DAILY MORNING NOTE | 24 February 2023

Trade of the Day

Las Vegas Sands Corp (NYSE: LVS)

Analyst: Zane Aw

(Current Price: US$57.35) – TECHNICAL BUY

Buy price: US$57.35 Stop loss: US$55.40

Take profit 1: US$60.30 Take profit 2: US$66.60

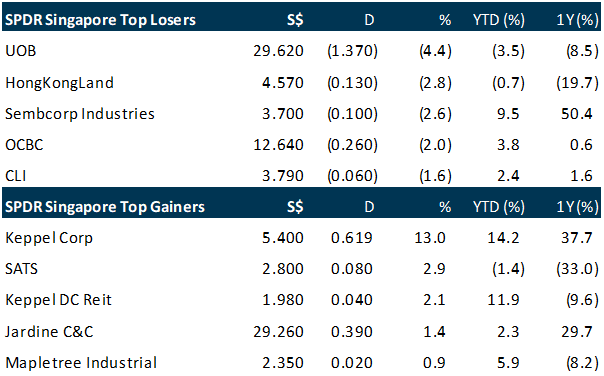

Singapore stocks fell amid a mixed regional performance on Thursday (Feb 23) as the Straits Times Index (STI) shed 1.1 per cent or 35.11 points to 3,264.93. Across the broader market, gainers beat losers 276 to 249 after 1.6 billion securities worth S$1.4 billion changed hands. Asian markets were mixed on Thursday. Hong Kong’s Hang Seng Index shed 0.4 per cent, while Japan’s Nikkei 225 fell 1.3 per cent and South Korea’s Kospi gained 0.9 per cent.

The S&P 500 snapped a four-day losing streak on Thursday, finishing higher along with other major indices following a rollercoaster session. Lifted by solid earnings from chip company Nvidia, tech shares led the market in early trading. But stocks swooned in the middle of the day before recovering. Equities have been under pressure this week amid worries that the Federal Reserve will prolong a period of aggressive interest rate hikes. But the yield on the 10-year US Treasury note edged lower after flirting with four per cent. The Dow Jones Industrial Average finished 0.3 per cent higher at 33,153.91. The broad-based S&P 5000 climbed 0.5 per cent to 4,012.32, while the tech-rich Nasdaq Composite Index jumped 0.7 per cent to 11,590.40.

Stocks to watch: OCBC

SG

OCBC’s 4Q2022 results were lower than expectations with net profit of S$1.31bn vs our estimate of S$2.03bn. This was mainly due to net interest income growth of 34% YoY (S$2.39bn), NIM growth of 79bps YoY to 2.31% and loans growth of 2% YoY (S$295bnn) offset by non-interest income dipping 42% YoY (S$615mn). 4Q22 dividend is up 43% YoY to 40 cents, total FY22 dividend at 68 cents (+28% YoY). More details to follow after the 9.30am analyst call.

Despite turning in a weaker financial performance for the six months ended Dec 31, 2022, CapitaLand Investment (CLI) remains “cautiously optimistic” about the coming year, especially with China’s reopening. The property giant reported a net profit of S$428 million in H2 2022 – a 33.8 per cent drop from the S$647 million chalked up the year before – largely due to lower gains from the revaluation of investment properties and asset recycling. Its bottom line also took a hit from foreign exchange losses amounting to S$85 million, a consequence of a stronger Singapore dollar.

Yangzijiang Shipbuilding on Thursday (Feb 23) reported a 30 per cent fall in net profit to 1.4 billion yuan (S$272.3 million) for the second half ended Dec 31, 2022, from 2.1 billion yuan the previous year. This came after the spin-off and listing of Yangzijiang Financial Holding in April last year, resulting in the absence of some 973.1 million yuan in profit from discontinued operations. On a continuing-operations basis, profit for H2 rose 33 per cent from the base of 1.1 billion yuan in H2 FY2021. Earnings per share for the second half stood at 36.51 fen, up from 27.9 fen previously. The company’s revenue for H2 increased 17 per cent year on year to 11 billion yuan, from 9.4 billion yuan.

Recruiting and consulting company HRnetGroup posted an 11.4 per cent rise in net profit to S$32.9 million in the six months ended Dec 31, 2022, up from S$29.6 million the year before. This was mainly due to lower employee benefit expenses, which fell 8.3 per cent to S$42.3 million during the second half (H2) of FY2022. Earnings per share for the period stood at 3.30 Singapore cents per share, up from 2.95 cents per share in the same period of 2021. Revenue for H2 2022 fell 5.7 per cent to S$297.6 million, down from S$315.4 million previously, after HRnetGroup’s flexible staffing and professional recruitment business segments both registered decreased topline earnings from year-ago periods.

Mainboard-listed Haw Par Corporation reported a 24.5 per cent rise in net profit to S$71.1 million for the six months ended Dec 31, 2022, from S$57.1 million in the previous corresponding period. Earnings per share improved to S$0.321 from S$0.258. Revenue in the period rose 14.9 per cent to S$86.6 million, from S$75.3 million. The group, which engages in investments and leisure activities, among others, attributed the improved performance to an increase in consumer spending on health products as global economies recover from the pandemic.

EC World Real Estate Investment Trust’s distribution per unit (DPU) declined 59.1 per cent to 0.628 Singapore cents for the fourth quarter ended Dec 31, 2022, from 1.537 cents for the corresponding period in 2021. Gross revenue of the China-focused e-commerce logistics landlord was down 11 per cent to S$28.4 million for the quarter, from S$31.9 million in the year-ago period. After straight-lining of step-up rental, security deposit accretion and other relevant distribution adjustments, EC World’s fourth-quarter gross revenue in RMB terms was 2 per cent lower than in the year before.

The manager of Europe-focused IReit Global reported a distribution per unit (DPU) of 1.28 euro cents for the six months ended Dec 31, 2022, down 14.7 per cent from 1.50 euro cents for the same period in 2021. This was due mainly to greater property operating expenses related to higher portfolio vacancy, increased tax costs, and management fees being 100 per cent paid in cash (up from 50 per cent in cash in FY2021), the real estate investment trust’s (Reit) manager said on Thursday (Feb 23). Gross revenue rose 10.7 per cent to 31.6 million euros in the period, while net property income (NPI) grew 5.2 per cent to 24.4 million euros.

Real estate services provider Apac Realty reported a 46 per cent drop in net profit for the six months ended Dec 31, 2022, the company said in a bourse filing on Thursday (Feb 23) evening. Net profit stood at S$9.9 million, down from the S$18.3 million posted the same period a year ago. Earnings per share fell to S$0.0278, from S$0.0516. Revenue in the period fell 5 per cent to S$360 million, from S$378.9 million, said the company, which holds the ERA regional master franchise rights.

US

Grab reported a 51 per cent year-on-year (y-o-y) drop in losses for FY2022 to US$1.7 billion from US$3.5 billion, as revenue for the period surged 125 per cent to US$1.4 billion from US$675 million in 2021. Excluding a US$68 million uplift in revenue from a business model change in one of the superapp’s markets from being an agent arranging for delivery service to becoming a principal delivery provider, FY2022 revenues still exceeded the guidance of US$1.3 billion. The fall in losses was driven by total segment-adjusted earnings before interest, taxes, depreciation and amortisation (Ebitda) turning positive from a loss of US$125 million in FY2021 to a positive US$65 million in FY 2022. Adjusted Ebitda fell 6 per cent from US$842 million to US$793 million.

Nvidia jumped after giving a bullish revenue outlook for the current quarter, suggesting that a push into artificial intelligence (AI) processors is helping offset sluggish demand for personal computer chips. “When you have ‘the next big thing’ in tech, it’s natural for investors to scramble to find ways to play the theme,” said Russ Mould, investment director at AJ Bell. “Nvidia’s involvement in the AI space now puts it directly under the spotlight.” The stock rose 13 per cent in early New York trading on Thursday (Feb 23), the biggest intraday advance since November. If the gain holds, Santa Clara, California-based Nvidia would be on track to add about US$64.3 billion in market value, taking its year-to-date gains to about US$214 billion.

Alibaba Group Holding reported better-than-expected quarterly revenue on Thursday, as the Chinese e-commerce giant benefited from the country easing Covid-19 curbs. The company has weathered a weak economy in China, which only last December lifted its zero-Covid policy after three years. Revenue rose 2 per cent to 247.76 billion yuan (S$48.2 billion) for its fiscal third quarter to Dec 31, compared with a Refinitiv consensus estimate of 245.18 billion yuan drawn from 23 analysts.

Netflix lowered the price of subscriptions in over 100 countries, mostly lower-income regions where the company has fewer customers. “We’re always exploring ways to improve our members’ experience,” Netflix said on Thursday (Feb 23) in a statement. “We can confirm that we are updating the pricing of our plans in certain countries.” The price cuts will impact more than 10 million subscribers in markets including Vietnam, Indonesia, Thailand and the Philippines, the independent research firm Ampere Analysis said separately. They are taking place across Asia, the Americas and the Middle East.

The US dollar index rose to its highest in nearly seven weeks on Thursday (Feb 23), a day after minutes from the Federal Reserve’s (Fed) last policy meeting that supported, but did not add to markets’ view the central bank will raise rates further. The index, which tracks the greenback against six major peers touched 104.68, its highest since Jan 6, in late morning in Europe, before trading just below that level steady on the day.

New York and US federal finance regulators have opposed the US$1.02 billion deal by Binance.US to purchase assets of defunct crypto lender Voyager, CoinDesk reported on Thursday (Feb 23), citing Securities and Exchange Commission (SEC) filings. The SEC said the proposed deal terms may also infringe the law, given how the plan expects to repay Voyager’s former customers, the report said. It added that the deal was opposed by New York State’s Department of Financial Services (NYDFS) and Attorney General Letitia James in two Feb 22 filings, including allegations that Voyager was unlawfully serving customers in the state.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

SATS Ltd – Launched $800mn rights issue

Recommendation: NEUTRAL (Maintained), Last Done: S$2.80

Target price: S$2.92, Analyst: Terence Chua

– 9M23 revenue in line, at 80.7% of FY23e. Its profitability continued to recover with core PATMI excl. reliefs at -$13.7mn vs. -$33mn in the same period last year.

– SATS shareholders will be allotted rights to subscribe for 323 rights shares for every 1,000 existing shares held at the price of $2.20 per rights share, representing a 16% discount to TERP.

– Funding clarity and all necessary approvals from all jurisdictions received should lead to a re-rating of the Company post rights-issuance.

– Maintain NEUTRAL with lower target price of $2.92 (prev. $3.08). We trim FY24e earnings by 3% as we account for higher share base from a lower-than-expected rights price. Our valuation is pegged to 20x FY24e. Risks to our view include 1) Integration challenges for WFS; and 2) revenue growth continuing to lag behind expenses growth

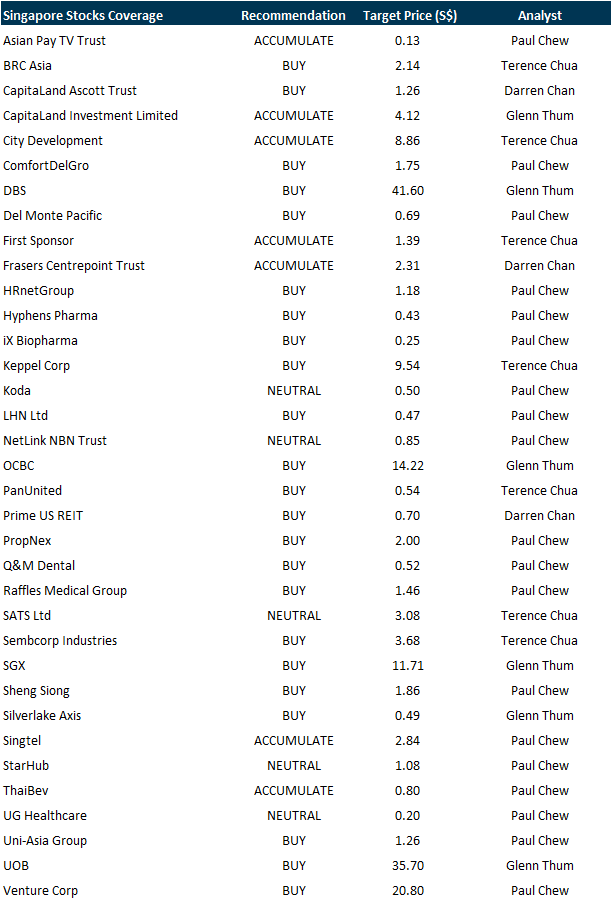

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Cromwell European REIT

Date: 28 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3xw5GYW

Guest Presentation by Keppel Pacific Oak US REIT (KORE) [NEW]

Date: 23 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3XY2n7v

Research Videos

Weekly Market Outlook: Airbnb, PayPal, DBS, Silverlake Axis, Prime US REIT, BRC Asia & More…

Date: 20 February 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials