DAILY MORNING NOTE | 26 January 2023

Trade of the Day

Lion-Phillip S-REIT ETF (SGX: CLR)

Analyst: Zane Aw

(Current Price: S$0.945) – TECHNICAL BUY

Buy price: S$0.945 Stop loss: S$0.930 Take profit: S$1.00

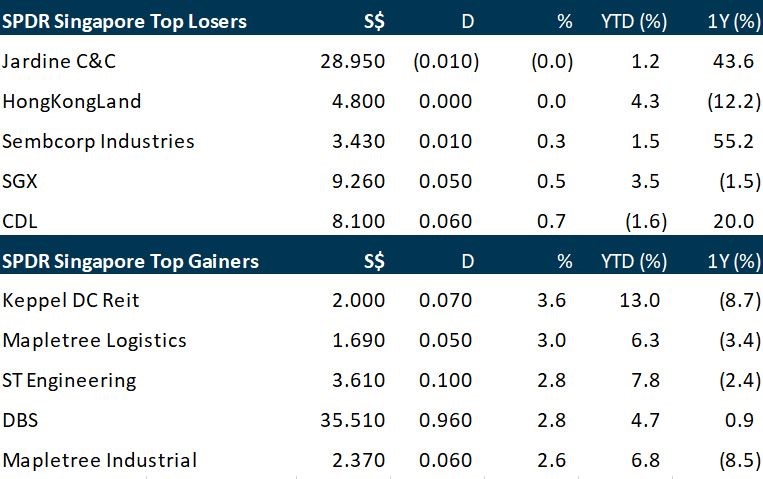

Singapore stocks jumped higher on Wednesday (Jan 25) with real estate investment trusts (Reits) leading the gainers, as investors returned after the Chinese New Year holidays. The benchmark Straits Times Index (STI) rose 1.8 per cent or 59.06 points to close at 3,352.77. Of the 30 STI constituents, 28 closed higher on Wednesday. Units of Keppel DC Reit and Mapletree Logistics Trust (MLT) were the top gainers for the day. Keppel DC Reit units rose 3.6 per cent to close at S$2, while MLT units climbed 3 per cent to close at S$1.69. Mapletree Industrial Trust and CapitaLand Ascendas Reit were also among the top STI gainers, climbing 2.6 and 2.5 per cent respectively. The local banks – DBS, UOB and OCBC – also performed strongly, rising between 1.5 and 2.8 per cent.

Wall Street stocks mostly slipped on Wednesday, pulling back on concerns over lackluster company earnings and ahead of key economic data released later this week. The tech-rich Nasdaq Composite Index fell 0.2 per cent to 11,313.357. The Dow Jones Industrial Average rose less than 0.1 per cent to 33,743.84, while the S&P 500 Index shed less than 0.1 per cent as well to land at 4,016.22.

SG

Singapore’s CPI-All Items inflation (or headline inflation) eased to 6.5% on a y-o-y basis in December, down from 6.7% in November. The lower headline inflation was mainly attributable to slower inflation in private transport. Private transport inflation moderated as car and petrol prices rose at a more gradual pace. Accommodation inflation also edged down as housing rents rose at a slower pace. Meanwhile, the Monetary Authority of Singapore (MAS) Core Inflation, which excludes the “accommodation” and “private transport” components, came in at 5.1% on a y-o-y basis in December, unchanged from November. This was attributable to the smaller price increases for retail & other goods as well as electricity & gas. However, the smaller increases were offset by higher inflation for food and services. On a m-o-m basis, core CPI increased by 0.6% while headline CPI rose by 0.2%.

Comment: Core inflation in Singapore remains stubbornly high. December core-CPI rose 5.1% YoY unchanged for the past 3 months. However, on a MoM basis, core-CPI is up 0.56%, the highest in 5 months. The current pace is higher than MAS expectations for 2023 of 2.5-3.5% (or 4.5-5.5% including GST). High inflation will lend some support to the Singapore dollar as MAS will not be reversing its tight monetary policy. For the upcoming April 2023 monetary policy statement, after three rounds of aggressive re-centre of the exchange rate, we expect monetary policy to be looser but still increasing the slope of the exchange rate.

Paul Chew

Head Of Research

paulchewkl@phillip.com.sg

Sea Ltd is considering a sale of Vancouver-based indie developer Phoenix Labs as the South-east Asian Internet giant slashes costs and focuses on its core business. The company faces increasing pressure to cut costs, with growth in its e-commerce and gaming business slowing after a pandemic-era high. Consumers are pulling back on spending online, as rising interest rates and prices weigh on the economy. Sea has lost more than US$160 billion of its market value since October 2021 on questions about its money-making prospects. Last month, Sea founder Forrest Li announced it was freezing salaries for most staff and paying out lower bonuses, bracing for a worsening global economic environment in 2023.

Sustainable engineering solutions provider Koh Brothers Eco Engineering posted a 7 per cent increase in net profit to S$2.2 million for the full year ended Dec 31, 2022, up from S$2 million in the year-ago period, according to a Wednesday (Jan 25) bourse filing. This was on the back of higher revenues – up 15.9 per cent to S$209.4 million – with both the engineering and construction, and bio-refinery and renewable energy segments seeing growth, the Catalist-listed company said. For the half year, net profit was up 20.6 per cent to S$1 million, while revenue was 51.2 per cent higher at S$107.5 million. For FY2022, earnings per share stood at 0.08 Singapore cent, the same as in the year-ago period. The counter ended 2.9 per cent or S$0.001 lower at S$0.033 on Wednesday, before the results were released.

ComfortDelGro invested four million euros (S$5.7 million) in a venture capital (VC) impact fund dedicated to supporting startups in the sustainable mobility sector. The investment in Shift4Good was made through ComfortDelGro’s US$100 million VC fund. The firm believes the investment will “accelerate the drive for sustainable mobility”, said ComfortDelGro managing director and chief executive officer Cheng Siak Kian. The move comes after the group announced a US$4 million investment in Israeli-owned teleoperation software capabilities company Ottopia two weeks ago.

US

Tesla said on Tuesday (Jan 24) it would invest more than US$3.6 billion to expand its Nevada Gigafactory complex with two new factories, one to mass produce its long-delayed Semi electric truck and the other to make its new 4680 battery cell. The cell plant would be able to make enough batteries for 2 million light-duty vehicles annually, including batteries using the 4680-type cell. The 4680 is key to Tesla meeting a goal of halving battery costs and ramping up battery production nearly 100-fold by 2030. The EV maker aimed to produce 50,000 Semis in 2024, Musk said on a post-earnings call in October.

Exchange operator Nasdaq Inc missed Wall Street estimates for fourth-quarter profit on Wednesday (Jan 25), hit by a slowdown in initial public offerings and higher business expenses. The Nasdaq stock exchange hosted only 18 IPOs in the fourth quarter, compared with 195 a year earlier. Operating expenses in the quarter rose nearly 3 per cent to US$557 million from a year earlier, as the company spent more on employees and business-related expenses. Net revenue, excluding transaction-based expenses in the fourth quarter, increased 2 per cent from a year earlier to US$906 million. The company said it repurchased US$633 million in shares of its common stock last year.

Apple has begun hiring employees for a retail push into Malaysia, preparing to bring its chain to the Asian nation for the first time. The move will bolster Apple’s presence in South-east Asia, where it already has stores in Thailand and Singapore. The company also recently started promoting job listings for its first location in India, which has been planned for several years. Apple doesn’t report sales in individual countries, but the company generated more than US$29 billion from its Asia-Pacific segment, which excludes Greater China and Japan, in the last fiscal year. The Cupertino, California-based company already operates an online store in Malaysia.

Boeing reported a loss in the fourth quarter of 2022 as it grappled with high costs that slowed its recovery, even as a late flurry of jet deliveries drove a surge in cash. The company’s adjusted earnings per share stood at minus US$1.75, it said on Wednesday (Jan 25). Shares of Boeing fell 2.3 per cent as at 8.22 am New York time on Wednesday, before the start of regular trading there. From the start of the year to Tuesday’s close, its shares had risen 11 per cent. Still, Boeing made good on a cash-flow recovery promised by executives, generating US$3.1 billion in the fourth quarter of last year. This was better than the US$2.9 billion that Wall Street had expected for the period. It also lifted the company to its first positive cash flow on an annual basis since 2018; it had burned through more than US$28 billion in the three-year stretch before 2022’s rebound.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

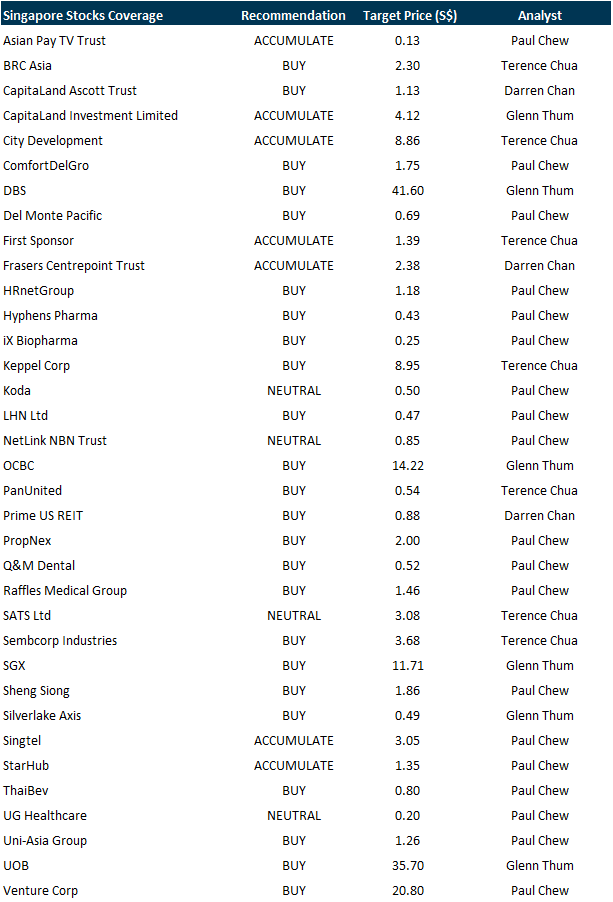

RESEARCH REPORTS

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Comba Telecom Systems Holdings Limited

Date: 31 January 2023

Time: 11am – 12pm

Register: https://bit.ly/3GuS5VK

Guest Presentation by LMS Compliance [NEW]

Date: 8 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3IX0pAr

Guest Presentation by First REIT Management Limited [NEW]

Date: 16 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3GY2tp8

Guest Presentation by Paragon REIT [NEW]

Date: 17 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3ZNn4W0

Guest Presentation by Keppel DC REIT [NEW]

Date: 17 February 2023

Time: 3pm – 4pm

Register: https://bit.ly/3CYgrGr

Research Videos

Weekly Market Outlook: Block Inc., SG Banking Monthly, Technical Analysis, US1Q23 Strategy & More

Date: 16 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials