DAILY MORNING NOTE | 21 November 2022

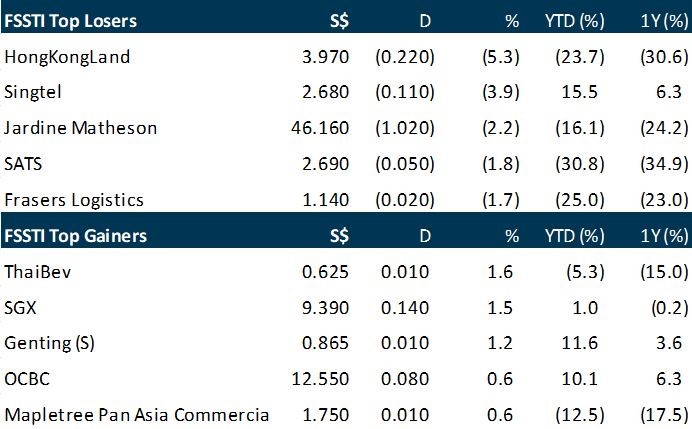

Singapore stocks fell on Friday (Nov 18), tracking Wall Street declines as Federal Reserve officials remained hawkish on future interest rate hikes. The benchmark Straits Times Index (STI) fell 0.4 per cent or 13.81 points to 3,272.23. In the broader market, losers beat gainers 281 to 260 after 1.2 billion securities worth S$1.2 billion changed hands. Regional markets were mixed on Friday. Japan’s Nikkei 225 fell 0.1 per cent, Hong Kong’s Hang Seng Index declined 0.3 per cent and South Korea’s Kospi rose 0.1 per cent.

Wall Street stocks picked up Friday after a rocky session following positive results from retailers and as markets tried to shake off concerns of further interest rate hikes by the US central bank. The Dow Jones Industrial Average rose 0.6 per cent to close at 33,745.69, while the broad-based S&P 500 edged up 0.5 per cent to 3,965.34. The tech-rich Nasdaq Composite Index was essentially flat, finishing at 11,146.06. Investors have been downbeat after a number of Federal Reserve officials have stressed the message that more rate hikes will be needed to bring down surging inflation, feeding fears of a recession in the world’s biggest economy. Boston Fed Bank President Susan Collins was the latest to do so in a speech Friday, although she said the central bank’s “intent is not a significant downturn.”

SG

The managers of CapitaLand Ascott Real Estate Investment Trust and CapitaLand Ascott Business Trust said on Friday (Nov 18) that Ascott Reit MTN – a wholly-owned subsidiary of the trustee of CapitaLand Ascott Reit – has issued S$165 million of 5 per cent notes due May 18, 2026. The notes are issued under its S$2 billion multicurrency debt issuance programme established in September 2009 and amended in July 2020. The payment obligations of Ascott Reit under the notes will be unconditionally and irrevocably guaranteed by DBS Trustee, in its capacity as trustee of CapitaLand Ascott Reit. The net proceeds arising from the issue of the notes will be used for refinancing the existing borrowings of CapitaLand Ascott Reit and its subsidiaries. Ascott Reit MTN has entered into swap transactions to swap the Singapore dollar-denominated coupon payments of the notes into Japanese yen at a fixed interest rate of 1.06 per cent per annum. CapitaLand Ascott Reit and CapitaLand Ascott Business Trust make up stapled group CapitaLand Ascott Trust (Clas). Units of Clas closed at S$0.96 on Friday, down 0.5 per cent or S$0.005, before the announcement.

Tech conglomerate GoTo Group will lay off 1,300 employees, including in Singapore, in a bid to curb costs and reach financial self-sufficiency more quickly in a persistently volatile global economic environment. The cuts amount to 12 per cent of GoTo’s workforce, said the firm, a major ride-hailing, e-commerce and fintech player in South-east Asia, in a statement on Friday (Nov 18). The company declined to disclose how many were laid off in Singapore and its latest headcount here. The group, formed through a merger of ride-hailing company Gojek and e-commerce firm Tokopedia, had nearly 10,000 permanent employees as at Jun 30, going by its second-quarter results for 2022. Those affected would be notified right away, added GoTo, which announced the exercise in a meeting for all employees on Friday chaired by chief executive Andre Soelistyo. The company went public in April with a US$1.1 billion (S$1.5 billion) stock sale, in one of the year’s biggest initial public offerings (IPOs), but share prices have since slid almost 40 per cent, with flagging investor confidence in the tech sector. GoTo said it has saved around 800 billion rupiah (S$70 million) in costs in the first half of 2022 by improving efficiency in technology, marketing and outsourcing, but the job cuts were still needed to ensure the company is equipped to navigate challenges ahead.

Singapore’s total domestic wholesale sales grew by 12.4% y-o-y in the 3Q2022. The expansion was attributable to the growths registered by most of the wholesale trade industries during the quarter. Excluding petroleum, domestic wholesale sales grew by 11.9% y-o-y. On a y-o-y basis, ship chandlers and bunkering led the growth with a 36.7% increase. This was followed by a 25.3% y-o-y growth in household equipment and furniture. A 20.6% y-o-y growth in the chemicals & chemicals products rounded up the top three contributors in the 3Q2022. According to the Department of Statistics Singapore (Singstat), the higher domestic sales of the ship chandlers & bunkering and the chemicals & chemicals products industries was due largely to the higher prices of petrochemical products and bunker fuel. The increase in household equipment and furniture was attributed to the increased demand for audio and video equipment. At the same time, the transport equipment industry contracted by 6.3% due to lower demand for motor vehicles, while domestic sales of the general wholesale trade industry fell by 7.3% y-o-y. On a seasonally adjusted q-o-q basis, Singapore’s domestic wholesale sales fell by 4.0%. Excluding petroleum, domestic sales fell 3.2% from the previous quarter.

US

Oil dropped by about 2 per cent on Friday, logging a second weekly decline, due to concern about weakened demand in China and further increases to US interest rates. Brent crude settled at US$87.62 a barrel, falling US$2.16, or 2.4 per cent. US West Texas Intermediate (WTI) crude settled at US$80.08 a barrel, losing US$1.56, or 1.9 per cent. Both benchmarks posted weekly losses, with Brent down about 9 per cent and WTI roughly 10 per cent. A stronger US dollar, which makes oil more expensive to non-American buyers, pushed down crude prices. The market structure of both oil benchmarks shifted in ways that reflect dwindling supply concerns. Crude came close to record highs earlier this year as Russia’s invasion of Ukraine added to those worries.

The US dollar gained slightly on Friday (Nov 18) and remained on track for its largest weekly gain in over a month, as investors eyed rising bond yields and continued to make bets on the US Federal Reserve’s interest rate hiking path. The US currency gained steam as the session wore on, and was up against the euro and the yen but down slightly against sterling, which regained some lost ground after a volatile session on Thursday following Britain’s latest budget. In the United States on Thursday, investors had reacted to hawkish policy maker comments with St Louis Fed President James Bullard saying that even under a “generous” analysis of monetary policy, the Fed needs to keep raising rates as its tightening so far “had only limited effects on observed inflation”. The euro was down 0.34 per cent against the dollar at US$1.0329 after earlier rising as much as 0.29 per cent. The pound pared gains against the greenback and was last up 0.22 per cent after rising as much as 0.70 per cent earlier. Both the euro and sterling had hit multi-month highs against the dollar earlier this week after inflation data showed an easing in US price pressures.

Autonomous delivery vehicle maker Nuro is laying off about 20 per cent of its workforce after admitting that rapid hiring in the past year was a mistake, the company’s co-founders wrote in an email to employees on Friday. “Laying off team members is always the last resort, but unfortunately it was needed after other options were exhausted,” the email said. The Silicon Valley-based startup, whose investors include Tiger Global Management, Alphabet Inc’s Google and Softbank Group Corp, had raised US$600 million last year at a valuation of US$8.6 billion. Nuro’s founders, Dave Ferguson and Jiajun Zhu, both worked on Google’s self-driving car project, later spun out as Waymo, before launching Nuro. They said Nuro grew rapidly in the past year helped by an abundant supply of capital, but 2022 brought a number of economic challenges, including an impending US recession and energy crises, forcing the company to cut costs. “We doubled the size of our team in less than two years and significantly increased our operating expenses, assuming the funding environment would remain strong,” Ferguson and Zhu said. “We made this call and take full responsibility for today’s circumstances,” they wrote. The layoffs will affect about 300 employees; impacted workers will be offered three months severance pay and other benefits, according to the email.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Technical Pulse: CapitaLand Investment Ltd

Analyst: Zane Aw

Recommendation: Technical SELLSell price: S$3.62 Stop loss: S$3.82 Take profit 1: S$3.25 Take profit 2: S$3.00

CapitaLand Investment Ltd (SGX: 9CI) A potential pullback of the recent rally to retest the support zones at S$3.25-3.40 and S$3.00-3.10.

Asian Pay Television Trust – Huge drag from currency

Recommendation: BUY (Maintained); TP S$0.13, Last close: S$0.109; Analyst Paul Chew

– 3Q22 earnings was below expectations due to the 5% weakness in the Taiwan dollar. YTD22 revenue and EBITDA were at 73%/71% of our FY22e estimates. 3Q22 distribution was maintained at 0.25 cents per unit.

– FY23e distribution is raised 5% to 1.05 cents, paid half yearly. Broadband enjoyed healthy 11% revenue growth, but weakness in basic cable dragged group revenue to fall 6% YoY.

– We lowered our EBITDA by 6% as we cut our Taiwan dollar forecast. Our BUY recommendation is unchanged, but we lower our target price to S$0.13 (prev. S$0.15). based on 8.5x FY23e EV/EBITDA, a 20% discount to Taiwanese peers. The current dividend yield of 9.6%, or S$19mn payout, is supported by free cash flows of around S$73mn p.a.

SATS Ltd – Breakeven in sight and funding clarity to drive re-rating

Recommendation: ACCUMULATE (INITIATION), Last Done: S$2.69

Target price: S$3.02, Analyst: Terence Chua

– Funding clarity to reduce overhang on the Company. SATS has provided clarity on its funding structure for the Worldwide Flight Services (WFS) acquisition by committing to a cap of S$800mn on the rights issue. We modeled a 3 for 10 rights issue scenario at an issue price of S$2.29 (~15% discount to last close) to arrive at a TERP of S$2.60.

– SATS profitability is at a key inflection point with breakeven in 2HFY23. We expect the Group to turn profitable by FY24e with the resumption of dividend in the same year.

– Initiate with ACCUMULATE and a target price of S$3.02. Our valuation is pegged to 18.5x FY24e, which is -1sd below its historical average. Risks to our view include 1) integration challenges for WFS and 2) revenue growth continuing to lag behind expenses growth.

Upcoming Webinars

Guest Presentation by NIO [NEW]

Date: 23 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3hLLptJ

Guest Presentation by KTMG Limited [NEW]

Date: 24 November 2022

Time: 1pm – 2pm

Register: https://bit.ly/3TGIgbC

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by Sabana Industrial REIT [NEW]

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by iWoW Technology [NEW]

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: PayPal, CLI, SATS, PropNex, Singtel, Starhub, Technical Analysis & More…

Date: 14 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials