DAILY MORNING NOTE | 19 January 2023

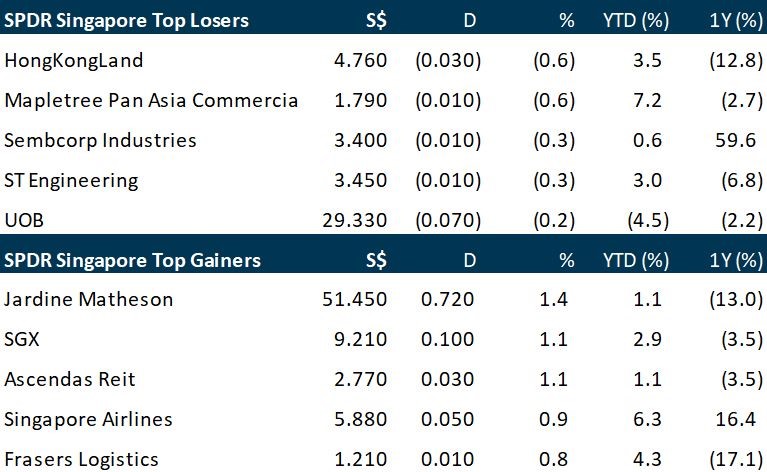

Singapore shares snapped a two-day losing streak on Wednesday (Jan 18), in tandem with most Asian bourses. The Straits Times Index (STI) closed 0.3 per cent or 9.04 points higher at 3,289.55 points. Across the broader market, gainers beat decliners 316 to 191, on a turnover of 826.3 million securities worth about S$1.1 billion.

Wall Street stocks finished sharply lower on Wednesday, shedding early gains and pulling back after a heady start to the 2023 trading season. Major indices had opened higher following US data showing a surprisingly big drop in December retail sales and a decline in wholesale prices. The reports added to expectations of an upcoming pivot by the Federal Reserve away from aggressive interest rate hikes, boosting sentiment. But stocks went negative soon after the open, adding to losses in the afternoon. The Dow Jones Industrial Average dropped 1.8 per cent, or nearly 615 points, to 33,297.02. The broad-based S&P 500 fell 1.6 per cent to 3,928.75.62, while the tech-rich Nasdaq Composite index declined 1.2 per cent to 10,957.01.

SG

The trustee-manager of CapitaLand India Trust (CLINT) has entered into a forward purchase agreement to acquire a one million square foot (sq ft) IT park in Bangalore, India for 12.3 billion rupees (S$201 million). The project at Outer Ring Road, Bangalore’s largest office micro-market, comprises two buildings with a total net leasable area of 1.5 million sq ft. CLINT is proposing to fund the development of the project and subsequently acquire a net leasable area of one million sq ft, with the remaining net leasable area to be retained by the landowners. The landowners have appointed CapitaLand Services (India) to oversee the design, development and leasing of the project. CLINT’s investment in the construction of the project will be through debt and internal resources. The trustee-manager expects to use debt from H1 2024. The estimated purchase price of 12.3 billion rupees includes funding for the project, which has a construction timeline spanning Q1 2023 to Q4 2025.

Shareholders of inflight caterer and ground handler Sats have voted in favour of the company’s plan to acquire Paris-based air cargo handler Worldwide Flight Services (WFS), with 96.8 per cent of votes cast for the proposed transaction. This represented 626.9 million shares, said Sats, following an extraordinary general meeting held on Wednesday (Jan 18). Temasek, via its indirect wholly-owned subsidiary Venezio Investments, had provided an irrevocable undertaking to vote in favour of the transaction. The Singapore state investor holds 466 million shares, or 39.68 per cent of Sats, via the subsidiary. Just 3.2 per cent of the total number of votes, representing 20.8 million shares, were cast against the deal. No party was required to abstain from voting on the ordinary resolution. Sats’ acquisition of WFS is expected to cost the company S$1.8 billion, of which up to S$800 million is expected to be raised through a renounceable underwritten rights issue. Some S$700 million will be obtained through a term loan, plus S$320 million from the company’s internal cash balances. With the shareholder approval, the proposed acquisition of WFS is now subject to requisite regulatory approvals. Sats expects the transaction to be completed by March or April this year.

Singapore’s latest six-month Treasury bill (T-bill) closed its auction with a cut-off yield of 4 per cent on Wednesday (Jan 18). The yield on the risk-free fixed-income product, backed by the Singapore government, appears to have peaked. Yields have stayed at elevated levels in recent months amid steep interest rate hikes by the US Federal Reserve. The T-bills were around 2.6 times subscribed for the S$5 billion allotment in the latest auction. Non-competitive bids, which totalled S$1.4 billion in the latest auction, were fully allotted. Those who submitted bids at the cut-off yield were allotted around 16 per cent of their application. Meanwhile, those who specified a lower yield were fully allotted, and those who specified a higher yield were not allotted. The total value of applications in this auction was S$13.1 billion, up from S$12 billion in the first auction of 2023.

US

Microsoft on Wednesday (Jan 18) said it would eliminate 10,000 jobs and take a US$1.2 billion charge as its cloud-computing customers dissect their spending and the company braces for potential recession. The layoff, far larger than cuts by Microsoft last year, pile on to tens of thousands of job cuts across the technology sector that’s long past its ceaseless growth during the pandemic. The news is particularly dramatic for Microsoft, a software maker heavily invested in generative artificial intelligence that represents an industry bright spot. In a note to employees, chief executive Satya Nadella said the layoffs, affecting less than 5 per cent of the workforce, would conclude by the end of March, with notifications beginning on Wednesday. The timing corresponds with the date its rival Amazon.com has said more employees will be notified in its own 18,000-person layoffs.

US retail sales fell more than expected in December, pulled down by a decline in motor vehicle purchases and a range of other goods, putting consumer spending and the overall economy on a weaker growth path heading into 2023. The Commerce Department said on Wednesday (Jan 18) that retail sales dropped 1.1 per cent last month. Data for November was revised to show sales decreasing 1.0 per cent instead of 0.6 per cent as previously reported. Economists polled by Reuters had forecast sales dropping 0.8 per cent, with estimates ranging from a 1.6 per cent decline to being unchanged. Retail sales are mostly goods and are not adjusted for inflation. December’s decrease in sales was likely in part the result of goods prices falling during the month. Holiday shopping was also pulled forward into October as inflation-weary consumers took advantage of discounts offered by retailers.

The average interest rate on the most popular US home loan dropped to its lowest level since September as more evidence inflation is past its peak sent Treasury yields lower, data from the Mortgage Bankers Association (MBA) showed on Wednesday (Jan 18). The average contract rate on a 30-year fixed-rate mortgage fell by 19 basis points to 6.23 per cent for the week ended Jan 13. Financial markets have been buoyed by a string of recent data that shows high inflation is slowing, allowing the Federal Reserve (Fed) to scale back its hefty interest rate hikes and plan a stopping point this spring. The yield on the 10-year note acts as a benchmark for mortgage rates.

Production at US factories fell more than expected in December and output in the prior month was weaker than previously thought, indicating that manufacturing was rapidly losing momentum as higher borrowing costs hurt demand for goods. Manufacturing output dropped 1.3 per cent last month, the Federal Reserve said on Wednesday (Jan 18). Data for November was revised lower to show production at factories decreasing 1.1 per cent instead of the previously reported 0.6 per cent. Economists polled by Reuters had forecast factory production would decline 0.3 per cent. Output fell 0.5 per cent on a year-on-year basis in December. It decreased at a 2.5 per cent annualised rate in the fourth quarter.

US business inventories increased in November as higher interest rates depressed sales, boosting the inventory-to-sales ratio to the highest level in nearly two years. Business inventories rose 0.4 per cent after gaining 0.2 per cent in October, the Commerce Department said on Wednesday (Jan 18). Inventories are a key component of gross domestic product (GDP). November’s increase in inventories was in line with economists’ expectations. Inventories increased 15.1 per cent on a year-on-year basis in November. The pace of inventory accumulation has slowed considerably from the robust pace in late 2021 and early 2022 because of improved supply, and ebbing demand for goods as the Federal Reserve aggressively raises interest rates to quell inflation.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

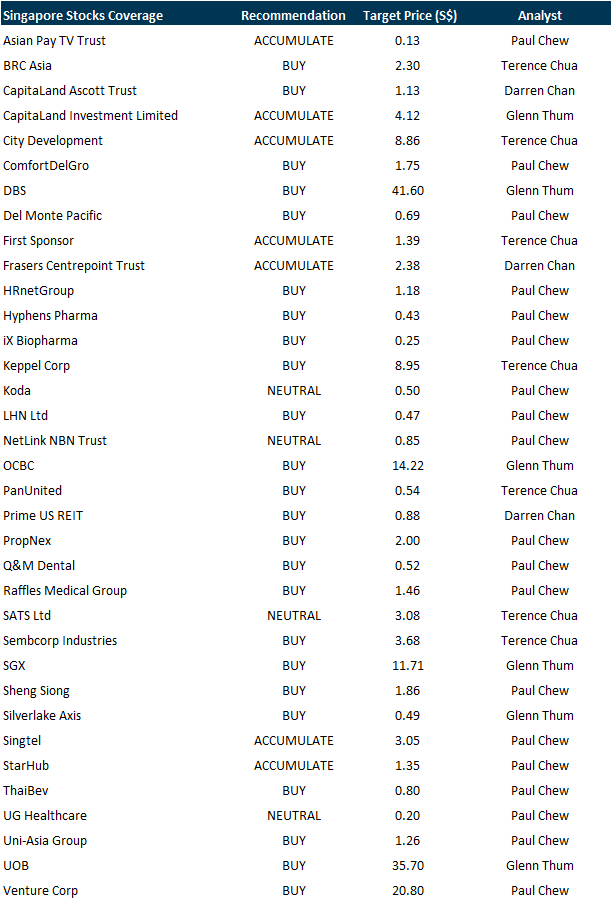

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Civmec

Date: 20 January 2023

Time: 12pm – 1pm

Register: https://bit.ly/3iwhMx1

Guest Presentation by Comba Telecom Systems Holdings Limited

Date: 31 January 2023

Time: 11am – 12pm

Register: https://bit.ly/3GuS5VK

Guest Presentation by LMS Compliance [NEW]

Date: 8 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3IX0pAr

Research Videos

Weekly Market Outlook: Block Inc., SG Banking Monthly, Technical Analysis, US1Q23 Strategy & More

Date: 16 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials