the growth segment, rising 16% YoY but pulled down by 7% contraction in cable TV revenue. 5G backhaul revenue was S$2.2mn annualised (FY21: S$1.6mn).

• We upgrade to BUY due to the recent share price weakness. No change to our FY22e EBITDA forecast and target price of S$0.15, based on 9x FY21e EV/EBITDA, a 20% discount to Taiwanese peers. The current dividend yield of 8.5% or S$18mn payout, is well supported by an estimated free cash flows of around S$80mn p.a.

ComfortDelGro Corp Ltd – Recovery is underway, except China

Recommendation: BUY (Maintained); TP S$1.80, Last close: S$1.47; Analyst Paul Chew

• 1H22 revenue and PATMI were 49%/35% respectively of our FY22e forecast. Results were below expectations due to taxi rebates of S$10mn in China due to the lockdown.

• Huge operating leverage was underway in the results. Excluding government relief and non-recurring items, operating profit in 2Q22 jumped 2.5-fold to S$62mn.

• The recovery is at a nascent stage. Return to office and other activities started only in the later part of 2Q22. We expect 2H22 to be stronger. Taxi revenue will benefit from the rising number of trips and an increase in booking fees. Rail ridership is recovering strongly from a surge in ridership. No change in our forecast or DCF target price (WACC 8%) of S$1.80.

Upcoming Webinars

Guest Presentation by First REIT

Date: 18 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3BqQe3q

Guest Presentation by Audience Analytics

Date: 23 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3P3eBYR

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Guest Presentation by Marathon Digital Holdings

Date: 26 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by Halcyon Agri Corporation Limited [NEW]

Date: 31 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3pjErMM

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Research Videos

Weekly Market Outlook: CLI, Pan-U Corp, HRnet, PropNex, Thai Bev, FAANGM, SG Weekly & More

Date: 15 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials