DAILY MORNING NOTE | 21 September 2022

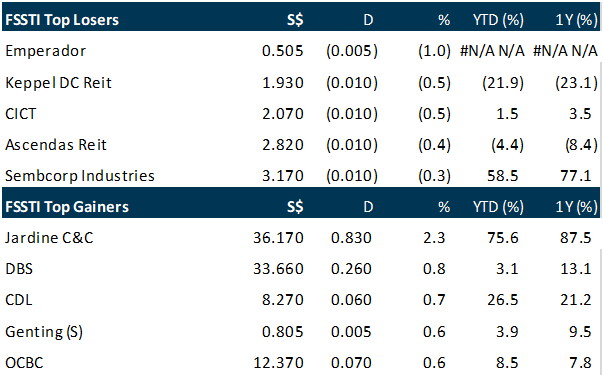

Markets may still be jittery about the upcoming interest rate hike from the US Federal Reserve, but a last-hour dip-buying in Wall Street which pushed US indices to reverse earlier declines has given Asian markets a lift. Key gauges across the region ended in the black on Tuesday (Sep 20). Hong Kong’s Hang Seng Index rose 1.2 per cent, while in mainland China, Shenzhen’s Component Index went up 0.7 per cent, and the Shanghai Composite Index edged up 0.2 per cent. South Korea’s Kospi closed 0.5 per cent higher, and Japan’s Nikkei 225 put on 0.4 per cent. In Singapore, the benchmark Straits Times Index (STI) finished 0.3 per cent higher, gaining 10.63 points to 3,266.94. Gainers outnumbered losers 240 to 223, with about 875.1 million securities worth S$670 million changing hands. Among STI constituents, Jardine Cycle & Carriage was the day’s top performer, gaining 2.4 per cent, or S$0.83 to S$36.17. Emperador, which was recently added to the index, fell 1 per cent, or S$0.005 to S$0.505, emerging as the worst-performing index counter for the day.

Wall Street equities ended with solid losses on Tuesday as US central bankers opened their two-day policy meeting which is widely expected to end with a three-quarter-point interest rate hike. Fed officials have vowed to raise rates to bring down soaring inflation, with some observers speculating about a possible one-percentage-point move. At the end of the trading session, the Dow Jones Industrial Average dropped 1.0 per cent to 30,706.23. The broad-based S&P 500 lost 1.1 per cent to finish at 3,855.93, while the tech-rich Nasdaq Composite Index sank 1.0 per cent to 11,425.05. Among individual companies, Beyond Meat, already suffering from disappointing sales and questions about its growth prospects, was down 6.0 per cent after its COO Doug Ramsey was arrested for biting a man’s nose after an altercation following an American football game. After the close, the company announced it had suspended Ramsey, without providing details. Ford fell 12.3 per cent in the wake of its announcement that supply chain issues would cost the company an extra US$1 billion this quarter.

SG

Parkway Life Real Estate Investment Trust (PLife Reit) has agreed to acquire 2 nursing homes in Japan for 2.88 billion yen (S$29.4 million) to deepen its expansion in the country’s aged care market. The healthcare-focused Reit is buying the properties from Japanese real estate developer Daiwa House. Together with 3 other acquisitions announced last week, this will bring its Japan portfolio to 57 properties valued at S$758.4 million. The acquisition will be made at 11.1 per cent below valuation, and is expected to generate a net property income yield of 5.2 per cent. The transaction is expected to be completed by Q3 2022. PLife Reit will be working with a new operator, Zen Wellness Co, which operates 11 nursing homes in the Kanto/Greater Tokyo region. The nursing homes are freehold properties built in 2021 and located in residential areas of the Tokyo and Chiba prefectures. PLife Reit will take over the existing lease agreements, with an average long balance lease term of 29 years. With the addition of the 2 nursing homes, the Reit’s weighted average lease expiry by gross revenue will increase from 17.05 years as at end-August to 17.21 years. Coupled with the 3 other nursing homes, the Reit’s leverage ratio will increase from 32.5 per cent as at end-June to 34.3 per cent. The acquisition will be fully funded by yen-denominated debt. The counter ended at S$4.62 on Tuesday (Sep 20), up S$0.03 or 0.65 per cent, before the announcement.

Marine logistics group Marco Polo Marine on Tuesday (Sep 20) said it will build, own and operate a new Commissioning Service Operation Vessel (CSOV), valued at about US$60 million, to meet rising demand in Asia’s offshore wind-farm industry. The CSOV, with a length of 83 m and beam of 21 m, will be used in commissioning works during the construction and maintenance of offshore wind farms. Its construction will be funded through existing resources and borrowings. The vessel is expected to be deployed in Q1 of 2024. Marco Polo chief executive Sean Lee said the company has received keen interest from offshore wind-turbine makers and offshore wind-farm developers since it unveiled new designs for service vessels in March. Charterers for offshore wind-support vessels have started to secure ships earlier and for longer, due to rising concerns of a shortage of suitable ships, according to a Q2 2022 report by shipping services group Clarksons. The report noted that CSOVs have higher utilisation and day rates across all regions due to higher demand from both the renewables and the oil-and-gas sectors, as well as a rise in prices for newly-built vessels. The group said the global offshore wind-farm market continues to remain robust, with the Asia-Pacific leading global wind power development and accounting for 84 per cent of new offshore installations in 2021. The annual global offshore market is expected to grow 49 per cent from 21.1 gigawatts in 2021 to 31.4 GW in 2026, said the Global Wind Energy Council’s Global Wind Report 2022. Shares of Marco Polo ended at S$0.039 on Tuesday, up S$0.001 or 2.63 per cent, before the announcement.

Glove manufacturer Top Glove Corporation posted its first quarterly net loss since the company’s Malaysia listing in 2001 amid mounting cost pressures and a pullback in demand. On Tuesday (Sep 20), Top Glove reported a net loss of RM52.6 million (S$16.3 million) for the fourth fiscal quarter ended August, reversing from a net profit of RM447.4 million in the corresponding year-ago period. Revenue for the quarter was down 52.3 per cent year on year to RM990.1 million from RM2.1 billion. The board did not propose a dividend for the period under review. In a call on Tuesday to discuss the company’s financial results, Top Glove executives said the glove industry is now facing several headwinds. The company also said it will defer its new expansion plans to align with glove demand and supply. On the supply side, there is currently an oversupply in the glove industry due to the “aggressive expansion” from existing players over the past 2 to 3 years. New entrants to the industry have also contributed to the oversupply, said managing director Lim Cheong Guan. There has also been a correction in demand for gloves, due to excess stockpiling by customers. Lim was quick to stress that the declines in topline and bottomline figures are part of the “nature of the (glove sector’s) business”. Top Glove has anticipated this, and is working on several cost conservation and resource optimisation levels. Glove ASPs have already fallen off their pandemic highs, and the drop in prices has forced Top Glove to write down its inventory value to net realisable value by RM56 million in Q4 2022 and by RM229 million for FY2022. Costs have also risen, further crimping margins for the company. Domestically, Top Glove was affected by an estimated 60 per cent hike in natural gas tariff over the course of FY2022, and a 25 per cent increase in the Malaysian minimum wage from RM1,200 to RM1,500 which took effect in May 2022. The fall in ASPs and spike in costs mean glovemakers like Top Glove “can’t continue to lose money”, said executive chairman Lim Wee Chai. In October, Top Glove hiked its selling price by 5 per cent. A company spokesperson told The Business Times that the company’s upward price revision, declining raw material prices and a stronger US dollar will help the group return to profitability. Shares of Top Glove, which are dual-listed in Singapore and Malaysia, fell S$0.005 or 2.3 per cent on the Singapore Exchange to close at S$0.215, while shares ended flat at RM0.70 on the Bursa.

US

Crypto exchanges FTX and Binance have made the leading bids for the assets of bankrupt crypto-lender Voyager Digital Ltd., according to people familiar with the matter, but neither bid has been accepted yet. The current bid from Binance is about $50 million, slightly higher than the competing bid from FTX, according to the people. Voyager, founded in 2019, operated a crypto lending platform that took in customer deposits, paid them interest and lent out the assets to other parties. It went public via a reverse merger in 2019. At the stock’s peak in 2021, the company’s market capitalization was $3.9 billion. At the time of its bankruptcy filing in July 2022, Voyager said it had total assets of $5 billion and total liabilities of $4.9 billion. FTX and Binance have emerged among the few winners in the crypto meltdown. Both have managed to increase their share of the trading market. FTX, owned by Sam Bankman-Fried, has been aggressively acquiring distressed assets during the downturn. The auction for Voyager’s assets began on Sept. 13. Other bidders involved include crypto investment manager Wave Financial and trading platform CrossTower. It is possible as well that a separate bidder could come in with a new competing bid. A hearing is scheduled in New York for Sept. 29 to announce the winning bid, but an announcement could come sooner. Voyager, which trades in Toronto and operates out of New York, declared bankruptcy in July after the selloff in cryptocurrencies sparked a wave of withdrawal requests that drained the company’s reserves. Its stock price in 2022 had fallen more than 95% at the time of the filing. It limited and then halted withdrawal requests, unable to fill them because it had lent out $1.1 billion. More than half was to the hedge fund Three Arrows Capital Ltd., to which Voyager lent more than $650 million. A British Virgin Islands court ordered Three Arrows to liquidate in June after creditors sued the company in the wake of the collapse of the stablecoin TerraUSD. Another borrower was trading firm Alameda Research, which like FTX is owned by Mr. Bankman-Fried. Alameda had borrowed cryptocurrencies from Voyager worth about $377 million at the time of the bankruptcy filing. Voyager also had sold a piece of itself to Alameda; in its July bankruptcy filing, Voyager said Alameda had a 9.5% equity stake. In June, Alameda extended two credit lines to Voyager, one for $200 million in cash and a second for 15,000 bitcoins. When Voyager filed for bankruptcy, Alameda was its largest creditor, with an unsecured $75 million loan. In a court filing on Monday, Alameda agreed to repay about $200 million worth of the crypto it had borrowed in exchange for $160 million in collateral Voyager had been holding.

Group One Holdings, the parent company of martial arts and gaming firm ONE Championship, is planning for an initial public offering (IPO) in the United States once market conditions are optimal to drive its global expansion, its chief executive said. To lay the ground work, the firm is changing its legal domicile to the Cayman Islands from Singapore, Chatri Sityodtong, who is also ONE’s founder, told Reuters in a Zoom interview earlier this month. ONE Championship has become Asia’s largest sports media player, according to Nielsen, a global audience measurement and data analytics company. In June, Sityodtong told an economic event in Qatar that ONE is valued at US$1.4 billion. The company does not have an expected date for the IPO. A strong global economy was also important to ensure the company has “tailwinds”, he said, adding that neither of those preconditions are in place now. A potential IPO is 1 of several options ONE is considering in order to raise capital, Sityodtong said, without elaborating. The startup has backing from Sequoia Capital, its largest institutional investor, and Qatar Investment Authority (QIA). ONE now draws an average of 50 million viewers per event compared to around 40,000 viewers 6 years ago, Sityodtong said in June.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Upcoming Webinars

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Guest Presentation by MeGroup Ltd [NEW]

Date: 5 October 2022

Time: 12pm – 1pm

Register: https://bit.ly/3RSOTXY

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Research Videos

Weekly Market Outlook: Prime US REIT, Frasers Centrepoint Trust, Sembcorp Industries, SG Weekly…..

Date: 19 September 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials