Daily Morning Note – 18 March 2022

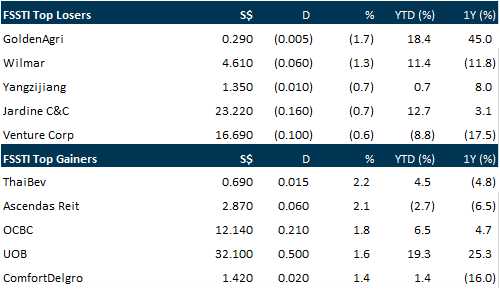

Singapore shares rose for a third straight session on Thursday (Mar 17) as Asian markets rallied following a spate of positive developments. Optimism was largely fuelled by clarity on the US monetary policy, China’s pledge to support the nation’s markets as well as progress in peace talks between Russia and Ukraine. The Singapore Straits Times Index (STI) advanced 0.97 per cent or 31.81 points to 3,322.71. With the exception of the Jakarta Composite Index, benchmark indices in the region ended the day higher.

Wall Street stocks rallied for a third straight session on Thursday despite a jump in oil prices as markets monitored developments in Ukraine and digested monetary tightening moves by central banks. Petroleum-linked shares had a banner day as oil prices shot up more than 8 per cent on continued worry about lost crude production from Russia following its invasion of Ukraine. Higher oil prices usually weigh on the broader equity market, but stocks continued to benefit from positive momentum, analysts said. Hopes for peace negotiations were dampened following the Russian bombing of a Ukrainian theater sheltering many civilians, but planned talks between the leaders of the United States and China raised investors’ hopes. “Wall Street is eagerly awaiting to see what happens with President (Joe) Biden’s call with President Xi (Jinping),” said Oanda’s Edward Moya. “If the US can have China refrain from providing support to the Russians, investors may grow more optimistic that an end to this war could happen much sooner.” The Dow Jones Industrial Average finished up 1.2 per cent at 34,480.76, its third straight session of adding more than 1 per cent. The broad-based S&P 500 also climbed 1.2 per cent to 4,411.67, while the tech-rich Nasdaq Composite Index advanced 1.3 per cent to 13,614.78.

SG

Eastern Dental Centre, a 60 per cent-owned subsidiary of medtech company QT Vascular, has entered into conditional sale and purchase agreements (SPAs) to acquire the businesses of 3 Eastern Dental Surgery clinics for a total of S$1.3 million. The three clinics are namely the branches at Jurong West, Bukit Batok and Jurong East, and collectively make up the Eastern Dental Surgery Group, the company said in a regulatory filing on Thursday (Mar 17) evening. In terms of the breakdown of cost, the Jurong West branch cost S$472,500; the Bukit Batok branch was S$451,500, and the Jurong East branch’s price was S$332,500. QT Vascular noted that the total purchase consideration represents a premium of 2,094.2 per cent over the net total assets of Eastern Dental Surgery Group. However the firm believes that the acquisition of profitable dental practices with proven track records is in the interests of the company as it will support and strengthen its investments and ventures in the healthcare business.

ARA US Hospitality Trust (ARA H-Trust) is proposing to divest Hyatt Place Chicago Itasca for US$7.75 million to family-owned corporation IHP Hospitality Group, the stapled group’s managers announced on Thursday (Mar 17). The consideration will be satisfied wholly in cash and represents a slight 0.6 per cent discount to the asset’s independent valuation of US$7.8 million as at end-2021. IHP Hospitality Group has paid a non-refundable deposit of US$0.5 million after entering into a conditional purchase and sale agreement with a subsidiary of ARA H-Trust as the vendor. Upon completion, net proceeds from the divestment will be used to pare down existing bank borrowings to improve ARA H-Trust’s aggregate leverage ratio, aside from general working capital requirements.

E-commerce brand aggregator Rainforest has fully acquired baby care brand NatureBond and its parent company, Millenium Enterprises, for an undisclosed 7-figure amount. In the press release on Wednesday (Mar 16), the company also announced that NatureBond’s existing team will join Rainforest along with Jeffrey Chua, the founder of Millenium Enterprise, who will join Rainforest as an advisor. Rainforest buys e-commerce brands, specifically in the mom, kids, baby care and home categories, and grows them with a focus on long-term success. NatureBond will join Rainforest’s growing portfolio which includes brands that sell toy storage products, home bedding accessories, products for travelling with infants and more. As NatureBond is known to create distinctive products in the industry, the brand’s reputation aligns well with Rainforest’s portfolio strategy to assemble compelling international brands targeted at the modern mother, the company’s co-founder and chief executive Jia Jih Chai said. This acquisition comes after NatureBond posted S$5.8 million worth of sales in 2020, with a 76 per cent compound annual growth rate from 2017 to 2020, while Rainforest has achieved over US$30 million annualised revenue since its establishment in 2021.

US

Oil prices climbed 8 per cent on Thursday, extending a series of wild daily swings, as the market rebounded from several days of losses with a renewed focus on supply shortages in coming weeks due to sanctions on Russia. Oil benchmarks in recent weeks have undergone their most volatile period since mid-2020. After sliding as buyers cashed in on the run-up, prices resurged on expectations that shortages will soon squeeze the energy market. Benchmark Brent crude futures added US$8.62, or 8.79 per cent, at US$106.64 a barrel, its largest percentage gain since mid-2020. US West Texas Intermediate (WTI) crude rose US$7.94, or 8.35 per cent, to US$102.98 a barrel. In the last eight trading sessions, Brent oil per barrel has traded as high as US$139 and as low as US$98 – a more than US$40 spread. That has pushed many investors to exit, creating conditions for more wild price swings in the weeks ahead, traders, bankers and analysts said.

Gold prices were flat on Thursday (Mar 17), hovering near a 3-week low touched in the previous session, after the US Federal Reserve‘s interest rate hike lifted Treasury yields and as the Russia-Ukraine peace talks also capped bullion’s appeal. Spot gold held its ground at US$1,929.57 per ounce, as of 1.28 am GMT, after touching its lowest since Feb 28 at US$1,894.70 on Wednesday. US gold futures rose 1 per cent to US$1,928.40. The US central bank raised interest rates for the first time since 2018 and laid out an aggressive plan to stamp out inflation while flagging the massive uncertainty the economy faces from the war in Ukraine and the Covid-19 health crisis. Gold is highly sensitive to rising US interest rates, which increase the opportunity cost of holding non-yielding bullion. Fed’s rate decision lifted the US 10-year Treasury yields to their highest since May 2019.

Amazon.com said it closed the US$8.5 billion acquisition of film studio Metro-Goldwyn-Mayer (MGM) after regulators declined to challenge the deal, cementing the company’s biggest takeover in 5 years. The closing, announced on Thursday (Mar 15) in a statement on the company’s website, marks the latest deal by a US technology giant to win approval despite criticism that the companies have been able to gobble up smaller firms with little pushback from competition enforcers. European Union regulators signed off on the MGM deal on Tuesday after finding it posed no competition problems. In the US, the deadline for the Federal Trade Commission (FRC) to challenge the deal before the deal closed passed without the agency taking action. The FTC still has the authority to sue to block the deal in the future if a majority of commissioners vote to file a lawsuit. The commission is currently split between 2 Republicans and 2 Democrats, including chair Lina Khan, while US President Joe Biden’s nominee for the fifth seat awaits Senate confirmation. Amazon shares were little changed at US$3,062.67 at 9.35 am in New York.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

Click the link to join: https://t.me/stocksbnb

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.