DAILY MORNING NOTE | 30 January 2023

Week 5 Equity Strategy: A busy week ahead with several major events. Most of Big tech will be releasing results together with a Fed rate decision. We are not expecting upside surprises in big tech earnings due to currency headwinds similar to Microsoft. We expect the current Fed pause or mini-goldilocks equity rally to continue this week. The Fed should be hiking the interest rate by 25 bps on 1 February. Speeches by key FOMC members Brainard and Williams signal no pushback to market expectations. Slowing rate hikes is a signal that a pause is approaching. However, we do worry that forward guidance by Powell may keep markets on edge. REITs can outperform as investors search for yield with interest rates peaking.

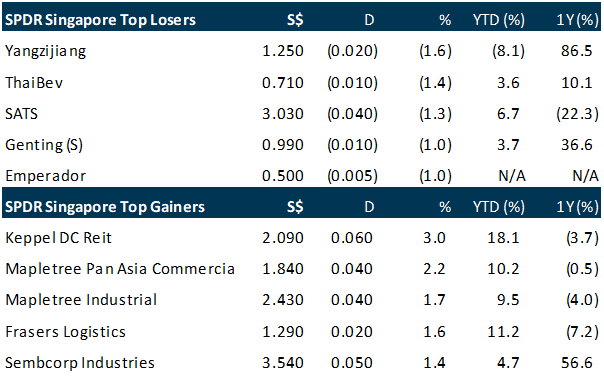

Singapore stocks rose for a fourth consecutive day on Friday (Jan 27), ending the week higher amid a broader rally across the region. The benchmark Straits Times Index (STI) rose 0.5 per cent or 17.02 points to close at 3,394.21. Over the trading week, the market barometer gained around 3.1 per cent or 100.5 points. Real estate investment trusts (Reits) led Friday’s gains, making up four of the five top-performing STI counters. Keppel DC Reit topped the index performance table, climbing 3 per cent or S$0.06 to S$2.09. It was also the top performer for the week, with its units rising 8.3 per cent since last Friday’s close. Meanwhile, Yangzijiang Shipbuilding was the worst STI performer on Friday, slipping 1.6 per cent or S$0.02 to S$1.25. Across the broader market, gainers outnumbered losers 335 to 222 after 1.6 billion securities worth S$1.4 billion were traded.

Wall Street advanced on Friday (Jan 27), marking the end of a rocky week in which economic data and corporate earnings guidance hinted at softening demand but also economic resiliency ahead of next week’s Federal Reserve monetary policy meeting. So far in the early weeks of 2023, the Nasdaq has jumped 11 per cent, while the S&P 500 and the Dow have gained 6 per cent and 2.5 per cent, respectively. The Dow Jones Industrial Average rose 28.67 points or 0.08 per cent to 33,978.08, the S&P 500 gained 10.13 points or 0.25 per cent to 4,070.56 and the Nasdaq Composite added 109.3 points or 0.95 per cent to 11,621.71. Among the 11 major sectors of the S&P 500, consumer discretionary led the percentage gainers, while energy suffered the largest percentage loss, down 2 per cent.

SG

Singapore’s sale of 12-month Treasury bills drew record demand for the maturity as investors sought to lock in higher yields amid speculation they may be close to peaking. The city state’s sale of $3.6 billion of securities due January 2024 drew total bids of $10.5 billion, an all-time high in data from the Monetary Authority of Singapore starting in 1987. They were sold at an average yield of 3.53%, the highest since 1992, and up from 3.28% at the prior sale in October. While yields have been rising at recent bill sales, they are still below the rate of inflation. Singapore’s core inflation rate held at 5.1% in December from a year earlier, according to a government report published Wednesday. That’s just short of the 5.3% pace reported in September, which was the highest since November 2008.

The pace of property price increases in the last quarter has slowed and sales volume is down after fresh cooling measures kicked in last year, but the government will continue to watch prices and borrowing, said Deputy Prime Minister Heng Swee Keat. “We must guard against a sustained increase in prices that is not backed by income and other fundamentals. Left unchecked, this could impair affordability and lead to a destabilising correction later on,” said Heng, who was speaking at the spring festival celebration of the Real Estate Developers’ Association of Singapore (Redas) on Friday (Jan 27). Latest official data released on Friday showed private residential prices were up by 8.6 per cent in 2022, slowing slightly from the 10.6 per cent rise in 2021. The increase in resale prices of Housing and Development Board (HDB) flats similarly flattened, rising 10.4 per cent in 2022, compared to 12.7 per cent in the year before. In 2022, more than 23,000 public housing flats were launched, and this year, up to 23,000 more will be launched. In the private residential market, the government has also ramped up supply through its state land sales programme, adding 6,300 units last year, with another 4,100 units in the pipeline in the first half of 2023 alone, Heng noted.

A new cash-advance scheme by ride-hailing service Grab has stoked conversations on whether such a lending product is beneficial to gig workers or could put them at risk of running up debts. The scheme comes four years after the company launched a similar product and then scrapped it. Grab rolled out the new scheme, called the Partner Cash Advance service, in December 2022. It invites eligible drivers and delivery riders to apply for cash advances of between S$1,000 and S$10,000. A one-time admin fee is charged upfront and the net amount disbursed is repaid weekly, over three to nine months. Grab has not widely publicised the scheme, but word of it got out on social media. A screenshot posted on a Facebook group indicated that a driver could apply for a S$5,000 cash advance from Grab payable over six months, with a S$450 admin fee at 9 per cent of the gross sum. He would have to repay about S$192 every week, with the sum automatically deducted from his in-app wallet.

Keppel Reit secured positive rental reversions of 23.4 per cent for its office assets in Singapore’s central business district (CBD) in the fourth quarter of 2022, bringing its portfolio’s reversions for the full year to 10 per cent, its head of asset management Rodney Yeo said. Speaking in an earnings call on Friday (Jan 27) after the real estate investment trust (Reit) posted a 1.7 per cent increase in distribution per unit (DPU) to S$0.0592 for FY2022 ended Dec 31, he said the Reit now expects reversions in the “mid to higher single digits” for leases expiring in 2023. In its latest financials, the Reit reported that FY2022’s rise in DPU was driven by an increase in net property income (NPI), which rose 2 per cent to S$158.9 million from S$155.8 million a year prior. The NPI performance was due to a full year of contribution from Keppel Bay Tower, a Singapore property which it acquired in May 2021, as well as higher NPI from Ocean Financial Centre in Singapore and Pinnacle Office Park in Sydney. However, this was offset by the divestment of Brisbane’s 275 George Street in July 2021, and lower NPI from Melbourne’s Victoria Police Centre and Seoul’s T Tower due to weak exchange rates. The higher NPI for FY2022, coupled with the anniversary distribution of S$100 million, resulted in a 4.1 per cent increase in distribution to unitholders to S$220.9 million.

US

The US has secured a deal with the Netherlands and Japan to restrict exports of some advanced chipmaking machinery to China in talks that concluded on Friday (Jan 27), Bloomberg reported, citing people familiar with the matter. The agreement would extend some export controls the US adopted in October to companies based in the two allied nations, including ASML Holding, Nikon and Tokyo Electron, the report said. Officials from the Netherlands and Japan were in Washington discussing a wide range of issues in talks led by White House national security adviser Jake Sullivan. Getting the Netherlands and Japan to impose tighter export controls on China would be a major diplomatic win for President Joe Biden’s administration, which in October announced sweeping restrictions on Beijing’s access to US chipmaking technology to slow its technological and military advances.

US consumer spending fell for a second straight month in December, putting the economy on a lower growth path heading into 2023, while inflation continued to subside, which could give the Federal Reserve room to further slow the pace of its interest rate hikes next week. The report from the Commerce Department on Friday (Jan 27) also showed the smallest gain in personal income in eight months, in part reflecting moderate wage growth, which does not bode well for consumer spending. Though the drop in spending was mostly in the goods sector, services outlays essentially stalled. Consumer spending, which accounts for more than two-thirds of US economic activity, dropped 0.2 per cent last month. Data for November was revised lower to show spending slipping 0.1 per cent instead of gaining 0.1 per cent as previously reported. Economists polled by Reuters had forecast consumer spending dipping 0.1 per cent.

The personal consumption expenditures (PCE) price index edged up 0.1 per cent last month after rising by the same margin in November. In the 12 months through December, the PCE price index increased 5 per cent. That was the smallest year-on-year gain since September 2021 and followed a 5.5 per cent advance in November. Excluding the volatile food and energy components, the PCE price index gained 0.3 per cent after climbing 0.2 per cent in November. The so-called core PCE price index rose 4.4 per cent on a year-on-year basis in December, the smallest advance since October 2021, after increasing 4.7 per cent in November. The Fed tracks the PCE price indexes for monetary policy. Other inflation measures have also slowed down significantly.

Britain’s soaring wage inflation is likely to push the Bank of England (BOE) to another sharp increase in interest rates this week. Investors and economists expect the UK central bank to raise its key rate a half point to 4 per cent on Thursday (Feb 2). That would mark the highest since 2008 and the quickest string of hikes in three decades. The move will deliver more pain for households already struggling with the tightest cost-of-living squeeze in memory. More than one million public sector workers are set to walk off the job this week in protest that their wages are not keeping up with inflation, which rocketed to a 41-year high last year. Policymakers led by BOE governor Andrew Bailey are concerned that wages are increasing at the strongest pace on record except for the period directly after the pandemic, adding to the risk of a wage-price spiral. Officials are preparing an annual pay survey and an assessment of the supply capacity of the economy, a measure of the UK’s growth “speed limit”.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

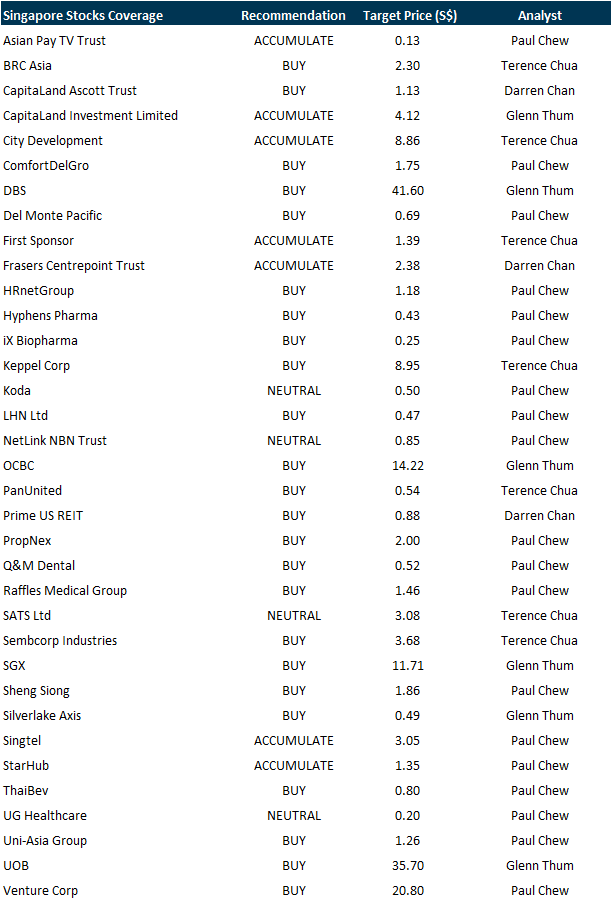

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Comba Telecom Systems Holdings Limited

Date: 31 January 2023

Time: 11am – 12pm

Register: https://bit.ly/3GuS5VK

Guest Presentation by LMS Compliance [NEW]

Date: 8 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3IX0pAr

Guest Presentation by First REIT Management Limited [NEW]

Date: 16 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3GY2tp8

Guest Presentation by Paragon REIT [NEW]

Date: 17 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3ZNn4W0

Guest Presentation by Keppel DC REIT [NEW]

Date: 17 February 2023

Time: 3pm – 4pm

Register: https://bit.ly/3CYgrGr

Research Videos

Weekly Market Outlook: Block Inc., SG Banking Monthly, Technical Analysis, US1Q23 Strategy & More

Date: 16 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials