DAILY MORNING NOTE | 30 November 2022

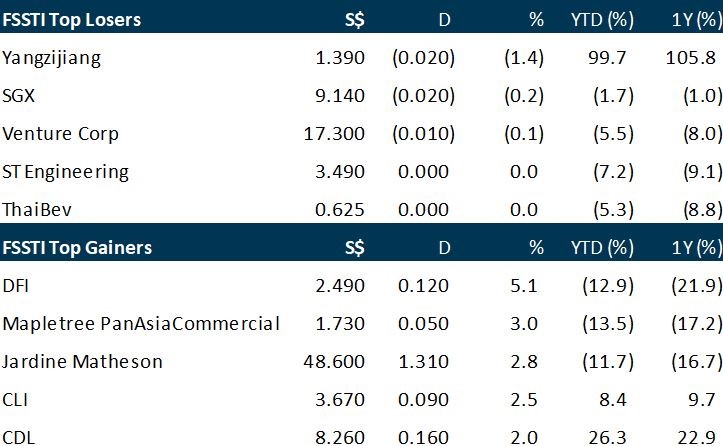

With the protests in China contained, Asian equities put up a better showing on Tuesday (Nov 29). The Singapore’s Straits Times Index (STI), for instance, jumped 1.1 per cent or 36.3 points to 3,276.36 points. The stocks that were affected by the weekend demonstrations against Covid measures in China on Monday rose in tandem on Tuesday, with news of the unrest being under control. Among the STI stocks, DFI Retail Group made the most improvement, by 5.06 per cent to US$2.49. Mapletree Pan Asia Commercial Trust clocked a 2.98 per cent increase to S$1.73 and conglomerate Jardine Matheson Holdings rose 2.77 per cent to US$48.60. These counters all have significant exposure to China, including Hong Kong. Buoying investor sentiment too was China’s lifting of a ban on property players undertaking capital fundraising, as well as some suggestions that the protests could push the government to exit its zero-Covid policy. Also, investors shrugged off the hawkish Fedspeak that the United States central bank would not pivot from its interest rate hike soon. The banking trio benefited from the Fed’s statement though; UOB, OCBC and DBS rose 1.65 per cent, 0.49 per cent and 1.45 per cent respectively to S$30.80, S$12.37 and S$34.95. Across the broader market, gainers beat decliners 339 to 203. Turnover stood at 1.1 billion securities worth S$1.27 billion. Elsewhere in Asia, the Hang Seng Index surged 5.24 per cent to 18,204.68 points, the Shanghai Composite went up 2.31 per cent to 3,149.75 points. FTSE Bursa Malaysia KLCI was, however, one of the few that closed in the red, down 0.64 per cent to 1,476.96 points.

Wall Street stocks mostly closed lower on Tuesday as markets anticipated an appearance from Federal Reserve Chair Jerome Powell that could offer clues on the direction of monetary policy. Powell’s address on Wednesday at the Brookings Institution comes as markets expect the central bank to soon moderate its policy of aggressive interest rate hikes to counter inflation. The Dow Jones Industrial Average veered into negative territory much of the day before ending essentially flat at 33,852.53. The broad-based S&P 500 slipped 0.2 per cent to 3,957.63, while the tech-rich Nasdaq Composite Index shed 0.6 per cent to 10,983.78. Consumer confidence in the United States slipped for a second straight month in November, likely due to a rise in gas prices, according to a survey released by the Conference Board. Meanwhile, the National Retail Federation estimated that 196.7 million Americans shopped in stores and online in the five-day stretch between last Thursday’s Thanksgiving and “Cyber Monday,” a better-than-expected result that highlighted the resilience of US consumers despite soaring inflation. But the group warned of a “devastating” hit if there is a freight rail strike, backing a call from President Joe Biden for Congress to intervene in the matter. Congressional leaders from both major parties expressed support for employing a rarely-used legislative power to avert a strike.

SG

Steel-solutions provider BRC Asia posted an 81 per cent rise in its net profit to S$50.4 million for its second half ended Sep 30, 2022, from S$27.9 million a year earlier. The company recorded increased sales volume and higher steel prices in the year, it said in a bourse filing on Tuesday (Nov 29). Earnings per share of the company stood at 18.36 Singapore cents for the half-year period, up from 11.46 cents the year before. Revenue for H2 rose 34 per cent to S$905.9 million, from S$675.9 million previously. A final dividend of six Singapore cents a share and a special dividend of six Singapore cents was proposed for the full year, up from the final dividend of four Singapore cents and the special dividend of four Singapore cents a year earlier. The date payable will be announced later. For the full year ended Sep 30, the company posted an unprecedented net profit of S$90.2 million, up 92 per cent from S$47 million a year earlier. Revenue rose 45 per cent on year to S$1.7 billion, an all-time high for the company, it said. The company expects a low-key start in FY2023, followed by more robust project activity levels amid strong local construction demand and more supportive labour conditions. BRC Asia’s chief executive Seah Kiin Peng expects the operating environment to be “much more challenging” amid rising costs for electricity and manpower. He noted that an increasingly competitive landscape caused by slow site progress may erode margins throughout the construction supply chain. However, he added that construction remains a fundamental building block for Singapore. With the resumption of delayed projects, Seah also expects local reinforcing steel demand to improve from the second quarter of FY2023 onwards. Shares of BRC Asia closed flat at S$1.77 on Tuesday, before the release of the results.

Seafood restaurant operator Jumbo Group has narrowed its net loss to S$91,000 for its full year ended Sep 30, 2022, from S$11.8 million a year ago. This was mainly due to an increase in revenue from its Singapore operations with the gradual easing of Covid-19 measures, said the group in a bourse filing on Tuesday (Nov 29). Revenue for FY2022 rose 41.3 per cent to S$115.6 million, from S$81.8 million a year ago. Loss per share is now at less than 0.1 Singapore cent for the full-year period, from 1.8 cents a year ago. For its second half ended Sep 30, it turned in a profit of S$4.4 million, compared to a loss of S$7.5 million a year ago. Revenue for H2 rose 81.3 per cent year on year to S$66 million, from S$36.4 million. No dividend was declared for the full year, unchanged from a year ago. Despite a strong recovery in Singapore, its core market, Jumbo said it is conserving liquidity “to support working capital requirements and carefully assessed growth investments and developments”. It said it has seen revenue and footfall reaching pre-Covid levels in some of its Singapore outlets in the final quarter of FY2022. In recent months, there has also been significant relaxation in Covid-19 measures in cities where it is operating. They include Seoul, Taipei, Ho Chih Minh City, Hanoi and Bangkok; and Jumbo is looking to improved business from outlets there. However, it is mindful of its China operations, which may be affected by ongoing pandemic restrictions. “We are optimistic that business performance will continue to improve, especially in our Singapore market,” said Ang Kiam Meng, its group chief executive officer and executive director. “In addition, we are creating new F&B concepts that we hope to introduce to the market in the near future.” Shares of Jumbo closed flat at S$0.25 before the results announcement.

Singapore’s range of electric vehicle (EV) purchase incentives is expected to boost both passenger and commercial EV sales in the near term, albeit at varying paces. In a report issued on Monday (Nov 28), Fitch Solutions Country Risk & Industry Research projected a 394.6 per cent growth in Singapore’s EV sales for 2022, driven mainly by government incentives. It nonetheless cautioned that the limited commercial EV options available in the city state will “remain a significant barrier to adoption” as it believes commercial EV sales is “highly dependent on model availability”. According to Fitch Solutions, Singapore’s Commercial Vehicles Emissions Scheme (CVES) is a key motivator for businesses to adopt cleaner commercial vehicles (CVs). The scheme includes penalties of S$10,000 for the most polluting vehicles, while electric CVs qualify for up to S$30,000 in incentives. The CVES’ impending expiry in 2023 is however expected to lead to a drop in commercial EV sales. As such, Fitch Solution forecasts Singapore’s commercial EV sales to contract by 47 per cent to reach just 826 units in 2023. Over the longer term, the company expects commercial EV sales in Singapore to average annual growth of 28.5 per cent to reach an annual sales volume high of just over 4,500 units by end-2023. Other EV purchase incentives offered in Singapore include the EV Early Adoption Incentive, which grants new electric car and taxi owners a 45 per cent rebate off the Additional Registration Fee, capped at S$20,000. Under the present Enhanced Vehicular Emissions Scheme, cars now qualify for a rebate of S$25,000 for cars in Band A1, and S$15,000 for cars in Band A2. Fitch Solutions expects such policies to likewise drive passenger EV sales in 2023 – albeit at a slower place amid a weakening global economic outlook. Passenger EV sales in Singapore are forecasted to grow 36.9 per cent next year to reach an annual sales volume of around 12,200 units, with locally assembled EVs to aid adoption.

US

Foxconn is offering big bonuses to entice workers back to its Zhengzhou, China factory after labor unrest over a pay dispute saw employees walk out, threatening to leave Apple with a shortfall of iPhones for the crucial holiday season. This month, employees clashed with security personnel at the Zhengzhou plant, the world’s largest iPhone factory run by Apple’s assembly partner Foxconn. The rare worker unrest came after employees took to social media to air their grievances over what appeared to be a delay to bonus payments. Taiwanese firm Foxconn later apologized for what it called a “technical error” which caused a discrepancy in pay from what was promised to staff. Foxconn’s factory was also hit by a Covid-19 outbreak last month leading to workers fleeing the facility as the company moved to control the outbreak through isolating infected people. But with workers walking out of the factory, Foxconn is now trying to make up a shortfall in staff that is threatening global iPhone supply. Foxconn said Tuesday that it will give a 500 Chinese yuan ($70) payment to returning workers, a 3,000 yuan bonus for those who stay more than 30 days and a 6,000 yuan January bonus. It comes a day after the company said it would pay wages of up to 13,000 yuan for some workers in December and January.

Tesla is still the top-selling electric vehicle brand in the U.S., but its dominance is eroding as rivals offer a growing number of more affordable models, according to a report Tuesday by S&P Global Mobility. The data firm found that Tesla’s market share of new registered electric vehicles in the U.S. stood at 65% through the third quarter, down from 71% last year and 79% in 2020. S&P forecasts Tesla’s EV market share will decline to less than 20% by 2025, with the number of EV models expected to grow from 48 today to 159 by then. A drop in Tesla’s U.S. market share was expected, but the rate of the decline could be concerning for investors in Elon Musk’s autos and energy company. As Musk focuses attention on fixing his recently acquired social media company, Twitter, Tesla shares closed down by about a point to $180 on Tuesday. Tesla’s stock has declined by almost half year to date. S&P reported that Tesla is slowly losing its stranglehold on the U.S. EV market to fully electric models that are now available in price ranges below $50,000, where “Tesla does not yet truly compete.” Tesla’s entry-level Model 3 starts at about $48,200 with shipping fees, but the vehicles typically retail for higher prices with options. “Tesla’s position is changing as new, more affordable options arrive, offering equal or better technology and production build,” S&P said in the report. “Given that consumer choice and consumer interest in EVs are growing, Tesla’s ability to retain a dominant market share will be challenged going forward.” The new data follows a Reuters report Monday that Tesla is developing a revamped version of its entry-level Model 3 aimed at cutting production costs and reducing the components and complexity in the interior.

CrowdStrike shares plunged 18% in extended trading on Tuesday after the cybersecurity company reported third-quarter results that top estimates but said new revenue growth was weaker than expected. Earnings was 40 cents per share, adjusted, vs. 31 cents expected by analysts, according to Refinitiv and revenue was $581 million vs. $574 million expected by analysts, according to Refinitiv. CrowdStrike reported annual recurring revenue (ARR) of $2.34 billion, up 54% year over year. More than $198 million was net new ARR added in the quarter, which ended Oct. 31. The company also added 1,460 net new subscription customers for the quarter.CEO George Kurtz said in a release that the company’s total net new ARR was below expectations. “Increased macroeconomic headwinds elongated sales cycles with smaller customers and caused some larger customers to pursue multi-phase subscription start dates, which delays ARR recognition until future quarters,” Kurtz said. Last year, CrowdStrike’s ARR increased by more than 67% in the third quarter, and the company added 1,607 net new subscription customers for that same period. Cybersecurity has remained a concern throughout the war between Russia and Ukraine, with governments warning companies to remain wary of attacks. Russian military hackers tried and failed to attack Ukraine’s energy infrastructure in April. Prior to the after-hours move, shares of CrowdStrike were down more than 32% so far this year. The Nasdaq has dropped about 30% over that stretch.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

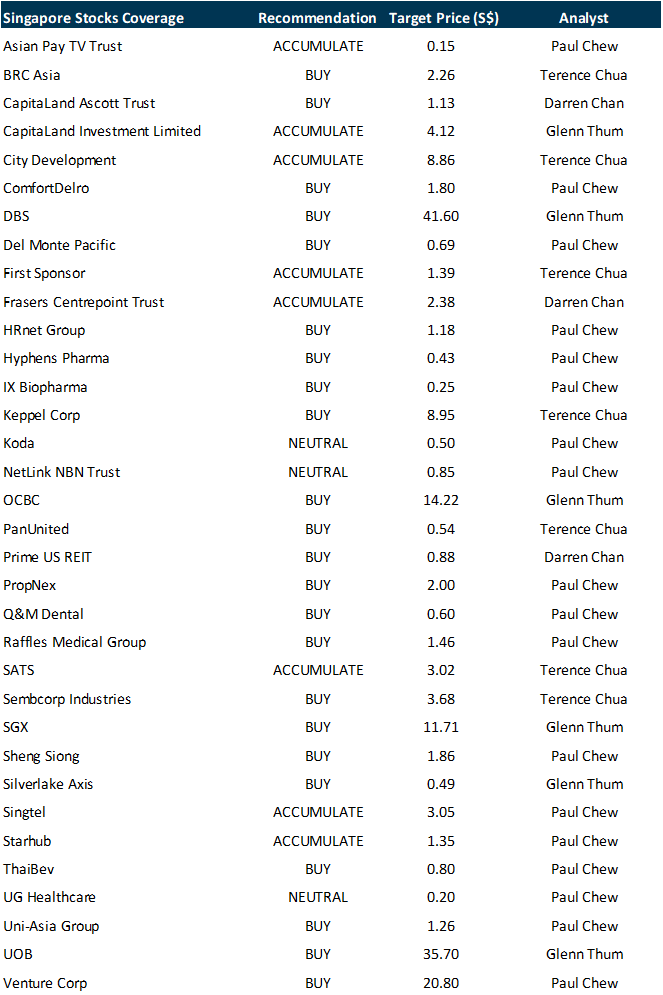

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by IREIT Global [NEW]

Date: 2 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3DRroub

Guest Presentation by Marco Polo Marine [NEW]

Date: 6 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3h1bowW

Guest Presentation by Zoom Video Communications, Inc

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Guest Presentation by Sabana Industrial REIT [NEW]

Date: 8 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3UIuyXl

Guest Presentation by iWoW Technology [NEW]

Date: 16 December 2022

Time: 12pm – 1pm

Register: https://bit.ly/3EqFiDT

Research Videos

Weekly Market Outlook: Sea Ltd, Silverlake Axis, Q&M Dental, ComfortDelgro, APTT, Tech Analysis…

Date: 21 November 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials