DAILY MORNING NOTE | 3 August 2022

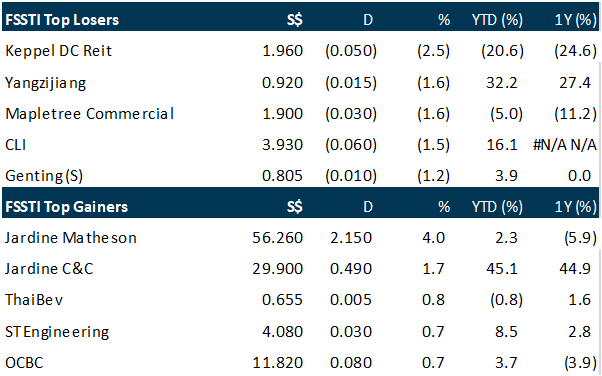

United States House of Representatives Speaker Nancy Pelosi’s possible trip to Taiwan stoked geopolitical tensions and stirred regional markets on Tuesday (Aug 2), but Singapore’s was one of those few – though barely – that shrugged off the concerns. Should Pelosi make the trip – a move that mainland China has threatened with repercussions and is expected to carry out military response in Taiwan vicinity – she would be the highest-ranking US official to set foot on the self-ruled island in 25 years. This caused bourses in the region, especially those in North Asia, to feel the heat. Key markets in North Asia dipped by as much as 2.36 per cent. In contrast, Singapore’s Straits Times Index (STI) , the 30-stock benchmark, was 0.4 points or 0.01 per cent higher at 3239.15 points. While it notched gains, the index has had the majority of its stocks in the red, with only 7 finished higher and three closed flat. Decliners beat gainers 297 to 193 in the broader market on a turnover of 1.4 billion with a total value of S$911.6 million.

Wall Street stocks finished Tuesday’s volatile session lower following more hawkish comments from US central bankers and as jittery investors monitored China’s response to House Speaker Nancy Pelosi’s visit to Taiwan. The yield on the 10-year US Treasury note rose sharply following comments from Cleveland Federal Reserve Bank President Loretta Mester and other central bankers that continued to vow aggressive interest rate hikes to counter inflation. Despite Fed Chair Jerome Powell last week taking a hardline on rising prices, after announcing the second consecutive three-quarter-point increase in the benchmark borrowing rate, weak economic data raised investors’ hopes that policymakers would start to dial back their inflation-fighting campaign. But recent remarks “have been more hawkish than what’s baked into consensus assumptions,” said Art Hogan, chief market strategist at B Riley Wealth Management. Meanwhile, markets carefully monitored Pelosi’s movements as she landed uneventfully in Taiwan. But China’s military said it was on “high alert” and would “launch a series of targeted military actions in response” to the US lawmaker’s visit. The Dow Jones Industrial Average dropped 1.2 per cent to end the day at 32,396.17. The broad-based S&P 500 shed 0.7 per cent to close at 4,091.19, while the tech-rich Nasdaq Composite Index declined 0.2 per cent to 12,348.76.

SG

Singtel’s joint-venture company, PT Telekomunikasi Selular (Telkomsel), has entered into a sale-and-purchase agreement for the sale of 6,000 more telecommunication towers to PT Dayamitra Telekomunikasi (Mitratel). Singtel has a 35 per cent stake in Telkomsel, an Indonesian telecommunications operator. Mitratel is a subsidiary of PT Telkom Indonesia, which provides and manages telecommunication towers. It has managed nearly 35,000 telecommunication towers across Indonesia. Telkomsel previously sold as many as 6,050 telecommunication towers and 4,000 towers to Mitratel in 2020 and 2021 respectively. Including this latest divestment, which was announced in a bourse filing on Tuesday (Aug 2), 16,050 units of telecommunication towers have been sold to Mitratel in total. As part of the agreement, Mitratel will also deploy Telkomsel’s Internet of Things and data analytics services to provide real-time management of the towers and “proactive” optimisation of power consumption. This will contribute to the reduction of carbon emissions and footprint, and demonstrate Telkomsel’s commitment to environmental, social, and governance initiatives, said Telkomsel. The agreement between Telkomsel and Mitratel is also expected to “strengthen the momentum” of both companies in the creation of asset management, as well as in the expansion of business lines to encourage company performance growth.

TalkMed Group reported a 12.2 per cent increase in net profit for its first half ended Jun 30, 2022 on the back of higher revenue. In a bourse filing on Tuesday (Aug 2), the mainboard-listed company said that net profit for the 6-month period rose to S$12.1 million from S$10.8 million in the year ago period. Earnings per share improved from S$0.0082 to S$0.0092. The board declared an interim cash dividend of S$0.015 per share, up from S$0.007 per share in the year-ago period. The dividend will be paid on Aug 22. Revenue for H1 2022 rose 12.5 per cent to S$32.5 million. TalkMed noted that the lifting of Covid-19 travel restrictions in April 2022 has resulted in an increase in the number of patient visits compared to the same corresponding period last year. Oncology services accounted for S$31.3 million in revenue, while cellular and gene therapy related product and services made up the remainder. TalkMed said it is “cautiously hopeful for the good performances to continue during the second half of 2022”, barring any unforeseen circumstances.

BRC Asia recorded a S$20.4 million net profit for Q3 ended Jun 30, 2022, double its S$10.2 million net profit in the year before. Revenue for the quarter rose to S$515.3 million, up from S$340.2 million a year ago, the company said in a business update. BRC’s order book was about S$1.1 billion as of end-June. The company’s net profit for the 9 months ended Jun 30 stood at S$60.2 million, more than double the S$29.3 million the year before. Its revenue for the same period rose to S$1.3 billion from S$832.9 million year on year. BRC noted that the local construction sector grew 3.8 per cent in the second quarter, “faster” than the 1.8 per cent expansion in the preceding quarter. This was in part due to the relaxation of border restrictions on the inflow of migrant workers, it added. It pointed out that construction site activity levels were “adversely” affected during the quarter due to 2 “transient” issues: a safety time-out from May 9 due to the rising number of workplace fatalities, and a spate of stop-work orders as a result of the high number of dengue cases, which impeded project progress. Said BRC: “Be that as it may, with the ending of government Covid-19 support measures for the local construction industry and a rising-interest-rate environment, we are of the view that credit risk remains elevated in the local construction industry.” It added that “persistently high” input costs should continue to pose “significant” challenges to businesses in this sector. On the other hand, BRC noted that construction order books island-wide have remained “robust on the back of strong demand” for public housing and infrastructure projects, as Singapore continues to emerge from the Covid-19 pandemic. “This bodes well for the demand for reinforcing steel and BRC, which are an integral part of the local construction supply chain,” it said.

US

Oil futures edged up less than 1 per cent on Tuesday ahead of a meeting of Opec+ producers this week that may not lead to a further boost in crude supply amid concerns a possible global recession could limit energy demand. Brent futures rose 51 cents, or 0.5 per cent, to settle at US$100.54 a barrel, while US West Texas Intermediate (WTI) crude rose 53 cents, or 0.6 per cent, to settle at US$94.42. Also giving oil prices a slight lift were analyst expectations that US crude inventories declined by around 600,000 barrels last week. The American Petroleum Institute (API), an industry group, will issue its US inventory report at 4.30 pm EDT (2030 GMT). The US Energy Information Administration (EIA) reports at 10.30 am EDT (1430 GMT) on Wednesday. The Organization of the Petroleum Exporting Countries and allies including Russia, known as Opec+, meet on Wednesday.

The United States is considering limiting shipments of American chipmaking equipment to memory chip makers in China including Yangtze Memory Technologies Co (YMTC), according to 4 people familiar with the matter, part of a bid to halt China’s semiconductor sector advances and protect US companies. If President Joe Biden’s administration proceeds with the move, it could also hurt South Korean memory chip juggernauts Samsung Electronics and SK Hynix, the sources said, speaking on condition of anonymity. Samsung has 2 big factories in China while SK Hynix is buying Intel’s NAND flash memory chips manufacturing business in China. The crackdown, if approved, would involve barring the shipment of US chipmaking equipment to factories in China that manufacture advanced NAND chips. It would mark the first US bid through export controls to target Chinese production of memory chips without specialised military applications, representing a more expansive view of American national security, according to export control experts. The move also would seek to protect the only US memory chip producers, Western Digital and Micron Technology, which together represent about a quarter of the NAND chips market. NAND chips store data in devices such as smartphones and personal computers and at data centres for the likes of Amazon, Facebook and Google. How many gigabytes of data a phone or laptop can hold is determined by how many NAND chips it includes and how advanced they are. Under the action being considered, US officials would ban the export of tools to China used to make NAND chips with more than 128 layers, according to 2 of the sources. LAM Research and Applied Materials, both based in Silicon Valley, are the primary suppliers of such tools.

Activision Blizzard, the biggest US video game publisher, reported revenue that beat analysts’ estimates, but adjusted sales declined 15 per cent from a year ago due to a soft Call of Duty launch last fall and a slow year for the gaming industry overall. Activision, which is in the process of being acquired by Microsoft, brought in adjusted revenue in the second quarter of US$1.64 billion, compared with the average analyst’s projection for US$1.6 billion. Adjusted revenue excludes deferred sales from online purchases. Adjusted earnings per share were 47 US cents, almost 50 per cent lower than a year earlier and slightly below analysts’ estimates, according to data compiled by Bloomberg. Last fall’s Call of Duty Vanguard, which Activision said hasn’t performed as well as anticipated, has had a ripple effect on the company’s fiscal year. The game received negative reviews and faced stiff competition from new entries in the popular Halo and Battlefield series. During the second quarter, Activision’s Blizzard division released Diablo Immortal, a new mobile entry in the action series. Activision’s Chinese partner NetEase delayed Diablo Immortal’s launch in the world’s biggest mobile app market by about a month, saying it needed additional time. It was finally released on Jul 25. Activision didn’t give revenue figures for the new Diablo game on Monday (Aug 1). The video game industry has faced a sluggish year as it deals with hardware supply chain issues affecting consoles, inflation and a lack of big hits. Interest in gaming has also cooled off as pandemic stay-at-home orders lifted and people resumed outside interests and activities. Spending in the video game industry is expected to drop 8.7 per cent this year, according to a report from the analytics firm NPD Group.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Raffles Medical Group Ltd. – Huge earnings beat from foreign patients and electives

Recommendation: BUY (Upgraded); TP: S$1.46 (prev. S$1.27)

Last Done: S$1.23; Analyst: Paul Chew

• 1H22 revenue/PATMI beat our estimates at 60%/95% of our FY22e forecast. 1H22 PATMI rose 51% YoY to $60mn. Earnings beat came from the recovery in foreign patients, return of elective treatments and more resilient COVID-19 related revenue.

• Revenue in China rose 5%, driven by Chongqing hospital, while Shanghai was negatively impacted by a two-month lock-down in 1H22. Raffles has also received approval to set up an In-Vitro Fertilisation centre in Hainan, to be operational in 1Q23.

• We raised our FY22e earnings earning by 60% to S$100mn. The uncertainty and lack of visibility in COVID-19-related services will cause the largest swing in our forecast. The major earnings drivers in 2H22 will be foreign patients, elective surgeries from local patients, increased visits at the GP clinics and higher prices. Weakness will come from lower COVID-19 testing and vaccination and fewer patients in a community treatment facility (CTF). With the increased earnings, our DCF is raised from S$1.27 to S$1.46. We also raised our discount rate to 7.5% from higher risk-free assumptions. Our recommendation is raised from NEUTRAL to BUY.

Upcoming Webinars

Guest Presentation by SATS [NEW]

Date: 4 August 2022

Time: 2.30pm – 3.30pm

Register: https://bit.ly/3IXysX5

Guest Presentation by Prime US REIT

Date: 4 August 2022

Time: 3.30pm – 4.30pm

Register: https://bit.ly/3uYlNgS

Guest Presentation by Pan-United Corporation Limited

Date: 5 August 2022

Time: 11am – 12pm

Register: https://bit.ly/3OFbJ41

Guest Presentation by A-Sonic Group

Date: 11 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3PmoIrl

Guest Presentation by Marathon Digital Holdings

Date: 18 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by First REIT

Date: 18 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3BqQe3q

Guest Presentation by Audience Analytics

Date: 23 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3P3eBYR

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Research Videos

Weekly Market Outlook: Microsoft, Meta Platforms, Alphabet Inc, UOB, Keppel Corp, Sheng Siong & More

Date: 1 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials