DAILY MORNING NOTE | 25 November 2022

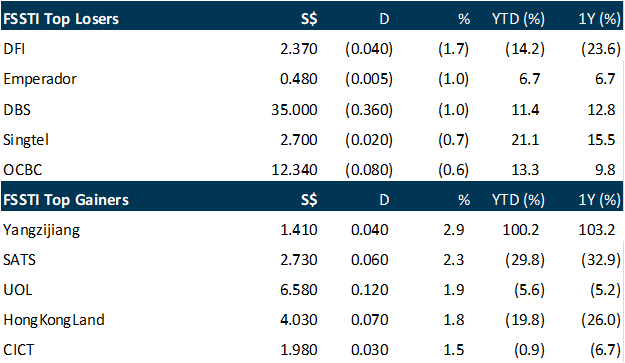

Singapore stocks declined modestly on Thursday (Nov 24), even as regional indices rose after Federal Reserve officials showed support for slowing down the pace of interest rate hikes. The Straits Times Index (STI) ended the day down 0.1 per cent, or 3.11 points, at 3,252.88. Advancers outpaced decliners 287 to 199 in the broader market, after 1.2 billion securities worth S$918.1 million changed hands.

Closer to home, Malaysia-listed stocks surged after the state palace announced Anwar Ibrahim as the nation’s 10th prime minister. The benchmark Kuala Lumpur Composite climbed to a three-month high after the midday announcement, closing 4 per cent higher on Thursday. The securities had traded within a narrow range earlier in the week, after last Saturday’s election produced no clear winner. Hong Kong’s Hang Seng index, which led losses at the start of the week, was up 0.8 per cent at Thursday’s close, while Tokyo’s Nikkei 255 and South Korea’s Kospi both gained 1 per cent. The Jakarta Composite ended the day up 0.4 per cent. The US markets were closed on Thursday (Nov 24) for Thanksgiving.

SG

Integrated marine logistics company Marco Polo Marine on Thursday (Nov 24) reported a net profit of S$10.5 million for the second half of the fiscal year ended September, a 19 per cent increase from earnings of S$8.8 million in the year-ago period. No dividend was declared for the period under review, unchanged from the corresponding year-ago period. The company said it would like to “conserve cash” for its capital expenditure requirements in the coming financial year. This took the group’s profit for the full year to S$21.3 million, some 44 per cent higher than earnings of S$14.8 million in the previous year, according to a bourse filing. Revenue for H2 came in at S$58.5 million, more than double the group’s topline of S$25 million in the corresponding period last year. Cost of sales for H2 was also up to S$39.2 million from S$18 million, which crimped the group’s margins. About 58 per cent of revenue for H2, or S$34.2 million came from the company’s ship chartering operations. The remaining 42 per cent or S$24.3 million came from ship building and repair operations. Marco Polo Marine said the revenue from ship chartering operations was mainly due to the consolidation of results of Indonesian shipping agency company PT Pelayaran Nasional Bina Buana Raya (PT BBR) and Taiwan-based PKR Offshore (PKRO) from March and May respectively. PT BBR contributed a revenue of S$6.9 million, while PKRO contributed a revenue of S$10.4 million from the point of consolidation, said the company. Marco Polo Marine added that it has also achieved higher average utilisation rates for both its fleets of offshore vessels and the fleet of tugboats and barges. The company has also obtained higher charter rates for its fleet of offshore vessels in the current year, it added. For shipbuilding and repair operations, the group said there was an increase in volume and contract values of the repair projects during the year. In its outlook statement, the company said the broader offshore and shipping industries continue to face uncertainties amid challenging macroeconomic and geopolitical situations. In particular, war-induced commodity price increases and broadening price pressures have led to rising inflation this year, the group noted, which have resulted in an increase in cost of “doing business”. Marco Polo Marine said it will continue to improve operational efficiency and tighten cost control to enhance its competitiveness. The company is also looking to further extend its reach into segments such as the renewable energy sector. Its ship chartering business will continue to explore opportunities to support the booming offshore windfarm market. The company will also continue to focus on securing ship repair and maintenance orders by expanding its customer base internationally for its shipyard division. The company will release “further updates on its business and operations” on Dec 6, it said. Shares of Marco Polo Marine ended Thursday at S$0.044, up 2.3 per cent or S$0.001 ahead of the results announcement.

Kopernik Global Investors LLC – an investment management company headquartered in Tampa, Florida – has ceased to be a substantial shareholder of local palm oil player Golden Agri-Resources. In a bourse filing on Thursday (Nov 24), the company announced that Kopernik Global Investors had sold some 37.3 million shares of Golden Agri via a market transaction at a price of S$0.2934 apiece on Nov 3. The date on which Kopernik Global Investors “became aware” of the change in interest was listed as Nov 22 in the filing, with the accompanying explanation that the investment manager “regrets the delay in meeting the filing notification deadline”. The date of notification to the listed issuer was Nov 22. Kopernik Global Investors has a deemed interest in the shares as it has discretionary power in the disposal rights over shares as an investment adviser, the filing said. With the sale, Kopernik Global Investors’ deemed interest in Golden Agri has been pared to 4.91 per cent or 622.3 million shares, from 5.2 per cent or 659.6 million shares previously. Shares of Golden Agri finished Thursday flat at S$0.285.

Keppel Corporation’s offshore and marine (O&M) arm, Keppel O&M, has received a payment of about US$160 million following the delivery of the first of three jackup rigs to ADNOC Drilling Company PJSC (ADNOC Drilling). In a press statement on Thursday (Nov 24), Keppel said the three rigs were part of a series of five rigs that Keppel Fels – Keppel O&M’s wholly-owned subsidiary – had been building for Borr Drilling. The construction contracts for the three rigs have since been novated by Borr Drilling to ADNOC Drilling, Keppel said. As part of the novation agreement, Keppel O&M will receive full payments for each of the two remaining rigs on delivery. Keppel O&M also expects to receive at least US$352 million for all three rigs between 2022 and 2023, and this is in addition to downpayments that Keppel O&M had initially received from the previous customers for the rigs. Tan Leong Peng, managing director for new builds at Keppel O&M, said that with the novation of the three jackup contracts to ADNOC Drilling, the company has “even greater certainty” of delivering the remaining rigs, receiving more cash payments sooner, and reducing Keppel O&M’s financial exposure to the legacy assets. “Our high-quality and cost-effective KFELS B Class family of rigs have a strong track record in the Middle East. Since the start of 2022, all nine of our proprietary jackup rigs have been contracted for deployment in the Middle East,” said Tan. “As drilling rig utilisation rates continue to increase, we are seeing more demand for high-quality rigs that our legacy rigs are well suited to meet.” As part of the definitive agreements Keppel has signed in connection with the proposed O&M transactions with Sembcorp Marine, these rigs are part of Keppel O&M’s legacy rigs, and such rigs – as well as any sales proceeds – will be transferred to Asset Co that is majority-owned by external investors on legal completion. Shares of Keppel closed on Thursday at S$7.49, up 0.8 per cent or S$0.06.

US

Benchmark Brent oil edged lower on Thursday (Nov 24) while West Texas Intermediate (WTI) crude held steady, hovering in sight of two-month lows as the level of a proposed G7 cap on the price of Russian oil raised doubts about how much it would limit supply. A bigger-than-expected build in US petrol inventories and widening Covid-19 controls in China also added downward pressure on crude prices. Brent crude futures were down 29 US cents, or 0.3 per cent, to US$85.12 a barrel by 15.15 pm ET (2015 GMT), while US WTI crude futures rose 2 US cents, to US$77.96. Trading volumes were thin because of the Thanksgiving holiday in the United States. Both benchmarks plunged more than 3 per cent on Wednesday on news the planned price cap on Russian oil could be above the current market level. European Union governments remained split over what level to cap Russian oil prices at to curb Moscow’s ability to pay for its war in Ukraine without causing a global oil supply shock, with more talks possible on Friday if positions converge. The G7 group of nations is looking at a cap on Russian seaborne oil at US$65-US$70 a barrel, a European official said, though European Union governments have yet to agree on a price. A higher price cap could make it attractive for Russia to continue to sell its oil, reducing the risk of a supply shortage in global oil markets. Some Indian refiners are paying the equivalent to a discount of around US$25 to US$35 a barrel to international benchmark Brent crude for Russian Urals crude, two sources said. Urals is Russia’s main export crude.

Gold prices bounced above the key $1,750 an ounce level on Thursday, consolidating gains after minutes of the U.S. Federal Reserve’s latest meeting signalled slower interest rate hikes. Spot gold rose 0.4% to $1,755.73 per ounce by 0321 GMT. U.S. gold futures advanced 0.6% to $1,755.90. Lower rates tend to lift the appeal for bullion in comparison with other interest-bearing assets. High interest rates have kept a leash on gold’s traditional status as a hedge against high inflation and other uncertainties this year as they translate into higher opportunity cost to hold the non-yielding asset. The minutes of the Fed’s Nov. 1-2 meeting showed that a “substantial majority” of Fed policymakers agreed it would “likely soon be appropriate” to slow the pace of interest rate hikes. Fed fund futures are now pricing in an 85% chance of 50-basis point (bps) increase in the December meeting, after four straight 75 bps hikes. Physical gold demand in Asia, meanwhile, stayed soft this week, with premiums in top hub China easing further as fresh COVID-19 restrictions dimmed activity, while higher domestic prices put off most buyers in India. Spot silver rose 0.5% to $21.62 per ounce, platinum added 0.3% to $999.38, while palladium gained 0.7% to $1,894.75.

Travelers get a bit of break over the Thanksgiving holiday, since gas prices dropped by 16 cents in the past week, bringing the average price of a gallon in the U.S. to $3.61. That’s well below the summer peak of over $5 for a regular gallon of gas, although as of Wednesday, prices are still 21 cents higher than a year ago, according to the American Automobile Association (AAA). It’s also the highest national average during Thanksgiving since 2000, when AAA first started tracking average gas prices in the U.S. “Thanksgiving [gas prices] will be about a dollar more per gallon than in pre-pandemic 2019. However, we can be thankful that gas prices are moving in the right direction for now,” said AAA spokesperson Andrew Gross. Gas prices are highest in western states, where they largely sit above $4 per gallon. At $5.16 per gallon, California has the second-highest average in the country, after Hawaii, where a gallon costs $5.20. Prices are cheapest in the South, where a gallon of gas is closer to $3. In Texas, a gallon costs $2.95, which makes it the cheapest state to pump gas. It’s also the only state where gas is below $3. Gas prices tend to vary by region due to differences in state and local taxes, distance from supply and retail competition.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

TDCX Inc. – Muted by macro uncertainty

Recommendation : BUY (Maintained); TP: US$15.50, Last Close: US$10.52

Analyst: Jonathan Woo

– 9M22 revenue was in line at 73% of our FY22e forecasts. PATMI was above expectations, at 84% of our FY22e forecasts due to higher interest and other operating income.

– The travel and hospitality vertical continues to provide growth tailwinds, returning to pre-pandemic levels with 29% YoY growth for 3Q22.

– We raised our FY22e PATMI by 12% to S$108mn primarily from higher-than-expected interest and other operating income, while keeping FY22e revenue unchanged. However, we cut our FY23e revenue growth forecasts by ~5% due to macroeconomic uncertainty and pullback in spending by tech companies. We maintain a BUY recommendation with a reduced DCF target price of US$15.50 (prev. US$16.39), a WACC of 10.4%, and a terminal growth rate of 3.0%.

PropertyGuru Group Ltd. – Cooling measures to affect growth

Recommendation: ACCUMULATE (Downgraded); TP: US$5.30, Last Close: US$4.99

Analyst: Maximilian Koeswoyo

– Revenue in line with expectation while earnings missed. 9M22 revenue at 66% of FY22e forecast. 9M22 Adj. EBITDA/net loss came in at 30%/125% of forecasts due to higher than expected employee compensation and other expenses.

– Vietnam revenue spiked 161% YoY while Malaysia grew 49%. Singapore remains the largest market, growing 28%. ARPA/ARPL increased by 24%/2.5% and achieved ~87% renewal rate. Government cooling measures are expected to pose headwinds in 4Q22.

– We cut our FY22e revenue by 6% and PATMI by 24% to account following management guidance of macroeconomic headwinds and increased cost assumptions. Downgrade to ACCUMULATE with a lowered DCF target price of US$5.30 (prev. US$5.73), with a WACC of 10.1% and g of 3%.

Upcoming Webinars

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by Sabana Industrial REIT [NEW]

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by iWoW Technology [NEW]

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: Sea Ltd, Silverlake Axis, Q&M Dental, ComfortDelgro, APTT, Tech Analysis…

Date: 21 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials