DAILY MORNING NOTE | 18 August 2022

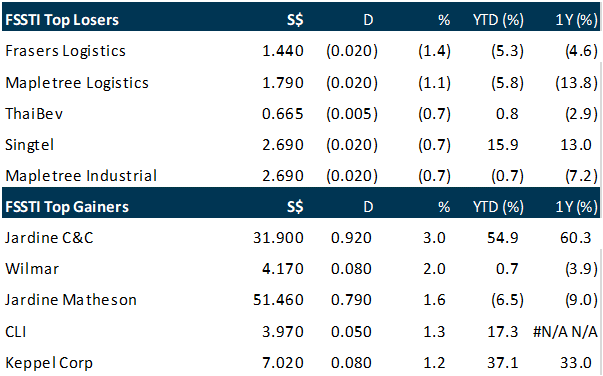

Singapore shares inched up on Wednesday (Aug 17), as traders sought out market opportunities ahead of the release of the minutes of the US Federal Reserve’s July meeting. Some positive fronts on macroeconomic data also lifted investor optimism. Data from Enterprise Singapore showed that Singapore’s key exports in July grew for the 20th consecutive month. The Straits Times Index (STI) rose 0.3 per cent or 8.97 points to cap Wednesday’s trading session at 3,262.76. Daily turnover came in at 1.2 billion securities worth a collective S$1.1 billion. Market winners outnumbered losers 256 to 208. On the local bourse, Jardine Cycle and Carriage was the top gainer, adding 3 per cent or S$0.92 to S$31.90. Venture Corporation was another top gainer, rising 0.9 per cent or S$0.16 to S$18.40. The trio of local lenders ended the day mixed. OCBC was one of the biggest advancers, booking a gain of 0.9 per cent or S$0.11 to S$12.29. On the other hand, DBS and UOB among the top decliners. DBS slipped 0.2 per cent or S$0.06 to S$32.25; UOB shed 0.1 per cent or S$0.03 to S$26.85.

Wall Street stocks declined on Wednesday following mixed retail sales and earnings reports as the market’s July and August rally showed signs of fatigue. US retail sales flatlined at US$682.8 billion in July as petrol prices retreated from record levels while American consumers boosted spending on furniture, food, electronics and at online stores. Earnings from big-box chains were also mixed, with Lowe’s topping profit estimates but Target suffering a big drop in earnings as the retailer contends with rising costs. The Dow Jones Industrial Average dipped 0.5 per cent to close at 33,980.32. The broad-based S&P 500 shed 0.7 per cent to end at 4,274.04, while the tech-rich Nasdaq Composite Index tumbled 1.3 per cent to 12,938.12. Minutes from the latest Federal Reserve meeting in July showed the central bank was committed to raising interest rates further to quell rising prices. But many officials at the meeting cautioned that there is a “risk” the Fed could go too far as it tries to cool demand to lower prices that have surged at the fastest pace in more than 40 years. The rapid, aggressive moves by the central bank have started to have an impact, and while officials say the US economy should continue to expand in the second half of the year, “many expected that growth in economic activity would be at a below-trend pace,” the minutes said. Among individual companies, Target dropped 2.9 per cent, while Lowe’s gained 0.6 per cent and TJ Maxx parent TJX, which also reported results, climbed 2.9 per cent.

SG

Mainboard-listed OUE Commercial real estate investment trust (C-Reit) successfully completed a S$978 million unsecured sustainability-linked loan to refinance existing secured borrowings. The loan, syndicated by a consortium of 4 mandated lead arrangers and bookrunners – CIMB Bank Singapore, Maybank Singapore, OCBC and Standard Chartered – was 1.26 times oversubscribed and supported by 19 banks, the Reit manager announced in a press statement on Wednesday (Aug 17). Post refinancing, the average term of debt as at Jun 30 will lengthen to 3.2 years on a pro forma basis with the weighted average cost of debt expected to remain largely stable, it added. The proportion of the Reit’s unsecured debt will also increase significantly from 30.9 per cent to 70.2 per cent on a pro forma basis. Sustainability-linked loans now account for 58 per cent of OUE C-Reit’s total debt. These loans incorporate interest rate reductions linked to predetermine sustainability performance targets which are aligned with the Reit’s commitment to reduce the environmental impact of its portfolio, the filing noted. OUE C-Reit has set energy and water intensity reduction targets of 25 per cent below 2017 levels, to be achieved by 2030.

Singapore’s key exports could cool in the coming months, amid weaker demand from China and dimmer prospects for electronic exports, economists have said. Non-oil domestic exports (NODX) to China contracted sharply by 21.3 per cent year on year in July, compared with a modest growth of 2.1 per cent in the previous month, according to data from Enterprise Singapore (EnterpriseSG) on Wednesday (Aug 17). Key exports to Japan in July also shrank for the first time this year by 15.3 per cent, a marked reversal from the 18.6 per cent growth clocked in the month before. Meanwhile, shipments to 6 of Singapore’s top 10 markets rose in July, with growth led by the euro zone, Malaysia and Taiwan. Accordingly, overall NODX eased to 7 per cent year on year, from 8.5 per cent in June, even amid gains in both electronic and non-electronic exports. Exports of electronic products rose 10.3 per cent year on year in July, up from 4.1 per cent, whereas non-electronic exports slowed to 6.1 per cent year on year in the same month, from 10 per cent. Just last week, EnterpriseSG upgraded its full-year NODX projection to 5-6 per cent, from an earlier estimate of 3-5 per cent, even if analysts were not altogether convinced this was driven by stronger external demand. In fact, most economists are now expecting export growth to slow down in the months ahead, even if they are keeping their full-year NODX outlook unchanged for now. OCBC’s forecast is 6-8 per cent; RHB’s is 7 per cent; Maybank’s is 5-6 per cent; and UOB’s is 5 per cent.

US

Gold prices were flat on Wednesday (Aug 17), as investors awaited the release of the minutes of the US Federal Reserve’s last policy meeting later in the day that could offer clues on further interest rate hikes. Spot gold was flat at US$1,775.59 per ounce, as of 1.19 am GMT, after hitting its lowest since Aug 8 at US$1,770.86 on Tuesday. US gold futures were steady at US$1,788.80 per ounce. The dollar held steady after rising to a 3-week peak against its rivals on Tuesday, while benchmark US 10-year Treasury yields edged higher. Market participants are awaiting the minutes of Fed’s Jul 26-27 policy meeting due at 6.00 pm GMT. Although gold is seen as a hedge against inflation, rising US interest rates dull non-yielding bullion’s appeal.

The US dollar held onto gains against other major currencies on Wednesday (Aug 17), ahead of the release of minutes of the US Federal Reserve’s (Fed) July meeting that could give further clues about the pace of further interest rate hikes. The greenback has recovered the ground it lost since softer-than-expected inflation data last week led to investor bets that price rises may have peaked, weakening the US dollar. Several Fed officials have signalled over the past week that the central bank will still act decisively to combat inflation, helping lift the US dollar back up. US retail sales data due later on Wednesday will also be watched closely as an indicator of the economy’s resilience. The US dollar index was last up 0.1 per cent on the day at 106.600. It has recovered by around 2 per cent since last week’s post-inflation data low, but remains more than 2 per cent off the 2-decade high of 109.29 hit in mid-July. The US dollar gained 0.5 per cent versus the yen to 134.960, after data showed Japan’s trade gap widened after a record surge in imports in July.

US business inventories increased strongly in June amid signs of a large build-up of stocks in the retail sector despite a pickup in sales. Business inventories rose 1.4 per cent after advancing 1.6 per cent in May, the Commerce Department said on Wednesday (Aug 17). Inventories are a key component of gross domestic product. June’s increase was in line with economists’ expectations. Inventories increased 18.5 per cent on a year-on-year basis in June. Retail inventories increased 2.0 per cent in June, as estimated in an advance report published last month. That followed a 1.6 per cent gain in May. Motor vehicle inventories accelerated 3.3 per cent instead of the 3.1 per cent estimated last month. They advanced 2.4 per cent in May. Retail inventories excluding autos, which go into the calculation of GDP, increased 1.5 per cent instead of 1.6 per cent as estimated last month. Business inventories increased at a strong clip in the first quarter as consumer spending slowed. The excess inventory, especially at retailers, left businesses with little appetite to continue restocking, which weighed on GDP in the second quarter. Walmart said on Tuesday it had cleared most of its summer seasonal inventory, but still had work to do in reducing stock of electronics, home goods and apparel. The economy contracted at a 0.9 per cent annualised rate in the second quarter after shrinking at a 1.6 per cent pace in the January-March period. Wholesale inventories increased 1.8 per cent in June. Stocks at manufacturers climbed 0.4 per cent. Business sales rose 1.3 per cent in June after gaining 1.0% in May. At June’s sales pace, it would take 1.30 months for businesses to clear shelves, unchanged from May.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

NetLink NBN Trust – Residential connections normalising

Recommendation: NEUTRAL (Maintained); TP S$0.96, Last close: S$0.945; Analyst Paul Chew

• 1Q23 revenue and EBITDA were within expectations, at 25/27% of our FY23e forecasts. Revenue rose 4.8%, supported by a sharp rebound in diversion revenue. Central office remains a drag as customers surrender more equipment space.

• Residential fibre connections rose 5,598 in 1Q23 (1Q22: +2,292). Last year was impacted by lockdowns and movement restrictions.

• Interest rate risk is well hedged, with 76% of the debt fixed at 1% until May 2026. Regulatory review of fibre prices is ongoing. Recent inflationary pressures and higher interest rates are positives. The planned capital expenditure (or regulated asset base) and WACC under consideration will be higher. No change to FY23e forecast. Our NEUTRAL recommendation and DCF target price of S$0.96 is maintained.

Analyst: Zane Aw

Recommendation: Technical BUY

Buy limit: 4.07 Stop loss: 3.88 Take profit 1: 4.40 Take profit 2: 4.7

SATS Ltd (SGX: S58) A retest of the immediate support at 4.00-4.10 is possible before price edges higher.

Upcoming Webinars

Guest Presentation by First REIT

Date: 18 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3BqQe3q

Guest Presentation by Audience Analytics

Date: 23 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3P3eBYR

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Guest Presentation by Unity [NEW]

Date: 25 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3w9ssW7

Guest Presentation by Marathon Digital Holdings

Date: 26 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by Halcyon Agri Corporation Limited [NEW]

Date: 31 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3pjErMM

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Research Videos

Weekly Market Outlook: CLI, Pan-U Corp, HRnet, PropNex, Thai Bev, FAANGM, SG Weekly & More

Date: 15 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials