DAILY MORNING NOTE | 2 November 2022

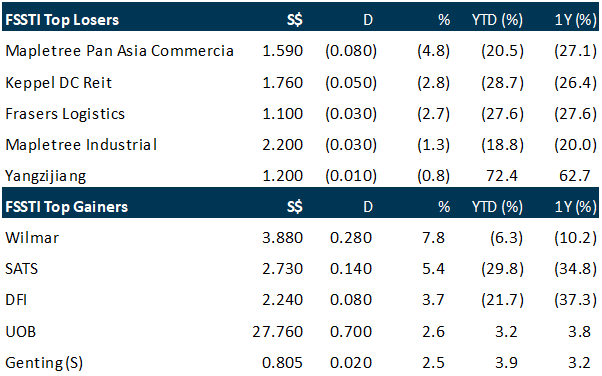

Singapore shares marched forward to extend gains for the sixth straight day on Tuesday (Nov 1), shrugging off overnight losses on Wall Street. The advance comes ahead of the Federal Reserve’s next rate hike move at its policy meeting, which has drawn mixed expectations over a possible dovish pivot to close out the year. The Straits Times Index (STI) rose 37.39 points or 1.2 per cent to 3,130.50. Almost all key gauges across the region, from China, Hong Kong, Japan, Taiwan, South Korea to Australia, posted gains while Malaysia’s key index retreated. Analysts attributed the gains to buy-on-dips activity, despite latest manufacturing data that signalled moderation in growth momentum among Asian economies. Expectations over a possible reopening of China also lifted trading sentiment in the region. On the local bourse, some 2.04 billion securities worth S$1.17 billion were traded. Gainers outpaced losers, with 402 counters up and 184 down. Gains were led by the Jardine stocks, DBS as well as Venture Corp. Sembcorp Marine was the day’s most active counter by volume with some 337 million shares traded. The counter rose S$0.004 or 3.2 per cent to close at S$0.131. The offshore & marine (O&M) giant last week announced sweetened terms for its merger with Keppel’s O&M unit amid stronger order momentum.

Wall Street stocks retreated on Tuesday after mixed US economic data added to nervousness ahead of a major decision by the Federal Reserve. A survey of manufacturers showed the sector barely in growth mode in October, with prices dropping for the first time in more than two years. But that report was offset by Labor Department data showing a surge in open positions in September, surprising investors who have been expecting the jobs market to slow. Markets rallied strongly in October, largely due to expectations that the Fed would soon pivot away from its very aggressive posture of fighting inflation. The Dow Jones Industrial Average finished down 0.2 per cent at 32,653.20. The broad-based S&P 500 shed 0.4 per cent to 3,856.10, while the tech-rich Nasdaq Composite Index declined 0.9 per cent to 10,890.85. Among individual companies, Uber shot up 12 per cent after it reported a surge in quarterly revenue. Pfizer climbed 3.1 per cent as it reported higher quarterly profits while lifting its full-year forecast for coronavirus vaccine sales. Abiomed surged almost 50 percent after announcing it agreed to be acquired by Johnson & Johnson in a deal valued at US$16.6 billion. Johnson & Johnson, which said the transaction would strengthen its cardiovascular capacities, dipped 0.5 per cent.

SG

DBS is to report their 3Q2022 results on Thursday, 3rd Nov 2022, morning. Consensus estimates for 3Q22 have forecasted net income to grow by 15% YoY to S$1.96bn, backed by net interest income growing 30% YoY to S$2.74bn and NIM continuing to improve to 1.73% (3Q21: 1.43%). Net fee income is expected to continue to decline by 11% YoY to S$791mn in 3Q22. Provisions are expected to return to normalised levels at S$350.4mn (3Q21: writeback of S$70mn).

SIA Engineering Company (SIAEC) posted a group net profit of S$19.7 million for its second quarter ended Sep 30, up 87.6 per cent from S$10.5 million in the same period last year, it said in a bourse filing on Tuesday (Nov 1). Revenue for the quarter rose 38 per cent to S$190.7 million, up from S$138.2 million the year before, largely driven by higher flight activities and higher revenue across all segments, it said. This took SIAEC’s basic earnings per share to 1.75 Singapore cents for the quarter, up from 0.94 cents the year before. However, the group will not be declaring an interim dividend due to “operating losses and uncertainties in macroeconomic conditions”, it added. It posted an operating loss of S$6.8 million for the quarter, a deterioration of S$3 million from a loss of S$3.8 million in the year before. Expenditure rose 39.1 per cent to S$197.5 million for the quarter due to lower government wage support, higher manpower costs and material costs, the group said, adding that revenue growth was not sufficient to offset the increase in expenditure. SIAEC’s second-quarter figures brought its first-half net profit to S$32.5 million, up 30 per cent from S$25 million the year before. Revenue for the first half was S$362.2 million, up 37.5 per cent year on year. The number of flights handled by SIAEC’s line maintenance unit in Singapore doubled year on year in the first half – representing approximately 55 per cent of pre-pandemic volume – as a result of Singapore removing most of its remaining travel restrictions, the group noted. Maintenance, repair and operations services also rose in demand due to the increase in flight activities, as operators look to return grounded aircraft back to service, SIAEC said. It added that base maintenance secured new customers and a long-term contract during the period. Work volume at engine and component shops was also higher, with “healthy improvement” in inductions. Inventory technical management services supported a larger fleet size due to a new contract secured and fleet growth of customer airlines, the group added. Along with its transformation efforts, the group said it will seize opportunities to broaden its customer base, develop new capabilities and expand its geographical presence through acquisitions and partnerships to achieve sustainable business growth. Shares of SIAEC closed at S$2.22 on Tuesday, up S$0.06 or 2.8 per cent, before the release of the results.

Parkway Life Reit on Tuesday (Nov 1) posted a 0.1 per cent rise in net property income to S$82.8 million in its third quarter ended Sep 30, from S$82.7 million in the same period a year ago. Gross revenue, meanwhile, was down 1.3 per cent to S$89 million, weighed by the depreciation of the Japanese yen and loss of income from the divestment of a non-core asset in 2021, according to a business update. In Q3 2021, gross revenue stood at S$90.1 million. The drop in gross revenue was partially offset by contributions from three properties acquired in 2021 and five properties acquired in 2022, along with higher rent from Singapore hospitals. As the real estate investment trust (Reit) hedged net income from Japan, the drop in revenue will be compensated by foreign exchange (FX) gains from the settlements of the forward contracts, the manager said. Principal FX risk has been mitigated as its Japan acquisitions are fully funded by loans denominated in yen. Income FX risks, meanwhile, have been mitigated with yen net income hedges in place until Q1 2027. Around 73 per cent of interest rate exposure is hedged. Parkway Life Reit’s gearing stood at 34.7 per cent as at end-September. The manager added that there are no long-term debt refinancing needs until June 2023.

US

Attention will be focused Wednesday on what Federal Reserve Chairman Jerome Powell says about whether the central bank might slow down interest-rate rises at its next policy meeting in December. Fed officials have already indicated that they are likely to raise their benchmark federal-funds rate by 0.75 percentage point this week to a range between 3.75% and 4%. That would mark their fourth consecutive increase of that size as they seek to reduce inflation by slowing the economy. Some of the officials recently began signaling their desire to start reducing the size of increases after this week and to potentially stop lifting rates early next year so they can see the effects of their moves. Those officials and several private-sector economists have warned of growing risks that the Fed will raise rates too much and cause an unnecessarily sharp slowdown. Until June, the Fed hadn’t raised interest rates by 0.75 point, or 75 basis points, since 1994. Fed officials widely supported the supersize rate increases this summer because they were playing catch-up. Inflation has been running close to 40-year highs, but interest rates were pinned near zero until March. Debate over how much more to raise rates could intensify as they reach levels more likely to restrain spending, hiring and investment. The fed-funds rate influences other borrowing costs throughout the economy, including rates on credit cards, mortgages and car loans. But some analysts say it will be difficult for the Fed to dial back the pace of rate increases in December because they expect inflation to continue to run hotter than other analysts forecast. Fed officials had expected inflation to decline this year, but that outlook has been in vain so far. They responded by targeting a higher destination for the fed-funds rate than they projected earlier in the year, resulting in the longer-than-anticipated string of 0.75-point rate rises. Officials at their September meeting projected that they would need to raise the rate to at least 4.6% by early next year. Economic data released since the Fed’s September meeting have been mixed. While domestic demand has slowed and the housing market is entering a sharp downturn, the job market has remained strong and inflation pressures have stayed elevated. Recent earnings reports have shown strong consumer demand and pricing increases. Officials will see two more months of economic reports before their mid-December meeting, including on hiring and inflation. “Even if Powell provides guidance at his press conference, it won’t involve a commitment. That’s because the decision does need to be data determined,” wrote former Fed governor Laurence Meyer, who runs economic-forecasting firm LH Meyer Inc., in a recent report. Some economists say the Fed will have to raise the fed-funds rate higher than 4.6% next year because of the resilience of consumer spending and domestic demand to higher rates so far. Many investors this year have been eager to interpret signs of a less aggressive rate-rise pace as a sign that a pause in rate increases isn’t far off, but a sustained market rally risks undoing the Fed’s work of slowing down the economy. Any discussion by Mr. Powell about how officials see the potential for a higher rate path could temper any market exuberance about a slower pace of increases, economists said.

AMD shares rose as much as 6% in extended trading on Tuesday after the chipmaker indicated its server chip business will grow in the quarters ahead, even as earnings and quarterly guidance failed to meet Wall Street’s expectations. Overall, AMD’s revenue grew by 29% year over year in the fiscal third quarter, which ended Sept. 24, according to a statement. Net income fell 93% to $66 million, mainly because of AMD’s $49 billion acquisition in February of Xilinx, a maker of chips called field-programmable gate arrays. On Oct. 6, AMD issued preliminary results for the fiscal third quarter that lagged guidance it provided in August, because of fewer chip shipments in a weaker PC market than expected. The stock fell almost 14%, its largest decline since March 2020. AMD has been preparing for the PC market to be lackluster in the fiscal fourth quarter, CEO Lisa Su said on a conference call with analysts. For the full year, AMD said it sees $23.5 billion in revenue, down from the $26.3 billion forecast the company gave in August. Analysts polled by Refinitiv had expected $23.88 billion. The company contracted its adjusted gross margin outlook to 52% from 54% in August. AMD said its Data Center segment generated $1.61 billion in revenue in the fiscal third quarter, up 45% and slightly below the consensus of $1.64 billion. The unit includes contributions from Xilinx and distributed computing startup Pensando, which AMD bought for $1.9 billion. The chipmaker has seen healthy demand for shipments of its server chips that carry the code name Genoa. AMD plans to launch Epyc data center chips on Nov. 10. Su said cloud revenue more than doubled and increased sequentially, while revenue from server makers targeting big companies was down sequentially. She said AMD has seen enterprise customers taking longer to make decisions and being slightly more conservative on capital expenditures. The Gaming segment produced $1.63 billion in revenue. That was up about 14% and in line with the $1.63 billion consensus among analysts. The company touted healthy demand for console chips for Microsoft and Sony as the holidays approach. The Embedded segment that includes some Xilinx sales delivered $1.3 billion, up from $79 million in the year-ago quarter and in line with the $1.3 billion consensus. AMD’s Client unit, which the chipmaker had warned about in October, generated $1.02 billion in revenue. That was down nearly 40% but in excess of the $1.17 billion consensus. Four days after AMD gave preliminary results, technology industry researcher Gartner said third-quarter PC shipments fell 19.5%, the steepest decline the company has seen since it started following the market in the mid-1990s. During the quarter AMD announced Ryzen 7000 desktop PC chips, and the company pointed to positive reviews of the products.

Pfizer on Tuesday raised its 2022 earnings guidance after booking a strong third quarter that beat Wall Street expectations. It now expects earnings per share of $6.40 to $6.50 for the year, up from its previous forecast of $6.30 to $6.45. The pharmaceutical company also raised the lower end of its sales guidance and now expects revenue of $99.5 billion to $102 billion for the year. Pfizer raised its full-year sales guidance for its Covid-19 vaccine to $34 billion this year, up $2 billion from the company’s previous expectations. It is maintaining revenue expectations of $22 billion for the antiviral pill Paxlovid. Its shares rose by about 2% in morning trading. But Pfizer’s third-quarter global revenue fell 6% to $22.6 billion compared to the same period last year due to softening demand for its Covid vaccines internationally. The company sold $4.4 billion of its vaccine worldwide in the quarter, a decrease of 66% compared with the third quarter of 2021. But softer global Covid vaccine sales internationally were offset by strong demand in the U.S., where revenue increased 83% year over year due to the rollout of the new BA.5 omicron boosters. Paxlovid also had a strong quarter, generating $7.5 billion in sales worldwide though mostly in the U.S. Sales of the Eliquis, a blood thinner to treat clots and prevent strokes, came in at about $1.5 billion, a 9% increase over the same quarter last year. And Pfizer’s pneumonia vaccine, Prevnar, booked $1.6 billion in global sales, an increase of 11% over the same period in 2021. Pfizer had net income of $8.6 billion for the third quarter, a 6% increase over the same quarter last year. Pfizer CEO Albert Bourla indicated that company is looking beyond the Covid pandemic which has led to record windfalls for the pharmaceutical giant. Bourla said in a statement that Pfizer plans to launch 19 new products or new uses for existing drugs in the next 18 months. The company, for example, reported positive clinical trial data Tuesday for its maternal RSV vaccine that protects newborns. Pfizer closed major acquisitions of Biohaven and Global Blood Therapeutics in the third quarter, deals worth $11.6 billion and $5.4 billion, respectively.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

First Sponsor Group – Dongguan projects see better sales

Recommendation: ACCUMULATE (Maintained), Last Done: S$1.24

Target price: S$1.39, Analyst: Terence Chua

– No financials provided in a voluntary 3Q22 business update.

– Housing policy relaxation measures in Dongguan drove sales higher. Time Zone saw faster sales in 3Q22 vs. 1H22.

– The Group’s European property holdings (PH) segment saw stronger performances for both its office and hotel portfolio.

– Lower tax liabilities saw a higher recovery of Group’s RMB330mn PRC defaulted loan. The Group’s total tax liabilities for its Pudong Villa and Pudong Mall were settled at about RMB35mn lower than expected.

– Maintain ACCUMULATE with unchanged SOTP target price of S$1.39. Catalysts for a TP upgrade are a recovery in the Chinese property market and its China hotel portfolio.

CapitaLand Ascott Trust– Rebound Underway

Recommendation: Buy (Upgraded), Last Done: S$0.955

Target price: S$1.13, Analyst: Darren Chan

– No financials provided in this business update. 3Q22 gross profit is at c.90% of pre-COVID-19 levels. Portfolio RevPAU jumped 88% YoY to S$132 due to higher average daily rate and occupancy (>70%), and is c.87% of 3Q19 pro forma RevPAU.

– 76% of debts at fixed rate. Every 50bps rise in interest rates would impact DPU by c.2%.

– Upgrade to BUY, DDM-TP lowered from S$1.24 to S$1.13. FY22e-FY24e DPU lowered by 5-7% on the back of foreign currency headwinds and an enlarged share base from the private placement as we pencil in the acquisition of S$318.3mn in assets. Our cost of equity increased from 8.14% to 8.34% on a higher risk-free rate assumption. Catalysts include the reopening of China, opportunistic divestments, and acquisitions of extended stay assets to raise the proportion of stable income sources to 25-30% to cushion the impact from recessionary concerns, rising inflation and macroeconomic uncertainties.

Spotify Technology S.A. – Volume and price growth

Recommendation : BUY (Maintained); TP: US$111.00, Last Close: US$80.58

Analyst: Jonathan Woo

– 3Q22 revenue beat expectations modestly on FX tailwinds; earnings missed due to higher than expected expenses. 9M22 revenue at 71% of our FY22e forecasts, with net loss EUR130mn more than our FY22e forecasts.

– Total MAUs/Premium Subscriptions beat guidance, showing resilience through an uncertain macro environment, up 20%/13% respectively. Premium ARPU was up 7% YoY.

– Gross Margin of 24.7% missed guidance by 0.5%, with higher-than-expected expenses led by 14% negative FX movements.

– We maintain a BUY recommendation with a reduced DCF target price of US$111.00 (prev. US$117.00) as we lower FY22e net loss forecasts by ~EUR500mn on the back of higher expenses.

Upcoming Webinars

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Guest Presentation by Elite Commercial REIT [NEW]

Date: 8 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3FquBCh

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc [NEW]

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Research Videos

Weekly Market Outlook: Netflix, Alphabet Inc, Meta Inc, Microsoft, Amazon, UOB, Sheng Siong & more

Date: 31 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials