DAILY MORNING NOTE | 31 October 2022

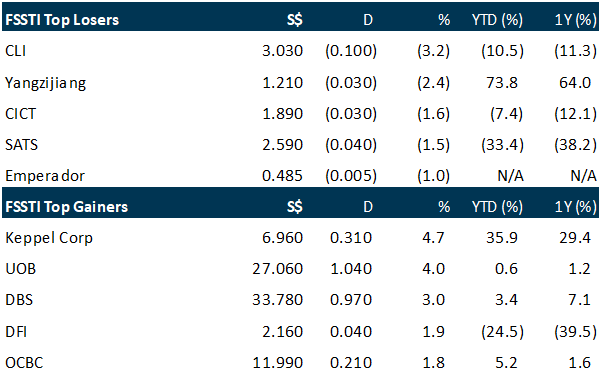

The Straits Times Index (STI) finished Friday’s (Oct 28) trading session 1.5 per cent or 43.95 points higher at 3,059.19. Daily turnover stood at 1.9 billion securities worth a total of about S$1.6 billion. However, decliners outnumbered advancers 271 to 247. Prior to Friday’s session, real estate investment trusts, banks and other financial services had seen the largest net institutional outflows in Singapore in October, he said. On the local bourse, UOB was the top advancer, after the bank announced a 34 per cent increase in Q3 earnings to S$1.4 billion on the back of record net interest income. The counter closed at S$27.06, up 4 per cent or S$1.04. The other two lenders were also among the top gainers. DBS rose 3 per cent or S$0.97 to S$33.78, and OCBC was up 1.8 per cent or S$0.21 at S$11.99. DBS will report its quarterly earnings on Nov 3, while OCBC is set to announce its results on Nov 4. Keppel Corporation was also among the top performers on Friday, gaining 4.7 per cent or S$0.31 to S$6.96. The group posted a 24 per cent year-on-year increase in revenue for the first nine months to $6.8 billion on Thursday. Nio was the biggest loser for the day, with the counter crashing 8.2 per cent or US$0.84 to US$9.44. CapitaLand Investment was another top decliner, shedding 3.2 per cent or S$0.10 to S$3.03. Sheng Siong, which reported a 4.6 per cent decline in Q3 net profit to S$32.8 million, also ended down 3.1 per cent or S$0.05 at S$1.56.

Wall Street stocks rallied Friday (Oct 28), propelled by big gains in Apple after solid earnings and positive momentum amid hopes of a pivot in Federal Reserve policy. The Dow Jones Industrial Average finished up 2.6 per cent, around 830 points, at 32,861.8 for its sixth straight positive session. The broad-based S&P 500 gained 2.5 per cent to 3,901.06, while the tech-rich Nasdaq Composite Index jumped 2.9 per cent to 11,102.45. Apple, the biggest company in terms of market value, soared 7.6 per cent after reporting higher profits despite lower-than-expected iPhone sales. The gains by Apple helped prompt an advance by large tech companies like Microsoft and Google parent Alphabet that were punished earlier in the week following disappointing results. Stocks have also been boosted in recent sessions by hopes the Federal Reserve will soon moderate its policies to counter inflation. Markets largely shrugged off a mixed economic data that showed inflation lingering but also a jump in household spending. Among other companies, Amazon sank 6.8 per cent as it predicted a slowdown in sales growth during the year-end holiday shopping season. But oil giants ExxonMobil and Chevron piled on 2.9 per cent and 1.2 per cent respectively after reporting blowout profits on lofty commodity prices.

Week 44 equity strategy: Market leadership in US equities has been shifting away from tech to finance and to even industrials. Since early 2021, financials is still a positive 16% compared to the 14% slip in Nasdaq. In Singapore, we favour banks and hospitality. Bank earnings growth from higher interest rates only began meaningfully this September quarter. We expect the momentum until 2Q23. Another area of leadership will be the re-opening theme. Hospitality in Singapore is expanding even ahead of pre-pandemic. Hotel RevPAR is at all-time highs, more than doubled YoY and 15% above pre-pandemic. Marina Bay Sands reported mass market casino takings at 4% higher than pre-pandemic.

Paul Chew,

Head Of Research,

paulchewkl@phillip.com.sg

SG

ASEAN markets will likely slow down but skirt a recession in the coming months, and UOB will benefit from fund flows into the region amid political risks elsewhere, its chief executive officer Wee Ee Cheong said on Friday (Oct 28). The bank reported a 34 per cent increase in quarterly net profit to S$1.4 billion, driven by record net interest income. Its earnings for the third quarter ended Sep 30 surpassed consensus estimates of S$1.2 billion, according to Bloomberg’s survey of five analysts. Annualised earnings per share for the quarter stood at S$3.30, up from S$2.46 in Q3 2021. UOB shares surged after its results announcement. The counter was up 4.7 per cent to S$27.23 at the midday break on Friday. It ended the day at S$27.06, up 4 per cent or S$1.04. Net interest income for Q3 was up 39 per cent to S$2.2 billion from S$1.6 billion a year ago. Net interest margin (NIM) increased to 1.95 per cent, expanding 40 basis points year on year and up 28 basis points from Q2. Margins for UOB’s regional markets also saw uplifts. In Malaysia, NIM was up by 21 basis points from the previous quarter, while operating profit grew 34 per cent. NIM in Vietnam expanded by 46 basis points; in Indonesia, it was up 11 basis points; while in Thailand, it went up 10 basis points. UOB will be completing its acquisition of Citi’s consumer business in Thailand and Malaysia on Tuesday (Nov 1), and will do so for the Vietnam and Indonesia franchises by end 2023. Ninety per cent of Citi staff have agreed to join UOB, Wee said. Total allowances fell 36 per cent for the quarter due mainly to lower specific allowances. Wee said the bank had managed to reverse a one-off non-performing loan classified in Q2. He was likely referring to the account of distressed Chinese developer Shimao. The bank’s non-performing loans ratio stood at 1.5 per cent, unchanged from a year ago. Lee said the bank is keeping an eye on some S$3 billion in loans to Chinese developers, but that most of this exposure involve completed properties. As at Sep 30, 2022, the bank’s total exposure to mainland China stood at S$23.1 billion, or 5 per cent of its total assets. The addition of Citi’s unsecured consumer portfolios may raise UOB’s credit costs, but this is likely to be offset by a larger uplift to interest margins, said UOB’s chief financial officer Lee Wai Fai. UOB’s common equity tier 1 (CET-1) ratio, which measures a bank’s core equity capital compared with its total risk-weighted assets ratio, stood at 12.8 per cent, down from 13.1 per cent a year ago. Lee acknowledged that cost of funding has increased, with an outflow of funds from current and savings accounts (Casa) to fixed deposits. UOB’s Casa ratio has fallen to 49.8 per cent, down from 55.8 per cent a year ago. Despite a 5 per cent quarterly growth in total customer deposits, the bank lost S$9 billion in Casa and added S$16 billion in fixed deposits. This trend will probably continue at a slower pace, as the rate of interest rate hikes will likely moderate, Lee said. Loan-related fees for the quarter moderated from a high base in Q2, while wealth fees remained soft amid subdued market sentiments. In the future, the bank’s executives believe margins will continue to reap upside momentum from Fed rate hikes until the first half of 2023, before a market correction sets in. The bank is “comfortable” maintaining a margin above 2 per cent, Lee said, and expects credit costs to hover around 20 to 25 basis points next year.

Wilmar International on Friday (Oct 28) posted a net profit of US$766.2 million, up 34.7 per cent from a year ago, for the third quarter ended Sep 30. Revenue increased 10.2 per cent to US$18.9 billion on the back of better sales across the group’s feed and industrial products, and food products businesses. The feed and industrial products segment saw an 8.5 per cent rise in sales volume, mainly driven by a 12.7 per cent increase in sales for oilseeds and grains, and 12.1 per cent increase in sales for sugar. The food products segment posted 3.2 per cent growth in sales volume, dragged down by a 2.8 per cent dip in consumer products sales. Wilmar nevertheless called the results “satisfactory”, and noted that prices of consumer products were adjusted upwards while raw material costs started to decline. The group also had a higher share of results from joint ventures and associates, and lower effective tax rate during the quarter. Net profit for the nine months ended September was US$1.9 billion, up 46.3 per cent from a year ago. Operating cash flow jumped 68.2 per cent in Q3 to US$3.5 billion, taking into account the recent decline in commodity prices and hence lower net working capital requirements. Wilmar said that while global operating conditions remained challenging, the group is confident of its “integrated and diversified business model and sound risk management policies”. The counter ended at S$3.60 on Friday, down S$0.02 or 0.6 per cent, before the results announcement.

US

Intel shares climbed in late trading after the chipmaker pledged to slash costs, an effort to weather a persistent slump in computer demand that is dragging down sales and profit and obstructing its turnaround efforts. The company said actions including headcount reductions and slower spending on new plants will result in savings of US$3 billion next year, with annual cuts swelling to much as US$10 billion by the end of 2025. Third-quarter profit and revenue tumbled, Intel said on Thursday (Oct 27) in a statement, and it again scaled back 2022 revenue and profit targets. Chief executive officer Pat Gelsinger had been banking on a rapid rebound in semiconductor sales to help fund his ambitious plans to restore Intel to its former dominance in the US$580 billion industry. Gelsinger, who predicted three months ago that the third quarter would be the nadir for the company’s performance, instead said that demand for Intel’s computer processors has fallen off even more sharply than projected and the outlook remains dour. “The worsening macro was the story and is the story,” Gelsinger said in an interview. “There’s no good economic news.” Predicting a bottom for the market for computer chips currently would be “too presumptive”, he said. Third-quarter net income was US$1 billion, or 25 US cents a share, down from US$6.8 billion, or US$1.67 a share, in the same period a year ago. Revenue dropped 20 per cent to US$15.3 billion. Before certain items, profit was 59 US cents a share. Wall Street was looking for a profit of 33 US cents on sales of US$15.4 billion. Intel shares initially fell, then rose about 5.4 per cent in late trading following the announcement. Earlier, they closed at US$26.27. The stock has plummeted 49 per cent this year. Fourth-quarter revenue will be about US$14 billion to US$15 billion, the company said, compared with analyst estimates for US$16.3 billion. Profit, excluding certain items, will be 20 US cents a share, below the average prediction of 66 US cents. For the year, Intel reduced its revenue forecast to US$63 billion to US$64 billion, a decline of as much as 20 per cent from 2021. Gross margin will narrow further than earlier anticipated to 47.5 per cent, and earnings per share will be about US$1.95. Gelsinger said that level of profitability isn’t good enough and is partially a result of inefficiencies in Intel’s operations that need to be addressed. The company’s plants, once the industry leader, will be forced to report their utilisation rates, and chip designers will have to improve at getting the blueprints they send to those facilities right the first time. Intel’s rivals use fewer people to get better results, he said. One bright spot in Gelsinger’s plans to reshape the company came earlier this week, when Intel’s self-driving technology unit, Mobileye Global, began publicly trading in a partial spinoff. Its shares surged 38 per cent in their market debut Wednesday. Intel retains control of the division, which raised US$861 million in the share sale. Gelsinger has said Mobileye may serve as a template for other such transactions that will help Intel capitalise on the value of some of its assets. Third-quarter sales for Intel’s data-centre division – which typically contributes an outsized portion of profit – dropped 27 per cent to US$4.2 billion, lower than the average analyst estimate of US$4.83 billion. Client computing, Intel’s PC-chip unit, reported a sales decline of 17 per cent to US$8.1 billion, compared with projections for US$7.78 billion. A collapse in consumer gadget-buying has spread into corporate spending amid concern that the global economy is heading towards a recession. That has confounded predictions by chip-industry leaders that the boom of the past two years could endure, driven by the proliferation of semiconductor use into more types of devices. Computer and smartphone demand remains the primary influence on the fortunes of the broader chip industry, which expanded by more than US$100 billion last year and some predicted would rapidly double to become a US$1 trillion business. Many of Intel’s largest rivals have posted downbeat reports or warnings about the outlook for computer components, falling billions short of estimates or slashing their predictions. While periodic slumps are not unusual for the chip business, analysts are concerned that the current decline is driven more by a contraction of the economy than a buildup of excess inventory that would have the potential to clear out quickly.

Pinterest surged after reporting third-quarter revenue that beat analysts’ estimates, standing out from its social media peers in a difficult market. Third-quarter sales grew 8 per cent to US$684.55 million, the company said, topping the average analyst estimate for US$666.85 million. Monthly active users also grew slightly to 445 million, from 444 million in the year-ago period, after three straight quarters of declines. The stock gained more than 15 per cent in post-market trading. Pinterest’s shares had fallen 40 per cent this year through Thursday’s (Oct 27) close. Pinterest’s revenue beat follows a miss by larger peers Snap and Alphabet, while Meta Platforms was in line with expectations. For the three months ending in December, Pinterest expects revenue growth to continue in the mid-single-digit range. The social media industry has been grappling with a decrease in spending on digital ads as marketers worry about economic uncertainty and cope with a change in Apple’s privacy policy that made some platforms’ advertisements less effective.

French video game maker Ubisoft said on Thursday (Oct 28) its net result turned into a loss in the half-year, citing lost research and development expenses and related game cancellations. The firm has been dogged by game delays, on top of project cancellations and heavy sector competition. Its shares have shed roughly 38 per cent this year. The maker of the blockbuster Assassin’s Creed franchise posted a net loss of 190.2 million euros (S$267.2 million)in the half-year that ended on Sep 30, compared to a slight profit of 1.6 million euros in the same period last year. “The H1 bottom line notably reflects accelerated R&D depreciation, including for the previously announced cancelled projects,” Ubisoft’s finance chief Frédérick Duguet said in a statement. In July, Ubisoft said in an analyst call it was pursuing cost optimisation, revealing the cancellation of games such as Splinter Cell VR and Ghost Recon Frontline. Ubisoft nonetheless on Thursday confirmed its full-year guidance and projected third quarter net bookings of around 830 million euros, on the back of a still unspecified mobile licencing deal. The Prince of Persia franchise maker posted net bookings down 2.6 per cent to 699.4 million euros for the six months that ended in September.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

United Overseas Bank Limited – Surge in Net Interest Margins

Recommendation: Buy (Maintained), Last done: S$27.06

TP: S$35.70, Analyst: Glenn Thum

– 3Q22 earnings of S$1,403mn were in line with our estimates due to higher net interest margin (NIM) and healthy net interest income (NII) growth. 9M22 PATMI is 72% of our FY22e forecast.

– NII was up 39% YoY from a NIM increase of 40bps YoY to 1.95% and loan growth of 6% YoY. Fee income fell 10% YoY while other non-interest income was up 58% YoY. Management is guiding mid-single digit loan growth with higher NIMs, stable cost-to-income ratio and stable credit costs.

– UOB has guided NIM to continue to expand each quarter and to reach an exit NIM of 2.5% to 3.0% by the end of 2022. We estimate 4Q22 NII to jump 65% YoY. Management is guiding for ROE of 13% in FY23 and 14% for FY24 from this year’s 11%.

– Maintain BUY with an unchanged target price of S$35.70. We raise FY22e earnings by 6% as we increase NII estimates for FY22e. We assume 1.45x FY22e P/BV and ROE estimate of 12.1% in our GGM valuation. We raised FY23e earnings by 12% as we increased NII estimates for FY23e. Our ROE estimate for FY23e is raised from 11.5% to 12.7%. Every 25bps rise in interest rates can raise NIM by 0.04% and PATMI by 4.3%.

Sheng Siong Group Ltd – Tough comparison but better-than-expected sales

Recommendation: BUY (Maintained); TP S$1.86, Last close: S$1.56; Analyst Paul Chew

– 3Q22 revenue and PATMI beat expectations. YTD22 revenue and PATMI were 78%/82% of our FY22e forecast.

– Same-store sales declined 7% YoY in 3Q22, as it was a tough base year. In 3Q21 Jurong Fishery Port and Pasir Panjang Wholesale Centre closure diverted huge fresh food sales to Sheng Siong stores. The four new stores added 2.6% points of revenue growth.

– We lift FY22e earnings by 5% to S$127.8mn. The increase in GST from 1 January 2023 could also pull some sales into 4Q22. Our BUY recommendation is maintained. The target price is unchanged at $1.86. Valuation is pegged to 22x PE, a 10-15% discount to the 5-year historical average of 25x PE. Revenue is normalising post-relaxation of COVID-19 restrictions but at a run-rate around 25% higher than the pre-pandemic period. We believe Sheng Siong’s strength in fresh food continues to drive its grocery market share.

Amazon Inc – FX inhibiting revenue growth

Recommendation: NEUTRAL (Maintained); TP: US$108.44, Last Close: US$103.41

Analyst: Maximilian Koeswoyo

• 3Q22 revenue was in line with expectations, while earnings were a miss. 9M22 revenue was at 69% of our FY22e forecast, while PATMI came in at 47%, excluding a pre-tax valuation gain of US$1.1bn from Rivian Automotive.

• Amazon Web Services (AWS) continues YoY growth for 3Q22 at 27% while contributing 100% of 3Q22 operating income. 4Q22 management guidance was below our forecast, expecting continued challenges from inflation and 4.6% FX headwinds.

• We cut our FY22e revenue by 3.5% and operating margin from 5% to 3.2% to account for a slower expected growth rate from reduced customer spending on AWS and increasing FX headwinds. We maintain a NEUTRAL rating with a lowered DCF target price of US$108.44 (prev. US$133.00), with a WACC of 6.4% and terminal growth of 5%.

Meta Platforms Inc. – Rising expenses continue to weigh on margins

Recommendation: ACCUMULATE (Downgraded); TP: US$113.00, Last Close: US$99.20

Analyst: Jonathan Woo

– 3Q22 revenue in line with expectations, earnings miss by 12%. 9M22 revenue/PATMI at 68%/60% of our FY22e forecasts.

– Earnings hurt by 19% rise in expenses; Reality Labs segment continuing losses; guided to another quarter of negative revenue growth.

– We cut our FY22e revenue/PATMI forecast by 7%/23% to account for slowing revenue growth, higher-than-expected total expenses and increasing FX headwinds. We also increased our total expenses forecast for FY23e. We downgrade to an ACCUMULATE recommendation with a lowered DCF target price of US$113.00 (prev. US$221.00).

Technical Pulse: Frasers Logistics & Commercial Trust

Analyst: Zane Aw

Recommendation: Technical BUYMarket buy: 1.13 Stop loss: 1.09 Take profit: 1.25

Frasers Logistics & Commercial Trust (SGX: BUOU) A potential corrective wave to retest the resistance zone at 1.20-1.28 in the current downtrend.

Keppel Corporation – Revised agreements will provide greater deal certainty

Recommendation: BUY (Maintained), Last Done: S$6.65

Target price: S$8.95, Analyst: Terence Chua

– Keppel Corporation (Keppel) has entered into revised agreements in connection with the proposed offshore and marine transactions. Sembcorp Marine (SMM) will now acquire 100% of KOM from Keppel. The exchange ratio between KOM and SMM is revised to 54:46 from 56:44.

– Keppel shareholders will receive an estimated 19.1 SMM shares per Keppel share based on the proposed issue price of $0.122/share.

– We believe the revised agreements provide greater certainty on the outcome of its legacy rigs and better certainty of deal completion as the revised structure benefits SMM shareholders through lower dilution and faster completion time.

– 9M22 revenue of $6.8bn was below of our estimates, at 69% of FY22e. The drag came from its Urban Development segment.

– Maintain BUY with unchanged SOTP TP of $8.95. We valued the Group based on the four new segments unveiled during Vision 2030 to better reflect the Group’s reporting segments going forward. Our TP translates to about 1.2x FY22e book value, a slight premium to its historical average as the Group’s transformation plans gain traction and ROE expands to 8.8%. Catalysts expected from approvals obtained for the transaction.

Microsoft Corp – Azure drives growth despite currency headwinds

Recommendation: BUY (Maintained); TP: US$319.00

Analyst: Ambrish Shah

– 1Q23 revenue/PATMI was within expectation at 23% of our FY23e forecasts. Total revenue grew 11% YoY to US$50.1bn driven by a 20% YoY rise in cloud business. PATMI fell by 14% YoY (2% YoY growth normalised) as margins contracted due to investments in Azure as well as US$3.3bn tax benefit in 1Q22.

– Azure revenue grew 42% YoY in constant currency driven by increasing cloud adoption. Office 365 Commercial revenue grew 17% YoY due to subscriber growth of 14% YoY and higher average revenue per user due to strong adoption of E5 license.

– We maintain a BUY recommendation with a lower DCF target price of US$319 (WACC 7.2%, g 4%), down from US$332. Our FY23e revenue/PATMI is lowered by 2%/3% to account for forex headwinds and PC market weakness. Overall, we believe that Microsoft will be a long-term beneficiary of continued strong digital transformation spending, shifting of workloads to the cloud, and cybersecurity upgrades.

Upcoming Webinars

Guest Presentation by Keppel REIT [NEW]

Date: 3 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3SOLOsr

Guest Presentation by Elite Commercial REIT [NEW]

Date: 8 November 2022

Time: 12pm – 1pm

Register: https://bit.ly/3FquBCh

Guest Presentation by Zoom Video Communications, Inc [NEW]

Date: 7 December 2022

Time: 9am – 10am

Register: https://bit.ly/3TzxFQ6

Research Videos

Weekly Market Outlook: PayPal, Keppel Corp, SPH, Fortress Minerals, SGBanking, SG Weekly & more…

Date: 17 October 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials