DAILY MORNING NOTE | 19 August 2022

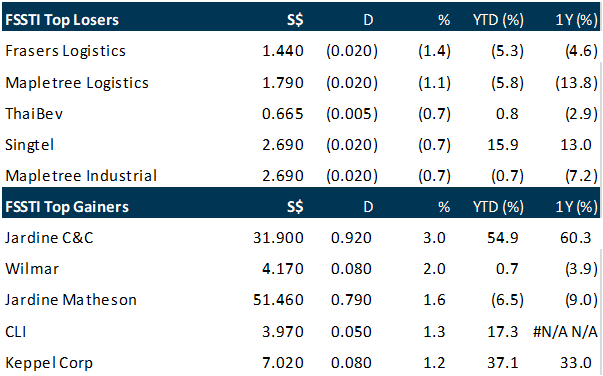

Singapore shares ended Thursday’s (Aug 18) trading session in the black, emerging as the only winner among key regional indices that took a hit on the back of hawkish comments from the Federal Reserve. The July minutes released on Wednesday signalled more interest rate hikes to fight rising inflation, although officials agreed on the need to eventually dial back the pace of these hikes. Despite the news, traders in Singapore were unfazed. The Straits Times Index (STI) rose 0.3 per cent or 10.72 points to 3,273.48. Gainers outpaced losers 245 to 218, after 1.2 billion securities worth S$961.6 million changed hands. The biggest gainer on the local bourse was iFast Corporation. The stock closed at S$4.74, up 10 per cent or S$0.43. The trio of lenders were also among the top gainers. DBS added 0.6 per cent or S$0.19 to S$32.44, UOB rose 0.6 per cent or S$0.15 to S$27.00, while OCBC advanced 0.8 per cent or S$0.10 to S$12.39.

Wall Street’s main indexes were subdued at the open on Thursday (Aug 18), with investors seeking fresh signals for future rate hikes after minutes from the Federal Reserve’s July meeting suggested a less aggressive monetary policy tightening path. The Dow Jones Industrial Average rose 1.54 points at the open to 33,981.86. The S&P 500 opened lower by 0.91 points, or 0.02 per cent, at 4,273.13, while the Nasdaq Composite dropped 0.34 points to 12,937.79 at the opening bell.

SG

Integrated marine logistics company Marco Polo Marine saw its revenue for the third quarter ended Jun 30 rise 139.5 per cent year on year. This comes on the back of more ship repair activities, stronger demand from end customers and an increase in capacity following the completion of extension works on its Dry Dock 1 in Q2 2022. Gross profit also rose 185.3 per cent to S$9.7 million, up from S$3.4 million previously, as both the shipyard and ship chartering segments experienced “tremendous growth”, the group noted in a business update on Thursday (Aug 18). For the ship chartering segment, demand for vessels remains strong, driven by both the oil and gas and offshore windfarm sector, the group said. The jump in revenue was also due to a significant increase in average charter rates, rise in average utilisation rates for vessels, as well as consolidation of revenue from Indonesian shipping agency company PT Pelayaran Nasional Bina Buana Raya and Taiwan-based offshore renewables service firm PKR Offshore – in which the group holds a 70.7 per cent and 49 per cent stake – respectively. The group expects a strong finish to the year on the back of rising demand from end customers for both the shipyard and ship chartering segments, the filing noted. This is the first quarter where contributions from recent acquisitions have positively impacted the group’s top and bottom line, according to chief executive officer of Marco Polo Marine, Sean Lee.

UOB and Doxa signed a memorandum-of-understanding (MOU) with Kimly Construction for the execution of the trio’s first green trade finance transaction together and as part of a industry-wide move to enable companies to move their procurement and trade financing processes online, the bank announced in a press statement on Thursday (Aug 18). Doxa, which develops the product Doxa Connex, is an online procure-to-pay platform that connects buyers, suppliers and financers in managing their workflow and payment process. The pilot with Kimly Construction and Doxa is the first of such green trade and sustainable transactions leveraging Doxa Connex, and will lead to easier procurement and trade financing processes to build efficiency and incorporate sustainability in the ecosystem for the long-term, UOB noted. The collaboration will accelerate the digitalisation of an industry that is generally very manual and paper based, said head of group transaction banking at UOB, So Lay Hua. The latest move means that the procurement and trade financing processes for Kimly Construction’s latest green project – the construction of the Singapore Institute of Technology campus at Punggol North (Plot 2) – will be moved entirely online. Kimly Construction will be able to validate its suppliers’ or subcontractors’ invoices on Doxa Connex, while its trade financing requests will be automatically forwarded to UOB. This eliminates the need for the company to send the hard copies of the relevant documents to UOB branches for submission.

Tee International has entered into a conditional subscription agreement with Meta5 to issue new shares in the company worth S$7.5 million. Meta5 will also subscribe S$7.5 million of unlisted and non-transferable share options in the company. Each option carries the right to subscribe for a new ordinary share in the company, the mechanical and electrical services group said in a bourse filing on Thursday (Aug 18). This follows Tee International’s announcement this month that its earlier plans to raise up to S$14 million through new share subscription and issue fell through after its 2 investors decided not to proceed with the proposed transactions. Proceeds from the subscription will be used to repay eligible creditors; they will also be used as working capital, and to fund the growth of the company’s business. Upon completion, the new subscription shares are expected to represent around 52 per cent of the enlarged share capital of the company. Tee International is also considering a debt-restructuring exercise, and proposing to issue new shares to its key management team as well as RSM Corporate Advisory. RSM was engaged in 2021 to review its businesses and improve its financial position and performance. Of its enlarged share capital, Tee International is planning to issue not more than 3.5 per cent to its key management team, and not more than 7 per cent to RSM. The company has also undertaken to pursue a rights issue to raise S$3.5 million, within 3 months from the competition of the above proposed transactions.

US

The US dollar touched a 3-week high on Thursday (Aug 18) after minutes from the Federal Reserve’s (Fed) July meeting pointed to US interest rates staying higher for longer to bring down inflation. The stronger greenback caused the pound briefly to dip below US$1.2 in early European trading, its lowest in 3 weeks, the euro to drop to as low as US$1.0146 and the Japanese yen to drift down to 135.45 per US dollar. This pushed the US dollar index as high as 106.96, its highest since late July. Fed officials saw “little evidence” late last month that US inflationary pressures were easing, minutes released on Wednesday showed. They flagged an eventual slowdown in the pace of hikes, but not a switch to cuts in 2023 that traders until recently had priced in to interest-rate futures. Traders see about a 40 per cent chance of a third consecutive 75 basis point Fed rate hike in September, and expect rates to hit a peak around 3.7 per cent by March, and to hover around there until later in 2023.

Oil rose as investors weighed lingering concerns about a global economic slowdown against bullish signals from the US and the Organization of the Petroleum Exporting Countries (Opec). West Texas Intermediate (WTI) climbed 1.1 per cent to over US$89 a barrel, while Brent jumped by 1.4 per cent to almost US$95. Oil’s main contracts have both traded in a narrow range for the past few days, though futures are still on track for a weekly loss as fears over a downturn and the potential for more supply from Iran continue to hang over the market. A bullish Energy Information Administration (EIA) report offset some of the gloom over a potential recession. US crude stockpiles sank by 7.06 million barrels last week, exports rose to a record and petrol demand climbed to the highest this year. Crude is trading near the lowest level in more than 6 months after giving up the gains made since Russia’s invasion of Ukraine, with time spreads signalling that market tightness is easing. Still, Opec’s new secretary-general Haitham Al Ghais said spare production capacity was “becoming scarce”, adding that he was confident demand will increase this year.

The number of Americans filing new claims for unemployment benefits fell moderately last week, suggesting some loss momentum in the labour market against the backdrop of higher interest rates. Initial claims for state unemployment benefits slipped 2,000 to a seasonally adjusted 250,000 for the week ended Aug 13, the Labor Department said on Thursday (Aug 18). Data for the prior week was revised to show 10,000 fewer applications filed than previously reported. Economists polled by Reuters had forecast 265,000 applications for the latest week. Though claims have drifted higher in recent weeks, they remain below the 270,000-300,000 range that economists said would signal a material slowdown in the labour market. Companies in the interest rate-sensitive housing and technology industries have been laying off workers in response to slowing demand caused by the Federal Reserve’s aggressive monetary policy tightening campaign to tame inflation. The US central bank has raised its policy rate by 225 basis points since March. Minutes of the Jul 26-27 policy meeting published on Wednesday showed that though Fed officials “observed that the labour market remained strong”, many also noted “there were some tentative signs of a softening outlook for the labour market”.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Ascott Residence Trust – Strong recovery in RevPAU

Recommendation: Accumulate (Maintained), Last Done: S$1.15Target price: S$1.15, Analyst: Darren Chan

• Recovery is underway as reflected in the 2Q22 results. Portfolio RevPAU of S$124 is c.82% of pre-Covid levels, up 91% YoY on the back of higher average daily rate and occupancy.

• Extended stay segment has been resilient with 95% occupancy and 8% expected rental growth for US student accommodations.

• Private placement to raise S$170million at S$1.120 to partially fund a proposed acquisition of serviced residence properties in France, Vietnam and Australia, rental housing properties in Japan and a student accommodation property in South Carolina, US for an aggregate purchase consideration of c.S$215.2million. Transaction is expected to be DPU accretive by 2.8%.

• Maintain ACCUMULATE, DDM-TP maintained at S$1.24. No change in our FY22e forecast. Catalysts include reopening of China and Japan to leisure travel, opportunistic divestments, and acquisitions of extended stay assets to raise the proportion of stable income sources to cushion the impact from recessionary concerns, rising inflation and macroeconomic uncertainties.

Technical Pulse: Bank of America Corp

Analyst: Zane Aw

Recommendation: Technical BUY

Buy limit: 33.90 Stop loss: 32.00 Take profit 1: 44.00 Take profit 2: 50.00

Bank of America (NYSE: BAC) A retest of the immediate support at 33.00-34.30 is possible before price edges higher.

Upcoming Webinars

Guest Presentation by Audience Analytics

Date: 23 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3P3eBYR

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Guest Presentation by Unity [NEW]

Date: 25 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3w9ssW7

Guest Presentation by Marathon Digital Holdings

Date: 26 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by Halcyon Agri Corporation Limited [NEW]

Date: 31 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3pjErMM

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Research Videos

Weekly Market Outlook: CLI, Pan-U Corp, HRnet, PropNex, Thai Bev, FAANGM, SG Weekly & More

Date: 15 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials