DAILY MORNING NOTE | 29 November 2022

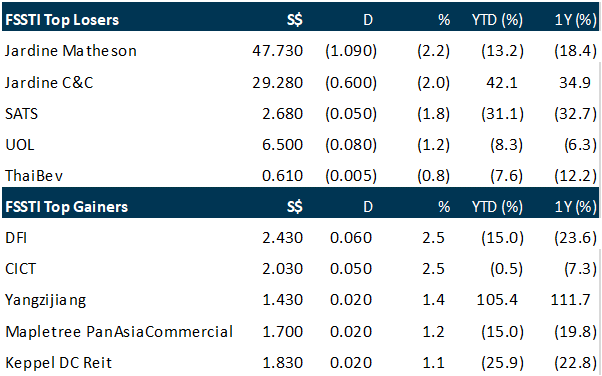

Asian equities, including Singapore shares, closed in the red on Monday (Nov 28), after a weekend of protests across China over restrictive Covid curbs dampened market sentiment. Singapore’s benchmark of 30 blue-chip stocks, the Straits Times Index (STI), was down in early trading hours but picked up over the day. Still, the index was down 4.49 points or 0.1 per cent to 3,240.06 points by the closing bell. Across the broad bourse, 316 losers against 234 gainers wrapped up the day’s trading on a turnover of one billion securities worth a total of S$889.4 million.

Wall Street stocks finished decisively lower on Monday on worries about China’s zero-Covid policy and caution ahead of key US economic data. Unhappiness over China’s strict Covid-19 restrictions has sparked a wave of nationwide protests not seen since pro-democracy rallies in 1989 were crushed, and security forces have since filled the streets of cities like Beijing and Shanghai. The unrest erupted after months of mounting frustration over tough coronavirus restrictions, pointing to public division over a hardline stance that has slowed the world’s second-biggest economy. The Dow Jones Industrial Average finished down 1.5 per cent at 33,849.46. The broad-based S&P 500 shed 1.5 per cent as well to 3,963.94, while the tech-rich Nasdaq Composite Index dropped 1.6 per cent to 11,049.50. After last week’s advance, US indices were in the red the entire day, finishing near session lows. Among individual firms, Apple fell 2.6 per cent following a report that the company’s iPhone production had been hit by unrest at a vast China factory.

SG

TLW Success’ offer to take Singapore Medical Group (SMG) private has turned unconditional. TLW Success is an investment vehicle owned by top Singapore Medical Group (SMG) executives. The total shares TLW Success and its concert parties owned, controlled or agreed to acquire, and the valid acceptances of the S$0.40 per share offer, crossed the 90 per cent threshold on Monday (Nov 28). The 444.6 million shares represented 91.4 per cent of the total number of issued shares and 90 per cent of the maximum potential number of issued shares. The offer will remain open for acceptance until 5.30 pm on Dec 19, TLW Success said on Monday. The vehicle is jointly owned in equal measure between SMG’s non-executive chairman Tony Tan Choon Keat, chief executive Beng Teck Liang and executive director Wong Seng Weng. It launched its bid to privatise SMG in September, at S$0.37 per share. This was later raised to S$0.40 per share or one new share in the offeror. The revised offer price represents some 16.8 per cent over the stock’s net asset value, and 357.1 per cent over its net tangible asset value per share as at end-December 2021.

Singapore Technologies Engineering (ST Engineering) strives to cut down on capital employed to help it lower its borrowing of S$6.8 billion, including a plan to reduce several hundreds of million of dollars in capital employed in the coming months. Chief financial officer Cedric Foo stated in a briefing on Monday (Nov 28) after the engineering heavyweight released its third-quarter market update: “And if you reduce your capital employed to run this particular size of business, you can also use it to reduce borrowing and therefore the impact on floating interest rates.” ST Engineering posted a 19 per cent rise in revenue to S$6.5 billion for the nine months ended Sep 30, compared with S$5.5 billion in the corresponding period a year earlier. It also declared an interim dividend of S$0.04 a share for the third quarter. The expected payment date is Dec 20, with books closure on Dec 7, the defence and engineering group said. The mainboard-listed firm has debts of S$6.8 billion as at end September, 54 per cent of which were on fixed rate and the remaining 46 per cent on floating rate. This is a “very balanced” approach to achieve an effective interest rate hedge and also to avoid undue speculation on interest rates movements., Foo said. He said: “Our core business is engineering and technology, and we should focus on that and try to be balanced about interest rates.” For every 25 basis-point increase in interest rate, on a sustained basis for a year, ST Engineering will need to pay S$7-8 million more in interest expense a year. But the firm’s cost of debt in the first nine months of this year was in the low 2 per cent as interest rates only started to rise in recent months. ST Engineering is working on cutting down its capital employed through these three measures: optimising net working capital, divesting non-core businesses and securitising aviation leasing assets. The firm has taken a “very active” approach to portfolio rationalisation as it reviews businesses that are non-strategic, non-core, cannot scale or have non-attractive markets, having divested or exited 15 businesses in recent years. Securitising aviation leasing assets will allow ST Engineering to be asset light, with the securitisation proceeds to be used to pay down borrowings on floating rates.

LHN Group on Monday (Nov 28) posted a 2.9 per cent rise in net profit to S$13.6 million for the six months ended Sep 30, despite a 6.9 per cent fall in revenue. The group, which has businesses in space optimisation, facilities management and logistics, saw its revenue slip to S$52.6 million following lower demand in the dormitory management business. LHN said better profitability from the residential co-living properties business helped prop up earnings. Earnings per share was 3.34 Singapore cents, compared with 3.26 cents a year ago. Share of results of associates and joint ventures jumped 157.1 per cent to S$7 million during the six months. The group recorded a fair-value gain on investment properties of S$3.6 million, compared with a S$8.9 million loss the year before. For the full year, net profit rose 63.3 per cent to S$45.8 million despite a 7.6 per cent fall in revenue to S$111.8 million. Revenue from the facilities management business, previously the largest segment, shrank 24.4 per cent. This was offset by a 39 per cent growth in co-living revenue. Share of results of associates and joint ventures also increased, growing 349.2 per cent to S$16.5 million. A fair-value gain on investment properties of S$12.3 million was recorded, compared with a S$11.6 million loss the year before. Earnings per share for the full year was 11.21 cents, compared with 6.94 cents a year ago. The board is recommending a final dividend of S$0.01 per share for the financial year, unchanged from a year ago.

US

Disney Chief Executive Officer Bob Iger said Monday during his first town hall since returning to the company that he won’t remove its hiring freeze as he reassesses its cost structure. Iger kicked off the town hall by quoting a song from the musical “Hamilton” that says “There is no more status quo. But the sun comes up and the world still spins,” according to sources who heard the town hall and asked to remain anonymous because the event was private. It was Iger’s first town hall with staff since Disney abruptly announced last week that he would replace Bob Chapek, who had been in the job for less than three years. Under Chapek, Disney faced criticism for its treatment of employees, its response to Florida’s controversial “Don’t Say Gay” legislation and its decision to take away budgetary power from creative heads. In a memo earlier this month, Chapek had announced plans for a hiring freeze, layoffs and cost cuts. Disney shares have fallen nearly 38% this year. “It felt like it was a wise thing to do in terms of the challenges, and at the moment, I don’t have any plans to change it,” Iger said Monday of the hiring freeze. Iger, 71, had repeatedly said he wouldn’t return as Disney’s CEO, but on Monday told staffers it was “an easy yes” to return to the job. He said it was the right thing for him to do because of his love for Disney and its employees. Several senior executives recently told board members they’d lost confidence in Chapek’s leadership, CNBC reported last week, prompting the company’s outreach to Iger, who previously served as Disney’s CEO for 15 years.

US crude turned positive and Brent pared losses on Monday after falling to close to their lowest levels in a year, as rumors of an Opec+ production cut offset concerns about street protests against strict Covid-19 curbs in China, the world’s biggest crude importer. Price action was volatile. US West Texas Intermediate (WTI) crude rose 76 cents, or 1 per cent, to US$77.04 at 1.58 pm ET (1858 GMT), after touching its lowest since Dec 22, 2021 at US$73.60. Brent crude also briefly turned positive, but was last down 47 cents, or 0.6 per cent, at trade at US$83.16 a barrel, having slumped more than 3 per cent to US$80.61 earlier in the session for its lowest since Jan 4, 2022. Both benchmarks, which hit 10-month lows last week, have posted three consecutive weekly declines. The Organization of the Petroleum Exporting Countries and allies including Russia, a group known as Opec+, will meet on Dec 4. In October, Opec+ agreed to reduce its output target by 2 million barrels per day through 2023. Rumours of a possible cut outweighed an earlier sell-off on the news hundreds of demonstrators and police clashed in Shanghai on Sunday night as protests over Covid-19 restrictions flared for a third day and spread to several cities. China has stuck with President Xi Jinping’s zero-Covid policy even as much of the world has lifted most restrictions.

Elon Musk said that Apple has cut back its advertising on Twitter and even threatened to withhold the social network from its app store, suggesting that a fight is brewing between the two companies. “Apple has mostly stopped advertising on Twitter,” Musk tweeted on Monday (Nov 28). “Do they hate free speech in America?” He then posted again and included the Twitter account of Apple chief executive officer Tim Cook: “What’s going on here?” A few minutes later, he claimed that Apple might boot Twitter from its app store “but won’t tell us why”. A decision by Apple to pull back on Twitter ads would be a major blow for the social network, which Musk acquired last month for US$44 billion. The iPhone maker was consistently one of the top advertisers on Twitter, which had an entire team of employees dedicated to helping maintain the relationship, according to two people familiar with the matter. Apple didn’t immediately respond to a request for comment. Despite Musk’s tweet, Twitter users said Monday that they continue to see Apple advertising in their feeds. A number of large companies have paused their ads on Twitter since Musk took over the company. The exodus included General Mills and Pfizer, and the billionaire acknowledged that the defections led to a “massive drop” in revenue. Since the takeover, he has cut thousands of jobs at Twitter, raising concerns that the platform won’t be able to combat hate speech and misinformation. A new approach to verifying accounts also opened the door to trolls impersonating major brands, as well as Musk himself. Twitter’s relationship with Apple is particularly significant because the tech giant’s app store is one of the main ways that people get on the social network. Phil Schiller, the longtime Apple executive who oversees the app store, deleted his Twitter account after Musk reinstated the account of former President Donald Trump, who had been booted from the platform in the wake of the Jan 6, 2021, attack on the US Capitol.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Upcoming Webinars

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by Sabana Industrial REIT [NEW]

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by iWoW Technology [NEW]

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: Sea Ltd, Silverlake Axis, Q&M Dental, ComfortDelgro, APTT, Tech Analysis…

Date: 21 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials