DAILY MORNING NOTE | 24 August 2022

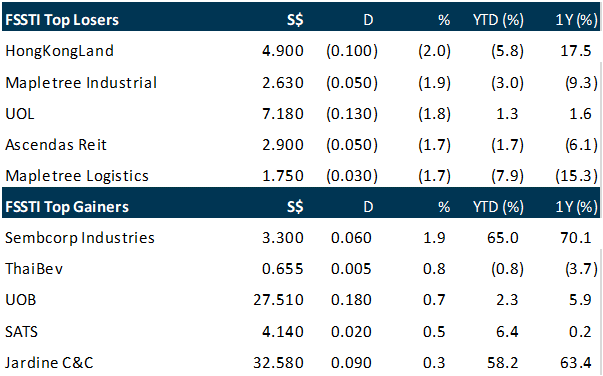

The Singapore market closed with a smaller dent on Tuesday (Aug 23) despite an upside surprise to the country’s inflation figures. Core inflation rose at a faster-than-expected pace to hit a new high of 4.8 per cent in July, latest consumer price index (CPI) figures showed. After the data’s release at 1 pm, the Straits Times Index (STI) deepened the day’s losses to hit a 5-day low of 3,224.98 at around 2.25 pm. But the market took a sharp turn afterwards and recouped much of the losses, ending 0.5 per cent or 16.36 points lower at 3,246.21. Among STI constituents, the biggest losers of the day were Hongkong Land, which slid 2 per cent to US$4.90, and Mapletree Industrial Trust, which fell 1.9 per cent to S$2.63. OCBC extended Monday’s losses and closed 0.7 per cent lower, while the other 2 local banks added to the previous day’s gains. UOB rose 0.7 per cent, while DBS ended 0.03 per cent higher. Sembcorp Industries gained the most, climbing 1.9 per cent or S$0.06 to S$3.30. In the broader market, losers outnumbered gainers 257 to 222, with 1.57 billion securities worth S$1.34 billion changing hands. Sembcorp Marine was the most actively traded counter by volume. The counter closed up 3.6 per cent at S$0.115, after 234.8 million shares worth S$26.5 million were traded.

The Dow slipped Tuesday, as data showing fresh signs of a slowing economy soured sentiment and overshadowed mostly positive quarterly results from retailers. The Dow Jones Industrial Average slipped 0.5% to finish at 32,909.60, Nasdaq was flat to close 12,381.30 while the S&P 500 slipped 0.3% to 4,128.72. Treasury yields paused their recent ascent following the data, supporting a recovery in tech, with chip stocks in particular tacking on gains. ON Semiconductor, Wolfspeed and NVIDIA led the move higher in the broader chip sector amid signs of improving sentiment in demand. A surge in energy stocks helped the broader market steady as oil prices climbed more than 3% after Saudi Arabia touted the prospect of production cuts by major oil producers to boost prices.

SG

Pharmaceutical company iX Biopharma posted an S$8.3 million loss for the second half of the fiscal year ended June 2022, sinking deeper into the red from a S$5.4 million loss in H2 FY2021. This came as the group recorded a negative fair value adjustment of S$3.1 million from its shares in Nasdaq-listed Seelos Therapeutics, which the group received during H1 to partially satisfy a US$9 million upfront fee under its Wafermine out-licensing agreement. The depreciation of the Australian dollar against the Singapore dollar further dragged on the group’s bottom line, contributing to a wider S$710,000 in currency exchange net losses compared to the previous year’s S$359,000 loss. Loss per share (LPS) for H2 FY2022 stood at 1.1 Singapore cents as opposed to 0.77 cent a year ago, resulting in a full-year LPS of 0.62 cent as opposed to FY2021’s LPS of 1.19 cents. Shares of Catalist-listed iX Biopharma ended Tuesday S$0.004 or 2.4 per cent higher at S$0.168.

Technology provider Trek 2000 maintains that it is uninvolved in legal charges against the company’s founder as well as former chairman emeritus and chief executive Henn Tan, as the matter is “in his personal capacity”. Responding to an Aug 15 article from The Business Times, the group said there was no financial impact to the company from these charges – and that the financial position of the company “continues to be healthy”. Based on Trek’s financial statements for the first half of the fiscal year ended June 2022, the group sank into a net loss of US$6.4 million from its earnings of US$504,000 the previous year. Revenue fell 64.2 per cent to US$7.4 million from US$20.7 million in H2 FY2021, which the group attributed mainly to the Covid-19 lockdown in China – its main market – along with volatility in foreign exchange rates. Gross profit margin for the half year decreased to 4 per cent from 7.5 per cent, due to lower sales demand faced in the global market. In a bourse filing on Tuesday (Aug 23), Trek said it remains unaware of any financial misappropriation from the charges faced by Tan, who earlier this month pleaded guilty to 5 charges of engaging in conspiracies to falsify accounts, forge documents to cover his tracks as well as cheat the external auditors. The company highlighted that its board has “taken decisive steps to identify the lapses in internal controls and governance systems” since the charges first came to light in 2016. Mainboard-listed Trek ended Tuesday unchanged at S$0.081 after the latest announcement was made.

As Singapore’s core inflation rose to a 13-year high of 4.8 per cent in July, official expectations for when price increases will start to ease have been pushed back later in 2022, even as full-year forecast ranges were left unchanged. The July figure was a hair above economists’ expectations of 4.7 per cent in a Bloomberg poll, and up from 4.4 per cent in June, according to Department of Statistics consumer price index (CPI) figures on Tuesday (Aug 23). Headline inflation – which includes accommodation and private transport costs – was in line with economists’ expectations at 7 per cent, up from 6.7 per cent in June and representing another multi-year high. The Monetary Authority of Singapore (MAS) and Ministry of Trade and Industry (MTI) said in a joint statement that core inflation is now “projected to stay elevated over the next few months, before it begins to ease towards the end of the year” – in contrast to last month’s report, where they expected it to “peak in Q3”. But they maintained their full-year forecast ranges of 3 to 4 per cent for core inflation and 5 to 6 per cent for headline inflation, having just raised these in July.

US

Google is strengthening its investments in Singapore – with the launch of its third data centre and an enhanced skills training programme – while its cloud business will work with the government to co-create Artificial Intelligence (AI) solutions in a public-private partnership. The tech giant unveiled these efforts at the Google for Singapore event on Tuesday (Aug 23), which marked its 15th anniversary operating in the city-state, as well as Google Cloud’s fifth year here. At Tuesday’s event, Google announced that its third data centre facility in Singapore, the construction of which it announced in 2018, has been completed and is in operation. This brings the company’s long-term investments in Singapore data centres to US$850 million. Separately, Google Cloud on Tuesday signed a memorandum of understanding with the Smart Nation and Digital Government Group (SNDGG) to co-create AI solutions in key sectors like finance, sustainability and healthcare. Other areas of the partnership include deepening the public service’s AI capabilities and supporting the government’s efforts to shape AI governance and ethics in sectors such as finance. This is the Singapore National AI Office’s first public-private AI partnership with a global tech company.

Luxury EV maker Polestar will provide battery and charging systems to electric boat firm Candela after the two Swedish companies signed a multi-year agreement. In a statement Tuesday, Polestar said the deal represented the beginning of a “broader intended partnership” between itself and Candela. Both businesses, it said, were “committed to exploring further opportunities for future collaboration.” In its own announcement, Candela – which has offices in Stockholm and Sausalito, California said the agreement would enable it to “tap into state-of-the-art automotive battery technology and scale up production” of its electric boats. Candela said the deal with Polestar reflected an attempt to overcome hurdles related to the electrification of boating. These included what it called the “prohibitively high cost of marine batteries for electric boats.” It added that electric boatbuilders had, to date, typically “relied on smaller, boutique vendors of marine battery packs. Scarcity and high unit costs of these packs are two factors that have prevented electric boats from achieving parity with ICE vessels.” By tying up with Polestar and tapping into its resources – Polestar’s founders are Volvo Cars and China’s Geely Holding – the hope is that this challenge can be overcome.

Video-calling software maker Zoom Video Communications pared back its full-year forecast for earnings and revenue. Zoom’s revenue in the second fiscal quarter grew 8% year over year, slowing from 12% growth in the prior quarter, according to a statement. The second fiscal quarter ended on July 31. Zoom’s net income fell to $45.7 million in the quarter from $316.9 million in the year-ago quarter as the company increased spending on sales and marketing. The strong U.S. dollar, performance in the company’s online business and sales that got weighted toward the end of the quarter negatively impacted revenue in the quarter, Kelly Steckelberg, Zoom’s finance chief, said in the statement. With respect to guidance, Zoom called for adjusted fiscal third quarter earnings of 82 cents per share to 83 cents per share on $1.095 billion to $1.100 billion in revenue. Analysts polled by Refinitiv had been looking for 91 cents in adjusted earnings per share and $1.15 billion in revenue. Management lowered its projections for the full 2023 fiscal year, calling for $3.66 to $3.69 in adjusted earnings per share and $4.385 billion to $4.395 billion in revenue, implying 7% growth at the middle of the revenue range. Analysts whom Refinitiv surveyed had expected $3.76 per share in adjusted earnings and revenue of $4.54 billion.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Technical Pulse: Home Depot Inc.

Analyst: Zane Aw

Recommendation: Technical BUY

Buy limit: 310.60 Stop loss: 292.00 Take profit 1: 350.00 Take profit 2: 375.00

Home Depot Inc. (NYSE: HD) A retest of the immediate support at 303.00-318.00 is possible before price edges higher.

Upcoming Webinars

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Guest Presentation by Unity [NEW]

Date: 25 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3w9ssW7

Guest Presentation by Marathon Digital Holdings

Date: 26 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by Halcyon Agri Corporation Limited [NEW]

Date: 31 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3pjErMM

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Research Videos

Weekly Market Outlook: Sea Ltd, SGX, Ascott Residence Trust, First REIT, SembCorp, Q&M & More

Date: 22 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials