DAILY MORNING NOTE | 3 January 2023

Weekly 1 Equity Strategy: We expect a quiet week. The release of US December payrolls (est. +175k) and wage data (+5% YoY) on Friday may trigger some activity only if it exceeds expectations meaningfully. The base case for most investors in 2023 is slower growth and subdued inflation. The absence any major macro shock leaves little for the market to trade outside this base case. Thematically, we expect value stocks to outperform again in 2023. With growth subdued and rates high, investors would rather own defensive, lower PE and higher dividend yield names, in our opinion.

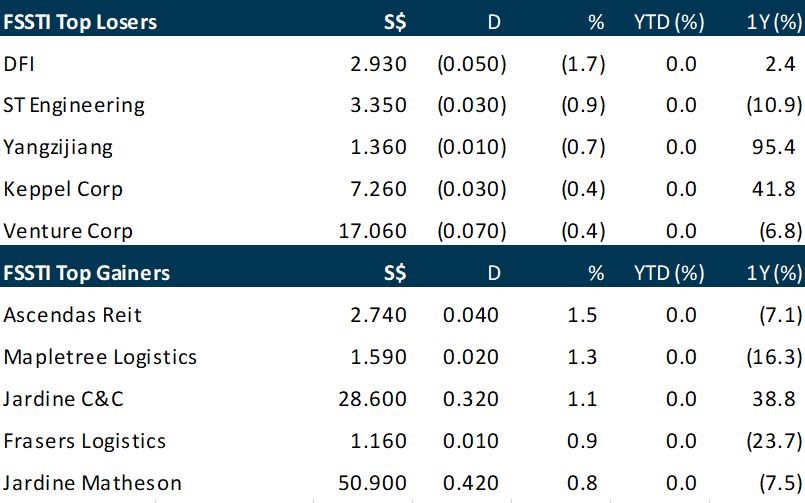

Singapore stocks finished the last trading day of 2022 largely unchanged, as traders chose to tread with caution. The Straits Times Index inched up just about 0.1 per cent or 2.08 points to cap Friday (Dec 30) at 3,251.32. Liquidity was also thin on the local bourse. Daily turnover came in at about 711 million securities worth a total of just S$536.7 million, with advancers outnumbering decliners 281 to 206. Jardine Matheson Holdings was the top gainer by value, adding 0.8 per cent or US$0.42 to US$50.90. Property players like Bukit Sembawang, City Developments, Ho Bee Land and Hotel Properties were also among the biggest gainers of the day. On the other hand, Japfa was the biggest loser on the bourse after the company spun off its dairy business in a listing on the Hong Kong Exchange. The counter crashed 35.5 per cent or S$0.19 to S$0.345. Nio was another one of the biggest losers, shedding 1.3 per cent or US$0.13 to US$10.11. Sembcorp Marine was the most heavily traded counter for the day, with some 66.7 million shares changing hands. The stock lost 0.7 per cent or S$0.001 to close at S$0.138.

Wall Street stocks marked a gloomy end to 2022 on Friday (Dec 30), slumping to close lower in their worst annual showing in years. Surging inflation and steep interest rate hikes to cool demand have battered markets and investor sentiment this year, on top of global shocks like Russia’s invasion of Ukraine. Key US indices saw their poorest performances since 2008, with the S&P 500 and Nasdaq both seeing double-digit drops over the past year. The Dow Jones Industrial Average shed 0.2 per cent to 33,147.25, while the broad-based S&P 500 lost 0.3 per cent to 3,839.50. The tech-rich Nasdaq Composite Index dropped 0.1 per cent to 10,466.48 after bigger losses earlier in the day. For the year, the S&P 500 posted a 19% decline, its biggest pullback since 2008. The Dow industrials dropped 8.8% and the Nasdaq slid 33%.

SG

Singapore’s GIC remained the most active state-owned investor (SOI) for the fourth year in a row in 2022, according to sovereign wealth fund (SWF) tracker Global SWF in a report released on Sunday (Jan 1). GIC completed 72 deals worth US$40.3 billion, up 17 per cent from a year earlier. Over half the capital was invested in real estate, with a “clear bias” towards logistics, the report said. Global SWF noted that there was a high level of activity among SWFs in 2022, with US$261.1 billion invested in 747 deals. The amount invested was 13.6 per cent more than in 2021. For the first time, however, assets managed by the world’s SWFs and public pension funds (PPF) declined. Global SWF estimates that assets under management (AUM) of SWFs fell 7.8 per cent to US$10.6 trillion as of end-December 2022, while the AUM of PPFs fell 5.9 per cent to US$20.8 trillion. “The major challenge of 2022 was the simultaneous and significant (more than 10 per cent) correction of bonds and stocks, which had not happened in 50 years,” the report said. Global SWF also observed increased interest and allocation of sovereign investors into hedge funds. The average allocation of sovereign investors to hedge funds is estimated to have reached an all-time high of 2 per cent – significantly beating the previous high of 1 per cent reached in 2009. The largest allocations were made by Abu Dhabi Investment Authority, China Investment Corporation and Kuwait Investment Authority. Another major trend the report identified was the re-emergence of mega-deals, defined as investments of US$1 billion or more. Temasek Holdings’ acquisition of UK-based testing company Element and GIC’s acquisition of real estate investment trust Store Capital, alongside private equity firm Oak Street, were the second and third-largest transactions made by SWFs ever. The deals were valued at US$7 billion each.

Market watchers had pointed to China’s strict zero-Covid stance as a key dampener on the Singapore-listed real estate investment trusts (S-Reits) with exposure to the world’s second largest economy. But S-Reit investors anticipating the overhang to be lifted along with the Covid-19 curbs are likely to be disappointed. Market reaction to China’s reopening plans has been surprisingly muted. Since Beijing announced the nationwide loosening of Covid restrictions on Dec 7, 2022, the price performance of the five China pure-play S-Reits — CapitaLand China Trust (CLCT), Sasseur Reit, Dasin Retail Trust, BHG Retail Reit and EC World Reit (ECW) — has not been inspiring. Of these China-focused real estate investment trusts (Reits), only one — Dasin Retail Trust — is trading higher since the initial announcement on China’s reopening. This comes as some relief to the property trust, which was trading at an 80 per cent discount to net asset value (NAV) earlier in the month. Units of fellow retail mall landlord Sasseur Reit, however, retreated 3.8 per cent or S$0.03 to S$0.755 despite the positive news. Even CLCT, the largest China-focused S-Reit, failed to generate any excitement among investors. Meanwhile, the performance of four other S-Reits with exposure to China — Mapletree Logistics Trust (MLT), CapitaLand Ascott Trust (Clas), Mapletree Pan Asia Commercial Trust (MPACT) and OUE Commercial Reit (OUE C-Reit) — has also been mixed. Clas gained 7.1 per cent or S$0.07 to close at S$1.05. With serviced residences, hotels, rental housing and student accommodation assets under its belt, the hospitality Reit is seen as one of the potential key beneficiaries of the reopening theme. However, MPACT, MLT and OUE C-Reit saw their unit prices fall between 1.8 and 6.9 per cent.

US

The US dollar edged up on Monday (Jan 2), pulling away from recent six-month lows against a basket of major currencies. The US currency has weakened as markets bet a Federal Reserve tightening cycle may be nearing an end. Sentiment remained fragile and the first trading day of the year was subdued, with many countries, including big trading centres such as Britain and Japan, closed for a holiday. The dollar index, which measures the value of the greenback against a basket of major currencies, rose by around 0.14 per cent to 103.63 – off roughly six-month lows hit last week at around 103.38. The euro slipped by about a third of a percent to US$1.0683, but was not far from its highest levels since June. Sterling was down 0.35 per cent at US$1.2051. Against the yen, the dollar fell 0.25 per cent to 130.76, having hit its lowest levels since August last month. Having raised rates by a total of 425 basis points since March to curb surging inflation, the Fed has started to slow the pace of hikes. That Fed tightening helped lift the dollar index 8 per cent last year in its biggest annual jump since 2015. Markets remain focused on central banks and inflation, as well as signals of how long and deep a recession might be. Data from China showed factory activity shrank for the third straight month in December and at the sharpest pace in nearly three years. But a downturn in eurozone manufacturing activity has likely passed its trough as supply chains recover and inflationary pressures ease, a survey showed on Monday. S&P Global’s final manufacturing Purchasing Managers’ Index bounced to 47.8 in December from November’s 47.1, matching a preliminary reading but still below the 50 mark separating growth from contraction.

Tesla Inc. delivered fewer vehicles in 2022 than it initially targeted, capping a year during which the stock suffered its worst annual performance as demand appeared to soften and Covid-related production disruptions persisted. Elon Musk‘s electric-vehicle maker said Monday that it delivered about 1.31 million vehicles last year, up roughly 40% from 2021. The company would have needed to hand over more than 1.4 million vehicles to meet its initial goal of increasing deliveries by 50% or more. Tesla signaled in October that it likely would come up short of its target, Wall Street had moderated its delivery expectations. Tesla still fell short of a lowered Wall Street forecast of around 1.34 million deliveries for 2022. Tesla said in a news release that changes in how the company produces cars and distributes them to customers left more vehicles in transit to their final destination at year-end. Tesla endured a challenging year, losing about $675 billion in market valuation as its share price fell 65%. The company idled its car factory in Shanghai on multiple occasions, early on because of local pandemic restrictions, then again in December as it faced a wave of Covid-19 infections among workers and suppliers. Mr. Musk suggested last month that the higher interest-rate environment was hurting vehicle demand. In a year-end sales push, Tesla offered discounts to many buyers who agreed to take delivery of vehicles before January. Although Tesla’s annual growth slowed in 2022, the company’s fourth-quarter deliveries marked a new quarterly high. The company produced 1.37 million vehicles in 2022, up 47% from a year earlier.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

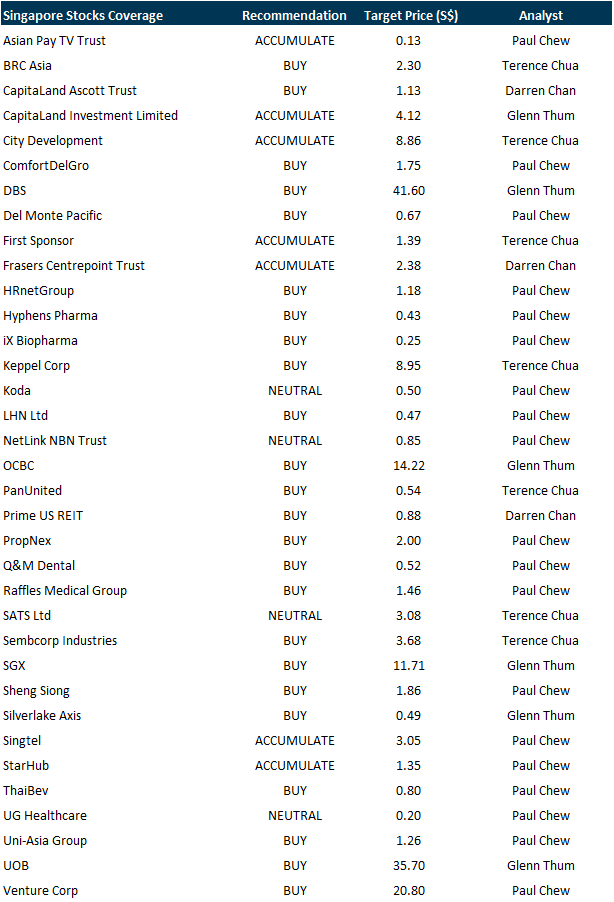

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Research Videos

Weekly Market Outlook: SGX, DelMonte, LHN, Zoom, City Developments, Zoom, Starhub, SG Weekly & More!

Date: 12 December 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials