DAILY MORNING NOTE | 28 February 2023

Singapore shares closed lower on Monday (Feb 27), tracking losses on Wall Street from last week. The Singapore market fell by 0.6 per cent or 19.06 points to close at 3,263.24. On the wider bourse, losers outnumbered gainers 353 to 228 after 1.8 billion securities worth S$1.2 billion changed hands. Key indices in the region were also in the red on Monday. The Nikkei 225 lost 0.1 per cent, the Kospi fell 0.9 per cent, the Hang Seng ended 0.3 per cent lower, and the KLCI slid 0.1 per cent.

Wall Street worked to bounce back from a grim end last week as major indices closed higher on Monday while traders eye upcoming earnings of retailers. The broad-based S&P 500 finished 0.3 per cent higher at 3,982.35, while the Dow Jones Industrial Average rose 0.2 per cent to 32,889.29. The tech-rich Nasdaq Composite Index picked up 0.6 per cent to 11,466.98.

SG

Supermarket operator Sheng Siong Group on Monday (Feb 27) posted a net profit of S$65.9 million for the second half of 2022, down by 1.4 per cent from S$66.9 million for the same period in 2021. For the full year, the group posted earnings of S$133.3 million, up 0.4 per cent from S$132.8 million in 2021. The board of directors has proposed a final cash dividend of S$0.0307 per share, down from S$0.031 per share in 2021. Subject to shareholders’ approval at the annual general meeting on Apr 28, the dividend will be paid out on May 19.

Technology solutions provider CSE Global posted a profit of slightly over S$0.2 million for the second half of 2022, down from earnings of S$4.9 million in the corresponding period in 2021. The company attributed the disappointing profit figures to the restructuring of one of its business divisions in the US which led to a one-off restructuring cost of S$1.3 million, as well as a loss of S$5.9 million due to cost overruns in two projects, where the costs to execute these were under-accounted for. Revenue for H2 was up 26.2 per cent to S$295.5 million on the back of growth in project and time and material revenues across all geographic regions.

Sembcorp Marine on Monday (Feb 27) reported a net loss of S$118.3 million for the second half of 2022, significantly narrower than the loss of S$523.3 million posted for the same period in 2021. The company attributed this to higher contributions from floater and offshore platforms projects, as well as stronger contributions from its repairs and upgrades business. This was offset by lower grant income and higher tax expenses. Sembmarine said it turned Ebitda-positive (earnings before interest, taxes, depreciation and amortisation) in H2. The company had also trimmed its loss for the full 2022 to S$261.1 million from about S$1.2 billion in 2021. Sembmarine said the net loss was impacted by one-off cost increases from residual Covid-19 challenges. No dividend was declared for the period under review.

Property developer Ho Bee Land saw its earnings for the second half of 2022 fall 93 per cent to S$16 million compared to S$225 million in H2 2021. On a per-share basis, earnings for the period under review came in at S$0.0241, down from S$0.3388 for the same period in 2021. The board of directors has recommended a first and final cash dividend of S$0.08 per share, down from S$0.10 per share in 2021. Subject to shareholders’ approval at the upcoming annual general meeting on Apr 26, the dividend will be paid out on May 25.

GK Goh Holdings’ largest shareholder is considering taking the Singapore-listed company private, according to people with knowledge of the matter. GKG Investment Holdings, which owns about 63 per cent of the company, is working with financial advisers on the deal, said the people. An announcement could come as soon as Monday (Feb 27), the people said, who asked not to be identified as the process is private. Discussions are still ongoing and GKG Investment could decide against proceeding with the buyout, the people said. Representatives for GK Goh and GKG Investment didn’t immediately respond to requests for comment.

Property developer Sinarmas Land on Monday (Feb 27) reported earnings of S$216.1 million for the second half of FY2022, more than triple its net profit of S$60.1 million in the corresponding period for FY2021. This took the group’s full-year earnings to a record-high of S$343.6 million versus S$145.7 million in FY2021. Revenue for the full year also rose 48.8 per cent to another high of S$1.3 billion. Revenue for H2 was also up 54 per cent to S$824.8 million from S$535.7 million. The group said the higher revenue for FY2022 was mainly driven by higher sales of commercial and industrial land parcels in BSD City and Kota Deltamas, Indonesia, as well as higher revenue recognised from residential units and commercial shophouses.

US

US chipmaker Broadcom is set to receive an European Union (EU) antitrust warning about the possible anti-competitive effects of its proposed US$61 billion bid for cloud computing company VMware in the coming weeks, people familiar with the matter said. The European Commission opened an investigation in December, saying the deal, announced last year, would allow Broadcom to restrict competition in the market for certain hardware components which interoperate with VMware’s software. The EU competition enforcer, which will decide on the deal by Jun 7, declined to comment. Broadcom said it would continue its “constructive work” with the Commission. The deal has received the green light in Brazil, South Africa and Canada, while the UK competition watchdog is investigating the acquisition.

The US dollar slipped from a seven-week high on Monday (Feb 27), as investors took stock of last week’s strong US economic data and the outlook for global interest rates. Data on Friday showed that US consumer spending rebounded sharply in January, while inflation accelerated. Pricing in futures markers showed that traders now expect the Federal Reserve to raise interest rates to around 5.4 per cent by the middle of the year. At the beginning of February, they envisaged rates rising to a peak of just 4.9 per cent. The US dollar index, which measures the greenback against six major peers, has risen almost 3 per cent in February and is on track to snapping a four-month losing streak. It was last down 0.1 per cent at 105.05, after earlier climbing to a seven-week high of 105.36.

Oil prices inched lower in volatile trade on Monday, as a stronger dollar and fears of recession risks offset gains arising from Russia’s plans to deepen oil supply cuts. West Texas Intermediate US crude futures (WTI) traded at US$76.09 a barrel, 23 cents, or 0.3 per cent lower, while Brent crude futures were down 30 cents, or 0.36 per cent, at US$82.86 a barrel at 0411 GMT. Both benchmarks closed more than 90 cents higher on Friday.

Electric vehicle startup Fisker said Monday that it spent less money in 2022 than it had expected, and that it remains on track to begin deliveries of its Ocean SUV this spring and to build more than 40,000 vehicles in 2023. Fisker said that to date, 56 Oceans have been built at manufacturing partner Magna International’s contract-manufacturing facility in Austria. Fifteen of those were completed before year-end and are being used for testing by both Fisker and Magna, as the two companies refine the manufacturing process, test additional features, and work through regulatory approval processes in the U.S., Canada and Europe.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

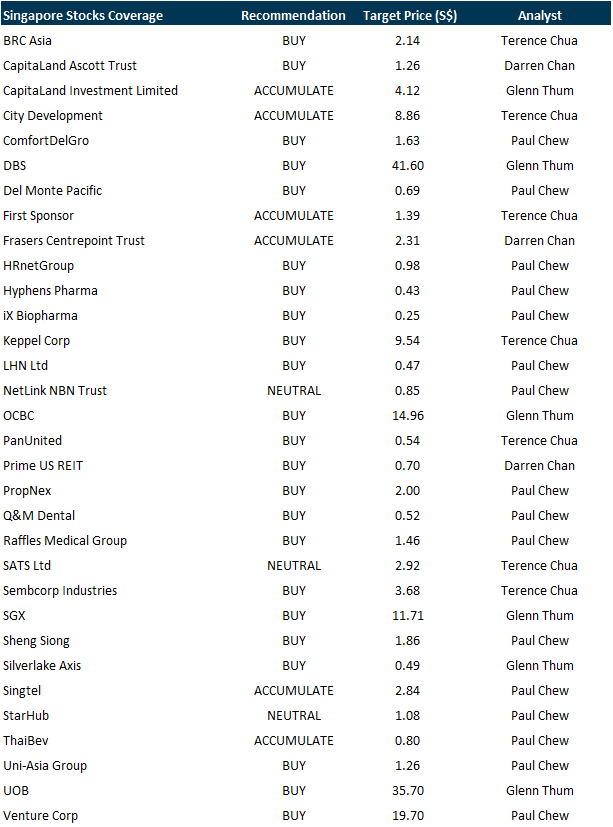

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Cromwell European REIT

Date: 28 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3xw5GYW

Guest Presentation by Enviro-Hub Holdings Ltd [NEW]

Date: 14 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3KBprpA

Guest Presentation by Luminor Financial Holdings Ltd [NEW]

Date: 15 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3kj6LjP

Guest Presentation by Meta Health Limited [NEW]

Date: 16 March 2023

Time: 3pm – 4pm

Register: https://bit.ly/41oikGX

Guest Presentation by Keppel Pacific Oak US REIT (KORE) [NEW]

Date: 23 March 2023

Time: 12pm – 1pm

Register: https://bit.ly/3XY2n7v

Research Videos

Weekly Market Outlook: UOB, OCBC, CLI, SATS, ComfortDelGro, HRnetGroup, Venture Corp, Tech Analysis

Date: 27 February 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials