DAILY MORNING NOTE | 23 November 2022

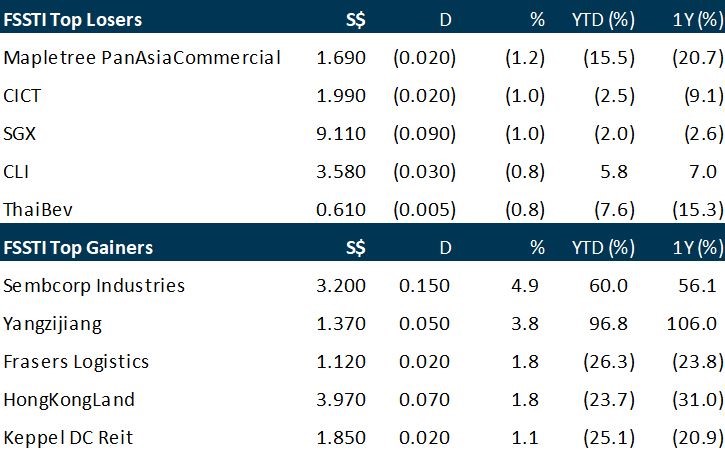

Singapore stocks closed higher on Tuesday (Nov 22), even as most other Asian indices moved deeper into the red with China’s Covid-19 infections surging close to record levels. The Straits Times Index (STI) rose 0.3 per cent, or 8.94 points, to end the day at 3,259.56 points. Advancers beat decliners 297 to 274 in the broader market, after 1.7 billion securities worth S$871.9 million changed hands. Hong Kong stocks led losses in the region, with the Hang Seng Index falling 1.3 per cent. South Korea’s Kospi lost 0.6 per cent, and the Kuala Lumpur Composite Index lost 0.5 per cent, while the Jakarta Composite Index fell 0.5 per cent. China has seen a rise in infections since loosening Covid-19 restrictions about a fortnight ago.

Wall Street stocks mostly rose early Tuesday (Nov 22) following mixed earnings from retailers before the holiday shopping season starts. Shares of Best Buy rocketed more than eight per cent higher after the electronics retailer’s earnings topped analyst expectations, while discount chain Dollar Tree fell by a similar percentage as it cautioned that higher costs were crimping profit margins. The holiday shopping season kicks off later this week with “Black Friday,” the day after Thursday’s Thanksgiving break when markets will be closed. The Dow Jones Industrial Average was up 0.5 per cent at 33,879.20. The broad-based S&P 500 gained 0.3 per cent to 3,961.85, while the tech-rich Nasdaq Composite Index dropped 0.3 per cent to 10,989.66. The early increases on the Dow and S&P 500 were a reversal from Monday’s losses, when worries about China Covid-19 restrictions weighed on sentiment.

SG

Media entertainment company NoonTalk debuted on the Singapore Exchange (SGX) Catalist board at S$0.225, 2.3 per cent above its initial public offering (IPO) price of S$0.22, before closing at its IPO price on Tuesday (Nov 22). This gives the stock a market capitalisation of S$43.6 million. The counter trades at 1,946 times its FY22 net profit of S$22,407. The company had earlier sold 22 million new shares, comprising 4.5 million public offer shares and 17.5 million placement shares. The offering raised gross proceeds of S$4.8 million, or S$3.3 million in net proceeds. The company said it will devote 47.1 per cent of gross proceeds from the IPO to extending its regional footprint in existing business verticals, while 10 per cent would go into multimedia technology investment and another 10 per cent would go towards working capital. The balance will be used for listing expenses. NoonTalk also intends to pay out 20 per cent of net profit after tax attributable to shareholders in FY23 and FY24.

Singapore-listed Yangzijiang Financial will partner Temasek-backed Heliconia Capital to invest in Singaporean and South-east Asian small and medium-sized enterprises (SMEs), through a fund with a target size of up to S$150 million. Yangzijiang Financial will contribute S$80 million to the Heliconia Generation Fund Limited Partnership, as the anchor limited partner, it said in a Tuesday (Nov 22) bourse filing. Investments may be structured in the form of equity, debt and/or hybrid debt-equity structures, it added. The fund intends to invest in promising SMEs with a focus on Singapore and Vietnam to catalyse more capital for them, co-investing alongside other funds managed by Heliconia such as the SME Co-Investment funds. “Heliconia focuses on investing in growth-oriented SMEs. Some criteria used in identifying its investments include a strong market position, sustainable competitive advantage, competent management, and the potential to be a significant player regionally or globally,” Yangzijiang Financial said. Shares of Yangzijiang Financial closed at S$0.34 on Tuesday, down S$0.005 or 1.5 per cent, before the announcement.

LMS Compliance, a provider of testing and certification services, on Tuesday (Nov 22) launched its initial public offering (IPO) for a Catalist listing on the Singapore Exchange (SGX). The company is looking to raise gross proceeds of S$3.64 million through the sale of 14 million shares at S$0.26 apiece. Net proceeds will amount to S$2.04 million. More than half these proceeds, or S$1.2 million, will be set aside for acquisitions, joint ventures and strategic alliances in countries such as Malaysia, Indonesia and China to grow the company’s business. Another S$0.54 million has been set aside for general working capital purposes, while the remaining S$0.3 million is earmarked for the expansion of two of the company’s business segments: the certification services segment and the conformity assessment technology distribution segment. Based on the issue price, LMS Compliance will have a market capitalisation of S$22.7 million at listing and a price-to-earnings ratio of 12.4 times. LMS Compliance was founded in 2006, and provides testing and certification services to industries such as food, fertiliser, pharmaceuticals and medical devices, and healthcare. While LMS Compliance does not yet have a fixed dividend policy, its directors intend to recommend and distribute dividends of at least 20 per cent of earnings for FY2022 to FY2024. The offer will close at noon on Nov 29, with the listing and trading of LMS Compliance’s shares expected to commence at market open on Dec 1.

US

New York-listed digital customer solutions provider TDCX on Tuesday (Nov 22) reported earnings of US$21.6 million for the third fiscal quarter ended September, up 2.3 per cent from earnings of US$21.1 million in the corresponding year-ago period. The stronger bottom line figures were chiefly due to a 16.1 per cent increase in revenue to US$120.5 million from US$103.8 million. The group attributed this to a 13 per cent rise in contributions from the provision of omnichannel Customer Experience (CX) solutions to US$70.4 million, as well as a 32.2 per cent jump in revenue from providing sales and digital marketing services to US$29.8 million. For CX solutions, the group added that business volumes of its key travel and hospitality clients continued to gain recovery momentum following the reopening of borders during the first half of the year. Revenue from the content, trust and safety services segment increased 6.4 per cent to US$19.6 million, while revenue from other service fees was up 38.5 per cent at US$0.7 million. TDCX said revenue contributions from new economy clients stood at 93 per cent for the first nine months of the year. The company said it had also signed 31 new logos so far this year, versus 20 logos in the year-ago period. On the expenses front, TDCX booked a 29.7 per cent increase in employee benefits expenses to US$78.3 million on the back of a higher employee count, employee wage adjustments and cost of living inflation, as well as the share-based payment expense arising from the implementation of the company’s performance share plan in November last year. The group said its average employee count in Q3 was up 24.5 per cent year on year, as a result of business volumes expansion of current campaigns and staffing requirements of new campaign launches in the first half of the year. TDCX also reiterated its full-year outlook, but narrowed the range of certain targets. The company’s revenue range for 2022 has been revised to between S$655 million and S$670 million, from the previous range of S$650 million to S$675 million. The mid-point, however, remains unchanged at S$662.5 million. For revenue growth on a year-on-year basis, TDCX has narrowed its target range to between 18 per cent and 20.7 per cent, from a range of 17.1 per cent to 21.6 per cent previously. The mid-point stays unchanged at 19.3 per cent. The group’s adjusted Ebitda (earnings before interest, taxes, depreciation and amortisation) margin target is unchanged at 30 per cent to 32 per cent. Shares of TDCX closed at US$11.49 on the New York Stock Exchange on Monday, down 1.7 per cent or US$0.20.

Computer maker HP Inc said Tuesday that it plans to cut 4,000 to 6,000 employees over the next three years. Shares rose as much as 1% in extended trading following the announcement. HP is the latest technology company to announce its intent to slim down given economic challenges. Facebook parent Meta, Microsoft and Salesforce are among those that have made similar changes. HP is responding after a deterioration in the sales of computers, which followed brought on by the Covid pandemic, where people rushed to buy computers to work and play from their homes. In a statement, HP said its “Future Ready Transformation plan” should result in annualized gross run rate savings of $1.4 billion or more in the next three years, with around $1 billion in costs including restructuring. Of that $1 billion, $600 million will come in the fiscal 2023 fiscal year, which ends Oct. 31, 2023. The rest will be split evenly between the 2024 and 2025 fiscal years, HP said. As of October 2021, HP had around 51,000 employees. In 2019 HP announced that it would eliminate between 7,000 and 9,000 employees. HP said revenue in the fiscal fourth quarter, which ended on Oct. 31, declined 0.8% year over year to $14.80 billion. Revenue in the Personal Systems segment, which includes PCs, fell 13% to $10.3 billion, as units dropped 21%. Consumer revenue in the segment slid 25%. Printing revenue, at $4.5 billion, was down 7%, as units fell 3%. In the previous quarter, Personal Systems revenue declined 3%, and Printing revenue moved down 6%. From a profitability standpoint, HP reported that the operating margin for the Personal Systems segment contracted to 4.5% from 6.9% in the prior quarter. Also on Tuesday HP announced downbeat earnings guidance. The company provided a range of adjusted fiscal first quarter earnings from 70 cents to 80 cents per share, below the consensus of 86 cents among analysts polled by Refinitiv. For the 2023 fiscal year, HP called for $3.20 to $3.60 in adjusted earnings per share, below the Refinitiv consensus of $3.62 per share.

The US dollar retreated on Tuesday (Nov 22) after rallying the previous day when investors rushed to the safe-haven currency on worries about China’s Covid flare-ups, while fears of fresh contagion from the collapse of crypto exchange FTX pressured bitcoin. The euro was up 0.3 per cent at US$1.0265 after an 0.8 per cent loss on Monday, sterling rose 0.46 per cent to US$1.187, partially reversing its 0.6 per cent fall, and the US dollar was at 141.86 yen, down 0.6 per cent after a 1.2 per cent gain. Flows to the US dollar on Monday came as Beijing warned that it was facing its most severe test of the Covid-19 pandemic, with a surge in Covid cases sparking fresh restriction measures. Deaths from the virus were also recorded in the capital for the first time since May. Restrictions in Beijing and elsewhere tightened further on Tuesday, though currency traders seemed to think the previous day’s moves were sufficient.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Sembcorp Industries – Equity fundraising ruled out

Recommendation: BUY (Maintained), Last Done: S$3.05

Target price: S$3.68, Analyst: Terence Chua

– Sembcorp Industries (SCI) announced the acquisition of 830MW of renewable assets in China through a joint venture with State Power Investment Corporation (SPIC).

– The acquisition of BEI Energy and Vector Green will be accretive to earnings and diversifies the Group’s presence from north western China.

– Management ruled out equity funding to finance spate of acquisitions. We believe the latest clarification will allay concerns over an equity call.

– We maintain BUY with unchanged target price of $3.68. Our earnings are unchanged while our target price is maintained at $3.68, still based on 1.2x P/BV, the average of its peers.

Trade of The Day – Technical Pulse: ASML Holding N.V.

Analyst: Zane Aw

(Current Price: US$596.21) – TECHNICAL BUY

Buy price: US$596.21 Stop loss: US$568.00 Take profit: US$700.00

The price formed a bullish consolidation pennant following a breakout of the long-term downtrend channel. We are likely to see follow through of the bullish momentum to drive the stock price higher to retest the next key horizontal resistance level at US$700.

Uni-Asia Group Ltd – Locked in attractive freight rates

Recommendation: BUY (Maintained); TP S$1.26, Last close: S$0.79; Analyst Paul Chew

– The average charter rate in 3Q22 for Uni-Asia was US$19,609/day, an increase of 37% YoY. We believe the jump in freight rates will drive similar growth rates for charter income. Charter income is around 85% of FY22e total revenue.

– Improvement in Hong Kong property projects in terms of units sold and construction progress.

– We are maintaining our FY22e forecast. Despite the Baltic Exchange Handysize index declining 45% YoY in 3Q22, Uni-Asia has locked in attractive freight rates. Our FY23e PATMI is lowered by 13% to US$19.2mn. Unless freight rates recover in 1Q23, there is a risk the next renewal cycle will be a major drag to revenue. We maintain our BUY recommendation and target price of S$1.26. The target price is pegged to 3x P/E FY22e, in line with industry peers. The soft economic conditions in China have led to softer demand for bulk commodities. Nevertheless, supporting longer-term freight rates will be the 30-year low in new dry bulk vessels of only 7% of fleet capacity.

Upcoming Webinars

Guest Presentation by NIO [NEW]

Date: 23 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3hLLptJ

Guest Presentation by KTMG Limited [NEW]

Date: 24 November 2022

Time: 1pm – 2pm

Register: https://bit.ly/3TGIgbC

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by Sabana Industrial REIT [NEW]

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by iWoW Technology [NEW]

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: Sea Ltd, Silverlake Axis, Q&M Dental, ComfortDelgro, APTT, Tech Analysis…

Date: 21 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials