DAILY MORNING NOTE | 30 September 2022

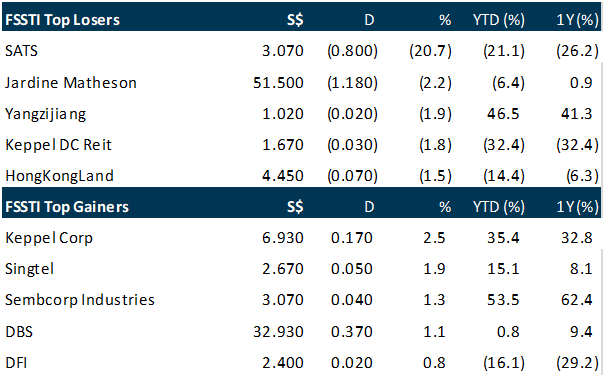

Singapore shares declined with other regional markets on Thursday (Sep 29), with the Straits Times Index (STI) shedding 0.04 per cent or 1.23 points to close at 3,115.08. Across the broader market, losers beat gainers 292 to 235, with 1.4 billion shares worth S$1.9 billion having been traded. Regional markets were in the red, with Hong Kong’s Hang Seng Index shedding 0.5 per cent, the Jakarta Composite Index declining 0.6 per cent and the Kuala Lumpur Composite Index falling 0.3 per cent. Japan’s Nikkei 225 index was an outlier, gaining 1 per cent. Saxo market strategist Charu Chanana noted that the broad-based S&P 500 snapped its 6-day rout on Wednesday to rise 2 per cent, as the dollar weakened across the board, supporting gains. Still, Saxo’s head of equity strategy Peter Garnry warned of more pain ahead as analysts may be “way off” in their estimates for the S&P 500 for the third quarter. “It is highly probable that there will be significant misses to the downside, followed by gloomy comments from company management about the outlook on margins,” he said.

Wall Street stocks suffered another ugly rout Thursday (Sept 29) as US bond yields resumed their upward climb on a bruising day for shares of Apple and other tech giants. Thursday’s economic reports included data showing a drop in weekly US jobless claims that point to a strong labour market likely to keep the Federal Reserve focused on its current policy of countering inflation. “Risky assets don’t stand a chance of a meaningful rally if the economy continues to show resilience while inflation continues to be significantly above the Fed’s Funds rate,” said Oanda’s Edward Moya. The broad-based S&P 500 dropped 2.1 per cent to 3,640.47, its lowest close since November 2020. The Dow Jones Industrial Average lost 1.5 per cent at 29,225.61, while the tech-rich Nasdaq Composite Index tumbled 2.8 per cent to 10,737.51. FHN Financial’s Chris Low said investors were also unnerved by market volatility in Britain after Prime Minister Liz Truss doubled down on a controversial tax cut policy that has rattled markets. Investors fear a “contagion” beyond Britain in response to the policy proposal, Low said, noting the Truss plan contradicts the efforts of central banks to counter inflation and has been criticised by the International Monetary Fund. Shares of large technology companies were under pressure after a downgrade of Apple by Bank of America based on expectations of slower growth. Apple dropped nearly 5 per cent and Facebook parent Meta lost 3.7 per cent, while Tesla sank 6.8 per cent.

SG

ISDN Holdings reported a net profit of S$11.1 million for the first half of the year ending Jun 30, 2022, down 9.1 per cent from the S$12.2 million earnings in the year-ago period. Revenue for H1 was down 12.2 per cent to S$190.7 million, from S$217.2 million a year ago. Cost of sales was down 14.1 per cent from S$159 million to S$136.6 million. The engineering company’s management attributed the decrease in revenue to business disruptions due to stringent Covid-19 lockdowns in China, particularly in April and May this year. However, this was partially offset by “strong financial performance” in the group’s other geographical markets, including Singapore, it said in an interim report filed with the Singapore bourse on Thursday (Sep 29). The group said its order book has stabilised after April and May, but forward visibility remains limited – a reflection of the generally volatile economic conditions across Asia. Nevertheless, it said it continues to witness broad-based and long-term demand for industrial automation solutions in China and the South-east Asian countries where it operates. These include Singapore, Malaysia, Indonesia, Thailand, and Vietnam. In particular, the group added that it has continued to see long-term demand from Asian businesses seeking industrial automation to relieve labour wage pressure, advance manufacturing capabilities and reduce business risk. It also noted that its emerging hydropower generation business in Indonesia is making progress towards commercialisation, with 2 of its 3 hydropower plants on track to start commercial operations. The group’s other operating income for H1 fell 32.2 per cent to S$2 million, which it said was due mainly to the absence of net foreign exchange gain. This was partially offset by an increase in the writeback of allowances. No interim dividend was declared for the period. ISDN shares ended Thursday up 1.2 per cent or S$0.005 at S$0.43.

The trustee of ESR-Logos real estate investment trust, RBC Investor Services Trust, has entered into a sales contract to divest the trust’s property at 2 Jalan Kilang Barat for S$35.3 million, translating to a 21.7 per cent premium to valuation. As at Thursday (Sep 29) when the announcement was made, an independent valuer had valued the 9-storey purpose-built industrial building located in Singapore’s Bukit Merah district at S$29 million. The property has a gross floor area of 7,679 square metres. It is approximately 19 years old and has a remaining land lease tenure of 39.8 years. The divestment is expected to be completed in Q4 2022, and is subject to the Singapore Land Authority’s approval, the trust’s manager said in a bourse filing on Thursday. Upon its completion, E-Log’s portfolio will comprise 80 properties across Singapore and Australia. Adrian Chui, chief executive officer of the trust’s manager, said the divestment is in line with its strategy to continue unlocking value from E-Log’s non-core properties, and will give it more flexibility to realise growth aspirations. The divestment is not expected to have any material impact on E-Log’s net asset value and distribution per unit for the financial year ending Dec 31, 2022. Net proceeds from the divestment will go towards repaying outstanding borrowings, financing upcoming asset enhancements or redevelopments, and/or funding general working capital requirements. E-Log units ended Thursday flat at S$0.355.

First Real Estate Investment Trust has secured a 1.7 billion yen (S$16.9 million) non-recourse social loan from Japan’s Shinsei Bank, which has partially funded the Reit’s 2.6 billion yen acquisitions of 2 nursing homes in Japan. The remaining financing of Loyal Residence Ayase and Medical Rehabilitation Home Bon Séjour Komaki was funded by Singapore-dollar debt, the Reit’s manager said on Thursday (Sep 29). The acquisition of the trust beneficial interest of the property in Komaki was completed on Sep 27, while that of the property in Ayase was completed on Thursday. With the Shinsei social loan, social loans and bonds will make up about a quarter of First Reit’s debt. The Shinsei social loan is not expected to have any material impact on the trust’s leverage ratio for the financial period ending Dec 31, 2022. Shinsei Bank had assessed the social impact from providing funding for these acquisitions to include securing houses for the elderly, and promoting women’s active participation in society. The bank assessed that the loan can contribute to the United Nations’ Sustainable Development Goals of good health and well-being (goal 3), gender equality (goal 5), as well as decent work and economic growth (goal 8).

US

Buybuy Baby has been a rare bright spot for struggling Bed Bath & Beyond. On Thursday, however, the baby gear chain reported a steep quarterly sales drop — raising eyebrows and prompting concerns that it may also be losing customers. Buybuy Baby’s comparable sales declined by a high-teens percentage compared with a year ago in the three-month period ended Aug. 27. At Bed Bath & Beyond’s namesake stores and website, comparable sales dropped by 28% year over year. Retail sales got a lift last year from government stimulus, including from child tax credits. Interim CEO Sue Gove said Thursday that Buybuy Baby faced tough comparisons in the quarter because of that, but has maintained market share in the category.Buybuy Baby has been one of its parent company’s strongest businesses and most valuable assets. As Bed Bath & Beyond namesake stores have shuttered, the company has opened more BuyBuy Baby locations. Its banner also caught the attention of activist investor Ryan Cohen, cofounder of Chewy and chair of GameStop, who pushed for a sale of the higher-performing banner. It reportedly drew interest from potential buyers, too. Bed Bath, which agreed to explore strategic options for Buybuy Baby as part of a truce with Cohen, has said it is focused on driving sales and refreshing the business, including the baby registry. (Several other companies, including Walgreens and Kohl’s, have also cited a chillier market for mergers & acquisitions, causing them to postpone or end potential deals.) Cohen has since sold his entire stake of Bed Bath. BuyBuy Baby Brand President Patty Wu told investors on Thursday’s call that the banner plans to return to grow in the back half of the year. She spoke about ambitions to become the go-to place for parents during pregnancy and beyond, pointing to several initiatives underway. She said Buybuy Baby will launch its first private label brand in November, which will include apparel, furniture and decor for infants to toddlers at good value. It will carry popular holiday items, such as matching pajamas for families, and offer related resources on its website, such as tips about travel gear that makes for a smoother flight or road trip over the holidays. Plus, she said, it will relaunch its baby registry in time for early next year and expand the number of store events. “We’re going to turn our stores into parenting hubs by bringing product and education together,” she said.

Shares of Apple fell 4.9% on Thursday after Bank of America analysts delivered the stock a rare downgrade. The analysts lowered their rating from buy to neutral, also cutting its price target from $185 to $160 per share. They said they anticipated “weaker consumer demand” over the next year and pointed to macroeconomic challenges. The downgrade came on the heels of a Bloomberg report Wednesday that said Apple had told some suppliers to abandon plans to ramp up production for its new iPhone 14 after failing to see as high demand as anticipated. That also put pressure on Apple’s stock. A second firm disagreed with the BofA rating, however. Rosenblatt Securities upgraded its rating on Apple from neutral to buy and raised its price target to $189 from $160, implying a 25% rally from current levels. It made the call after its survey of over 1,000 U.S. adults showed strong demand for even the pricier new Apple products. Rosenblatt cast doubt on the production report, writing that there’s “a recent history of comparable reports proving to be misleading when actuals come out.”

Initial filings for unemployment claims fell last week to their lowest level in five months, a sign that the labor market is strengthening even as the Federal Reserve is trying to slow things down. Jobless claims for the week ended Sept. 24 totaled 193,000, a decrease of 16,000 from the previous week’s downwardly revised total and below the 215,000 Dow Jones estimate, according to a Labor Department report Thursday. The drop in claims was the lowest level since April 23 and the first time claims fell below 200,000 since early May. Continuing claims, which run a week behind, fell 29,000 to 1.347 million. The strong labor numbers come amid Fed efforts to cool the economy and bring down inflation, which is running near its highest levels since the early 1980s. Central bank officials specifically have pointed to the tight labor market and its upward pressure on salaries as a target of the policy tightening. Stocks plunged following the report while Treasury yields were higher. “The recent decline in layoffs flies in the face of the Fed’s efforts to soften up labor market conditions and knock inflation back down toward its 2% target,” said Jim Baird, chief investment officer at Plante Moran Financial Advisors. “The capital markets have heard the Fed, and investors are feeling the pain. But the jobs market? For now at least, it’s not listening.” There was more bad news Thursday for the Fed on the inflation front. The personal consumption expenditures price index, a favorite inflation gauge for the Fed, showed a 7.3% year-over-year price gain in the second quarter, the Commerce Department reported in its final GDP estimate for the period. That was above the 7.1% reading in the prior two Q2 estimates and just off the 7.5% gain in the first quarter. Excluding food and energy, core PCE inflation was 4.7%, 0.3 percentage point higher than the previous two estimates but below the 5.6% jump in Q1.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Technical Pulse: Applied Materials, Inc.

Analyst: Zane Aw

Recommendation: Technical BUY

Buy limit: 86.00 Stop loss: 79.50 Take profit: 96.95

Applied Materials, Inc (NASDAQ: AMAT) A potential bullish reversal to the upside.

Upcoming Webinars

Guest Presentation by MeGroup Ltd [NEW]

Date: 5 October 2022

Time: 12pm – 1pm

Register: https://bit.ly/3RSOTXY

Guest Presentation by RE&S Enterprises Pte Ltd [NEW]

Date: 21 October 2022

Time: 2pm – 3pm

Register: https://bit.ly/3REOBnY

Research Videos

Weekly Market Outlook: Adobe PropertyGuru TechnicalPulse FOMC SG Weekly Top Glove Emperador

Date: 26 September 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials