DAILY MORNING NOTE | 26 August 2022

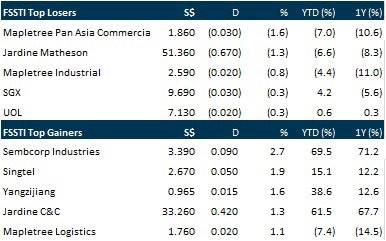

The Singapore market closed higher on Thursday (Aug 25), tracking Wall Street’s slight rebound overnight following a 3-day losing streak in anticipation of a speech by US Federal Reserve chair Jerome Powell at the Jackson Hole Symposium on Friday. Its benchmark Straits Times Index (STI) rose 0.4 per cent or 14.32 points to 3,247.8. Gainers far outnumbered losers 321 to 187 in the broader market, with 1.5 billion shares worth S$914.5 million changing hands. Among STI constituents, Mapletree Pan Asia Commercial Trust, which fell 1.6 per cent or S$0.03 to S$1.86, was the biggest loser. Trailing behind was Jardine Matheson, which slid 1.3 per cent to US$51.36. OCBC snapped its 3-day losing streak and climbed 0.9 per cent to reach S$12.10. The other 2 local banks also traded higher. UOB gained 0.6 per cent to hit S$27.51, and DBS rose 0.5 per cent to hit S$33. The session’s biggest winner was Sembcorp Industries, which climbed 2.7 per cent or S$0.09 to close at S$3.39. In the broader market, Marco Polo Marine was the most actively traded counter by volume for a second day running. It closed up 5.6 per cent at S$0.038 after 131.2 million of its shares worth S$4.9 million changed hands.

Wall Street equities finished with solid gains Thursday (Aug 25), boosted by upbeat economic data and despite more Federal Reserve officials repeating the message that interest rates will continue to rise to combat inflation. Shares opened higher and remained in the green throughout the trading session, as the Dow Jones Industrial Average gained 1.0 per cent to finish the day at 33,291.78. The broad-based S&P 500 jumped 1.4 per cent to close at 4,199.52, while the tech-rich Nasdaq Composite Index increased 1.7 per cent to 12,639.27. Government reports showed initial applications for unemployment benefits unexpectedly fell last week, dispelling concerns about a weakening job market, while GDP in the second quarter contracted by 0.6 per cent, much less than first reported. Before Powell’s speech, markets on Friday will get a look at the Fed’s preferred inflation index, which like CPI is expected to show a dramatic slowdown in July due to falling petrol prices.

SG

Singtel has agreed to sell a 3.3 per cent direct stake in its regional associate Bharti Airtel to Bharti Telecom, its joint venture with India’s Bharti Enterprises, for S$2.25 billion. In a press statement on Thursday (Aug 25), the telecommunications company said it expects to net a gain of S$600 million from the transaction. This will leave Singtel with a 29.7 per cent effective stake in Airtel comprising a 19.2 per cent indirect stake through Bharti Telecom, and a 10.5 per cent direct stake. Proceeds from the sale will help Singtel fully meet its needs for 5G and growth initiatives in the years to come, Lang added, putting the group in a “strong position to grow (its) dividends in a sustainable way in line with (its) dividend policy”. Following the transaction Singtel also plans to increase its stake in Intouch Holdings, the parent company of its regional associate AIS, as well as partially divest Airtel Africa as part of its recent capital management initiatives to rebalance and optimise Singtel’s associates portfolio. Shares of Singtel ended Thursday S$0.05 or 1.9 per cent higher at S$2.67.

Fashion and lifestyle retailer F J Benjamin Holdings reported the Group’s attributable net profit of $3.0 million for the full year ended 30 June 2022 (FY22), reversing a net loss of $10.9 million for the previous full year ended 30 June 2021 (FY21) as governments eased social distancing restrictions, borders reopened, and people returned to the malls. The improved performance came mainly in the second half of FY22 with attributable net profit of $4.3 million against an attributable net loss of $7.2 million in 2HFY21. The Group recorded share of profit from its Indonesian associate of $1.9 million in FY22 against a share of loss of $2.4 million in FY21. The second half of FY22, from January to June 2022, saw writebacks totalling $1.5 million for impairments and reversed allowances for expected credit losses on receivables from an Indonesian associate and related party. For the whole of FY22, the Group’s revenue rose 21% to $80.9 million with sales in Singapore (excluding exports to Indonesia) and Malaysia gaining 6% and 28% respectively. Sales at FJB’s Indonesia associate grew 16% in FY22. The revenue growth came in the second half of FY22 when sales momentum picked up strongly following a sluggish first quarter when many of the Group’s stores were closed and business was interrupted due to intermittent COVID-19 disruptions. Shares in F J Benjamin closed 0.02 cents higher or 8.33% up on Aug 25 at 0.26 cents.

UG Healthcare Corp has reported earnings of $15.5 million for the 2HFY2022 ended June, 75.6% lower than the net profit of $63.8 million in the same period the year before. FY2022 earnings stood at $36.8 million, down 69% y-o-y from FY2021’s $118.7 million. Earnings per share (EPS) for 2HFY2022 stood at 2.48 cents, compared to 10.37 cents for 2HFY2021. EPS for FY2022 stood at 5.93 cents, compared to 19.42 cents for FY2021. Revenue fell 35.6% y-o-y to $115.3 million from $179 million for 2HFY2021, while FY2022 revenue fell 31.3% y-o-y to $232.5 million. Although demand remains strong for hand protection for safety and hygiene purposes, the company says the rapid downward adjustments in average selling price (ASP) of disposable examination gloves to pre-Covid levels from the increase in global supply resulted in its customers’ preference to hold lower inventory. This underscored UG Healthcare’s weaker financial performance for FY2022 as more countries progress from the pandemic to endemic phase. The company reported gross profit of $39.8 million for 2HFY2022, 58.9% down y-o-y from $97 million for 2HFY2021. FY2022 gross profit decreased by 57% y-o-y from $196.2 million to $84.4 million. This was in tandem with the lower revenue from lower ASP across all product segments, partially offset by lower raw material prices despite an increase in production volume. Correspondingly, gross profit margin declined from 58% in FY2021 to 36.3% in FY2022. UG Healthcare’s net asset value increased from $190.6 million as at June 30, 2021 to $228.9 million as at June 30 this year. Similarly, net asset value increased from 30.93 cents as at June 30, 2021 to 36.69 cents as at June 30 this year. The group’s net cash position stood at approximately $83.8 million as at June 30. As a token of appreciation to shareholders, UG Healthcare has proposed a special dividend of 0.32 cents per share and a final dividend of 0.32 cents per share. The total dividend of 0.64 cents for FY2022 is a slight increase from FY2021’s 0.61 cents. Shares in UG Healthcare closed at an unchanged 21.5 cents on Aug 25.

US

Graphics chip designer Nvidia forecast a sharp drop in revenue in the current quarter on the back of a weaker gaming industry. The company said it expected third-quarter revenue of US$5.90 billion, down 17 per cent on year, but said the declines would be partially offset by growth in the data centre and automotive business. Nvidia graphics chips called GPUs have been used for cryptocurrency mining and sales have taken a hit as the crypto market has crumbled. Analysts have been concerned about a slowdown in data centre growth, which has supported chip sales. The company’s second-quarter revenue of US$6.70 billion was significantly lower than the US$8.10 billion Nvidia forecast in May. Its gaming division posted revenue of US$2.04 billion, down 33 per cent year on year. Data centre revenue held up at US$3.81 billion, up 61 per cent year on year. The gaming industry has been showing signs of weakness as consumers pull back from discretionary purchases such as video-gaming gear amid decades-high inflation. Nvidia said it took a US$1.34 billion charge in the second quarter as it wrote down inventory built up when it thought the gaming and data centre markets would be much stronger. Nvidia chief executive Jensen Huang told analysts on the call that the company also faced supply chain challenges that prevented it from selling more systems to data centres.

Property portal PropertyGuru is the first among Singapore-based startups to turn profitable following its listing in the United States in March. For the first time since its listing, the property portal reported on Thursday (Aug 25) that its net income for the second quarter of FY2022 ended Jun 30 had turned positive, coming in at S$3.8 million. This is a reversal from a net loss of S$139.8 million in the same quarter a year ago. PropertyGuru’s revenue increased 44.3 per cent year on year to S$33 million from S$23 million over the same time period. For the first half of FY2022, revenue came in at S$61.3 million. The proptech company said in a statement that this was balanced with growth across all markets and business segments. Its adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) was S$3 million in the second quarter of FY2022, a reversal from a loss of S$2 million a year ago. Its earnings per share, attributable to shareholders of the New York-listed company, is also in the black at 2 cents per share, compared to a loss of US$2.48 per cent share over a year ago. PropertyGuru maintains its full-year outlook of approximately 44 per cent revenue growth, driven by the strong start to 2022 and growth across all core markets. It expects to return to full-year positive adjusted EBITDA, as it realises the full benefits of its pandemic-period investments. However, it also cautioned that this outlook could be hit by uncertainty around rising inflation and interest rates, government policy and fiscal intervention, political instability and other macro factors.

Plug Power has signed a deal with Amazon.com to supply liquid green hydrogen, the companies said on Thursday (Aug 25), sending the hydrogen fuel cell maker’s shares up over 12 per cent in early trade. Green hydrogen is often touted as the future of energy, as the flexible and zero-emission fuel can be used for transportation and electricity generation. Amazon said Plug Power will supply 10,950 tons of green hydrogen every year starting 2025 that it will use to replace grey hydrogen, diesel, and other fossil fuels. The companies, however, did not divulge the supply pricing specifics. Grey hydrogen is made from natural gas, without the carbon sequestration, and makes up the bulk of the 90 million tonnes of hydrogen produced globally every year. The green hydrogen deal will provide enough annual power for 30,000 forklifts or 800 heavy-duty trucks, Amazon said. The world’s largest online retailer said that it uses hydrogen to power over 15,000 fuel-cell propelled forklifts, and plans to increase that number to 20,000 units in 3 years. The company also has an order for 100,000 electric delivery vehicles with Rivian Automotive Inc, in which it is the largest shareholder, according to Refinitiv. Plug said the Amazon deal will help the company grow towards its goal of US$3 billion in revenue in 2025. It also said it has granted Amazon a warrant to buy up to 16 million of its shares at an exercise price of US$22.9841 a unit for the first 9 million shares. Amazon would vest the warrant in full if it spends US$2.1 billion over the 7-year term of the warrant across Plug products, it added.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Technical Pulse: Yangzijiang Shipbuilding Holdings Ltd

Analyst: Zane Aw

Recommendation: Technical BUY

Buy limit: 0.950 Stop loss: 0.920 Take profit 1: 0.990 Take profit 2: 1.03

Yangzijiang Shipbuilding Holdings Ltd (SGX: BS6) A retest of the immediate support at 0.940-0.950 is possible before the price edges higher.

Upcoming Webinars

Guest Presentation by Marathon Digital Holdings

Date: 26 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by Halcyon Agri Corporation Limited [NEW]

Date: 31 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3pjErMM

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Guest Presentation by ComfortDelGro Corporation Limited [NEW]

Date: 29 September 2022

Time: 12pm – 1pm

Register: https://bit.ly/3Ql57J7

Research Videos

Weekly Market Outlook: Sea Ltd, SGX, Ascott Residence Trust, First REIT, SembCorp, Q&M & More

Date: 22 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials