DAILY MORNING NOTE | 27 February 2023

Week 9 equity strategy: In the near term, we are heading back to the 2022 inflation trade – long US dollar and short equities and bonds. It was a double whammy for inflation watchers. Not only did the PCE (Fed’s preferred CPI) rise above expectation at 4.7% in January (est. 4.3%), but the prior month was also revised up 0.2% points to 4.6%. Interest rate expectations are now firmly for 75 basis points hikes to 5.25% by June. We remain in the disinflation camp but with a headwind in the near term. Higher interest rates work with a lag and interest rates were still zero just a year ago. Global trade is slowing and commodity prices are on a downward trajectory.

We like OCBC. The bank pays a yield of 5.4% with a huge capital buffer of 15% CET 1. And there is additional earning recovery from insurance investments as rates stabilise and China reopens.

The Singapore market gained 0.5 per cent or 17.37 points to close at 3,282.30 on Friday (Feb 24), snapping a four-day losing streak in a week marked by shaky investor sentiment on US rate hike fears. Advancers outnumbered decliners 293 to 250, with 1.37 billion securities worth S$1.17 billion traded. The more positive performance on Friday saw the overall market pare some losses to end the week down a total of 1.4 per cent.

Wall Street stocks finished an ugly session decisively lower Friday (Feb 24) after another round of hot inflation data exacerbated worries over monetary policy. The Federal Reserve’s preferred gauge of inflation, the personal consumption expenditures price index, rose 5.4 per cent last month from January 2022. The broad-based S&P 500 finished at 3,970.04, down 1.1 per cent for the day and 2.7 per cent for the week.

SG

*We are ceasing coverage of UG Healthcare Corporation Ltd, Asian Pay Television Trust and Koda Ltd with immediate effect due to a reallocation of resources. The previous recommendation can no longer be relied upon.*

Skincare products firm Best World International reported early on Sunday (Feb 26) a net profit of S$47.7 million for the fourth quarter ended Dec 31, 2022, down 7.1 per cent from S$51.3 million in the previous corresponding period. No dividend was declared for the period under review. Earnings per share also went up 15.3 per cent year on year to 10.87 Singapore cents for the quarter. The group highlighted that the growth in revenue was bolstered by stronger performance in its China, Taiwan and Hong Kong markets – largely due to a resumption of marketing events and activities in these areas as travel restrictions eased post-pandemic.

Hotel Properties on Friday (Feb 24) reported a net profit of S$74.5 million for the second half of the year ended Dec 31, 2022, versus earnings of S$14.6 million in the comparable period for 2021. Revenue for the period came in at S$276 million, up 58.1 per cent from S$174.6 million. The board of directors has recommended a first and final cash dividend of S$0.04 per ordinary share, as well as a special dividend of S$0.01 per share. The date payable, as well as the books closure date, will be announced in due course, the company said.

Hong Leong Finance posted a 113.7 per cent rise in net profit to S$85.8 million for its second half ended Dec 31, 2022, from S$40.1 million the year before. In 2022, the finance company recorded strong loan growth and an uplift in its asset yields, which outpaced a higher cost of deposits amid the ongoing interest rate hikes, it said in a bourse filing on Friday (Feb 24). Earnings per share stood at 38.28 Singapore cents for the half-year period, up from 17.93 cents the previous year.

Venture Corporation reported a 13.8 per cent rise in net profit to S$195.3 million in the six months ended Dec 31, 2022, up from S$171.7 million in the corresponding period in 2021. This was due mainly to higher revenue growth from robust customer demand and the introduction of new products in the second half (H2), Venture said in a regulatory filing on Friday (Feb 24). Earnings per share for H2 2022 stood at 67.1 Singapore cents per share, up from 59.1 Singapore cents per share in H2 2021.

QAF, the maker of Gardenia bread, posted net profit of S$11.2 million for the second half ended December 2022, down 54 per cent from S$24.6 million a year ago. The decline was mainly due to the absence of earnings from discontinued operations with the disposal of its primary production business. Earnings from continuing operations fell 21 per cent in H2 FY2022, from S$14.2 million in the year-ago period, as higher costs and expenses outpaced a growth in revenue. Revenue was 6 per cent higher at S$307.1 million in H2, compared with S$290.4 million the previous year.

The earnings of semiconductor equipment maker AEM fell 30 per cent to S$44 million for the second half ended December 2022, from S$62.4 million the year before. H2 revenue dropped 12 per cent to S$330 million, from S$373.2 million previously. Earnings per share (EPS) slipped to S$0.1423 for the six months ended Dec 31, 2022, from S$0.2078 for H2 FY2021. The company said that its management “is providing a target revenue guidance for FY2023 of S$500 million that may be revised as second-half visibility becomes clearer”.

Transport operator ComfortDelGro on Friday (Feb 24) posted earnings of S$57.8 million for the second half of the year ended Dec 31, 2022, up 63.3 per cent from net profit of S$35.4 million for the same period in 2021. This took the group’s full-year earnings to S$173.1 million, up 40.7 per cent from S$123 million. Revenue for the period under review was up 9 per cent to S$1.9 billion from S$1.8 billion. Topline from ComfortDelGro’s underlying businesses was partially offset by an “unfavourable” foreign currency translation of S$76 million from the weaker Australian dollar and the Sterling.

US

Oil edged higher in volatile trade on Friday (Feb 24), and was flat on the week, with prices supported by the prospect of lower Russian exports but pressured by rising inventories in the United States and concerns over global economic activity. Brent crude futures settled at US$83.16 a barrel, up 95 cents, or 1.2 per cent. West Texas Intermediate US crude futures (WTI) settled at US$76.32 a barrel, rising 93 cents, or 1.2 per cent. Earlier, both fell by more than US$1 a barrel. The benchmarks were little changed on the week.

Goldman Sachs Group is expecting to incur US$2.3 billion more in potential losses from legal proceedings than the reserves it had set aside for such matters last year, a regulatory filing by the investment bank showed on Friday (Feb 24). That was in line with what the bank had estimated at the end of its third quarter in September, but was higher than the US$2 billion loss it projected in 2021. Goldman has been a target of lawsuits ranging from its role in Malaysia’s 1MDB sovereign wealth fund scandal to the collapse of Archegos Capital Management in 2021.

The US dollar index rose to seven-week highs on Friday (Feb 24), as investors prepared for US interest rates to stay higher for longer after a set of strong US economic data. Strong US jobs data and rhetoric from Federal Reserve (Fed) officials this month about openness to higher rates if needed in the fight against inflation have resulted in the US dollar erasing its year-to-date losses. The US dollar index – which measures the US currency against six others – was 0.2 per cent higher at 104.80, its highest since Jan 6. It was set for a fourth-straight weekly gain, having risen 2.5 per cent this month.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

CapitaLand Investment Limited – Fund and lodging businesses boost growth

Recommendation: Accumulate (Maintained), Last done: S$3.88

TP: S$4.12, Analyst: Glenn Thum

– FY22 revenue of S$2,867mn (+25% YoY) was slightly below our estimates, forming 97% of our forecast.

– RE investment revenue grew 40% YoY, driven by an occupancy recovery in the core markets, Singapore and India. Fee-related revenue was up 9% YoY, lifted by PE fund management (+26%) and lodging management (+36%) as RevPAU recovered and rose 40% YoY. Funds under management (FUM) has risen to S$88bn (FY21: S$86bn) with inflows of S$2bn in FY22, the newly launched CapitaLand China Data Centre Partners and CapitaLand China Opportunistic Partners Programme brings embedded FUM to S$96bn.

– Maintain ACCUMULATE with an unchanged SOTP TP of S$4.12. We lower FY23e earnings by 8% as we lower property fee management revenue estimates for FY23e. Our SOTP derived TP of S$4.12 represents an upside of 10.8% and a P/E of 16x. The pick-up in travel and China’s re-opening will be immediate catalysts for CLI.

ComfortDelGro Corp Ltd – Weighed by upfront costs

Recommendation: BUY (Maintained); TP S$1.63, Last close: S$1.20; Analyst Paul Chew

– FY22 revenue met expectations at 99% of our forecast. Adjusted PATMI was 13% below due to an additional S$15mn rail electricity expense from the new contract in Singapore. Cost recovery will come from the 13.5% fare adjustment effective late December 2022.

– Special dividend of 2.46 cents was declared to mark the 20th anniversary of the SGX listing. FY22 total special dividend was 3.87 cents while the ordinary dividend was 4.61 cents (3.8% yield).

– We lowered our FY23e PATMI by 20% to S$178.4mn as the timing of the indexation of the UK bus contract is unclear. Nevertheless, we expect earnings growth in FY23e from increased passenger volumes for both taxis and trains, re-pricing of rail fares in Singapore, indexation of UK bus contracts and reduction of taxi rebates in China. We maintain BUY with a reduced DCF target price of S$1.63 (prev. S$1.75).

HRnetGroup Limited – China speedbump

Recommendation: BUY (Maintained); TP S$0.98, Last close: S$0.81; Analyst Paul Chew

– FY22 revenue met expectations but PATMI was below (at 90% of our FY22 forecast). The loss of COVID-related staffing revenue and the lockdown in China affected 2H22 margins and earnings.

– Professional recruitment declined 12% YoY to S$44.8mn. Placement volume was down 15% YoY with pricing up 5%. Flexible revenue dropped a more modest 5% YoY, led by a 6% fall in volume. Margins suffered from a 9% decline in gross profit per contractor.

– We expect a softer 1H23 as economic conditions soften and hiring decisions to get delayed. Recovery in 2H23 will come from the re-opening and normalization of activities in China. We lowered our FY23e PATMI forecast by 6%. Our BUY recommendation is maintained but we have lowered our target price to S$0.98 (prev. S$1.18), 12x PE FY23e ex-cash.

Oversea-Chinese Banking Corp Ltd – Lower fee and insurance income offset NII growth

Recommendation: Buy (Maintained), Last done: S$12.67

TP: S$14.96, Analyst: Glenn Thum

– 4Q22 earnings of S$1.31bn were below our estimates. It came from lower fee and insurance income offset by higher net interest income. FY22 PATMI was 89% of our FY22e forecast. 4Q22 DPS was up 43% YoY to 40 cents; full-year FY22 dividend rose 28% YoY to 68 cents.

– NII grew 60% YoY underpinned by loan growth of 2% YoY and NIM surging 79bps YoY to 2.31%. Total non-interest income dipped 42% YoY due to lower fee and insurance income. Allowances stable YoY at S$314mn.

– Maintain BUY with a higher target price of S$14.96 (prev. S$14.22). We lower FY23e earnings by 8% as we lower NII but increase fee income estimates for FY23e. We assume 1.29x FY22e P/BV and ROE estimate of 10.8% in our GGM valuation. Catalysts include continued interest income growth and fee income recovery as economic conditions improve. OCBC is our preferred pick among the three banks due to attractive valuations and yield of 5.4%, huge dividend buffer from the 15.2% CET 1, and fee income recovery from China’s reopening.

United Overseas Bank Limited – Rise in NII offset by higher allowances

United Overseas Bank Limited – Rise in NII offset by higher allowances

Recommendation: Buy (Maintained), Last done: S$29.85

TP: S$35.70, Analyst: Glenn Thum

– 4Q22 adjusted earnings of S$1,398mn were slightly below our estimates due to lower fee income and higher allowances offset by NII growth. FY22 adjusted PATMI was 96% of our FY22e forecast. 4Q22 DPS was up 25% YoY to 75 cents; full-year FY22 dividend rose 13% YoY to 135 cents.

– 4Q22 NII was up 53% YoY from a NIM increase of 66bps YoY to 2.22% and loan growth of 3% YoY. Fee income fell 16% YoY due to lower WM and loan-related fees, while other non-interest income was up 61% YoY. Management is guiding mid-single digit loan growth with higher NIM of 2.2%, double-digit fee income growth, stable cost-to-income ratio and stable credit costs for FY23e.

– Maintain BUY with an unchanged target price of S$35.70. We raise FY23e earnings by 3% as we increase NII and fee income estimates for FY23e. We assume 1.48x FY23e P/BV and ROE estimate of 12.9% in our GGM valuation. Continued NIM and NII improvement and fee income recovery will boost earnings.

Venture Corporation Ltd – Outlook starting to dim

Recommendation: ACCUMULATE (Downgraded); TP S$19.70, Last close: S$18.17; Analyst Paul Chew

– FY22 results were within expectations. Revenue and PATMI were 102%/97% of our FY22e forecast. 4Q22 PAT rose 3.4% YoY. Gross margin was the weakest in seven years.

– There was caution in the company’s outlook. The environment in the short term is uncertain. Healthcare, life science and semiconductor sectors are the medium-term opportunities with their long product cycles.

– We lower our FY23e PATMI by 9% to S$359mn and downgrade our recommendation from BUY to ACCUMULATE. Our target price is lowered to S$19.70 (prev. S$20.80), 16x PE FY23e. The macro backdrop for electronic exports has declined significantly and the global economy slowing.

SATS Ltd – Launched $800mn rights issue

Recommendation: NEUTRAL (Maintained), Last Done: S$2.80

Target price: S$2.92, Analyst: Terence Chua

– 9M23 revenue in line, at 80.7% of FY23e. Its profitability continued to recover with core PATMI excl. reliefs at -$13.7mn vs. -$33mn in the same period last year.

– SATS shareholders will be allotted rights to subscribe for 323 rights shares for every 1,000 existing shares held at the price of $2.20 per rights share, representing a 16% discount to TERP.

– Funding clarity and all necessary approvals from all jurisdictions received should lead to a re-rating of the Company post rights-issuance.

– Maintain NEUTRAL with lower target price of $2.92 (prev. $3.08). We trim FY24e earnings by 3% as we account for higher share base from a lower-than-expected rights price. Our valuation is pegged to 20x FY24e. Risks to our view include 1) Integration challenges for WFS; and 2) revenue growth continuing to lag behind expenses growth.

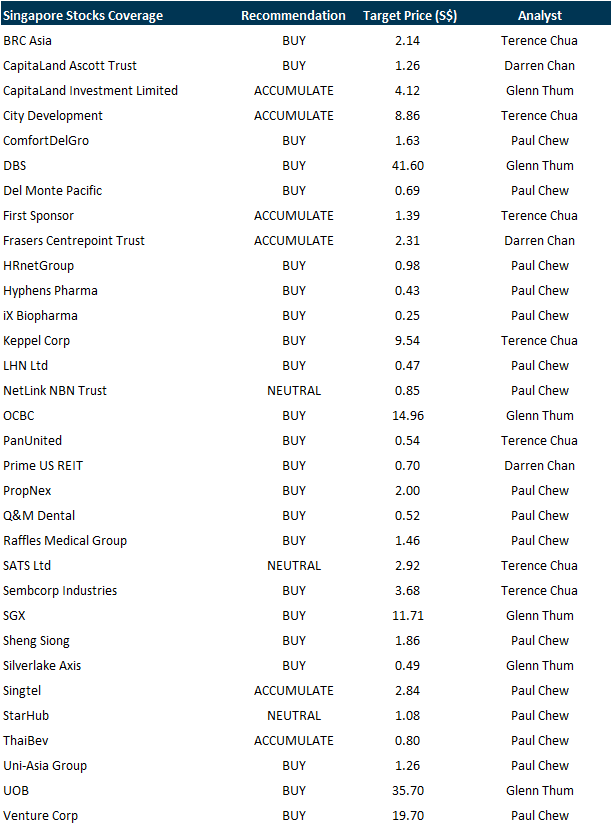

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Cromwell European REIT

Date: 28 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3xw5GYW

Guest Presentation by Enviro-Hub Holdings Ltd [NEW]

Date: 14 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3KBprpA

Guest Presentation by Luminor Financial Holdings Ltd [NEW]

Date: 15 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3kj6LjP

Guest Presentation by Meta Health Limited [NEW]

Date: 16 March 2023

Time: 3pm – 4pm

Register: https://bit.ly/41oikGX

Guest Presentation by Keppel Pacific Oak US REIT (KORE) [NEW]

Date: 23 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3XY2n7v

Research Videos

Weekly Market Outlook: Airbnb, PayPal, DBS, Silverlake Axis, Prime US REIT, BRC Asia & More…

Date: 20 February 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials