DAILY MORNING NOTE | 20 October 2022

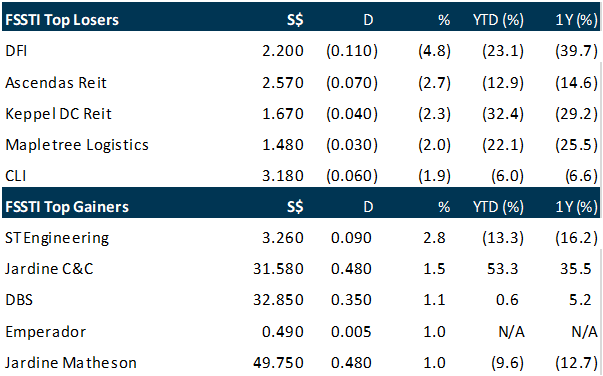

Singapore stocks ended lower on Wednesday (Oct 19), amid mixed trading in the region. The Straits Times Index (STI) lost 0.1 per cent or 3.08 points to close at 3,022.8. Losers outnumbered gainers 315 to 209, after 964 million securities worth S$856.5 million changed hands. Yangzijiang Shipbuilding was the top-traded counter by volume, with 35.4 million shares worth S$40.2 million traded. The counter fell 1.7 per cent to S$1.14 at the close. The top gainer on the STI was ST Engineering. The counter rose 2.8 per cent to end at S$3.26, with 8.1 million shares worth S$26.5 million changing hands. The trio of local banks were up on Wednesday. DBS gained 1.1 per cent to S$32.85, OCBC rose 0.4 per cent to S$11.64, and UOB was up 0.04 per cent at S$26.27. Elsewhere in Asia, key indices were mixed. The FTSE Bursa Malaysia KLCI Index gained 1.1 per cent; the Nikkei 225 Index was up 0.4 per cent. The Hang Seng Index lost 2.4 per cent, and the SSE Composite Index was down 1.2 per cent.

Wall Street stocks retreated on Wednesday, snapping a two-day rally as the latest jump in treasury yields exacerbated recession worries, offsetting generally good earnings. The yield on the 10-year US Treasury note, a proxy for Federal Reserve interest rates, jumped above four percent following a gloomy inflation report from Britain. The Dow Jones Industrial Average finished down 0.3 per cent at 30,423.81. The broad-based S&P 500 shed 0.7 per cent to 3,695.19, while the tech-rich Nasdaq Composite Index dropped 0.9 per cent to 10,680.51.

SG

Sabana Industrial real estate investment trust’s (Reit) third quarter 2022 occupancy has hit a high of 89.1 per cent, a level not seen since Q3 2017. Without 1 Tuas Avenue 4, which is undergoing asset enhancement, total occupancy would have been 92.2 per cent. The Reit has signed 83,588 square feet (sq ft) of new leases and renewed 71,266 sq fft of leases. The renewals come with a positive 10.2 per cent rental reversion, Sabana Reit’s 10th positive quarterly reversion since the first quarter of 2020. But the rental reversion is lower than 17.4 per cent for the second quarter of 2022. The weighted average lease expiry for Q3 2022 stands at 2.7 years, a dip from 2.8 years for Q2 2022. The bulk of the borrowings for the Reit (73.3 per cent) are on fixed rates and the weighted average fixed debt expiry of 2.2 years. The aggregate leverage ratio for Sabana Reit stands at 33.7 per cent. There is a proposal to convert 1 Tuas Avenue 4 into a brand new warehouse and logistics facility, subject to approval from the authorities. There are ongoing discussions with prospective tenants for the property. “As we forge ahead, we are doing our utmost to manage our costs, optimise our funding sources, and seize opportunities that will enhance our portfolio resilience,” said Donald Han, chief executive officer, Sabana Industrial Reit manager. Units of Sabana Reit closed down S$0.005 or 1.2 per cent to S$0.405 on Wednesday (Oct 19).

Raffles Education said it was in compliance in response to queries from the Singapore Exchange Regulation (SGX RegCo) over its implementation of board diversity policy. The company said that it evaluates board composition at the appointment of a new director and on an ongoing basis to achieve board diversity. In particular, Raffles Education said that it is in compliance with provision 2.4 of the Code of Corporate Governance regarding the appropriate size and skills for a company’s board of directors. Currently, the company’s board consists of four independent and non-executive directors and one non-independent and non-executive director and one executive director. “This composition means most directors are independent of management and free from any business or other relationship which could interfere with the exercise of independent judgement or the ability to act in the best interests of the Company,” said Raffles Education in a bourse filing on Wednesday (Oct 19). The directors’ ages range between 50 and 72 years old, and have a variety of skills due to their diverse backgrounds, according to the company. It highlighted the experience of Lim How Teck and Joseph He, two directors that are currently under investigation by the Commercial Affairs Department and the Monetary Authority of Singapore for possible breaches of the Securities and Futures Act. Other directors like Ng Kwan Meng and Lim Siew Mun were also mentioned, whose experience in banking and finance was highlighted, as well as Chua Chwee Koh’s rank of Brigadier General in the Singapore Armed Forces. Raffles Education has said that it would look to appoint younger directors as part of the ongoing renewal process. The company said that the nominating committee consults with the board, with board composition and diversity in mind, in response to a query to detail the process and guidance by the nominating committee in reviewing the board’s collective skills matrix. “Besides the usual knowledge and expertise, the human skills of each candidate are also evaluated,” said Raffles Education. Shares of Raffles Education closed unchanged at S$0.054 on Wednesday.

Stamford Land has responded to the Singapore Exchange Regulation (SGX RegCo) on its proposed disposal of Stamford Plaza Auckland and the business of SPAK, as well as the inability to seek shareholders’ approval prior to the proposed disposal. SGX RegCo had queried the company on the differences between the excess book value and expected net gain of disposing Stamford Plaza Auckland and SPAK. Its response was that the S$74.4 million was the excess of the property sale price over the book value of S$48.5 million, while the expected net gain of S$50 million was after deducting expenses related to the disposal, such as professional fees, agent commissions and taxes. As for the SPAK business disposal, the S$14.5 million was the excess of the book value of S$18,000, and the S$10 million was the expected net gain after deducting professional fees, agent commissions and taxes. Taking into account the company’s confidentiality obligations and the commercial sensitivity of the information requested, the company will not be disclosing the details of the fees incurred by the company in connection with the proposed transactions, save to say that these fees are paid to third parties not related to the board or the controlling shareholders,” said Stamford Land in a bourse filing on Wednesday (Oct 19). As for why it was unable to seek shareholders’ approval prior to the proposed disposal, Stamford Land reiterated that it wasn’t a bidding process, but a buyer who had expressed interest in acquiring the property. The agreement with the buyer was that the disposal was not subject to shareholders’ approval. The company also referred to its reasons set out in the waiver application, that it was not a core asset of the business, nor was it used as security for financing, and that the transactions were commercially and time-sensitive. Both parties had agreed to enter into a definitive agreement on or about Sep 28, with the buyer confirming they were proceeding with the transaction on Sep 19. The company will be reallocating its rights proceeds to Stamford Plaza Brisbane, Stamford Grand Adelaide and Stamford Plaza Melbourne after the disposal of Sir Stamford at Circular Quay. As construction costs have spiked due to inflation, supply chain delays, constraints and bottlenecks, coupled with high labour costs, the refurbishment of Stamford Plaza Melbourne and Stamford Grand Adelaide has been delayed until costs moderate. The company said it may continue to receive unsolicited offers for its hospitality portfolio, which was what had happened with the disposals. Shares of Stamford Land closed unchanged at S$0.365 on Wednesday.

US

Procter & Gamble beat estimates for quarterly sales and profit on Wednesday (Oct 19), helped by price hikes on everything from Head & Shoulders shampoo to Tide detergent, even as a stronger dollar weighed on its revenue from overseas markets. Demand for household consumer goods has so far fallen at a slower pace than discretionary products like apparel and electronics, as consumers prioritise spending on essential items. However, with inflation stubbornly stuck at a 40-year high, some retailers, worried that they may not be able to clear overstocked shelves, are starting to push back on price hikes from P&G and other companies. P&G said average prices across its product lines rose 9 per cent in the first quarter ended Sept 30, while sales volumes fell 3 per cent. The consumer goods giant, which gets more than half of its revenue from international markets, said a strengthening greenback would eat into annual sales by 6 percentage points, compared with a previous forecast of 3 percentage point hit. The company said it was expecting fiscal 2023 sales to fall 1 per cent to 3 per cent, compared with its previous forecast of flat to 2 per cent growth. It also said its full-year earnings would come in at the low-end of its previous guidance of flat to 4 per cent growth. On an adjusted basis, the Tide detergent maker earned US$1.57 per share on net sales of US$20.61 billion. Analysts had estimated earnings of US$1.54 per share on sales of $20.28 billion, according to IBES data from Refinitiv.

Tesla reported third-quarter earnings after the bell, and executives addressed a broad range of questions during the earnings call, including macroeconomic concerns and CEO Elon Musk’s pending takeover of Twitter. Shares fell by about 4% after hours following the results. Tesla’s net income (GAAP) for Q3 2022 reached $3.33 billion, with automotive gross margins holding steady at 27.9%, exactly where it stood in the second quarter of 2022. During the same period last year, Tesla reported $1.62 billion in profits. On an earnings call on Wednesday to discuss the results, Musk addressed shareholder questions about demand and a possible share buyback. “I can’t emphasize enough we have excellent demand for Q4 and we expect to sell every car that we make for as far into the future as we can see,” Musk said. “The factories are running at full speed and we’re delivering every car we make, and keeping operating margins strong.” Tesla is likely to do a “meaningful buyback” next year, he added, potentially between $5 billion and $10 billion pending board approval. He also said, optimistically, “I’m of the opinion that we can far exceed Apple’s current market cap. In fact I see a potential path for Tesla to be worth more than Apple and Saudi Aramco combined. That doesn’t mean it will happen or will be easy.” Shareholders asked Tesla executives to address concerns about macroeconomic issues in China and Europe. “China is experiencing a recession of sorts” mostly in the property markets, Musk said, “and Europe has a recession of sorts driven by energy.” He added, “North America’s in pretty good health, although the Fed is raising interest rates more than they should, but I think they’ll eventually realize that and bring them down again.” In response to a question, he also talked about his pending acquisition of Twitter , saying ”“I’m excited about the Twitter situation…I think it’s an asset that has sort of languished for a long time but has incredible potential.” He later added ,“The long-term potential for Twitter is an order of magnitude greater than its current value.”

IBM shares rose as much as 6% in extended trading on Wednesday after the technology conglomerate surpassed analysts’ estimates for the third quarter and lifted its growth projection for the full year. Revenue increased 6.5% from a year earlier, according to a statement. “With our year-to-date performance, we now expect full-year revenue growth above our mid-single digit model,” CEO Arvind Krishna said in the statement. In July the company said it had expected growth at the high end of the model. The company said foreign-exchange rates should result in 7% less revenue than it otherwise would generate in the full year. IBM reiterated its guidance from July of around $10 billion in free cash flow. “I certainly hope that we are seeing the end of the dollar strengthening,” Krishna said on a conference call with analysts. In Europe, the energy crisis and inflation are making for more cautious conversations, but the concerns aren’t reflected yet in the data, Krishna said. The company ended the third quarter with a $3.21 billion loss from continuing operations, compared with income of $1.04 billion in the year-ago quarter. IBM spun off its managed infrastructure services business into Kyndryl in November 2021. During the third quarter IBM paid a one-time non-cash pension settlement charge tied to the transfer of some pension obligations and assets to third-party insurers. IBM reported an adjusted pre-tax margin of 13.9%, while analysts polled by StreetAccount had been looking for 15.1%. Revenue from software totaled $5.81 billion. That represents growth of nearly 7.5% year over year and exceeds the $5.54 billion consensus estimate among analysts polled by StreetAccount. About 8% of software revenue came from a commercial relationship with Kyndryl, said Jim Kavanaugh, IBM’s finance chief, on the conference call. Revenue from transaction processing software grew 23%. Consulting revenue came to $4.70 billion, which was up 5.5% and above the StreetAccount consensus of $4.51 billion. Pre-tax margins in the consulting unit narrowed to 9.8% from 10.5%. Continued labor cost inflation factored into profit for the unit, IBM said. “However, coming out of the third quarter, we are seeing signs of progress,” Kavanaugh said, flagging higher utilization rates. The infrastructure segment delivered $3.35 billion, up 14.8% and higher than the $3.06 billion StreetAccount consensus. Revenue from IBM’s z Systems line of mainframe computers jumped 88%. Sales of the z16 mainframe computer began in the second quarter.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

FAANGM Monthly September 22 – Wake me up when September ends

Recommendation: OVERWEIGHT (Maintained); Analyst: Jonathan Woo, Maximilian Koeswoyo

– The FAANGM declined 11.6% in September, its weakest month YTD. The Nasdaq fared slightly better, down 10.6%, while the S&P 500 also declined 9.3% for the month

– The overall market continued to skid after higher-than-expected inflation numbers made sure that the Fed would stay aggressive in raising interest rates as it tries to bring inflation down to its 2% target. A strengthening US dollar should also continue to negatively weigh on FAANGM with ~50% of revenue coming from outside the US.

– META was the laggard, down 16.7%, while NFLX was the biggest gainer, up 5.3%.

– We remain OVERWEIGHT on FAANGM as we believe that they will continue to be long-term winners amidst the economic slowdown. FAANGM valuations are also at relatively attractive levels, with forward P/E of 30x slightly below its longer-term average of 31x.

Technical Pulse: Sino Biopharmaceutical Ltd

Analyst: Zane Aw

Recommendation: Technical BUY

Buy limit: 3.92 Stop loss: 3.72 Take profit: 4.64

Sino Biopharmaceutical Ltd (HKEX: 1177) A potential pullback before heading higher in the bullish reversal pullback.

Upcoming Webinars

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Guest Presentation by Zoom Video Communications, Inc [NEW]

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Research Videos

Weekly Market Outlook: PayPal, Keppel Corp, SPH, Fortress Minerals, SGBanking, SG Weekly & more…

Date: 17 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials