DAILY MORNING NOTE | 22 February 2023

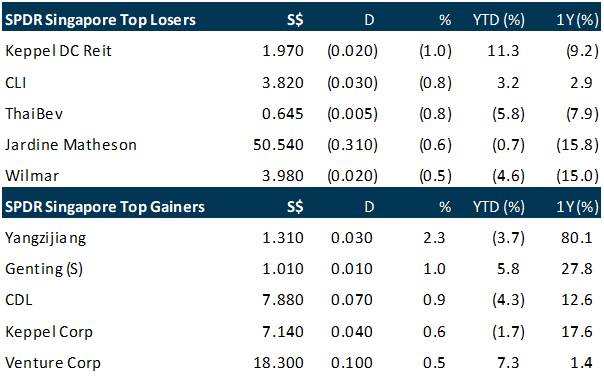

Singapore stocks traded flat on Tuesday (Feb 21) amid softer trading sentiment in the region. The Straits Times Index (STI) fell 0.1 per cent or 1.89 points to 3,306.86. Across the broader market, gainers narrowly beat losers 241 to 240 after 1.63 billion securities worth S$781.42 million changed hands. Across the broader region, major Asian markets were mixed on Tuesday. Hong Kong’s Hang Seng Index fell 1.7 per cent, while Japan’s Nikkei 225 declined 0.2 per cent and South Korea’s Kospi gained 0.2 per cent.

Wall Street stocks finished decisively lower on Tuesday as angst over more Federal Reserve interest rate hikes in the pipeline added to the hit from retailers’ lackluster forecasts. The Dow Jones Industrial Average ended 2.1 per cent lower – down nearly 700 points – at 33,129.59. The broad-based S&P 500 shed 2.0 per cent to 3,997.34, while the tech-rich Nasdaq Composite Index dropped 2.5 per cent to 11,492.30.

Stocks to watch: Nanofilm Technologies

SG

Nanofilm Technologies posted a 43.6 per cent drop in net profit to S$25 million in the six months ended Dec 31, 2022, down from S$44.3 million the year before. This was mainly due to a fall in revenue during the second half of FY2022, along with an increase in some expenses. Earnings per share for H2 FY2022 stood at 3.8 Singapore cents, down from 6.71 Singapore cents in the same period a year ago. Revenue for H2 FY2022 fell 16 per cent to S$126.1 million, from S$150.1 million last year. Administrative expenses during the same period rose 27.8 per cent to S$24 million.

Mainboard-listed vehicle inspection company Vicom on Tuesday (Feb 21) posted a 2.4 per cent increase in net profit to S$13.1 million for the second half ended December 2022, from S$12.8 million the previous year. H2 revenue grew 6.3 per cent to S$55 million, from S$51.7 million in the year-ago period. This brings full-year earnings up 5.7 per cent to S$26.2 million, while FY2022 revenue was 7.3 per cent higher at S$108.3 million. Earnings per share (EPS) rose to S$0.0738 for FY2022, from S$0.0699 in FY2021.

Agribusiness group Wilmar International posted an 8.6-per-cent rise in net profit to US1.2 billion for its second half (H2) in the six months ended Dec 31, 2022, up from US$1.1 billion in the same period a year prior. All its key business segments reported higher profits, along with higher contributions from associates and joint ventures, and lower tax rates, Wilmar said in a regulatory filing on Tuesday (Feb 21). Earnings per share stood at 19.8 US cents in H2 2022, up from 18.1 US cents in the same period in 2021.

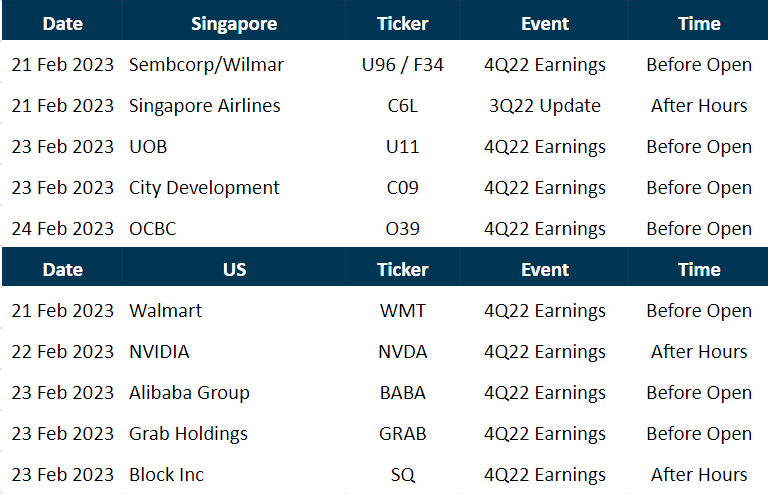

Sembcorp Industries on Tuesday (Feb 21) posted a 54 per cent increase in its net profit for H2 ended Dec 31, 2022, to S$358 million, from S$233 million for H2 2021. The group attributed the improved profits to higher contributions from its renewables and conventional energy segments. Earnings per share for the energy company also rose 54 per cent to 20.09 Singapore cents for H2 2022, from 13.06 Singapore cents for H2 2021. Sembcorp’s H2 turnover grew 3 per cent to S$3.9 billion, from S$3.8 billion.

Flag carrier Singapore Airlines (SIA) posted record operating profits for its third quarter (Q3) on the back of robust demand for air travel across its network. Operating profit for the three months ended Dec 31, 2022, rose 11.4 per cent to S$755 million, up from S$678 million in the second quarter – which was itself a quarterly record then. Net profit for Q3 rose 12.7 per cent to S$628 million, up from S$557 million in the preceding quarter. Earnings per share stood at 10.3 Singapore cents in Q3, up from 8.6 Singapore cents in the second quarter.

Rex International Holding will report a loss for its FY2022, because of lower volume of oil sold. The company says it expects to incur a loss for the year ended Dec 31 2022 but a strong positive EBITDA, positive cash flow and strong cash position for the year. The lower volume sold was because of production stoppages, so as to undertake upgrades of the production facilities between Feb and April last year. Additional “unforeseen” factors in June and November 2022 affected production as well.

Dyna-Mac Holdings has reported earnings of $10.1 million for the 2HFY2022, 4.2 times higher than the earnings of $2.4 million in the same period the year before. The higher earnings were attributable to several factors including the higher revenue for the half-year period, higher gross profit margin, higher other income and lower finance expenses. Earnings for the FY2022 also surged by 138.7% y-o-y to $13.4 million. 2HFY2022 revenue increased by 47.1% y-o-y to $167.4 million due to higher progress achieved for the projects carried out during the period and the FY2022.

US

Qualcomm on Tuesday (Feb 21) said it is launching a paid cloud software service to help companies that use its chips keep tabs on goods as they move through the supply chain. The San Diego, California company is the world’s biggest provider of chips that help smartphones connect to mobile data networks. But Qualcomm has used its wireless communication speciality to enter other markets where devices need to talk to the Internet, such as automobiles and factories. Qualcomm Aware, as the new service is called, works with Qualcomm chips that go into tracking devices for shipping containers, pallets, packages and other parts of supply chains to help companies track where their goods and materials are.

Tencent Holdings is in talks with Meta Platforms to distribute its Meta Quest line of virtual reality (VR) headsets in China, three people familiar with the matter said. The talks between Tencent and Meta started last year and have continued in recent months, according to one of the sources who has direct knowledge of the matter, adding that the talks remain early stage and details have yet to be agreed. Tencent and Meta did not immediately respond to requests for comment on Tuesday (Feb 21). The people declined to be identified because the talks are not public.

Walmart struck a cautious note in its economic outlook for 2023 on Tuesday as the retail bellwether forecast full-year earnings below estimates and warned that tight spending by consumers could pressure profit margins. Higher US consumer prices and loftier costs for rental housing and food have raised fears among executives that the US Federal Reserve could further lift borrowing costs to cool domestic demand, leading to an economic downturn in the second half of the year. Walmart forecast earnings of US$5.90 to US$6.05 per share for the year through January 2024, below analysts’ estimates of US$6.50 per share, according to Refinitiv IBES data, as the company continues to battle price hikes from many of its product suppliers.

Coinbase Global, the biggest US cryptocurrency exchange, reported a fourth-quarter revenue decline that was less than forecast by analysts. Fourth-quarter revenue was US$629.1 million, higher than the average analyst estimate of US$581 million. It had US$2.5 billion in revenue during the year-earlier period. The net loss in the quarter was US$557 million, while trading volume missed estimates. The company expects first-quarter subscription and services revenue between US$300 million and US$325 million.

Porsche Automobil Holding has smashed records in the Schuldschein market on its debut, borrowing 2.7 billion euros (S$3.9 billion) in the largest-ever deal for the German debt. The offering this month, which was initially marketed at only 500 million euros, pulled in about 120 investors including European, Asian and American banks, pension funds and insurers. It shows enduring demand for anything related to the sports car marquee, after Porsche’s stock offering last year was Europe’s biggest in a decade.

Holiday Inn owner IHG missed full-year revenue expectations as it was impacted by Covid-19 curbs in China, while a US$750 million share buyback did little to cushion a drop in its share price on Tuesday (Feb 21). While the tourism industry is gradually recovering from the aftermath of the pandemic, hotel chains have seen an uneven recovery in China as a rise in Covid-19 infections in the final quarter of the year led to indefinite restrictions. IHG reported full-year revenue of US$1.84 billion and a 55 per cent rise in operating profit from reportable segments of US$828 million, both of which missed expectations.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

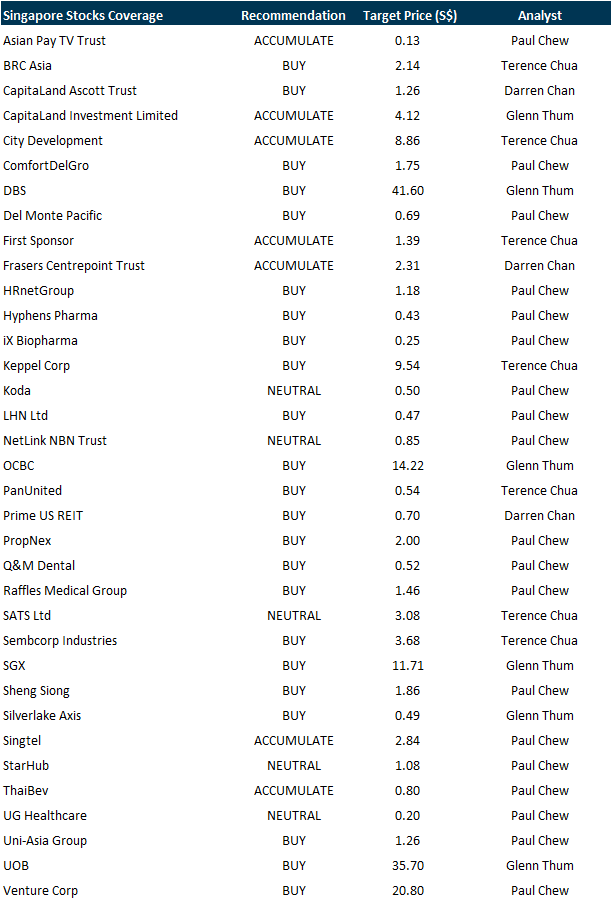

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by First REIT Management Limited [NEW]

Date: 23 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3GY2tp8

Guest Presentation by Cromwell European REIT[NEW]

Date: 28 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3xw5GYW

Research Videos

Weekly Market Outlook: Airbnb, PayPal, DBS, Silverlake Axis, Prime US REIT, BRC Asia & More…

Date: 20 February 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials