DAILY MORNING NOTE | 22 September 2022

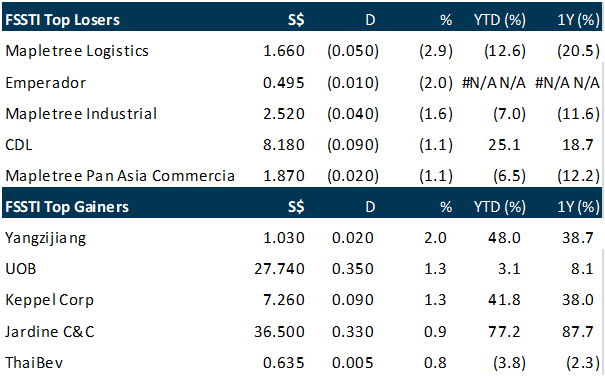

Tracking losses on Wall Street ahead of the Federal Reserve’s rate hike, Singapore shares ended in the red on Wednesday (Sep 21), along with other regional bourses. The Straits Times Index (STI) fell 0.2 per cent, losing 5.15 points to 3,261.79. There were almost twice the number of losers than gainers at 300 to 182, as some 1 billion securities worth S$970.1 million changed hands. Hong Kong’s Hang Seng Index declined 1.8 per cent, while in mainland China, the Shanghai Composite Index dipped 0.2 per cent and the Shenzhen bourse slipped 0.7 per cent. Meanwhile, Bursa Malaysia lost 1 per cent while Japan’s Nikkei 225 fell 1.4 per cent. Glovemaker Top Glove’s share price slid after the company posted its first quarterly loss since its Malaysian listing in 2001. It fell 7 per cent, dropping S$0.015 to S$0.20 on the Singapore bourse. Parkway Life Real Estate Investment Trust (Reit), which announced on the same day that it had agreed to acquire 2 nursing homes in Japan for 2.88 billion yen (S$29.4 million) to deepen its expansion in the country’s aged care market, declined 2 per cent or S$0.09 to S$4.53.

Wall Street stocks fell sharply Wednesday after the Federal Reserve enacted another three-quarter point interest rate hike and signaled more monetary tightening ahead as it combats inflation. The Dow Jones Industrial Average finished down 1.7 per cent at 30,183.78. The broad-based S&P 500 also shed 1.7 per cent to 3,789.93, while the tech-rich Nasdaq Composite Index declined 1.8 per cent to 11,220.19. The US central bank announced its third consecutive interest rate increase of 0.75 percentage point, continuing the forceful action to tamp down inflation that has surged to the highest in 40 years. The increase – the fifth one this year – takes the policy rate to 3.0-3.25 per cent. Markets were expecting another big interest rate increase, but were caught off guard by the Fed’s outlook as far as the need for additional hikes. The latest Fed statement included interest rate projections for the end of 2023 and 2024 that are higher than the previous forecasts, signaling the US central bank now sees the need for a more prolonged monetary tightening cycle in light of inflation trends. All 11 sectors of the S&P 500 fell, while virtually all members of the Dow index dropped. An exception was Walmart, which advanced 0.9 per cent after it announced it would hire 40,000 workers for the upcoming holiday season, far fewer than last year as inflation pressures corporate profits. Among individual companies, General Mills jumped 5.7 per cent after reporting better-than-expected quarterly profits.

SG

SATS is in discussions to acquire air cargo handler Worldwide Flight Services but no definitive terms or formal legal documentation, including the purchase consideration, have been agreed upon, the company said on Wednesday (Sep 21) in a bourse filing. The mainboard-listed inflight caterer and ground handler called for a trading halt earlier in the day following a Bloomberg report, based on sources, of a potential acquisition for as much as US$3 billion. SATS has sounded out financing for the potential purchase of Worldwide Flight Services from its private equity owner Cerberus Capital Management, the report said. SATS said on Wednesday there is no certainty a transaction will materialise. Cerberus bought Paris-based Worldwide Flight Services in 2018 for about 1.2 billion euros (S$1.68 billion). The company had annual revenues of more than 1.2 billion euros when the deal was announced. Founded in 1971, Worldwide Flight Services operates in more than 160 major airports in over 20 countries, said its website. Shares of SATS last traded at S$4.09 on Wednesday, up S$0.03 or 0.7 per cent.

The manager of First Real Estate Investment Trust (Reit) has agreed to buy 2 nursing homes in Japan for 2.6 billion yen (S$26.3 million), as part of its expansion in a key growth market. The freehold properties, Loyal Residence Ayase (Ayase) and Medical Rehabilitation Home Bon Séjour Komaki (Komaki), have a combined net property yield of 5.2 per cent. The acquisitions will be fully funded by debt and are expected to be DPU (distribution per unit) accretive. Japanese entity Healthcare & Medical Investment Corporation is selling it for 1.45 billion yen. The property is situated near parks and facilities such as hospitals and community centres, and is a half-hour drive from Nagoya City Centre. Following the acquisitions, developed markets will contribute to about one-quarter of First Reit’s assets under management. The Reit manager plans to step up growth in developed markets to more than 50 per cent of the overall portfolio. The Japan portfolio currently comprises 12 nursing homes acquired in March 2022. The 2 additional nursing homes are operated by unrelated third-party operators. The counter ended flat at S$0.275 on Wednesday (Sep 21).

The Singapore Exchange (SGX Group) has launched its foreign exchange (FX) electronic communication network, SGX CurrencyNode, after obtaining a recognised market operator licence from the Monetary Authority of Singapore (MAS). SGX CurrencyNode offers market participants such as global banks, brokers and institutional investors access to multiple sources of over-the-counter (OTC) FX liquidity anonymously through a single venue, SGX Group said in a statement on Wednesday (Sep 21). Using a central prime brokerage model, SGX CurrencyNode currently streams liquidity for FX spot, precious metals and non-deliverable forwards (NDFs), and there are plans to launch FX swaps and NDF spreads later, SGX Group said. BNP Paribas and Deutsche Bank are the central prime brokers. SGX Group has been investing to expand its FX business and acquired subsidiaries such as BidFX and MaxxTrader in recent years. The group said that SGX CurrencyNode completes the buildout of its OTC FX infrastructure.

US

At Walmart Inc., holiday hiring is cooling along with demand for patio furniture and apparel. The company said Wednesday that it plans to hire around 40,000 mostly seasonal workers to serve shoppers over the busy holiday shopping period and that it would offer current employees extra hours before filling roles. Last year, as many large retailers scrambled to fill positions to meet booming demand, Walmart said it was looking for around 150,000 permanent employees to work over the holidays and beyond. The shift at the country’s largest private employer is a sign of how shrinking demand for some products, higher prices and tighter household budgets might shape hiring plans in the months ahead. A Walmart spokeswoman said the company is hiring less this year because its operations are better staffed versus the previous holiday-shopping season. The company had about 1.7 million U.S. employees as of January, compared with 1.6 million as of early 2021. Retailers are still competing for truck drivers and delivery workers. Walmart aims to hire around 1,500 full-time permanent truck drivers as part of its roughly 40,000 holiday workers, said a spokeswoman.

Meta is looking to cut costs by 10% in coming months, according to a report published Wednesday by The Wall Street Journal. The cost cuts are likely to include job reductions due to internal business department reorganizations as opposed to more formal layoffs. The cost cutting is expected to commence over the next few months. For its second-quarter earnings report in July, the Facebook parent company reported a 22% year-over-year increase in costs and expenses totaling nearly $20.4 billion. The company has been investing heavily in the metaverse in the hopes that yet-to-be developed technology will lead to massive sales. The company also reported its first-ever revenue decline from a year ago, and predicted during that earnings call that its sales would drop again in its third quarter. Meta shares were up less than 1% in midday trading to $146.33 on Wednesday. However, shares are down more than 56% this year, far worse than the S&P 500, which is down less than 20%, and the tech-heavy NASDAQ Composite, which is down about 26%.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Adobe Inc – Big Figma acquisition

Recommendation: BUY (Maintained); TP: US$420.00

Analyst: Ambrish Shah

– 3Q22 results were in line with expectations. 9M22 revenue/PATMI was at 74%/75% of our FY22e forecasts. Total revenue grew 13% YoY to US$4.4bn, driven by 13%/14% YoY increases in Digital Media and Digital Experience revenues.

– Adobe agreed to acquire collaborative design software firm Figma in a cash-and-stock deal worth US$20bn. The company is acquiring Figma for 50x its FY22e annual recurring revenue (ARR) of US$400mn. The transaction is expected to close in FY23e and aims to expand tools for creative professionals. We believe that the deal would take out an emerging competitor as Figma poses a potential threat standalone.

– We nudge lower our FY22e revenue/PATMI by 1% due to macroeconomic uncertainty and FX headwinds. On a standalone basis, we maintain a BUY recommendation on ADBE with a lowered DCF target price of US$420.00 (prev. US$549.00), with an increased WACC of 7.1% and unchanged terminal growth rate of 4.0%. Overall, we believe that Adobe’s long-term secular tailwinds remain intact, including paperless workflows, explosion in digital content creation and continued shift to the cloud. Completion of the Figma transaction will cause a 7% downgrade to our target price due to operating margin dilution and additional shares in the diluted share count.

Analyst: Zane Aw

Recommendation: Technical BUY

Buy limit: 26.45 Stop loss: 24.75 Take profit: 30.70

HP Inc (NYSE: HPQ) A potential bullish reversal to the upside to retest the downtrend channel resistance.

Upcoming Webinars

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Guest Presentation by MeGroup Ltd [NEW]

Date: 5 October 2022

Time: 12pm – 1pm

Register: https://bit.ly/3RSOTXY

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Research Videos

Weekly Market Outlook: Prime US REIT, Frasers Centrepoint Trust, Sembcorp Industries, SG Weekly…..

Date: 19 September 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials