DAILY MORNING NOTE | 19 July 2022

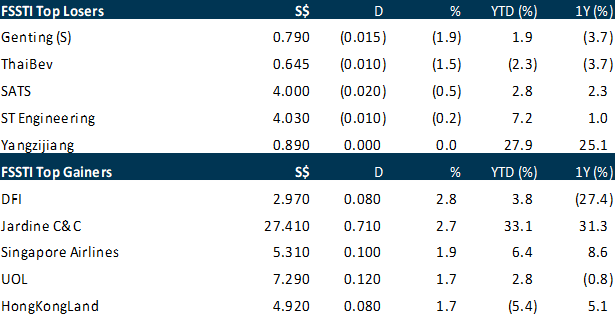

The Straits Times Index (STI) gained 0.7 per cent or 22.61 points to close at 3,121.76 points on Monday (Jul 18), tracking a rally on Wall Street last Friday. Across the wider market, gainers outnumbered losers 312 to 164, with 835.7 million shares worth S$736.6 million changing hands. Asian markets were also helped along by hopes of more aggressive stimulus measures in China to resolve its property market wobbles, as officials from the People’s Bank of China (PBOC) over the weekend promised more support for the economy. Hong Kong’s Hang Seng Index rose 2.7 per cent, South Korea’s Kospi gained 1.9 per cent, the FTSE Bursa Malaysia KLCI was up 0.8 per cent and the Jakarta Composite Index edged up 0.1 per cent.

Wall Street stocks fell on Monday after an early rally petered out following a report that Apple plans to trim spending and hiring. Equities began well after solid Goldman Sachs results and markets appeared poised to extend Friday’s positive momentum following commentary from banks expressing confidence in US economic resiliency. But the trend reversed after Bloomberg News reported that Apple was pulling back on some investments in preparation for a potential economic slowdown. Apple shares dropped 2.1 per cent. Analysts also pointed to a jump in oil prices and to the premium in the yield of short-term Treasury bonds over longer-term issues that is seen as a prognosticator of recessions. The Dow Jones Industrial Average lost 0.7 per cent to finish at 31,072.61. The broad-based S&P 500 fell 0.8 per cent to 3,830.85, while the tech-rich Nasdaq Composite Index also shed 0.8 per cent to 11,360.05.

SG

Unitholders of First Reit have raised a number of questions regarding the company’s divestment of Siloam Hospitals Surabaya. In a bourse filing on Monday (Jul 18), the real estate investment trust (Reit) posted a lengthy list of questions that it had received from its unitholders, including queries on the rationale of the divestment, the resultant distribution per unit (DPU) changes, as well as the plans of the Reit manager to turn around the group’s business and profitability. First Reit in May announced that it would divest Siloam Hospitals Surabaya — which comprises 5 integrated purpose-built hospital buildings — at an agreed property value of 430 billion rupiah (S$40.1 million) subject to post-completion adjustments. One of the questions from unitholders noted that the sale price is at a mere 0.1 per cent premium to the asset’s valuation, and questioned if First Reit’s manager had sourced for better offers. The manager argued that although the premium figure is correct, the price represents a 143.2 per cent gross premium over First Reit’s original purchase consideration of S$16.8 million. First Reit acquired Siloam Hospitals Surabaya back in 2006 as part of its initial portfolio.

Keppel Data Centre Fund II (KDCF II) has entered into a strategic partnership with Heying — a wholly-owned subsidiary of Tianjin Zhengxin Group — to jointly develop a greenfield data centre in Greater Beijing, China. KDCF II will acquire a majority stake in Huailai Data Centre and jointly develop the property with Heying, Keppel said in a press release on Monday (Jul 18). The total development cost of the project is approximately 1.4 billion yuan (S$292 million). KDCF II is managed by Alpha Investment Partners Limited (Alpha), which is the private fund management arm of Keppel Capital. This latest development marks Keppel’s sixth project since entering mainland China’s data centre market in 2020. Located in Huailai County in the Hebei province, Huailai Data Centre is situated on a land plot that spans 3.3 ha. This plot forms part of a larger data centre campus spanning 29.7 ha. Keppel said the development of the Huailai Data Centre is taking place “in phases”. When th data centre is fully developed by the end of Q1 2023, it will have an expected gross floor area, of 678,807 sq ft, which can fit more than 5,700 high-density racks.

Singapore’s wholesale electricity price surged for the second time in a week, a sign of further volatility in the market amid a global power crunch. The cost of 1 MWh jumped to more than S$4,200 for 3 hours on Sunday (Jul 17) night, the longest period of such high prices this year. That is close to the maximum limit of S$4,500 permitted on the wholesale market, and comes after the price briefly spiked to a similar level last Monday. While the exact cause of the recent spikes is not clear, volatility typically occurs when supplies are tight, such as when plants go offline. The recent price jumps have taken place at times when demand does not appear to be elevated. An average of 6.8 GW of power was supplied on Sunday, little changed from a week earlier and near the average 7.2 GW supplied so far in July, data from market operator Energy Market Co showed.

US

Netflix will ask customers in 5 Latin America countries to pay a fee if they want to use their account in an additional home, a test the company hopes will generate additional revenue by getting customers to pay to share their Netflix account. Customers in Argentina, El Salvador, Guatemala, Honduras and the Dominican Republic will be asked to pay an extra fee if they use an account for more than 2 weeks outside of their primary residence, the company said in a blog post on Monday (Jul 18). This won’t affect the use of Netflix on mobile devices such as smartphones, tablets or laptops, nor will it affect people on vacation. The additional home will cost 219 pesos (S$2.38) in Argentina and US$2.99 in the other countries. Netflix has said that more than 100 million households are using accounts paid for by other people, and blamed password sharing as one of the primary reasons for its flagging subscriber growth. The company lost 200,000 customers in the first quarter, and forecast it would lose 2 million more in the second. Its share price has dropped more than 65 per cent this year as investors fret that the streaming business is in trouble.

Apple was hit with an antitrust lawsuit over Apple Pay, accused of using its market power in the mobile device industry to fend off competition from rival payment apps and charging card issuers fees to boost its bottom line. The proposed class-action complaint by Affinity Credit Union marks the latest antitrust battle for the iPhone maker, after facing increased scrutiny in recent years over its App Store policies from government regulators. European regulators, after a nearly 2-year investigation, also found on a preliminary basis that Apple abused its dominant position with Apple Pay in the market for tap-to-pay apps or mobile wallets. iPhone users must use Apple Pay if they want to buy something by tapping the phone against a terminal in a store. Other iPhone payment services such as PayPal and Square – as well as financial institutions like Chase, Citi and American Express – can’t launch tap-to-pay iPhone apps with their own features and interface. By excluding competition, Apple can charge “payment card issuers fees that no other mobile wallet ventures to impose”, Affinity Credit Union, the Des Moines, Iowa-based payment card credit union that issues payment cards, said in the lawsuit, filed on Monday (Jul 18) in federal court in San Jose, California.

International Business Machines (IBM) lowered its forecasts for free cash flow this year due to the impact of a strong dollar and the loss of business in Russia, sending the shares down. The revision overshadowed results that topped analysts’ estimates, signalling that demand for mainframe computers, consulting and cloud services remains strong amid concerns of a pullback in tech spending. IBM said it estimates free cash flow of US$10 billion this year, at the low end of a previous range of US$10 billion to US$10.5 billion. The reduced range isn’t a result of a broader business slowdown chief financial officer Jim Kavanaugh said in an interview. “Our demand remains solid,” he said. The shares slid about 4 per cent in extended trading after closing at US$138.13 in New York. IBM has been a rare pocket of stability in the tech market meltdown, gaining 3.3 per cent this year compared with a 31 per cent loss for the iShares Expanded Tech Sector ETF. Sales rose 9 per cent to US$15.5 billion in the 3 months ending Jun 30, the company said on Monday (Jul 18) in a statement. Analysts were expecting an average of US$15.2 billion according to data compiled by Bloomberg.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Upcoming Webinars

Guest Presentation by Keppel DC REIT

Date: 28 July 2022

Time: 2.30pm – 3.30pm

Register: https://bit.ly/3uLBo3f

Guest Presentation by Pan-United Corporation Limited

Date: 5 August 2022

Time: 11am – 12pm

Register: https://bit.ly/3OFbJ41

Guest Presentation by A-Sonic Group

Date: 11 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3PmoIrl

Guest Presentation by Marathon Digital Holdings

Date: 18 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by Audience Analytics

Date: 23 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3P3eBYR

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Research Videos

Weekly Market Outlook: Airbnb Inc, Fortress Minerals, 3Q22 Strategy SG & US, SG Weekly

Date: 18 July 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials