DAILY MORNING NOTE | 23 September 2022

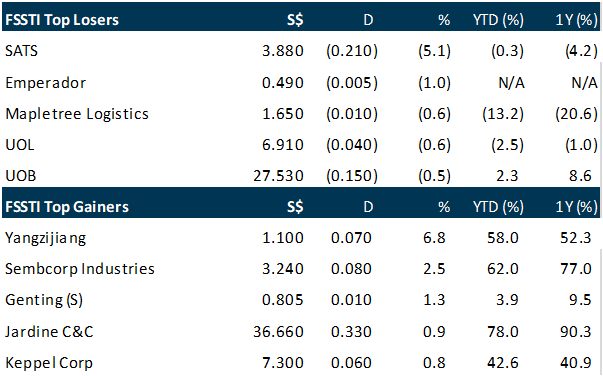

Asian markets were mostly lower on Thursday (Sep 22) after the Federal Reserve’s September meeting. That’s not only because the US central bank raised interest rates by 75 basis points (bp), which was a move widely expected by the market. Traders were caught off-guard by indications that more rate hikes were coming as the Fed combats soaring inflation. Regional bourses closed in the red. In mainland China, the Shenzhen bourse fell 0.8 per cent, while the Shanghai Composite Index declined 0.3 per cent. In Hong Kong, the Hang Seng Index lost 1.6 per cent. Meanwhile, Japan’s Nikkei 225 lost 0.6 per cent and South Korea’s Kospi fell by as much. Singapore’s Straits Times Index (STI), however, bucked the trend, closing flat with slight gains of 0.04 per cent. The index rose 1.28 points to 3,263.07. Losers slightly outnumbered gainers 257 to 230, with about 1 billion securities worth S$1.09 billion changing hands. Among STI constituents, Sats emerged as the top decliner, falling 5.1 per cent or S$0.21 to S$3.88, after announcing that it was in discussions to acquire air cargo handler Worldwide Flight Services. However, no definitive terms or formal legal documentation, including the purchase consideration, have been agreed upon. The day’s top performer was Yangzijiang Shipbuilding. Its shares soared, rising 6.8 per cent or S$0.07 to S$1.10. In the broader market, First Real Estate Investment Trust fell 1.8 per cent or S$0.005 to S$0.27, after it announced that it has agreed to buy 2 nursing homes in Japan for 2.6 billion yen (S$26.3 million) as part of its expansion in a key growth market.

Wall Street stocks fell again on Thursday amid growing recession fears as more central banks raised interest rates and following the Federal Reserve’s latest aggressive move to counter surging inflation. The Bank of England on Thursday announced its second consecutive half-point rate increase and warned the British economy was slipping into recession. Others to tighten the screws include the European, Swiss and Norwegian central banks. Losses on New York followed drops of nearly 2 per cent Wednesday after the Fed announcement of another super-sized rate hike, and came on the heels of declines earlier Thursday in most overseas bourses. The tech-rich Nasdaq Composite Index led the major indices lower, falling 1.4 per cent to 11,066.81. The Dow Jones Industrial Average shed 0.4 per cent to 30,076.68, while the broad-based S&P 500 declined 0.8 per cent to 3,757.99. Among individual companies, Tesla shares fell 4.1 per cent as it recalled 1.1 million vehicles due to a defect with the automatic window system that poses risks of pinching a driver’s finger. Target dropped 3.8 per cent after the big-box retailer announced plans to hire up to 100,000 seasonal workers and begin holiday promotions in early October. FedEx climbed 0.8 per cent as it announced plans to cut up to US$2.7 billion in spending in the wake of a slowdown in demand.

SG

SATS shares dropped to a 2.5-month low on Thursday (Sep 22) morning, after the in-flight caterer and ground handler disclosed on Wednesday that it is in talks to acquire air cargo handler Worldwide Flight Services. The counter dropped to a low of S$3.87 as at 10.33 am on the day, down 5.1 per cent or S$0.21 with 4.8 million shares changing hands. The last time the counter closed near this level was on Jul 5. SATS shares were down 5.1 per cent to S$3.88 at market close. But the deal, Citi analysts said, could be “strategically correct” to SATS, given the limited overlap in the geographies they serve, which would pave the way for the Singapore-listed player to scale up. In the note, Citi analysts said SATS’ potential target, which operates in more than 160 major airports in over 20 countries in North America and Europe, has limited geographical overlap with the Singapore player, which has an Asia-Pacific focus. Also, the analysts noted that the move would create the world’s third-largest ground handler based on their total number of stations. The bond rating, Citi analysts wrote, of Worldwide Flight Services of B/B3 may improve if the market sees SATS’ major shareholder and Singapore state investor Temasek as an implicit guarantor. Already, the bond prices have jumped, noted the analysts. On the structure it could take, they said, could be a share swap into a merged entity. This is because SATS had about US$1.3 billion in equity with about US$178 million in net cash, excluding lease liability, as of Jun 22. Even if the company could take on US$2.6 billion in borrowing, or a gearing ratio of 2, the borrowed amount is still lower than Worldwide Flight Services’ US$3 billion price tag. While the report by Citi has stated a target price of S$4.70 with a “buy” recommendation on SATS, the analysts qualified that these are subject to the structure, potential earnings, synergy contributions, valuation and dilution risks of the deal, should it proceed.

GIC has bought a majority stake in Mediterranean luxury beach resort Sani/Ikos Group (SIG), valuing the company at 2.3 billion euros (S$3.2 billion), the companies said in a joint statement on Thursday (Sep 22). The Singapore sovereign wealth fund has bought a stake held by investors that include Oaktree Capital Management, Goldman Sachs Asset Management and UK-based Hermes GPE. This partnership will help the resort group to deliver on its 5-year investment plan of over 900 million euros and create jobs in the Mediterranean, the joint statement said. The deal is expected to close in the fourth quarter of 2022. Morgan Stanley acted as a financial adviser.

Daiwa House Logistics Trust (DHLT) is proposing to acquire a portfolio of 2 logistics facilities and a piece of freehold land in Japan for a total consideration of 4.68 billion yen or S$47.7 million. In a filing late on Wednesday (Sep 21), the real estate investment trust (Reit) manager estimates this to represent an 11.8 per cent discount to the properties’ average appraised value. It intends to finance the acquisition through a combination of bank borrowings as well as a proposed sponsor subscription of units in DHLT amounting to 1.25 billion yen. The subscription’s minimum issue price of S$0.77 per unit represents a premium of 14.9 per cent to DHLT’s closing price as at Sep 20, 2022. As the Reit’s maiden acquisition, it is expected to lift DHLT’s distribution per unit (DPU) by about 1.3 per cent on a pro-forma basis from the time of its Nov 26, 2021 listing up until Jun 30, 2022. This is assuming that both the proposed acquisition and sponsor subscription will be completed on Dec 2, 2022. Both free logistics facilities in the target portfolio – DPL Iwakuni 1 & 2 and D Project Matsuyama S – are 100 per cent occupied as of end-June 2022 and count listed companies among their tenants. DPL Iwakuni 1 & 2 is a multi-tenanted logistics facility developed to specifications including ceiling heights of up to 8 m and floor loads of up to 2.5 tonnes per square metre, while D Project Matsuyama S was built to cater to the specific needs of its tenant, including temperature-controlled facilities for frozen or chilled foodstuff storage. The freehold land parcel, D Project Iruma S Land, is an existing property in the portfolio of DHLT where the Reit presently owns a leasehold interest. Acquiring the land will better preserve its value by avoiding a gradual decline in the valuation due to the shortening of its land lease term, said the manager. It added that the overall value of this property will also be enhanced as freehold properties are generally valued based on a tighter cap rate compared to leasehold properties. The target portfolio collectively spans a land area of about 420,393 square metres (sq m), an overall occupancy rate of 98.6 per cent, and a weighted average lease expiry (WALE) by net lettable area (NLA) of 6.8 years as at end-June 2022. The acquisition is expected to bring DHLT’s enlarged portfolio to a total NLA of 444,728 sq m, total land area of 458,910 sq m, an overall occupancy rate of 98.6 per cent and a WALE by NLA of 6.7 years on a pro-forma basis. It will also bring the proportion of freehold properties in DHLT’s enlarged portfolio to 54 per cent from 48.3 per cent; and raise the proportion of properties on freehold land and land with leases exceeding 40 years to 88.8 per cent from the current 84.8 per cent. The Reit manager believes enlarging its portfolio with this acquisition will broaden DHLT’s earnings base and diversify its portfolio across various regions in Japan to mitigate potential concentration risk, as well as potential impacts to the portfolio from earthquakes. DHLT ended Wednesday unchanged at S$0.67 before the announcement was made.

US

U.S. government bond yields surged Thursday, after foreign governments and central banks rushed to raise interest rates or otherwise support local currencies pressured by the dollar’s strongest rally in a generation. U.S. yields were largely stable overnight after the Federal Reserve raised short-term rates by 0.75 percentage point for the third consecutive meeting and said more large rate increases are likely as the central bank seeks to quell inflation. But long-term U.S. yields began a sharp ascent shortly before the start of U.S. stock trading Thursday, responding at least in part to several central banks raising rates and Japan, the world’s third-largest economy, intervening in the foreign exchange market to sell dollars and buy yen for the first since 1998. The moves unnerved investors, who are already contending with the sharp decline in U.S. stock indexes this year and expectations that the Fed’s rate-tightening campaign will inevitably lead to a significant economic slowdown. As central banks one-up each other, raising rates and taking other aggressive actions, it is generating a high degree of uncertainty about what they will do next, said Jim Caron, senior portfolio manager and chief strategist of global fixed income at Morgan Stanley Investment Management. Selling of U.S. government bonds sent the yield on the benchmark 10-year U.S. Treasury note to 3.705% from 3.511% Wednesday, according to Tradeweb. That marked its biggest one-day gain since June 13 and highest close since February 2011. Yields rise when prices fall. U.S. Treasury yields play a critical role in the global economy, setting a floor on borrowing costs for U.S. consumers and business and establishing a benchmark forward-looking return against which other assets are measured. A historically large climb in yields this year—driven by stubbornly high inflation and escalating expectations for how high the Fed will raise interest rates—has already sent mortgage rates soaring. It also has punished stocks, causing investors to mark down the value of expected corporate profits because they can now get a substantial return by just buying and holding Treasurys. Thursday’s big jump in yields stands to exacerbate those trends, while highlighting the unpredictable fallout of the current inflationary environment. Analysts said they couldn’t definitely pin Thursday’s move on one particular event. Still, many said it could be broadly explained by how the Fed’s aggressive interest-rate increases are strengthening the U.S. dollar by encouraging global investors to pull money out of other markets to invest in higher-yielding U.S. assets. That trend in turn is putting extra pressure on other countries to defend their currencies as they also fight inflation, and contributing to a race to lift rates around the world. On Thursday, central banks from Norway to South Africa raised interest rates by larger-than-expected increments. The Bank of England eschewed a 0.75-percentage-point increase in favor of a more conservative half-percentage point but moved ahead with plans to sell its portfolio of U.K. government bonds, contributing to a large increase in U.K. government bond yields. Of particular concern to U.S. investors was the Japanese government’s intervention to support the yen. That move led to speculation on Wall Street that the government might be selling Treasurys to raise the dollars it needed to buy its home currency. Some analysts expressed skepticism about that scenario, noting that the Japanese government is believed to have large holdings of U.S. cash and cash-equivalents, reducing the need to sell longer-term Treasurys. For his part, Japanese Finance Minister Shunichi Suzuki declined to comment about the specifics of the intervention, including how many yen Japan bought for dollars and what types of dollar-denominated assets it sold. More broadly, some analysts said investors have reason to worry about demand for Treasurys from foreign investors now that U.S. bonds are no longer an outlier in the developed world offering positive returns.

Tesla Inc. is recalling almost 1.1 million of its electric vehicles over concerns that a closing window could pinch a passenger before it retracts. The recall applies to certain of its Model 3 vehicles for 2017-22 along with Model Ys for 2020-21 and Model S and Model X vehicles for 2021-22, the National Highway Traffic Safety Administration said. The company is going to perform over-the-air software updates for the vehicles to fix the problem. The NHTSA said letters will be mailed to owners Nov. 15. The company isn’t aware of any crashes, injuries or deaths associated with the issue, it said in a safety recall report. Tesla shares fell more than 3% on Thursday. The stock has lost nearly a fifth of its value so far this year. Tesla has had other recalls this year. In May, the company recalled roughly 130,000 vehicles over issues with the vehicles’ central processing units, according to the NHTSA. Issues with the unit could prevent the center screen from displaying certain attributes. In April, the company recalled almost 600,000 vehicles over concerns that the vehicles’ pedestrian warning system sounds could be obscured. The company had planned to release over-the-air software updates to handle both of those issues as well.

FedEx Corp. said it plans to raise shipping rates by an average of 6.9% across most of its services starting in January as the delivery giant copes with a global slowdown in business. The rate increase is higher than previous years and comes days after the company slashed its profit and sales forecasts. FedEx and rival United Parcel Services Inc. raised shipping rates by an average of 5.9% for 2022—the first time in eight years that either had strayed above 4.9%. Inflation in the U.S. has been hovering near four-decade highs. Energy prices have declined in recent weeks, though they are still above year-ago levels. FedEx offsets some of those costs with fuel surcharges. The company is raising rates as it and other carriers are suddenly stuck with excess capacity. Ocean freight rates have plunged during what is typically the industry’s peak season after cargo owners shipped holiday goods early and inflation dented consumer demand. The average number of packages FedEx handled daily in the quarter ended Aug. 31 fell 11% from the prior year. Increases in fees such as fuel surcharges helped boost FedEx’s revenue despite the decline in volumes. However, operating expenses weighed on the company’s profit margins. FedEx’s rate move was announced Thursday as part of its first-quarter earnings report, which showed profit fell 20% from a year earlier and that it was planning additional cost cuts. The company said it expects to generate between $2.2 billion and $2.7 billion in savings this fiscal year from a plan announced last week to park aircraft, suspend Sunday deliveries and close some offices. It also plans to wring an additional $4 billion in annual costs from its operations over the next two years. FedEx’s results were released before market close on Thursday, about 90 minutes ahead of schedule, which a company spokeswoman said was the result of a technical glitch. Shares in FedEx closed trading up less than 1%. FedEx said Thursday it expects to save this fiscal year between $1.5 billion and $1.7 billion in its Express business by reducing flight frequencies and parking aircraft. It expects to save up to $500 million in its Ground business from closing sorting operations and stopping some Sunday deliveries. It expects to cut up to $500 million from overhead, such as closing FedEx Office and corporate office locations.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Upcoming Webinars

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Guest Presentation by MeGroup Ltd [NEW]

Date: 5 October 2022

Time: 12pm – 1pm

Register: https://bit.ly/3RSOTXY

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Research Videos

Weekly Market Outlook: Prime US REIT, Frasers Centrepoint Trust, Sembcorp Industries, SG Weekly…..

Date: 19 September 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials