DAILY MORNING NOTE | 21 October 2022

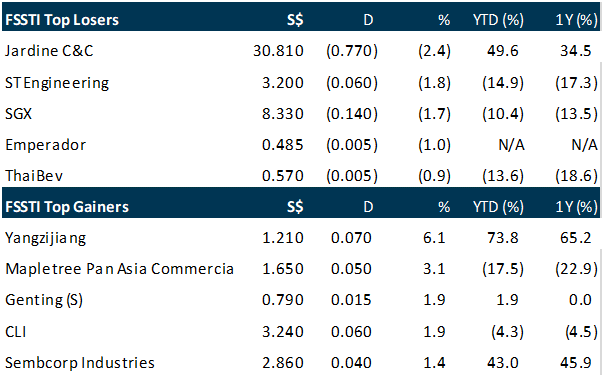

Singapore shares were flat at the close on Thursday (Oct 20), while most regional markets ended lower as inflation worries continue to weigh on investors. The Straits Times Index (STI) ended down 0.1 point to 3,022.7. Gainers outnumbered losers 266 to 257, with 1.6 billion securities worth S$1.1 billion changing hands. The trio of local banks saw mixed trading on Thursday, with DBS falling 0.5 per cent to S$32.69 and UOB losing 0.4 per cent to S$26.16. OCBC was flat at S$11.64. Meanwhile, the top gainer on the STI was Yangzijiang Shipbuilding, which gained 6.1 per cent to S$1.21 at the close. Some 137 million shares worth S$166 million changed hands, making it one of the top traded counters by volume on Thursday. Genting Singapore also saw active trading, with 54.1 million shares worth S$43.2 million changing hands. The counter was up 1.9 per cent at S$0.79. On Thursday, hospitality group Las Vegas Sands said Marina Bay Sands’ net revenue contribution more than trebled for the quarter ended Sep 30, on the back of tourism recovery in Singapore. Elsewhere in Asia, key indices were largely lower. Japan’s Nikkei 225 was down 0.9 per cent, Hong Kong’s Hang Seng lost 1.4 per cent and the Shanghai Composite fell 0.3 per cent. Meanwhile, the FTSE Bursa Malaysia was up 1.6 per cent.

Wall Street stocks dipped on Thursday following the latest rise in US Treasury yield as weak housing data pointed to the drag from higher lending rates. The yield on the 10-year US Treasury note climbed further above 4.0 per cent, reflecting the market’s expectation for more aggressive Federal Reserve interest rates to counter inflation. Data showed existing home sales in the United States fell for an eighth straight month in September, as surging mortgage rates following earlier Fed rate hikes weigh on demand. The Dow Jones Industrial Average finished down 0.3 per cent at 30,333.59. The broad-based S&P 500 shed 0.8 per cent to 3,665.78, while the tech-rich Nasdaq Composite Index dropped 0.6 per cent to 13,869.19. Worries about higher interest rates offset a largely positive set of earnings from IBM, A&T and others. But Tesla tumbled 6.7 percent after reporting that profits more than doubled to US$3.3 billion but revenues missed analyst expectations.

SG

Keppel Infrastructure Trust reported a 12.1 per cent increase in Q3 2022 distributable income to S$50.1 million from S$44.7 million in Q3 2021. The increase was in tandem with a 15.4 per cent growth in operational cash flows from S$56.8 million in Q3 2021 to S$65.5 million in Q3 2022. Expenses also rose 27.5 per cent from S$12.1 million in Q3 2021 to S$15.4 million in Q3 2022. The growth in operational cash flows was driven by all three business segments. The energy transition segment’s contribution of S$28.5 million was driven mainly by the first distribution from Aramco Gas Pipeline Company, but offset by a 7.8 per cent dip in Keppel Merlimau Cogen’s contribution. Environmental services saw a 3.8 per cent increase to S$18.5 million due to the contractual economic benefits from the acquisition of the remaining 30 per cent of SingSpring Desalination Plant. Distribution and storage also saw a 3.9 per cent jump to S$18.5 million mainly driven by Ixom’s contributions, which was partially offset by losses incurred at Philippine Coastal. KIT expects assets under management to increase to S$6.1 billion after completion of new acquisitions in Q4 2022. The trust is jointly investing with other Keppel companies to acquire Eco Management Korea, a waste management player in South Korea. KIT will hold a 52 per cent interest post acquisition for a consideration of about S$346.4 million. Another acquisition on the horizon is to acquire a 50 per cent stake in Keppel Marina East Desalination Plant with an enterprise value of S$355 million. Definitive agreements are expected to be signed in Q4 2022, subject to approvals from authorities. Units of KIT closed unchanged at S$0.525 on Thursday.

Ooway Group on Thursday (Oct 20) said its S$1.5 million interest-free loan offered to Kitchen Culture did not come with any pre-conditions, contrary to what the latter has said. Its clarification comes nearly a week after the board of Catalist-listed Kitchen Culture claimed Ooway Group had made statements with various “factual inaccuracies and mischaracterisation of events”. Kitchen Culture alleged in its Oct 14 statement that the S$1.5 million interest-free loan offered by Ooway Group to help the company meet its general working capital requirements came with a pre-condition that a specific candidate had to be appointed the company’s chief financial officer. Kitchen Culture said it could not accept the condition after its board’s nominating committee found the candidate unsuitable. The company subsequently sought urgent funding from other sources after balance proceeds from past fundraising activities started to fall to a “precariously low level of S$26,559”. At the same time, liabilities accumulated under the management of former executive director and interim chief executive Lincoln Teo swelled to about S$935,000. This led to Kitchen Culture entering into an agreement with lender Tan Gin Tat for a S$1 million loan, so that it can meet its anticipated general working capital requirements until the end of 2022. The loan came with a term of one year and an interest rate of 10 per cent per annum. In its latest statement on Thursday, Ooway Group noted that the terms for its S$1.5 million loan included a loan tenor of one year from the first drawdown date, no interest being payable, and Ooway having the option to extend its loan tenor or convert the loan to equity shares of Kitchen Culture after the initial term expires. Kitchen Culture’s board on Sep 30 received a notice from Ooway Group and seven individuals who own an aggregate of 21.71 per cent of the company’s shares asking for five of its directors to resign. Among these shareholders, Ooway Group holds the largest stake in Kitchen Culture at 21.19 per cent. Trading in the shares of Kitchen Culture has been suspended since Jul 12, 2021.

Singapore’s container port is currently operating at 85 per cent of its maximum handling capacity, with enough buffer to meet short-term increases in demand from shipping lines, said Senior Minister of State for Transport Chee Hong Tat on Thursday (Oct 20). The maximum handling capacity is 44 million twenty-foot equivalent units (TEU) per annum, he noted. Chee was speaking in response to a parliamentary question about the easing and “normalisation” of global supply chain congestions and their impact on Singapore’s seaport. Noting that the Port of Singapore remained open throughout the pandemic, Chee said the Maritime Port Authority worked closely with port operator PSA and the unions to open additional berths and yards. They also deployed more port workers and equipment to handle surges in container volumes. Singapore’s port, which served as a “catch-up” port for ships that faced delays elsewhere, handled a record high container throughput of 37.5 million TEUs last year, Chee said. “As more berths at Tuas Port are completed, our handling capacity will increase further and provide sufficient capacity to handle future growth in volume,” he told Parliament.

US

US wireless carrier AT&T raised its annual profit view and posted a better-than-expected adjusted profit in its third-quarter on Thursday (Oct 20) on strong demand for its phone and Internet services, and as more Americans upgraded to 5G plans. After unwinding its efforts to become a media and entertainment company, AT&T is back to focusing on wireless services in a highly competitive telecoms market where customers are cutting back on spending due to decades-high inflation. AT&T’s promotional offers on smartphones and wireless plans helped it add 708,000 net new monthly bill paying wireless phone subscribers, surpassing Factset estimates of 552,300 additions and sending its shares up 2.8 per cent before the bell. The carrier also added 338,000 fibre Internet customers in the quarter and said it was on track to achieve its annual free cash flow target of US$14 billon. AT&T has not raised prices since a July warning that some customers were taking more time to clear their bills, which had forced it cut its forecast for annual free cash flow. The company now expects adjusted profit per share for the full year to be US$2.50 or higher compared with earlier expectations of US$2.42 to US$2.46 per share. Total revenue rose 3 per cent to US$30 billion, exceeding expectations of US$29.86 billion, according to Refinitiv data. Income from continuing operations was US$6.3 billion compared with US$5 billion a year earlier. Adjusted earnings per share came in at 68 cents per share, topping estimates of 61 cents.

Snap shares plummeted more than 25% in extended trading on Thursday after the social media company reported weaker-than-expected revenue for the third quarter. It’s Wall Street’s first peak into the current state of the struggling online ad market. Snap’s third-quarter revenue grew 6% from a year earlier, the first time it’s dipped into single digits since the company’s public market debut in 2017. Meanwhile, even as it reported a surprise adjusted profit, Snap’s net loss surged 400% to $360 million, partly due to a $155 million restructuring charge. Daily active users increased 19% year-over-year, showing the company is still able to attract people to the service despite the struggles on the business side. Average revenue per user (ARPU) was down 11% to $3.11. In August, Snap announced that it would lay off 20% of the company’s roughly 6,000 employees as part of a major restructuring plan. Severance and related costs made up a big part of the restructuring charge in the period.

Philadelphia Federal Reserve President Patrick Harker on Thursday said higher interest rates have done little to keep inflation in check, so more increases will be needed. “We are going to keep raising rates for a while,” the central bank official said in remarks for a speech in New Jersey. “Given our frankly disappointing lack of progress on curtailing inflation, I expect we will be well above 4% by the end of the year.” The latter comment was in reference to the fed funds rate, which currently is targeted in a range between 3%-3.25%. Markets widely expect the Fed to approve a fourth consecutive 0.75 percentage point interest rate hike in early November, followed by another in December. The expectation is that the Federal Open Market Committee, of which Harker is a nonvoting member this year, will then take rates a bit higher in 2023 before settling in a range around 4.5%-4.75%. Harker indicated that those higher rates are likely to stay in place for an extended period. “Sometime next year, we are going to stop hiking rates. At that point, I think we should hold at a restrictive rate for a while to let monetary policy do its work,” he said. “It will take a while for the higher cost of capital to work its way through the economy. After that, if we have to, we can tighten further, based on the data.” Inflation is currently running around its highest level in more than 40 years. According to the Fed’s preferred gauge, headline personal consumption expenditures inflation is running at a 6.2% annual rate, while the core, excluding food and energy prices, is at 4.9%, both well above the central bank’s 2% target. “Inflation will come down, but it will take some time to get to our target,” Harker said.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Technical Pulse: SPDR Gold Trust

Analyst: Zane Aw

SPDR Gold Trust (NYSEARCA: GLD) A potential continuation of the downtrend in the downtrend channel.

Upcoming Webinars

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Guest Presentation by Zoom Video Communications, Inc [NEW]

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Research Videos

Weekly Market Outlook: PayPal, Keppel Corp, SPH, Fortress Minerals, SGBanking, SG Weekly & more…

Date: 17 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials