DAILY MORNING NOTE | 21 February 2023

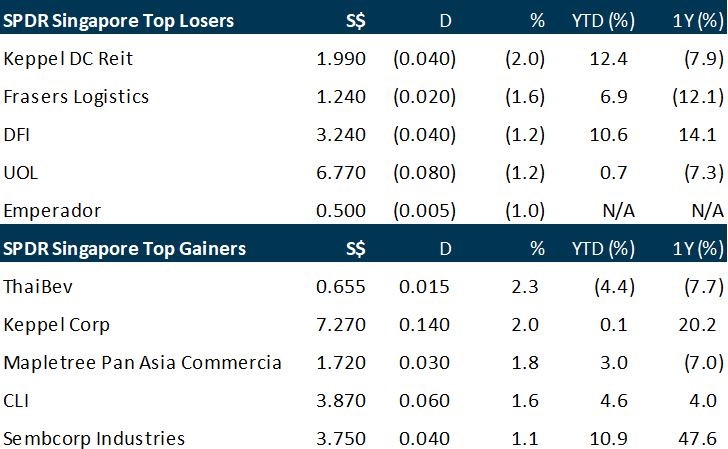

Singapore shares bucked regional trends on Monday, as expectations of further rate hikes by the United States Federal Reserve weighed on investor sentiment. The Straits Times Index (STI) shed 0.6 per cent, or 19.62 points, to 3,308.75. In the broader market, losers beat gainers 302 to 239 after 1.7 billion shares worth $847.7 million changed hands. Across the region, other major markets were largely in the black. Hong Kong’s Hang Seng Index rose 0.8 per cent, Japan’s Nikkei 225 edged up 0.1 per cent, and South Korea’s Kospi Composite Index climbed 0.2 per cent.

US stock markets were shut on Monday for the Presidents’ Day holiday. European shares inched higher on Monday (Feb 20), with sustained gains in miners on bets of a demand recovery in China offsetting a fall in industrials and shares of Telecom Italia. The pan-European Stoxx 600 index closed 0.1 per cent higher ahead of a slew of economic data due later this week. The basic resources index climbed 2.4 per cent after prices of industrial metals rose on hopes of a recovery in demand from top consumer China and on support from global mining supply disruptions.

Stocks to watch: Hiap Hoe

SG

An attempt for the collective sale of Orchard Towers has failed to obtain the requisite 80 per cent consent from unit owners, according to mainboard-listed property developer Hiap Hoe. Hiap Hoe, whose subsidiary Golden Bay Realty owns 59 strata lots – comprising 21 shops and 38 offices – at Orchard Towers, said in a bourse filing on Monday (Feb 20) it had been informed that the proposed deal had fallen through. The collective sale committee of Orchard Towers did not obtain the required threshold for the sale and therefore the process was halted, Hiap Hoe said.

Manufacturer Grand Venture Technology has reported higher revenue of $131.1 million for FY2022, up 12.8% over the preceding year ended Dec 2021. However, due to one-off costs incurred because of recent acquisitions, as well as unfavourable forex and other costs, earnings for the same FY2022 was $13.3 million, down from $17.6 million reported for the preceding FY2021. At the operating level, GVT was able to largely maintain its Ebitda at $29.9 million for FY2022, versus $31.4 million reported for FY2021. The company plans to pay a final dividend of 0.3 cents per share, bringing full year payout to 0.6 cents.

OKP Holdings has reported higher revenue for 2HFY2022 but because of higher admin and finance costs, it incurred a net loss of $2.2 million, versus earnings of $0.5 million reported for the year earlier 1HFY2021. Revenue, for the six months to Dec 2022 was $64.1 million, up 42.4%. This brings full year revenue to $11.6 million, up 30.7% over FY2021. The company, which is in construction and property development, reported a loss of $1 million, versus earnings of $1.5 million for FY2021. Despite the net loss, the company plans to maintain a final dividend of 0.7 cents.

Genting Singapore has reported net profit of $340.1 million for FY2022 ended December, 85% higher y-o-y, as profit before tax more than doubled during the year. Revenue grew 62% y-o-y during the period to $1.7 billion, while cost of sales grew 52% y-o-y to $1.1 billion. The Directors have proposed a final dividend of 2 cents per ordinary share, double the final dividend paid the year prior. Together with the 1 cent per share interim dividend declared in 1HFY2022, Genting Singapore’s full-year dividend for FY2022 is 3 cents per share.

CDW Holding says it expects to report a “significant improvement” in its consolidated profit for the FY2022 ended Dec 31, 2022. The higher profit is attributed to the improvement in its LCD backlight units and LCD parts and accessories segment. The group’s total delivery volume of LCD backlight units improved y-o-y due to the low base in the year before as its backlight unit productions were temporarily suspended in April and May 2022 due to Covid-19 restrictions in Shanghai.

US

The US dollar edged lower on Monday (Feb 20) but kept close to last Friday’s six-week high, after a flurry of economic data reinforced the market’s expectations of tighter monetary policy from the Federal Reserve. The US dollar index, which measures the greenback against six other major currencies, slipped 0.1 per cent to 103.91. It is still up almost 1.8 per cent for the month, keeping it on track for its first monthly gain since September 2022. It hit a six-week high of 104.67 last Friday. Liquidity is expected to be thin on Monday, with US markets closed for Presidents’ Day.

Galois Capital, a crypto investment firm known for betting against the Luna token before its implosion last year, is closing its flagship fund after it was hit by the collapse of cryptocurrency exchange FTX. The fund had lost almost half its assets in “the FTX disaster and then sold the claim for cents on the US dollar,” Galois co-founder Kevin Zhou said in a series of tweets on Monday (Feb 20). “Although this is the end of an era for Galois, the work we have done together for the past few years has not been in vain,” Zhou said. “I can’t say more than this for now.”

Indian billionaire Gautam Adani has decided against bidding for a stake in state-backed electricity trader PTC India, people familiar with the matter said, as his business empire looks to preserve cash amid criticism from a US short-seller. Adani was among the possible bidders reviewing preliminary information on the Mumbai-listed company, Bloomberg News reported in January. The tycoon will not proceed with any offer for the energy trading firm, said the people, who asked not to be identified as the information is private. A representative for the Adani Group declined to comment.

US President Joe Biden said during an unannounced visit to the Ukrainian capital on Monday (Feb 20) that Washington would provide Kyiv with a new military aid package worth US$500 million. Biden said details of the package would be announced on Tuesday, and that Washington would also provide more ammunition for High Mobility Artillery Rocket Systems in Ukraine’s possession.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

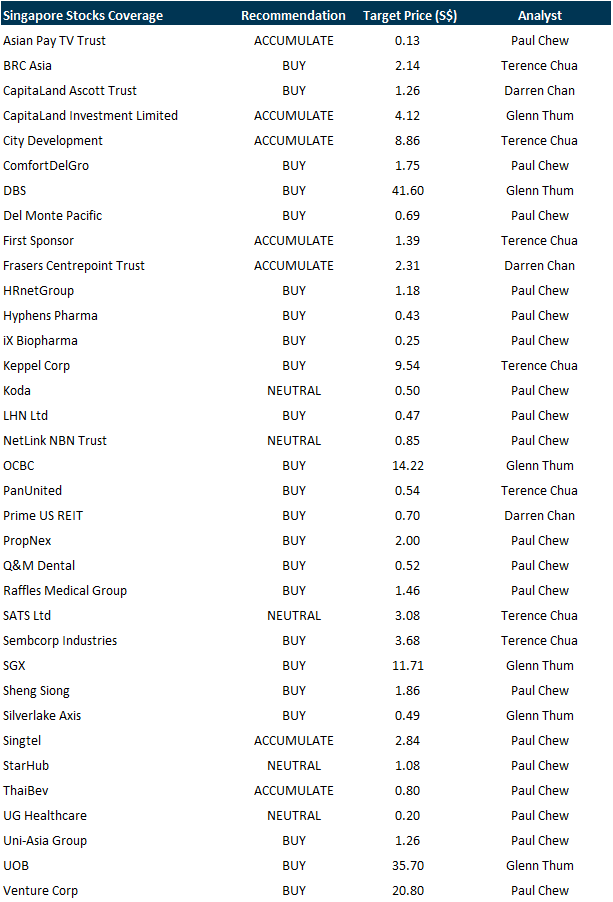

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by First REIT Management Limited [NEW]

Date: 23 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3GY2tp8

Guest Presentation by Cromwell European REIT[NEW]

Date: 28 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3xw5GYW

Research Videos

Weekly Market Outlook: Airbnb, PayPal, DBS, Silverlake Axis, Prime US REIT, BRC Asia & More…

Date: 20 February 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials