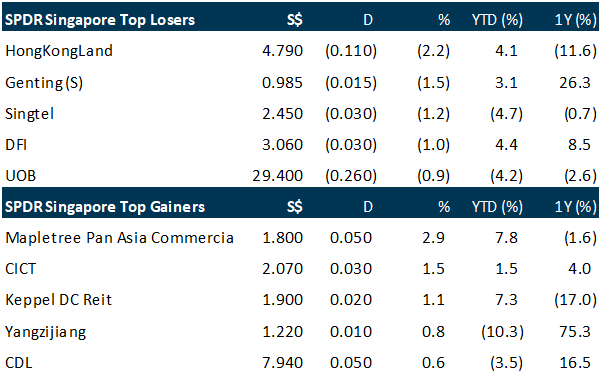

DAILY MORNING NOTE | 18 January 2023

Singapore shares slid in line with the declines recorded at most Asian bourses on Tuesday (Jan 17), amid reports of the Republic’s December exports having experienced their steepest decline in a decade. The Strait Times Index (STI) was down 3.09 points or 0.1 per cent to 3,280.51 points – the second day in a row that the blue-chip barometer has dropped.

Wall Street’s main indexes opened lower on Tuesday (Jan 17) after Goldman Sachs missed quarterly profit estimates, worsening sentiment already dented by downbeat economic data from China earlier in the day. The Dow Jones Industrial Average fell 80.29 points, or 0.23 per cent, at the open to 34,222.32. The S&P 500 fell 0.01 per cent to 3,999.09 points at the open, while the Nasdaq Composite dropped 9.15 points, or 0.08 per cent, to 11,070.00 at the opening bell.

SG

Multi-industry food company QAF expects its operating performance before exceptional items for its second half (H2) of 2022 to exceed its results in the first half, the company said in its profit guidance on Tuesday (Jan 17). QAF said its H2 performance is “typically” better than H1, although it had been challenging to comment on the trend in the current volatile environment. For its financial year ended 2022, the company also recorded insurance payouts as exceptional gains. In October, QAF said it received total interim insurance payments of RM62 million (S$20 million) for damages at one of its Malaysian factories during severe flooding in December 2021. Meanwhile, the company expects it will record higher unrealised foreign exchange loss of S$10.4 million for FY2022, mainly from its holdings in Australian dollar-denominated cash and deposits that amounted to A$147.6 million (S$134.5 million). QAF also expects to record non-cash impairment of around S$5 million on its investment in its joint venture Gardenia Bakeries (KL), as part of its periodical assessment on the recoverable amount of its investment.

Singapore tourism receipts reached an estimated S$13.8 billion to S$14.3 billion in 2022, about half of the 2019 pre-pandemic level, based on preliminary figures, the Singapore Tourism Board (STB) said at their year-in-review on Tuesday (Jan 17). This was on the back of 6.3 million international visitor arrivals – above STB’s forecast of four to six million visitors, though only about a third of the 2019 figure. December alone saw 931,337 international visitor arrivals, the highest since the onset of the pandemic, though it remains below December 2019’s 1.7 million visitors, STB data showed. There were 816,340 tourist arrivals in November 2022. Barring unexpected circumstances, tourism activity is now expected to recover to pre-pandemic levels by 2024, earlier than the previously expected mid-2020s recovery.

Singapore’s non-oil domestic exports (NODX) contracted again in December, dragged by declines in non-electronic shipments and declining deliveries to most of the Republic’s top 10 key markets, data from Enterprise Singapore (EnterpriseSG) showed on Tuesday (Jan 17). Non-oil domestic exports (NODX) in December tumbled 20.6 per cent year on year from a high year-ago base, extending the 14.7 per cent fall in the previous month and marking the third consecutive month of decline. December’s performance was lower than what private-sector economist had expected – a 17.5 per cent contraction year on year, according to a Bloomberg poll. The shipment of electronic products fell 17.9 per cent year on year in December, against the previous month’s 20.2 per cent contraction. Contributing most to the fall in electronic NODX was integrated circuits (-26 per cent), disk media products (-36.5 per cent) and PC parts (-41.7 per cent). Non-electronic exports also declined by 21.3 per cent in December, extending November’s 12.8 per cent decline. Non-monetary gold (-63.3 per cent), specialised machinery (-16.6 per cent) and primary chemicals (-55.6 per cent) contributed the most to the decline in non-electronic NODX.

US

Apple on Tuesday (Jan 17) unveiled new MacBooks powered with the latest M2 Pro and M2 Max chips made in-house, in a surprise announcement ahead of its traditional launch event. The Mac mini starts at US$599, cheaper than the latest iPhone 14 series, and is available beginning Jan 24. Apple however did not provide pricing information for the laptops. The new MacBook Pro’s performance is six-times faster than the Intel-based MacBook Pro, according to Apple. The company traditionally has four launch events in a year, with the first spring event scheduled in March, when Apple launches its iMacs and accessories.

Morgan Stanley reported a smaller-than-expected 41 per cent drop in fourth-quarter profit on Tuesday (Jan 17) as the bank’s trading business got a boost from market volatility, offsetting the hit from sluggish dealmaking. Revenue from Morgan Stanley’s investment banking business fell 49 per cent to US$1.25 billion in the fourth quarter, with revenue declines across the bank’s advisory, equity and fixed income segments. The investment banking business slowdown weighed on the company’s net revenue, pulling it down 12 per cent to US$12.7 billion. Morgan Stanley increased its provision for credit losses in the fourth quarter to US$87 million from US$5 million a year earlier amid worries of a looming recession in the US and worsening consumer credit quality.

Goldman Sachs Group on Tuesday (Jan 17) reported a bigger-than-expected 69 per cent drop in fourth-quarter profit due to heavy losses in its consumer business and a slump in dealmaking that hit its investment banking unit. The bank reported a profit of US$1.19 billion, or US$3.32 per share, for the three months ended Dec 31, compared with US$3.81 billion, or US$10.81 per share, a year earlier. Goldman’s investment banking fees fell 48 per cent in the quarter. The bank also reported a pre-tax loss of US$778 million in its platform solutions unit, which houses transaction banking, credit card and financial technology businesses. Fixed income, currency and commodities trading revenue was up 44 per cent, while revenue from equities trading fell 5 per cent. Overall net revenue was down 16 per cent at US$10.6 billion.

Saudi Arabia is open to discussions about trade in currencies other than the US dollar, according to the kingdom’s finance minister, in what could be another challenge to the greenback’s hegemony. “There are no issues with discussing how we settle our trade arrangements, whether it is in the US dollar, whether it is the euro, whether it is the Saudi riyal,” Mohammed Al-Jadaan told Bloomberg TV on Tuesday (Jan 17) in an interview in Davos. “I don’t think we are waving away or ruling out any discussion that will help improve the trade around the world,” Al-Jadaan said. The world’s largest oil exporter, which has maintained a currency peg to the dollar for decades, is seeking to strengthen its relations with crucial trade partners including China. The kingdom is a pillar to a petrodollar system established in the 1970s that relies on pricing crude exports in the US currency. Saudi Arabia is also working with multilateral institutions to provide support to Pakistan, Turkey and Egypt, as part of the kingdom’s largesse to nations it deems “vulnerable,” Al-Jadaan said.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

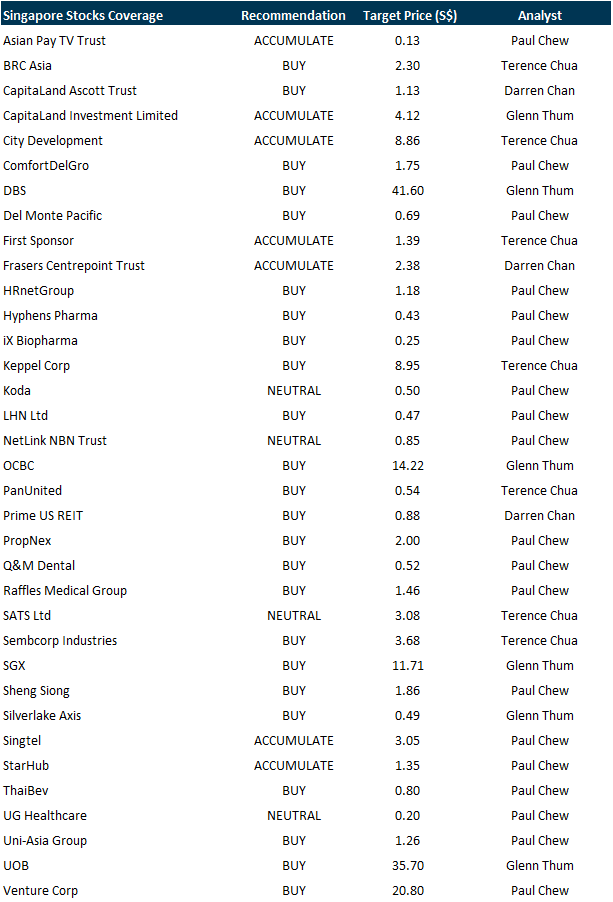

RESEARCH REPORTS

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Civmec

Date: 20 January 2023

Time: 12pm – 1pm

Register: https://bit.ly/3iwhMx1

Guest Presentation by Comba Telecom Systems Holdings Limited

Date: 31 January 2023

Time: 11am – 12pm

Register: https://bit.ly/3GuS5VK

Research Videos

Weekly Market Outlook: Block Inc., SG Banking Monthly, Technical Analysis, US1Q23 Strategy & More

Date: 16 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials