DAILY MORNING NOTE | 31 January 2023

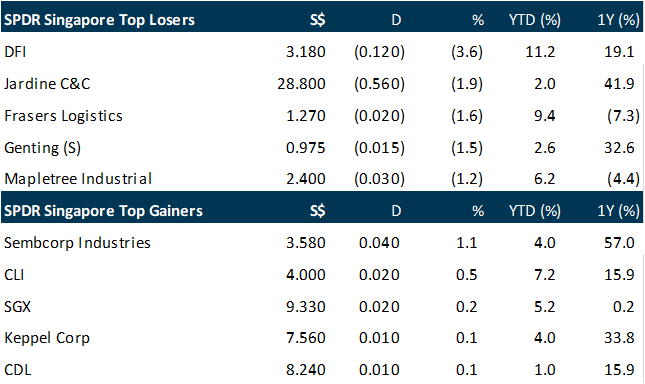

Singapore stocks ended lower on Monday (Jan 30), as markets remained cautious ahead of various key events happening this week. The Straits Times Index (STI) fell 0.5 per cent or 15.92 points to close at 3,378.29. Losers outnumbered gainers 350 to 234, after 1.3 billion securities worth S$1.6 billion changed hands. The region’s markets ended the day mixed. The Hang Seng Index fell 2.7 per cent, and the Kospi Composite Index ended 1.4 per cent lower. The Nikkei 225 Index rose 0.2 per cent and the FTSE Bursa Malaysia Index gained 0.1 per cent.

Wall Street stocks started an eventful week on a downcast note on Monday, retreating ahead of key central bank announcements and corporate earnings. Analysts pointed to profit taking as a factor in the bruising session after equities spent much of January pushing higher. The Dow Jones Industrial Average finished down 0.8 per cent at 33,717.09. The broad-based S&P 500 dropped 1.3 per cent to 4,017.77, while the tech-rich Nasdaq Composite Index sank 2.0 per cent to 11,393.81. This week’s calendar includes several major central bank announcements, with the Federal Reserve set to unveil its rate decision on Wednesday. Analysts expressed unease after Spanish consumer prices unexpectedly accelerated, raising worries about a European Central Bank meeting later in the week. The economic agenda also includes quarterly results from tech heavyweights such as Apple and Amazon, as well as from industrial companies including ExxonMobil and General Motors.

SG

Singapore hotels’ average room rate (ARR) picked up in December 2022 after a marginal fall in November to record a new 14-year high, going by Singapore Tourism Board data on Monday (Jan 30). ARR was up 27.7 per cent from the year-ago period to S$285.84. It was also up 1.9 per cent from November’s S$280.57 rate. The figure came as tourist arrivals grew to a new high of 931,337 since the onset of the pandemic. Performance was mixed across hotel categories. ARR was up for the month in the luxury (S$599.44) and upscale segments (S$545.14), but down slightly in the economy (S$216.59) and mid-tier (S$144.11) segments. On the month, revenue per available room (RevPAR), at S$226.23, was lower than the S$241.51 recorded in November by 6.3 per cent. It was still up 36 per cent on the year. December’s average occupancy rate of 79.1 per cent was also slightly lower than the preceding month’s 86.1 per cent and pre-pandemic rates in December 2019 and January 2020. On the year, it was up 4.8 per cent.

Micro-Mechanics Holdings (MMH) has reported a net profit of $6.1 million for the six months ended 31 December 2022, down 35.5% from 1HFY2022. This translates to earnings per share of 4.42 cents for 1HFY2023, down from 6.85 cents in the year earlier period. For the manufacturer of high precision tools and parts used in process-critical applications for the semiconductor industry, group revenue eased 9.6% to $36.9 million in 1HFY2023, reflecting slower conditions in the global semiconductor industry and the difficult operating environment in China. Notwithstanding the market slowdown, MMH has maintained its interim dividend at 6 cents per share (one-tier tax exempt) for 1HFY2023, which will be paid on Feb 17.

City Developments Limited (CDL) said on Monday (Jan 30) that it is currently in discussions for the proposed acquisition of the St Katharine Docks (SKD) development in London, United Kingdom. The company – which was responding to media reports on the deal – said in a bourse filing that acquisition is subject to satisfactory due diligence and negotiation on the terms. CDL added that it has “signed an exclusivity for due diligence together with a non-binding heads of terms”. According to a media report by CoStar last week, asset manager Blackstone is in talks to sell St Katharine Docks marina to CDL for around £400 million (S$650.9 million).

CSE Global has announced securing two major contracts worth $87.3 million in the US and Singapore. The technology company’s first major contract is for the design, engineering, fabrication, installation and integration of complex electrical, instrumentation and control systems and equipment for wastewater treatment plants in the US, which is slated for execution from 2023 to 2027. The other major contract relates to a multi-year system maintenance contract from the Singapore government in the infrastructure sector. Group managing director of CSE Global Lim Boon Kheng says: “We are very encouraged to have secured these two major contracts, as our customers continue to leverage on our expertise and place their trust in our solutions and services. Infrastructure remains a key focus area where we are diversifying our business and these wins are testament to the strength of our strategy.”

ESR-Logos Reit posted a distribution per unit (DPU) of S$0.0154 for its second half ended Dec 31, 2022, up 7.5 per cent from a DPU of S$0.01433 a year ago. Gross revenue was up 61 per cent to S$195.6 million for the half-year period, from S$121.4 million a year ago. Net property income (NPI) grew 64 per cent on the year to S$141.5 million for the half year, from S$86.3 million. The higher year-on-year gross revenue and NPI were mainly attributed to contributions from Ara Logos Logistics Trust (ALog Trust) after the merger in April 2022, the Reit’s manager said in a bourse filing on Monday (Jan 30). The increase in NPI was partially offset by higher electricity rates arising from a surge in global energy prices and higher electricity demand, it added. Total income available for distribution rose 79.6 per cent year on year to S$103.5 million, from S$57.6 million.

US

Ford Motor Co said it is boosting production and cutting prices of its electric Mustang Mach-E crossover up to 8.8% on some versions. The move comes weeks after Tesla Inc. slashed prices on a number of its models. The Dearborn, Mich., auto maker said its supply chain for its electric vehicles is coming online, and it is seizing on streamlined costs to lower prices. Ford also said the price cuts are a part of the company’s plan to keep the vehicle competitive in a rapidly changing market. “We are not going to cede ground to anyone,” said Marin Gjaja, chief customer officer of Ford’s electric-vehicle business. He added that the company is keeping its pricing competitive and reducing customer wait times. Ford’s Mach-E price cuts range from 1.2% to 8.8%, depending on the configuration. In dollar terms, that is about $600 to $5,900 less than the previous sticker price on the sporty SUV, a model that hit the market in late 2020 and is a direct competitor to Tesla’s Model Y.

Bed Bath & Beyond Inc.’s slide toward a potential bankruptcy filing threatens to flood the retail real-estate market with hundreds of vacant stores after the company said last week it would close about 90 additional locations. But landlords who own big-box space occupied by the troubled home-goods retailer are more confident about finding new tenants than they would have been in years past, according to property owners and retail analysts. One of the bigger Bed Bath & Beyond landlords has received commitments from tenants to fill all 12 locations if and when they close, according to a person familiar with the matter, including Sephora, Trader Joe’s, Dick’s Sporting Goods Inc., T.J. Maxx, Ross Stores Inc. and HomeGoods.

A federal appeals court rejected Johnson & Johnson ‘s plan to use a legal strategy to push about 38,000 talc lawsuits into bankruptcy court, hampering the controversial tactic the company and a handful of other profitable businesses have used to move mass personal-injury cases to chapter 11. The Third U.S. Circuit Court of Appeals on Monday dismissed the chapter 11 case of J&J subsidiary LTL Management LLC, which the consumer-health-goods giant created in 2021 to move to bankruptcy court the mass lawsuits alleging its talc-based baby powder products caused cancer. The unanimous ruling was a rebuke to an emerging corporate restructuring strategy in which companies facing mass tort litigation invoke a Texas law to create a new subsidiary with minimal business operations and make it responsible for tort liabilities before putting that subsidiary in bankruptcy. A Johnson & Johnson spokeswoman said the company would challenge Monday’s ruling and that it put the talc subsidiary into bankruptcy to equitably resolve the litigation for all parties, including current and future injury claimants.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

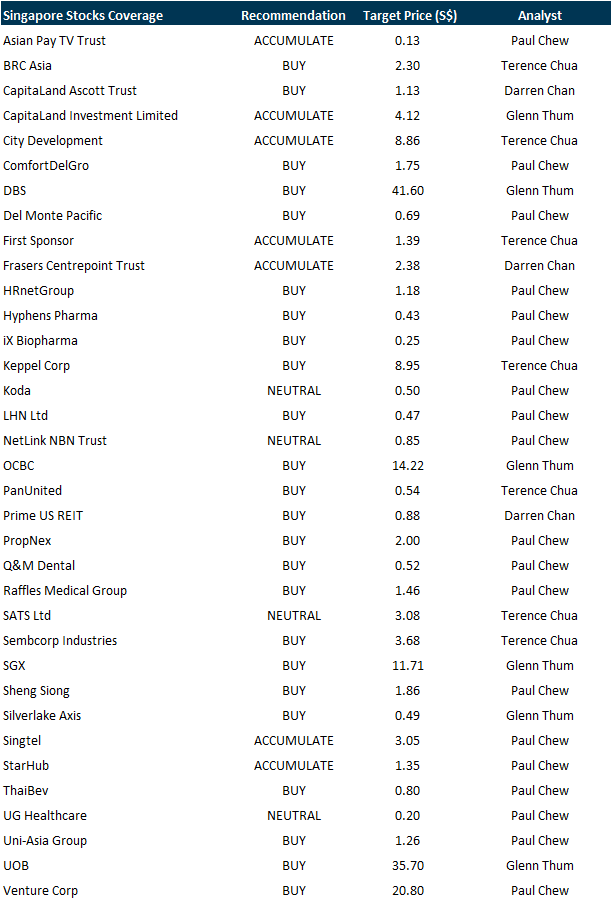

RESEARCH REPORTS

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by Comba Telecom Systems Holdings Limited

Date: 31 January 2023

Time: 11am – 12pm

Register: https://bit.ly/3GuS5VK

Guest Presentation by LMS Compliance [NEW]

Date: 8 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3IX0pAr

Guest Presentation by First REIT Management Limited [NEW]

Date: 16 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3GY2tp8

Guest Presentation by Paragon REIT [NEW]

Date: 17 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3ZNn4W0

Guest Presentation by Keppel DC REIT [NEW]

Date: 17 February 2023

Time: 3pm – 4pm

Register: https://bit.ly/3CYgrGr

Research Videos

Weekly Market Outlook: Block Inc., SG Banking Monthly, Technical Analysis, US1Q23 Strategy & More

Date: 16 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials