DAILY MORNING NOTE | 17 January 2023

Trade of The Day

Technical Pulse: CapitaLand Integrated Commercial Trust (SGX: C38U)

Analyst: Zane Aw

(Current Price: S$2.04) – TECHNICAL BUYBuy price: S$2.04 Stop loss: S$2.00 Take profit: S$2.20

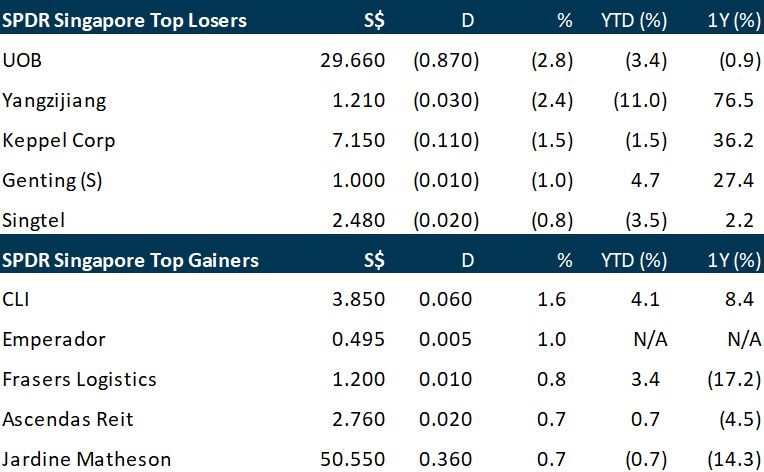

Singapore stocks started the week in the red, with the Straits Times Index (STI) closing 0.3 per cent or 10.15 points lower at 3,283.60 points on Monday (Jan 16). The STI bucked the trend among its Asian peers, which were buoyed by optimism surrounding China’s reopening. Across the broader Singapore market, decliners beat gainers 295 to 248, on a turnover of 851.4 million securities with a total value of S$991.4 million.

The S&P 500 and Nasdaq were closed on Monday (Jan 16) in observance of Martin Luther King Jr. Day. European shares hit a near nine-month high on Monday, albeit in light trading due to a US holiday, with real estate and retail stocks helping offset losses in commodity-linked sectors. The pan-European Stoxx 600 closed up 0.5 per cent at 454.6 – its highest level since April 2022 – as global equities continued to build on a new year rally spurred by hopes of a rebound in China’s economy and an easing of prices pressures in the United States and Europe. The Stoxx 600 index has gained 6.6 per cent since the start of the year, as warmer weather added to hopes of an easing in the European energy crisis brought on by the Russia-Ukraine war.

SG

New private home sales plummeted to their lowest level since the global financial crisis in 2008, weighed down by an absence of new project launches and the seasonal year-end holiday lull. According to data released by the Urban Redevelopment Authority (URA) on Monday (Jan 16), developers sold a total of 170 units, excluding executive condominiums (ECs), in December 2022, down 34.6 per cent from the 260 units moved in the month before. The latest December sales figure is also 73.8 per cent less than the 650 units sold in the same month in 2021, and is the lowest since January 2009, when just 108 units were transacted.

Plans to use a 4,200-kilometre power cable to send clean energy from Australia to Singapore are no longer commercially viable, according to one of the project’s billionaire investors. A review of Sun Cable’s A$30 billion (S$28 billion) proposals concluded the project should ditch an ambition to export electricity and focus instead on using a huge planned solar and battery facility to feed green industries at home, according to Andrew Forrest’s Squadron Energy unit — which holds a 25 per cent stake in the developer. Sun Cable entered into voluntary administration last week after a disagreement between Forrest and tech tycoon Mike Cannon-Brookes over funding and the plans to send clean power overseas. Forrest is considering a potential offer for the company, a person familiar with the details said last week.

A combined 2.7 million passengers flew on Singapore Airlines (SIA) and Scoot in December, marking an 11.7 per cent month-on-month increase. Group passenger traffic and load factors remained robust across all route regions including East Asia, said SIA Group in a bourse filing on Monday (Jan 16). In Hong Kong, Japan and Taiwan, the demand for air travel was boosted by the relaxation of travel restrictions. Group passenger capacity was 6.9 per cent higher in December compared to the prior month, reaching 80 per cent of pre-Covid levels. The group recorded its highest monthly passenger load factor (PLF) in December, with PLF coming in 3.8 percentage points higher month on month at 89.7 per cent. Year on year, PLF improved by 43.2 percentage points. SIA and Scoot posted record monthly PLFs of 89.1 per cent and 91.6 per cent, respectively. The group, however, experienced weaker cargo demand. Cargo operations had a load factor of 54.3 per cent, 24.5 percentage points lower year on year.

Catalist-listed Memories Group will delist on Wednesday (Jan 18), according to a bourse filing on Monday. This announcement follows Memories’ offer to privatise the tourism company last September for either S$0.047 per share in cash or shares in offeror Memories (2022) at the same price per new offer share. Both parties previously said that new offer shares in Memories (2022) have not been considered to be listed on any securities exchange. Approval was given to the group on Dec 7, 2022 to delist. Based in Myanmar, Memories (2022) is affiliated with investment firm Yoma Strategic and focuses on experiences, hotels and services. Memories Group last traded at S$0.044 on Dec 2, 2022.

Oceanus Group has signed a trade agreement Uzbekistan’s Ministry of Investments, Trade and Industry, to grow trade and commerce activities between the two countries, with a target annual export volume of more than US$200 million. Oceanus is also in talks with Uzbekistan to set up a joint venture company, with an eye on the regional markets of Asean, China, Middle East and even Europe. In addition, Oceanus has signed a two-year MOU with the Chamber of Commerce and Industry of Uzbekistan on the establishment of Uzbekistan-Singapore Chamber of Commerce. Oceanus Group shares closed Jan 16 at 1.4 cents, down 6.67% for the day and down 53.33% over the past year.

US

Oil prices held near this year’s highs on Monday (Jan 16), as easing Covid restrictions in China raised expectations for a recovery in demand from the world’s top crude importer. Brent crude fell 0.5 per cent or US$0.41, to US$84.87 a barrel by 1236 GMT. US West Texas Intermediate crude was down 0.4 per cent or US$0.28, at US$79.58 per barrel, amid thin trade during Monday’s US public holiday. Both contracts rose more than 8 per cent last week in the biggest weekly gains since October 2022. This came after China abandoned what remained of its zero-Covid policy by reopening its borders on Jan 8. China’s crude imports rose 4 per cent year on year in December. An expected resurgence in travel for the Chinese New Year holiday at the end of this week has raised the outlook for transport fuel demand.

Microsoft is likely to receive an European Union (EU) antitrust warning about its US$69 billion bid for Call of Duty maker Activision Blizzard, people familiar with the matter said, that could pose another challenge to completing the deal. The European Commission is readying a charge sheet known as a statement of objections setting out its concerns about the deal which will be sent to Microsoft in the coming weeks, the people said. The EU antitrust watchdog, which has set an Apr 11 deadline for its decision on the deal, declined to comment. Microsoft said: “We’re continuing to work with the European Commission to address any marketplace concerns. Our goal is to bring more games to more people, and this deal will further that goal.” The US software giant and Xbox maker announced the acquisition in January last year to help it compete better with leaders Tencent and Sony. US and UK regulators, however, have voiced concerns, with the US Federal Trade Commission going to court to block the deal.

Gold held near nine-month highs on Monday (Jan 16), aided by expectations of slower interest rate hikes from the US Federal Reserve. Spot gold was little changed at US$1,918.60 per ounce, as of 0014 GMT. Earlier, prices had hit US$1,922.25, its highest since April 2022. US gold futures fell 0.1 per cent to US$1,920.10. Market participants are mostly expecting a 25 basis points (bps) rate hike increase at the Fed’s next policy meeting. Lower rates tend to be beneficial for gold as they decrease the opportunity cost of holding the non-yielding bullion. US consumers are becoming more confident that price pressures will ease considerably over the next 12 months, with a survey on Friday showing their one-year inflation expectations falling in January to the lowest level since the spring of 2021.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

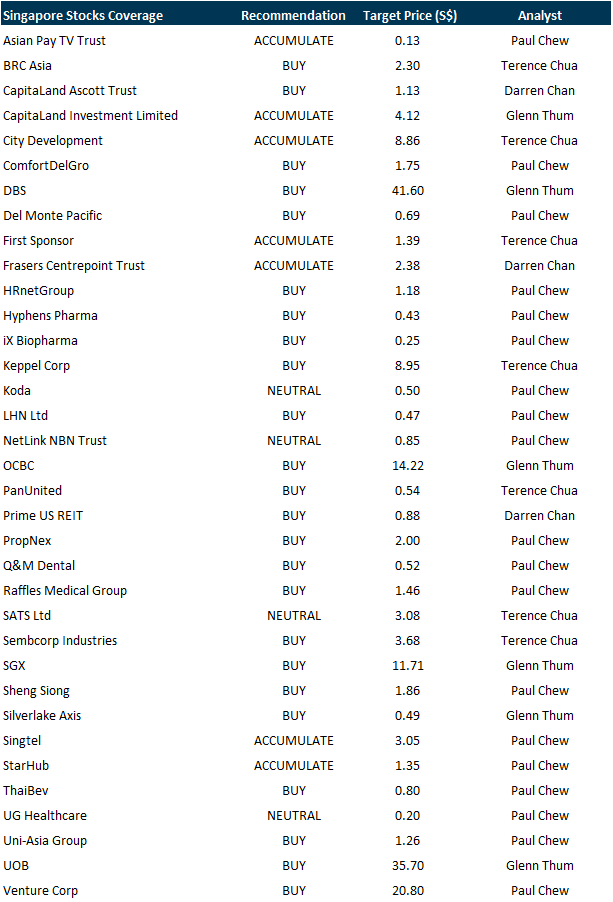

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Civmec

Date: 20 January 2023

Time: 12pm – 1pm

Register: https://bit.ly/3iwhMx1

Guest Presentation by Comba Telecom Systems Holdings Limited

Date: 31 January 2023

Time: 11am – 12pm

Register: https://bit.ly/3GuS5VK

Research Videos

Weekly Market Outlook: Block Inc., SG Banking Monthly, Technical Analysis, US1Q23 Strategy & More

Date: 16 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials