DAILY MORNING NOTE | 19 October 2022

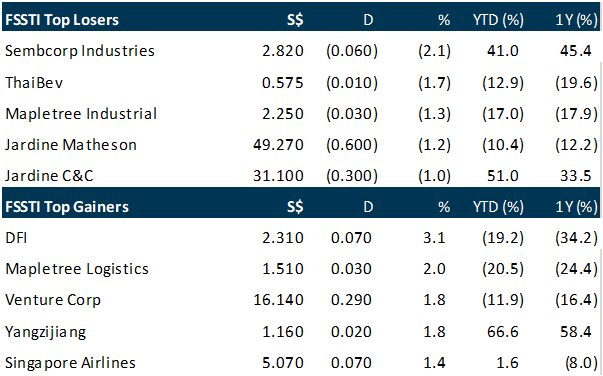

Singapore stocks ended higher on Tuesday (Oct 18), snapping an eight-day losing streak as regional markets rallied on the back of positive developments in the UK’s economic policy. The Straits Times Index (STI) gained 0.3 per cent or 10.13 points to close at 3,025.88. Gainers outnumbered losers 328 to 216, with 1.6 billion securities worth S$979.6 million having changed hands. DFI Retail Group was the top gainer on the STI on Tuesday, rising 3.1 per cent to US$2.31 at the close. Some 231,400 shares worth US$530,000 were traded. Singapore Airlines (SIA) rose 1.4 per cent to close at S$5.07, with 3.6 million shares worth S$18.2 million traded. In the flag carrier’s September 2022 operating results, the group noted that SIA and Scoot carried 2.1 million passengers for the month. Passenger capacity rose by 2.5 per cent from the previous month, reaching about 67 per cent of pre-Covid-19 levels for September. The trio of local banks also closed higher on Tuesday. DBS gained 0.3 per cent to S$32.50, UOB rose 0.7 per cent to S$26.26, while OCBC was up by 1 per cent at S$11.59. Elsewhere in Asia, key indices were largely up. The FTSE Bursa Malaysia KLCI Index gained 1 per cent, the Nikkei 225 Index was up 1.4 per cent, and the Hang Seng Index rose 1.8 per cent. The SSE Composite Index in Shanghai was down by 0.1 per cent. This week, China delayed the release of some of its economic data amid its ongoing Party Congress.

Wall Street stocks rose for a second straight session on Tuesday on the back of another round of generally solid earnings, with blockbuster results coming later this month. Goldman Sachs and Johnson & Johnson were among the companies that reported better-than-expected results, while Lockheed Martin shot up nearly 9 per cent as it confirmed its full-year profit outlook and authorized up to US$14 billion in additional share repurchases. The Dow Jones Industrial Average climbed 1.1 per cent to 30,523.80. The broad-based S&P 500 gained 1.1 per cent to 3,719.98, while the tech-rich Nasdaq Composite Index advanced 0.9 per cent to 10,772.40.

SG

Cromwell European Real Estate Investment Trust (Cromwell E-Reit) on Tuesday (Oct 18) announced its acquisition of a logistics asset in Copenhagen for 117.4 million Danish kroner (S$22.3 million). The acquisition consideration represents a discount of 7 per cent to the asset’s independent valuation of 126.2 million kroner as at end-September 2022. Cromwell E-Reit’s manager does not expect the transaction to have a material effect on the Reit’s net tangible assets. Named Sognevej 25, the asset is a freehold, five-building light industrial complex occupying 41,649 square metres in a business park in Brondby, Copenhagen. It is located adjacent to two other Cromwell E-Reit assets, Prioparken 700 and 800. Given “relatively limited space” within the neighbourhood of these properties, Cromwell E-Reit’s manager said it sees a potential influx of tenant-customers to the Prioparken site – which is designated for long-term industrial use. It also believes there is a low likelihood of new warehouse land supply in the area around Sognevej 25. “The close proximity of these assets provides long-term strategic value as competing industrial parks further west have been earmarked for rezoning into residential spaces in the next 10 years, potentially reducing the supply of well-located last mile delivery hubs in Copenhagen,” said the manager. The asset’s net operating yield is 9.1 per cent, underpinned by a one-year vendor rental guarantee on the recent departure of cleaning equipment manufacturer Nilfisk, whose headquarters previously occupied the space. Looking ahead, the manager intends to step up leasing efforts for Sognevej 25 and expects to raise its occupancy levels to 80 per cent, from 29 per cent at the time of acquisition. Cromwell E-Reit also intends to enhance the ESG (environmental, social and governance) credentials of the asset, through initiatives such as creating bio farms, installing solar panels, and attaining green building certifications. The total purchase cost of the acquisition is estimated to come in at around 16.3 million euros (S$22.9 million). The transactions were largely funded by the proceeds of Cromwell E-Reit’s divestment of two of its non-core, light industrial assets in Germany at above valuation for a total consideration of 11 million euros. A combination of the company’s existing cash balances and the revolving credit facility was used to bridge the timing difference for the latest acquisition of Sognevej 25. The recently-completed divestment of Cromwell E-Reit’s two German assets comes as part of the Reit manager’s divestment plans announced in September.

Demand for luxury condominiums in Singapore continues to hold up, even as sales of top-end Good Class Bungalows (GCB) soften, said Huttons Asia in its latest report on the luxury market released on Tuesday (Oct 18). According to the report, 110 non-landed new homes with a price tag of S$5 million and above were sold in Q3 2022, similar to the previous quarter. The total quantum that buyers forked out for these homes was S$1 billion this quarter, up 15.5 per cent from Q2. More larger units were also being sold at a higher quantum this quarter. This is because larger units are hard to come by and buyers are willing to pay a premium for them. At the top end of the non-landed luxury property market is a 11,227 square foot (sq ft) penthouse at Les Maisons Nassim in District 10, which sold for S$68 million or S$6,057 per square foot (psf). Another two units were sold at the ultra-luxury freehold condominium this quarter – a 8,687 sq ft unit for S$46 million or S$5,296 psf, and a 6,286 sq ft unit for S$36 million or S$5,727 psf. With this, 10 out of 14 units at Les Maisons Nassim have been sold at an average of S$5,625 psf. Additionally, Huttons noted that the three bestselling luxury projects in Q3 were Cape Royale at Sentosa Cove, The Avenir at River Valley, and Nouvel 18 at Anderson Road. Chinese nationals, Americans and Malaysians were the top three foreign buyers of luxury properties this quarter, added the real estate consultancy. Likewise, a recent report by OrangeTee & Tie showed that about 20 per cent of luxury condominiums priced at S$5 million and above were bought by Mainland Chinese nationals between January and August 2022. Luxury condominium purchases by foreigners and Singapore permanent residents (PRs) have also almost returned to pre-pandemic levels, it added.

Developers will need to provide for larger homes in non-landed projects in the Central Area from January 2023, when new guidelines from the Urban Redevelopment Authority (URA) for dwelling units kick in. From Jan 18, 2023, a minimum of 20 per cent of dwelling units (DUs) with a nett internal area of 70 square metres (sq m) will be required for all new flats, condominiums and residential components of commercial and mixed-use developments in the Central Area. This size is considered reasonable by URA for small families, taking into account the tighter space constraints of the Central Area. “URA has not imposed a cap on the total number of DUs within the Central Area because it is generally well-served by public transport, with residents here less reliant on private vehicles. As such, new developments are less likely to put a strain on local infrastructure,” said URA. Since 2018, when URA revised guidelines to “moderate the excessive development of shoebox units”, requirements on dwelling unit size have been applied only to projects outside the Central Area. Developers have to set at least 20 per cent or more of a project’s DUs with nett internal area of at least 100 sq m, and at most 20 per cent of the DUs with nett internal area of less than 50 sq m. “However, for developments within the Central Area, URA has observed a persistent trend in declining DU sizes. There is thus a need to ensure a good mix of DU sizes within the Central Area to support the planning intention,” URA said in its circular issued on Tuesday (Oct 18). “URA will continue to monitor and review the guidelines periodically, taking into account factors such as lifestyle changes and infrastructural developments,” it said.

US

Goldman Sachs Group said on Tuesday (Oct 18) it was reorganizing its business into three units, as the Wall Street giant undertakes another overhaul in less than three years, and reported a drop in third-quarter profit. Profit applicable to common shareholders fell to US$2.96 billion, or US$8.25 per share, in the quarter ended Sep 30, from US$5.28 billion, or US$14.93 per share, a year ago. Analysts had expected a profit of US$7.69 per share, according to Refinitiv data. It was not immediately clear if the reported numbers were comparable to estimates.

It is the biggest shakeup by the investment bank in just over two years and outlined plans for four core units: investment banking, global markets, consumer and wealth management and asset management. The reshuffle comes as the Wall Street titan seeks to boost its income from fee-based businesses at a time when rising interest rates have dented valuations and deal-making. The overhaul follows a round of global job cuts in September that could have impacted hundreds of bankers. The move also comes as the bank is rounding out a mixed quarter for big US banks, in which choppy capital markets and slowing economic growth weakened investment banking. However, rising borrowing costs boosted net interest income to cushion the blow. Dealmaking slowed in the quarter, casting a pall over some of Goldman’s most lucrative businesses. Total revenue fell 12 per cent to US$11.98 billion in the quarter. In the face of aggressive Federal Reserve rate increases and the war in Ukraine, investors, however, boosted trading activity, helping the bank’s fixed income, currency and commodities division.

Netflix shares skyrocketed more than 14% after the bell Tuesday as the company posted better-than-expected results on the top and bottom lines. The streamer also reported the addition of 2.41 million net global subscribers, more than doubling the adds the company had projected a quarter ago. Revenue for the quarter grew 5.9 per cent to US$7.93 billion, beating analysts’ projections. Profit of US$3.10 a share also topped estimates, and the number of paying customers increased to 223.1 million. Additionally, Netflix will begin to crack down on password sharing next year, opting to allow people who have been borrowing accounts to create their own. The company will also allow people sharing their accounts to create sub-accounts to pay for friends or family to use theirs. The majority of Netflix’s net subscriber growth during the quarter came from the Asia-Pacific region, which accounted for 1.43 million subscribers. The U.S.-Canada region had the smallest growth of Netflix’s regions, contributing just 100,000 net subscribers. “We’re still not growing as fast as we’d like,” Spencer Neumann, Netflix’s chief financial officer, said during the company’s earnings call. “We are building momentum, we are pleased with our progress, but we know we still have a lot more work to do.” Starting next quarter, Netflix will no longer provide guidance for its paid memberships but will continue to report those numbers during its quarterly earnings release. Netflix forecast it would add 4.5 million subscribers during its fiscal first quarter and said it expects revenue of $7.8 billion, largely due to currency pressures overseas. The company touted shows and movies such as “Stranger Things” season four, “The Gray Man” and “Purple Hearts” as hits that helped move the needle during the third quarter. It also teased the addition of its new lower-priced ad-supported plan, which launches in 12 countries in November. The streamer said it was “very optimistic” about its new advertising business. While it doesn’t expect the new tier will add a material contribution to its fourth-quarter results, it foresees membership growing gradually over time. Its current forecast for subscriber growth is based on its upcoming content slate and the typical seasonality that comes during the last three months of the year.

Comment: After a set of strong results that beat both top and bottom line estimates, Netflix seems to be back on track in terms of subscriber growth – which was the main concern over the first half of this year, with the company adding 2.4 million subscribers during the quarter. We think that continued momentum in subscriber growth, plus the addition of a new ad-supported subscription tier, should continue to drive both revenue and earnings growth moving forward.

Jonathan Woo,

Senior Research Analyst,

jonathanwookj@phillip.com.sg

Adobe, the biggest maker of creative design software, gave a revenue forecast for 2023 that just fell short of analysts’ estimates, saying currency fluctuations and economic uncertainty will dent sales. Fiscal-year revenue will be about US$19.2 billion, the company said on Tuesday (Oct 18) in a statement. Profit, excluding some items, will be as much as US$15.45 a share for the period ending in November 2023. Analysts, on average, projected earnings of US$15.53 a share on sales of US$19.8 billion. Exchange rates are expected to cause a 4 per cent headwind to sales growth in 2023, and about a US$700 million downward revaluation to the company’s digital media annual-recurring revenue, the company said. In the statement, chief executive officer Shantanu Narayen highlighted “Adobe’s continued success in this uncertain macroeconomic environment.” Investors seemed relieved by the numbers, sending shares about 3.5 per cent higher in extended trading. Adobe said the forecast doesn’t include Figma, a smaller creative software rival the company announced last month it would acquire for US$20 billion. Analysts were surprised by the price tag, the highest ever for a private software company, and suggested competitors were making greater inroads than previously thought. The San Jose, California-based company’s shares have declined 21 per cent since the Figma deal was announced, closing at US$292.98 on Tuesday in New York. Adobe is looking to expand its web-based products to attract more casual designers and small businesses, a market that has gravitated in recent years to companies such as Canva, Lightricks and Figma. During Adobe’s annual conference earlier on Tuesday, the company introduced changes to its flagship Photoshop image-editing program to add more collaboration tools, artificial intelligence features and web capability. The company also affirmed its fiscal fourth-quarter guidance of about US$4.5 billion in sales and earnings, excluding some items, of US$3.50 a share.

Comment: Adobe forecast 9% growth for the fiscal year 2023, compared with almost 13% growth in the most recent quarter. However, the estimate would have been 4% higher excluding currency fluctuations. Its anticipated US$20bn acquisition of design software firm Figma, which is expected to close in 2023, is not included in the prediction.

Ambrish Shah,

Research Analyst,

amshah@phillipcapital.in

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Upcoming Webinars

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Guest Presentation by Zoom Video Communications, Inc [NEW]

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Research Videos

Weekly Market Outlook: PayPal, Keppel Corp, SPH, Fortress Minerals, SGBanking, SG Weekly & more…

Date: 17 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials