DAILY MORNING NOTE | 17 March 2023

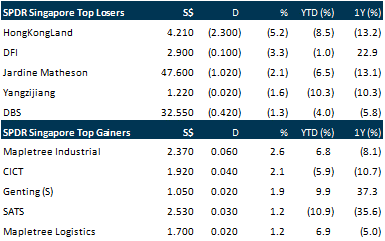

After snapping a five-day losing streak on Wednesday, Singapore stocks fell once again on Thursday (Mar 16), tracking a broader regional decline as banking sector concerns continue to weigh on markets. Singapore stocks fell 0.5 per cent or 17.38 points to close at 3,155.54. Elsewhere, key indices in Japan, Australia, Hong Kong and Shanghai were down between 0.8 per cent and 1.7 per cent. On the Singapore market, the trio of local banks – DBS, OCBC and UOB – closed the day in negative territory, falling between 0.7 per cent and 1.3 per cent.

Wall Street stocks finished solidly higher on Thursday after a consortium of major US private banks announced a US$30 billion rescue package for embattled lender First Republic. After opening lower, stocks rallied on reports anticipating the package. All three major US indices finished firmly higher. The Dow Jones Industrial Average finished up 1.2 per cent at 32,246.55. The broad-based S&P 500 gained 1.8 per cent to 3,960.28, while the tech-rich Nasdaq Composite Index jumped 2.5 per cent to 11,717.28.

SG

Singapore state investors GIC and Temasek are new investors in the latest US$6.5 billion fundraising by Stripe, which nearly halved the US fintech’s valuation to US$50 billion. Other investors in the round include existing Stripe shareholders – Andreessen Horowitz, Baillie Gifford, Founders Fund, General Catalyst, MSD Partners and Thrive Capital – as well as another new investor, Goldman Sachs Asset and Wealth Management, the fintech announced on Thursday (Mar 16). The company will use the capital to address tax obligations arising from equity awards to its staff, as well as to provide liquidity to current and former employees. The tax bill was reportedly estimated at US$3.5 billion, according to past media reports.

Singapore pushed New York off the top spot for the strongest growth in residential rents in the last quarter of 2022, fuelled by a supply crunch and strong demand. The city-state saw annual rents jump 28 per cent in the quarter from a year earlier, according to a report by Knight Frank. New York followed with 19 per cent growth, while London and Toronto took the third and fourth spots, according to the survey of prime residential rents across 10 cities.

GS Holdings’ chicken rice brand, Sing Swee Kee, and its Hainanese-style coffee brand, Raffles Coffee & Toast, are expanding into China. The Catalist board-listed company on Thursday (Mar 16) signed a master franchise agreement with De Run Elderly Care Property Management (Guangdong) Group to bring the brands into the country. The signing precedes even Raffles Coffee & Toast’s debut in Singapore. Its first outlet in Singapore is slated to open in May, the company noted. GS Holdings said that barring unforeseen circumstances, the first Sing Swee Kee outlet in China is expected to open by the third quarter of the year.

The trio of Singapore banks’ exposures to Credit Suisse are insignificant, the Monetary Authority of Singapore (MAS) said on Thursday (Mar 16), in response to media queries on the local fallout of the embattled Swiss lender’s crisis. The Singapore central bank said DBS, OCBC and UOB are well-capitalised, and conduct regular stress tests against credit and other risks. Their “liquidity positions are healthy, underpinned by a stable and diversified funding base”, it added as it reiterated that Singapore’s banking system remains “sound and resilient”.

Keppel Corp has inked a pact with Cambodia’s Royal Group Power for the long-term import and sale of one gigawatt (GW) of low-carbon electricity, in a move that marks Singapore’s largest cross-border electricity contract and progress in the city-state’s decarbonisation goals for the power sector. This development also makes Keppel the first to clinch conditional approval from Singapore’s Energy Market Authority (EMA) in its search for parties to import and sell up to 4 GW of low-carbon electricity by 2035, said EMA in a statement on Thursday (Mar 16). The conditional go-ahead was awarded to Keppel Energy, wholly owned by Keppel Infrastructure, which counts Keppel as parent company.

Singapore and Indonesia are exploring cooperation in new areas such as tech talent and smart cities, following the resolution of longstanding bilateral issues, including over airspace, both leaders said at an annual leaders’ retreat in the city-state on Thursday (Mar 16). At a joint press conference at the Istana, Singapore Prime Minister Lee Hsien Loong said bilateral relations are in “excellent order”, with both countries having taken a “major step forward” to resolve three longstanding issues.

Against a backdrop of heightened volatility in the global financial markets, Singapore’s latest six-month Treasury bill (T-bill) had a cut-off yield of 3.65 per cent when the auction closed on Thursday (Mar 16). This was the lowest since last September’s 3.32 per cent. The allotment size was S$4.6 billion, with an oversubscription rate of about 2.8 times. The non-competitive applications – without specifying a yield – were fully allotted as these amounted to only S$837 million, well below the 40 per cent of allotment amount. Of the competitive applications at cut-off yield, 66 per cent were allotted. The median yield was 3.58 per cent and the average yield was 3.41 per cent.

The ongoing glove oversupply situation, a softer order book and rising production costs have led Top Glove to turn in a net loss of RM164.7 million (S$49.4 million) for the second quarter of FY2023. This translates to a loss per share (LPS) of 2.06 sen, as opposed to the 1.09 sen earnings per share (EPS) recorded the previous year. For the quarter ended Feb 28, 2023, the glove manufacturer reported revenue of RM618 million, representing a 58 per cent decline from RM1.5 billion in revenue for Q2 FY2022.

Thai Beverage (ThaiBev) clarified that it has no concrete plans to list or sale its spirits business, after Bloomberg reported that it is exploring options that include an initial public offering in Singapore. In a late-night bourse filing on Thursday (Mar 16), ThaiBev said it “continually evaluates strategies and opportunities to optimise its various businesses, and regularly engages with professional advisers and banks”.

US

Microsoft on Thursday (Mar 16) trumpeted its latest plans to put artificial intelligence (AI) into the hands of more users, answering a spate of unveilings this week by its rival Google with upgrades to its own widely used office software. The company previewed a new AI “copilot” for Microsoft 365, its product suite that includes Word documents, Excel spreadsheets, PowerPoint presentations and Outlook emails. Going forward, AI can offer a first draft in Microsoft’s applications, speeding up content creation and freeing up workers’ time, the company said.

Regulators at the US Federal Deposit Insurance Corp (FDIC) have asked banks interested in acquiring failed lenders Silicon Valley Bank and Signature Bank to submit bids by Mar 17. The new auctions show how the FDIC is making a concerted effort to return the lenders to the private sector after regulators took over Silicon Valley Bank (SVB) last Friday and Signature Bank on Sunday, during a weekend of turmoil that has reverberated through the global financial system. This will be the FDIC’s second attempt at selling SVB after a failed effort on Sunday. The FDIC has since retained investment bank Piper Sandler Companies to run a new auction, the sources said.

Applications for US unemployment benefits fell last week by the most since July, unwinding most of the prior week’s jump as claims in New York plunged. Initial unemployment claims decreased by 20,000 to 192,000 in the week ended March 11, Labor Department data showed on Thursday(Mar 16). The median estimate in a Bloomberg survey of economists called for 205,000 applications. Continuing claims, which include people who have received unemployment benefits for a week or more, fell by 29,000 to 1.68 million in the week ended March 4.

The European Central Bank raised interest rates by 50 basis points on Thursday (Mar 16) as promised, ignoring financial market chaos and calls by investors to dial back policy tightening at least until sentiment stabilises. The ECB has been raising rates at its fastest pace on record to curb inflation, but a rout in global markets since the collapse of Silicon Valley Bank in the United States last week had threatened to upend those plans at the last moment. In line with its often-repeated guidance, the central bank for the 20 countries that share the euro lifted its deposit rate to 3 per cent, the highest level since late 2008, as inflation is seen overshooting its 2 per cent target through 2025.

Large US banks injected US$30 billion into First Republic Bank on Thursday, swooping in to rescue the lender caught up in a widening crisis triggered by the collapse of two other mid-size US lenders over the past week. Banking stocks globally have been battered since Silicon Valley Bank collapsed last week due to bond-related losses that piled up when interest rates surged last year, raising questions about what else might be lurking in the wider banking system.. Some of the biggest US banking names including JPMorgan Chase & Co, Citigroup, Bank of America, Wells Fargo & Co, Goldman Sachs and Morgan Stanley were involved in the rescue, according to a statement from the banks.

Britain said on Thursday (Mar 16) it would ban TikTok on government phones with immediate effect, a move that follows other Western countries who have barred the Chinese-owned video app over security concerns. TikTok has come under increasing scrutiny due to fears that user data from the app owned by Beijing-based company ByteDance could end up in the hands of the Chinese government, undermining Western security interests. Britain’s National Cyber Security Centre has been reviewing whether TikTok should be barred from government phones, while the United States, Canada, Belgium and the European Commission have already banned the app.

Taiwanese contract manufacturer Foxconn has won an order to make AirPods for Apple and plans to build a factory in India to produce the wireless earphones, two people with direct knowledge of the matter told Reuters. The deal will see Foxconn, the world’s largest contract electronics maker and assembler of around 70 per cent of all iPhones, become an AirPod supplier for the first time and underlines efforts by the key Apple supplier to further diversify production away from China. AirPods are currently made by a range of Chinese suppliers. One source said Foxconn will invest more than US$200 million in the new India AirPod plant in the southern Indian state of Telangana. It wasn’t immediately clear how much the AirPod order would be worth.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

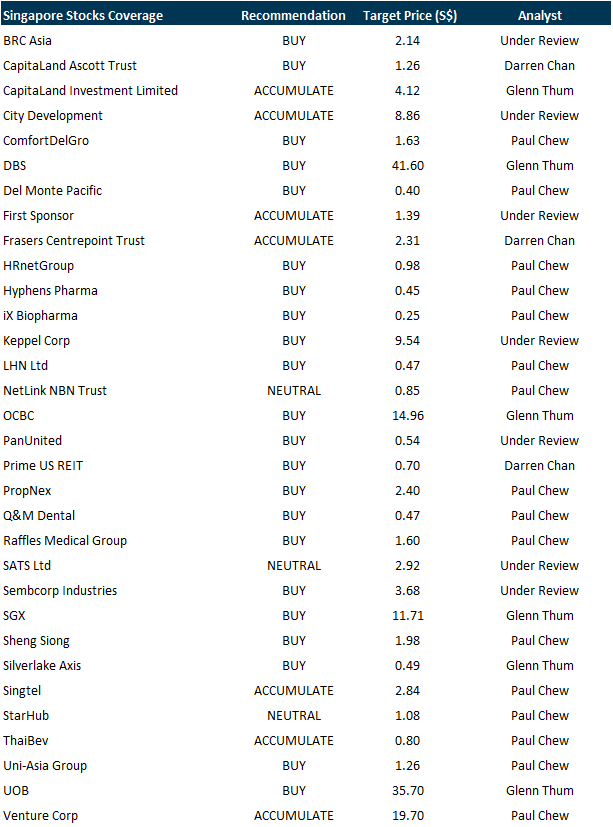

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Keppel Pacific Oak US REIT (KORE) [NEW]

Date: 23 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3XY2n7v

Research Videos

Weekly Market Outlook: Salesforce, Sea Ltd, TDCX, Hyphens Pharma, Q&M, Tech Analysis & More…

Date: 13 March 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials