Daily Morning Note – 24 March 2022

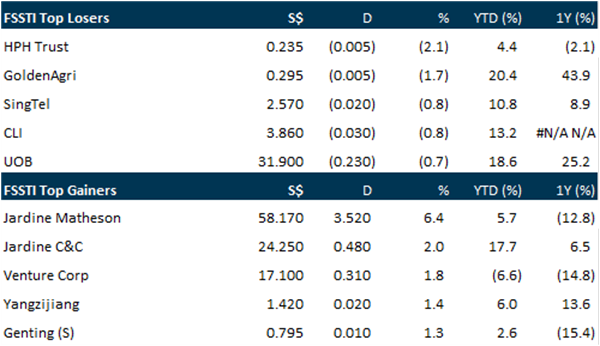

Singapore stocks rose on Wednesday (Mar 23), tracking positive investor sentiment seen across other markets in the Asia-Pacific. The benchmark Straits Times Index (STI) rose 0.4 per cent or 14.09 points to close at 3,364.26. Elsewhere, major indices in Japan, Hong Kong, South Korea and Australia also ended the day higher, climbing between 0.5 per cent and 3 per cent following overnight gains on Wall Street on Tuesday.

US stock indexes opened lower on Wednesday as oil prices rose and megacap shares fell, while investors assessed the outlook for US interest rates following calls from policymakers for bigger increases. The Dow Jones Industrial Average fell 58.62 points or 0.17 per cent at the open to 34,748.84. The S&P 500 opened lower by 18.51 points or 0.41 per cent at 4,493.10, while the Nasdaq Composite dropped 118.46 points or 0.84 per cent to 13,990.35 at the opening bell.

SG

Lendlease Global Commercial Reit private placement to raise at least S$325 million was 3.3 times subscribed. The upsized option was also exercised, bringing the total amount raised via the private placement to $400 million for the issue of 551.7 million new units. There was strong interest from new and existing institutional investors as well as real estate specialist funds, the manager said on Wednesday (Mar 23). Units of Lendlease Reit fell as much as 5 per cent after resuming trading on Wednesday.

Capitaland Investment’s wholly-owned lodging business unit The Ascott Limited has acquired 2 properties for a total of S$190 million through Ascott Serviced Residence Global Fund (ASRGF), its private equity fund with Qatar Investment Authority. In a press statement on Wednesday (Mar 23), The Ascott said this will bring its total funds under management (FUM) to S$9 billion. The first property in Ningbo, China, was acquired on a turnkey basis and comprises 2 residential towers that are due to open as the 206-unit serviced residence, Somerset Hangzhou Bay Ningbo, in 2025. Another property is a freehold asset located in Amsterdam, the Netherlands. It is due to be refurbished and relaunched as a 93-unit serviced residence known as Citadines Canal Amsterdam in 2023.

ST Engineering’s credit rating has been downgraded by S&P from AAA to AA+, following its US$2.7billion acquisition of US traffic management firm TransCore that’s largely funded by debt. “We downgraded ST Engineering given the company’s growth appetite will keep its debt level elevated for at least the next two to three years,” states S&P. Prior to TransCore, which is ST Engineering’s largest acquisition to date, the company, in a bid to generate growth in new business areas, have made a couple of other big acquisitions. While S&P downgraded the rating, it has tacked a “stable” outlook.

US

Oil prices jumped 5 per cent to over US$121 a barrel on Wednesday as disruptions to Russian and Kazakh crude exports via the Caspian Pipeline Consortium (CPC) pipeline added to worries over tight global supplies. The situation adds to market worries about the ripple effect of heavy sanctions on Russia, the world’s second-largest crude exporter, after its invasion of Ukraine. The CPC pipeline is a significant supply line for global markets, carrying around 1.2 million barrels per day of Kazakhstan’s main crude grade, or 1.2 per cent of global demand. Brent crude futures settled up US$6.12, or 5.3 per cent, to US$121.60, while U.S. West Texas Intermediate (WTI) crude futures rose US$5.66, or 5.2 per cent, to US$114.93 a barrel.

Gold prices fell on Wednesday (Mar 23) as US Treasury yields gained after Federal Reserve officials insisted on sharper interest-rate hikes to combat inflation, although concerns over the Ukraine crisis slowed bullion’s decline. Spot gold was down 0.2 per cent at US$1,918.29 per ounce by 1.30 am GMT. US gold futures also slipped 0.2 per cent to US$1,918.40. Benchmark US 10-year Treasury yields jumped to fresh highs since May 2019.

SpaceX was already close to offering Internet service in Ukraine, but Russia’s invasion accelerated the process, and it’s now offering consumer connections in a war zone. “We were close to getting the approvals to offer service but the documents weren’t all signed,” Gwynne Shotwell said Tuesday (Mar 22) at the Satellite 2022 conference in Washington. After the conflict began, “they tweeted at my boss and that was permission to provide capability”. SpaceX’s Starlink service was one of the options Ukraine’s government sought as Russian forces targeted much of the country’s infrastructure. Viasat said on Mar 1 that it suffered a cyberattack after the invasion, it affected thousands of residential and business Internet customers in Ukraine.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

Click the link to join: https://t.me/stocksbnb

Date: 21 March 2022

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.