DAILY MORNING NOTE | 23 August 2022

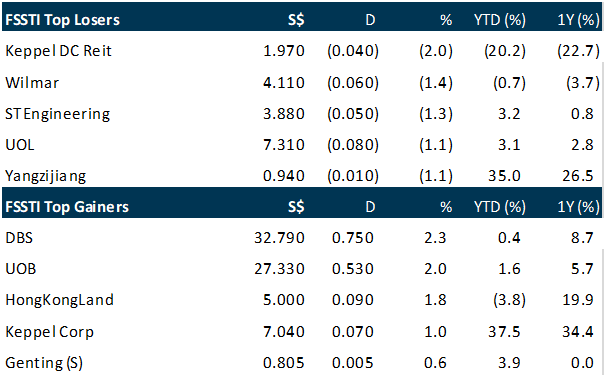

Singapore stocks ended lower on Monday (Aug 22), tracking regional losses. The benchmark Straits Times Index (STI) slipped 0.5 per cent or 16.06 points at 3,262.57, losers outnumbered gainers 252 to 206 after 1.31 billion shares worth S$1.09 billion changed hands. Keppel DC Reit was the top STI decliner, finishing 2 per cent or S$0.04 lower at S$1.97. Also performing poorly were Wilmar International and ST Engineering, which fell 1.4 per cent and 1.3 per cent respectively to close at S$4.11 and S$3.88. Meanwhile, 2 among the trio of local banks topped the STI performance table. DBS gained 2.3 per cent or S$0.75 to end at S$32.79, while UOB closed up 2 per cent or S$0.53 at S$27.33. OCBC went the other direction, however, with a 0.3 per cent or S$0.03 drop to its value. Its shares traded at S$12.18 at Monday’s close.

The Dow slumped Monday, pressured by a sea of red in tech as Treasury yields continued to climb on fears that the Federal Reserve could spring a hawkish surprise later this week. The Dow Jones Industrial Average slipped 1.9% to finish at 33,063.62, the Nasdaq was down 2.6% to 12,381.57, and the S&P 500 shed 2.1% to 4138.00. Tech stocks picked up from where they left off last week as rising Treasury yields, the enemy of stocks that have high valuations, piled on the pressure with just days to go until the Federal Reserve is expected to deliver fresh clues on monetary policy at its annual Jackson Hole symposium later this week. Google-parent Alphabet, Microsoft and Meta Platforms were down more than 2%. Energy was the relatively outperforming sector on the day, down about 0.2%, as oil prices recovered losses after Saudi energy minister touted the prospect of major oil producers cutting costs to ensure that oil futures prices reflect the current supply and demand fundamentals.

SG

First Real Estate Investment Trust on Monday (Aug 22) launched a tender offer to buy back S$60 million in Series 002 subordinated perpetual securities in cash, at 70 per cent of the principal amount. On top of the purchase price, First Reit will also pay the accrued – but unpaid – distribution on all securities accepted for sale. In its bourse filing, the management of First Reit said the rationale for its offer is to “provide liquidity to the securityholders given the illiquid nature of the outstanding securities”, and to optimise the trust’s debt capital structure as part of its continuing capital and liability management initiatives. Securityholders have until 5 pm on Sep 2 to submit their tender application forms, ahead of the settlement date on Sep 9. Based on Bloomberg data, the last quoted price of the perpetual securities on Aug 19 was S$62.613. Units of First Reit closed flat at $0.28 on Monday.

Singapore Telecommunications is moving forward with a planned sale of its cyber security business Trustwave Holdings that could raise about US$200 million to US$300 million, people familiar with the matter said. The Singapore operator has been speaking with financial advisers as it prepares for a potential divestment of the Chicago-based unit, the people said, asking not to be identified because the matter is private. Trustwave could attract interest from other firms in the industry and investment funds, according to the people. Considerations are preliminary and Singtel could still decide to retain the asset, they said. A representative for Singtel declined to comment. Singtel is streamlining its portfolio as it seeks to raise cash and focus on 5G operations as well as developing new growth engines including IT services and data centers.

Mainboard-listed Lion Asiapac reported a loss of S$707,000 in the fourth quarter, reversing a S$96,000 net profit from a year ago, due mainly to an exchange loss and limekiln refurbishment cost. This brings its loss for the full-year ended Jun 30, 2022 to S$1.6 million, reversing a S$937,000 profit in the previous financial year, according to financial statements filed after the market closed on Monday (Aug 22). Loss per share for the fiscal year stands at 1.92 cents, versus earnings per share of 1.16 cents for the previous financial year. “The group’s operations are subject to the market conditions and challenges of the steel industry. Escalating costs and the uncertainties in the market will continue to pose constraints to the group’s core businesses,” said the company. No dividends were declared. Shares of Lion Asiapac closed unchanged at S$0.34 on Monday.

US

Tesla Inc will start charging US$15,000 for the driver-assistance system it calls Full Self-Driving, raising the price of the controversial product for the second time this year. The hike for customers in North America will take effect Sep 5, chief executive officer Elon Musk tweeted on Sunday (Aug 21). The current US$12,000 price will be honoured for orders made before that date, he wrote. Tesla last raised the price of FSD by US$2,000 in January. The company said last month that more than 100,000 drivers had access to FSD Beta at the end of the second quarter. Musk tweeted that a wide release of FSD Beta is one of his 2 big goals for this year, the other being Space Exploration Technology Corp getting its Starship to orbit. The closely held company has designed the rocket to eventually take humans to Mars.

Ford Motor said it will cut a total of 3,000 salaried and contract jobs, mostly in North America and India, as it restructures to catch up with Tesla in the race to develop software-driven electric vehicles (EV). Ford chief executive Jim Farley has been saying for months that he believed the Dearborn, Mich. automaker had too many people, and that not enough of its workforce had the skills required as the auto industry shifts to electric vehicles and digital services. Like other established automakers, Ford has a workforce largely hired to support a traditional combustion technology product lineup. Going forward, Farley has mapped out a strategy for Ford to develop a broad lineup of electric vehicles. Like Tesla, Ford wants to generate more revenue through services that depend on digital software and connectivity. Ford has begun separating its operations into electric, combustion engine and commercial vehicle operations. Farley said in July “cost reduction will happen” in the combustion operations. But Ford said on Monday the staff cuts will affect all parts of the company.

Pfizer and partner BioNTech said on Monday (Aug 22) they had completed a submission to the US Food and Drug Administration (FDA) for authorisation of a Covid-19 vaccine adapted to target the Omicron variant. The request was for a so-called bivalent vaccine that contains the dominant BA.4/BA.5 variants of the virus, along with the original coronavirus strain. The FDA in June asked Covid-19 vaccine makers to tailor shots to target the 2 subvariants. The US government has since signed a deal with both Moderna and Pfizer for delivery of Omicron-adapted vaccines, pending clearance.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Upcoming Webinars

Guest Presentation by Audience Analytics

Date: 23 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3P3eBYR

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Guest Presentation by Unity [NEW]

Date: 25 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3w9ssW7

Guest Presentation by Marathon Digital Holdings

Date: 26 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by Halcyon Agri Corporation Limited [NEW]

Date: 31 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3pjErMM

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Research Videos

Weekly Market Outlook: Sea Ltd, SGX, Ascott Residence Trust, First REIT, SembCorp, Q&M & More

Date: 22 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials