DAILY MORNING NOTE | 22 November 2022

Trade of The Day

Technical Pulse: Frencken Group Ltd

Analyst: Zane Aw

Recommendation: Technical SELLSell price: S$1.07 Stop loss: S$1.11 Take profit: S$0.985

The price has traded sideways since retesting the previous support now turned resistance level at S$1.12. It closed with a bearish engulfing candlestick on 21 November, with MACD momentum decreasing. We are likely to see the stock price continue moving lower to retest the uptrend line support.

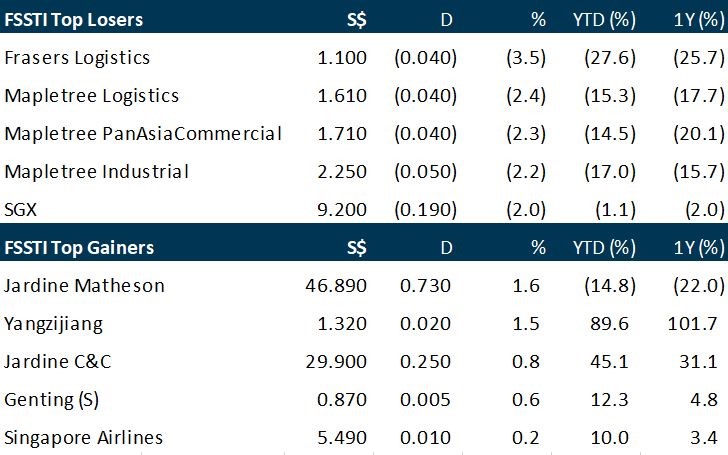

Singapore stocks finished Monday (Nov 21) with a loss of 0.7 per cent, with the Straits Times Index (STI) falling 21.61 points to 3,250.62. Losers outpaced gainers 355 to 184 in the broader market, after 1.7 billion securities worth S$965.4 million changed hands. This mirrored a downward trend in the Asia-Pacific region, which some analysts attributed to investors’ fears from fresh Covid-19 restrictions in China as cases rise. South Korea’s Kospi fell 1 per cent, Hong Kong’s Hang Seng Index fell 1.9 per cent, the Jakarta Composite Index fell 0.3 per cent while the Kuala Lumpur Composite Index fell 0.1 per cent. Japan’s Nikkei 255 bucked the trend, edging up 0.2 per cent at the closing bell on Monday.

The S&P 500 and the Nasdaq opened lower on Monday (Nov 21) as Covid-19 flare-ups in China reignited concerns about slowing growth, while a jump in Disney’s shares following Bob Iger’s surprise comeback as chief executive supported the Dow. The Dow Jones Industrial Average rose 14.6 points, or 0.04 per cent, at the open to 33,760.3. The S&P 500 fell 9.1 points, or 0.23 per cent, at the open to 3,956.23, while the Nasdaq Composite dropped 55.1 points, or 0.49 per cent, to 11,091.008 at the opening bell.

SG

Yoma Strategic’s subsidiary will now acquire Telenor’s 51 per cent stake in Digital Money Myanmar (Wave Money) for US$40 million instead of the US$53 million announced earlier this year. All other material terms from the previous share purchase agreement will remain unchanged, the group said in a bourse filing on Monday (Nov 21). Both parties entered into an amendment agreement for the deal on Nov 18. They had agreed on the new consideration after taking into account their respective long-term business strategies for Myanmar and the economic outlook. “The company remains confident that the financial services pillar will contribute a significant part of the group’s business performance over the next three to five years,” Yoma Strategic said. Mainboard-listed Yoma Strategic, through its subsidiary Yoma MFS Holdings (YMFS), previously agreed to pay US$53 million for the Norwegian telecommunications giant controlling interest in Wave Money, a mobile financial services firm. This included 510,000 ordinary shares and 17.9 million redeemable preference shares. Prior to the US$53 million deal, Yoma proposed to increase its existing shareholding and take a controlling interest in Wave Money via a US$76.5 million deal with Telenor in June 2020. It formed YMFS to restructure the holding of its interest in Wave Money. Yoma later informed shareholders that the Apr 30, 2021 long stop date to complete the proposed acquisition had not been extended, but talks with Telenor over opportunities regarding Wave Money remained. Yoma Strategic was trading flat at S$0.096 as at 1.33 pm on Monday.

The public offer tranche of media entertainment company NoonTalk Media’s initial public offering (IPO) was around 1.2 times subscribed, the company said on Monday (Nov 21). Founded in 2011, NoonTalk is a Singapore-based, home-grown media entertainment company that specialises in artiste and talent management, multimedia production and event conceptualisation. NoonTalk’s IPO, which comprises 22 million shares at S$0.22 apiece, will raise total gross proceeds of S$4.8 million. Based on the offering price, NoonTalk’s market capitalisation is expected to be around S$43.6 million post-offering, the company said. The IPO comprised a placement of 17.5 million shares to investors, and an offering of 4.5 million shares by way of a public offer. At the close of the placement on Nov 17, all public offer shares were validly subscribed for, and the company received indications of interest for 5.3 million public offer shares, reaching a total value of S$1.2 million. All 17.5 million placement shares were also validly subscribed for, with application monies received amounting to S$3.85 million. NoonTalk expects to begin trading on the Catalist board of the Singapore Exchange (SGX) at 9 am on Nov 22. Dasmond Koh, executive director and chief executive of NoonTalk, said: “Listing on SGX serves as a platform to enhance our exposure and allows us to gain access to the capital markets to extend our regional footprint.” Anchor investors of the placement include energy supplier Union Energy Corporation; Lim Hock Leng, managing director of Sheng Siong Group; and Qilin Wealth Fund, a Singapore-based single family office. Other notable investors include Dr Chong Weng Chiew, who is executive director of Citic Envirotech and previously a Member of the Parliament, as well as chief executive of Ang Mo Kio-Thye Hua Kwan Hospital. Evolve Capital Advisory is the sponsor, issue manager and co-placement agent for the IPO, while CGS-CIMB Securities (Singapore) is the underwriter and co-placement agent.

Halcyon Agri Corporation, which is the target of a mandatory offer, posted an operating loss of US$2.2 million for its third quarter ended Sep 30, 2022, compared to the operating profit of US$0.7 million a year earlier. Core earnings before interest, taxes, depreciation, and amortisation (Ebitda) was at US$10.2 million, up year on year from US$9.4 million in Q3 2021, but down quarter on quarter from US$16.2 million in Q2 2022. Meanwhile, gross profit for the period was up 13.3 per cent on-year to US$39.1 million, while revenue rose 17.9 per cent on-year to US$709.8 million, said the natural rubber supplier on Monday (Nov 21). The company noted that its sales volume for the quarter rose to 394,684 metric tonnes, from 330,474 metric tonnes from a year earlier, which it attributed to its “timely capture of market demand through its global pole position and vertically integrated capabilities”. A recent decline in rubber prices had resulted in “some level of margin compression” in its plantation and processing businesses. But this was offset by a stronger performance in its distribution business in destination markets, the company said. Li Xuetao, chief executive of Halcyon Agri, said the company remains “encouraged and cautiously optimistic on our prospects in the remaining months” of 2022. He said: “The recent interest rate increases by the US Federal Reserve will inevitably affect global demand, but this could be offset by the resurgence of demand upon China’s reopening.” Last Wednesday, Shanghai Stock Exchange-listed China Hainan Rubber Industry Group said it will acquire 574.2 million shares in Halcyon Agri at US$0.315 apiece, for a total cash consideration of US$180.9 million. This represents a 36 per cent stake in Halcyon Agri; the share purchase will also trigger a mandator general offer (MGO) for the Singapore-listed company. Li noted that the company’s businesses will operate as usual while the share purchase and MGO takes time. “Halcyon Agri views this transaction positively, as it can further augment our position as the leading integrated supply chain manager,” he added. Shares of Halcyon Agri closed flat at S$0.38 on Monday, before the release of the results.

US

Online property portal PropertyGuru on Monday (Nov 21) posted a net loss of S$7.4 million for the quarter ended Sep 30, a reversal from its profit-making performance last quarter. This comes as higher expenses weighed on the group’s bottom line, even though it reported a net profit of S$3.8 million last quarter, the first time since becoming listed on the New York Stock Exchange in March this year. However, this quarter’s loss is still an improvement compared to a year ago, which saw a net loss of S$9.6 million. The group’s revenue for the quarter came in at S$34.6 million, a 47 per cent improvement from a year earlier at S$23.5 million. This was supported by a consistent growth in all markets and segments on PropertyGuru’s business. Revenue captured from its Vietnamese market showed the most significant growth as revenue nearly trebled from S$2.4 million to S$6.1 million in Q3. Singapore, however, remains its largest market, contributing S$18.1 million of the group’s revenue. Adjusted earnings before interest, taxes, depreciation, and amortization (Ebitda) was positive at S$5.7 million for the quarter, while loss per share for the quarter stood at S$0.05. The group anticipates a full-year revenue of between S$134.0 million and S$138.0 million as a result of greater fiscal policy uncertainty stemming from rising global inflationary pressures, near-term actions by the Vietnamese government to limit access to credit, and the recent Malaysian election. It added that the Singapore property market remains strong and expects an adjusted Ebitda of between S$8 million and S$12 million for FY2022. “We remain encouraged by our market penetration as we enter the final quarter of 2022, although we understand that near-term market headwinds resulting from global inflationary pressures and subsequent governmental counteractions will need to be closely monitored,” said Joe Dische, chief financial officer of PropertyGuru. Shares of PropertyGuru traded up 2.2 per cent or US$0.11 higher at US$5.15 before the results announcement.

Shares of Disney popped Monday, the morning after the company announced it had replaced CEO Bob Chapek with Bob Iger. Disney’s stock rose more than 7% on Monday. As of Friday’s close, the company’s shares had fallen about 40% so far this year. Chapek, who succeeded Iger as CEO in early 2020, had come under increasing criticism and scrutiny over the company’s performance in recent months. Its most recent quarterly earnings report, which hit earlier this month, arrived with a thud, sending the company’s shares down dramatically. Three days after that report, Chapek told his lieutenants in a memo that Disney would seek to cut costs through hiring freezes, layoffs and other means. Still, the decision to replace Chapek with Iger stunned the business world. Iger, who worked for 15 years as Disney’s chief, had said previously that he would not return to the job, while the company renewed Chapek’s contract earlier this year as he pressed his reorganization vision for Disney. Chapek took over just before the Covid pandemic severely cramped Disney’s business, shutting its theme parks and keeping its movies out of theaters for months. As Chapek helped the company weather that storm, with Iger still serving as chairman through December of last year, the company’s stock climbed to just above $200 at one point in 2021. Since then, Disney’s shares have tumbled. They closed below $100 on Friday. During Chapek’s tenure, as of Friday, Disney’s stock fell 28% as the Dow rose 25% and the S&P 500 increased 27%. This year, Disney has been among the three worst performers in the Dow, along with Intel and Salesforce.

Oil prices slipped to trade near two-month lows on Monday (Nov 21), having earlier slid by around US$1 a barrel, as supply fears receded while concerns over fuel demand from China and US dollar strength weighed on prices. Brent crude futures for January had slipped 52 cents, or 0.6 per cent, to US$87.10 a barrel by 1326 GMT. US West Texas Intermediate (WTI) crude futures for December were at US$79.40 a barrel, down 68 cents or 0.9 per cent, ahead of the contract’s expiry later on Monday. The more active January contract was down 43 cents or 0.5 per cent to US$79.68 a barrel. Both benchmarks closed Friday at their lowest since Sept 27, extending losses for a second week, with Brent down 9 per cent and WTI 10 per cent lower.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Sembcorp Industries – Equity fundraising ruled out

Recommendation: BUY (Maintained), Last Done: S$3.05

Target price: S$3.68, Analyst: Terence Chua

– Sembcorp Industries (SCI) announced the acquisition of 830MW of renewable assets in China through a joint venture with State Power Investment Corporation (SPIC).

– The acquisition of BEI Energy and Vector Green will be accretive to earnings and diversifies the Group’s presence from north western China.

– Management ruled out equity funding to finance spate of acquisitions. We believe the latest clarification will allay concerns over an equity call.

– We maintain BUY with unchanged target price of $3.68. Our earnings are unchanged while our target price is maintained at $3.68, still based on 1.2x P/BV, the average of its peers.

Upcoming Webinars

Guest Presentation by NIO [NEW]

Date: 23 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3hLLptJ

Guest Presentation by KTMG Limited [NEW]

Date: 24 November 2022

Time: 1pm – 2pm

Register: https://bit.ly/3TGIgbC

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by Sabana Industrial REIT [NEW]

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by iWoW Technology [NEW]

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: Sea Ltd, Silverlake Axis, Q&M Dental, ComfortDelgro, APTT, Tech Analysis…

Date: 21 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials