DAILY MORNING NOTE | 4 August 2022

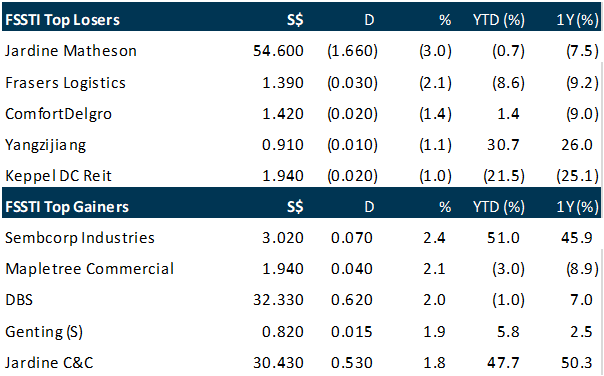

Asian markets shrugged off worries on Wednesday (Aug 3) as China has thus far exercised military restraint over a trip made by a high-level US official to Taiwan. House Speaker Nancy Pelosi arrived safely on the island, regarded as a breakaway province by Beijing, amid heightened geopolitical tensions between the world’s 2 largest economies, thereby easing investor concern over possible military conflict for now. “Given it’s an evolving event, investors should brace for a test of nerves which may imply high market volatility in the near term,” Bao Xiadong, fund manager at Edmond de Rothschild Asset Management in Paris, was quoted by the media. “The official return of US influence in Asia-Pacific will inevitably accelerate US-China decoupling.” The Straits Times Index (STI) rose 12.91 points or 0.4 per cent to 3,252.06, buoyed by the local banking trio, following the release of OCBC’s financial results. The counter was up 1.4 per cent or S$0.17 at S$11.99. OCBC’s results helped to lift confidence in the other 2 banking counters, with DBS shares rising 2 per cent to S$32.33 and UOB’s gaining 0.2 per cent to S$27.78. DBS’s earnings will be released on Thursday, while UOB announced its results last Friday.

Wall Street stocks finished solidly higher on Wednesday, bouncing after two down sessions following better-than-expected services industry data and mostly good earnings. A report from the Institute for Supply Management showed surprising strength in the massive US services sector, thanks to a jump in business activity and new orders even as some companies expressed recession fears. A note from Oxford Economics described the ISM data as “encouraging,” but pointed to lingering questions about the direction of the economy. “The recovery’s best days are clearly in the rearview mirror, but this doesn’t mean a downturn has begun,” Oxford said. “We think fundamentals are strong enough to prevent a recession this year, though the window to achieving a softish landing is narrowing.” Analysts also pointed to a sharp drop in oil prices that is expected to translate into lower petrol prices, providing relief to consumers. The Dow Jones Industrial Average finished up 1.3 per cent at 32,812.50. The broad-based S&P 500 advanced 1.6 per cent to 4,155.17, while the tech-rich Nasdaq Composite Index jumped 2.6 per cent to 12,668.16.

SG

The global economy may be facing greater uncertainties, but OCBC’s management team expects Asia will continue posting economic growth — albeit with some slowdown — in the second half of this year. The lender gave a positive outlook for its FY2022, noting that South-east Asian markets will likely post steady recovery this year. China, meanwhile, should benefit from accommodative fiscal and monetary policies, and easing lockdowns. In a briefing on the bank’s second-quarter results on Wednesday (Aug 3), OCBC group chief executive Helen Wong said she does not see significant inflationary risks for the core markets where the bank operates. She does, however, remain cautious on near-term headwinds. Wong guided for loan growth in the mid-single-digit percentages this year. She sees upside for the bank’s net interest income, amid rate hikes and the repricing of its loan books, as well as customer shifts from Casa (current and savings account) to fixed deposits. “Higher net interest income should also offset weaker capital-markets-dependent fees like wealth management, as consumers are expected to be more risk-off continuing into the second half of the year,” Wong said. OCBC’s net profit for its second quarter rose 28 per cent, underpinned by robust performance across its banking, wealth management and insurance businesses. Net profit for the 3 months ended Jun 30, 2022 stood at S$1.48 billion, compared with S$1.16 billion last year. Net interest income for the quarter gained 16 per cent to a new high of S$1.7 billion, on the back of asset growth and margin expansion. Net interest margin rose 13 basis points to 1.71 per cent for the quarter, from 1.58 per cent from a year ago, as asset yields growth outpaced higher funding costs amid a rapidly rising interest rate environment. Non-interest income was up 6 per cent to S$1.18 billion, on higher trading income and life insurance profit.

Prime US Reit reported on Wednesday (Aug 3) a 5.7 per cent year-on-year increase in distribution per unit (DPU) for the first half ended Jun 2022, on the back of higher gross revenue and net property income. DPU for the first half rose to US$0.0352 from US$0.0333 in the corresponding year-ago period. The higher DPU translates to an annualised distribution yield of 10.5 per cent per annum, based on the closing price of US$0.675 as at Jun 30 this year, Prime US Reit’s manager noted. The book closure date is Aug 12, and the distribution will be paid on Sep 26. Gross revenue rose 13.5 per cent on year to US$81.8 million in H1 2022; net property income was up 9.7 per cent on year to US$50.8 million. The manager said this was mainly attributable to 2 properties, Sorrento Towers in San Diego, California, and One Town Center in Boca Raton, Florida, which were acquired in July 2021. Meanwhile, income available for distribution to unitholders rose 16.7 per cent from US$35.4 million in H1 2021 to US$41.3 million in H1 2022. The manager said that lease renewal and executing new leases continue to be a key focus of management.

Daiwa House Logistics Trust on Wednesday (Aug 3) posted a distribution per unit (DPU) of S$0.0309 for the period between Nov 26, 2021 (its listing date) and Jun 30, 2022. This was in line with its pro-rated forecast disclosed in its initial public offering prospectus, the manager said. A weaker yen against the Singapore dollar led net property income and gross revenue to fall short of the real estate investment trust’s (Reit) pro-rated forecasts from the prospectus. Net property income slid 4.5 per cent to S$30 million from the pro-rated forecast of S$31.5 million, while gross revenue dropped 3.6 per cent to S$38.9 million from the S$40.4 million projected. On a yen basis, gross revenue was 0.4 per cent higher at 3.5 billion yen, due to higher utilities income and other income compared with what was assumed in the manager’s forecast. Higher capital returns from Japan entities had also lifted distributable income to S$20.9 million, in line with estimates, despite the weaker yen against the Singapore dollar. The Reit’s DPU of S$0.0309 will be paid out on Sep 6, after the record date on Aug 12. On top of bagging a new lease, all leases due to expire during the half year were renewed, bringing the occupancy rate to 98.6 per cent as at Jun 30. Rents also rose at an average of 3.1 per cent during the period. The Reit’s weighted average lease expiry stood at 6.8 years, while gearing was 34 per cent as at end-June. Units of Daiwa House Logistics Trust closed at S$0.75 on Wednesday, up S$0.01 or 1.4 per cent, after the results release.

US

Opec+ is set to raise its oil output goal by 100,000 barrels per day, an amount analysts said was a setback to US President Joe Biden after his trip to Saudi Arabia to ask the producer group’s leader to pump more to help the United States and the global economy. The increase, equivalent to 0.1 per cent of global demand, follows weeks of speculation that Biden’s trip to the Middle East and Washington’s clearance of missile defence system sales to Riyadh and the United Arab Emirates will bring more oil to the world market. “That is so little as to be meaningless. From a physical standpoint, it is a marginal blip. As a political gesture, it is almost insulting,” said Raad Alkadiri, managing director for energy, climate, and sustainability at Eurasia Group. The increase of 100,000 bpd will be one of the smallest since Opec quotas were introduced in 1982, Opec data shows.

Clorox tumbled after its earnings guidance fell well short of analyst estimates, underscoring how inflation could continue to plague companies long into 2023. The owner of Burt’s Bees natural skincare and Hidden Valley salad dressing forecast earnings per share in a range of US$3.85 and US$4.22, excluding some items, in the 12 months ending June 2023. That trailed the US$5.26 average estimate from analysts surveyed by Bloomberg. Net sales during the same period are seen in a range of negative 4 per cent to positive 2 per cent, according to a company statement that included results for its fiscal fourth-quarter. Clorox aims for a long-term target of 3 to 5 per cent. While consumers flocked to Clorox products such as disinfectant wipes during the early days of the pandemic, sales growth has moderated in recent quarters as demand for cleaning supplies returns to pre-Covid levels and inflation pressures shoppers’ budgets. Meanwhile, higher costs for commodities and transportation have eroded the company’s profitability. Clorox shares fell as much as 8 per cent in extended trading in New York. The company’s stock had declined 17 per cent this year through Wednesday (Aug 3), compared to a 2.9 per cent decline in the S&P 500 Consumer Staples Index. The company expects net sales in the current quarter will be down by high-single digits compared with the same period a year ago. Inflation pressure is also expected to peak this quarter.

The Solana ecosystem was impacted early on Wednesday (Aug 3) with thousands of wallets affected in the latest hit to the cryptocurrency market after bridge protocol Nomad was attacked at the start of the week. Estimates of the damage vary. Just over US$5.2 million in crypto assets have been stolen so far from more than 7,900 Solana wallets, according to blockchain forensics firm Elliptic. Security company PeckShield said 4 Solana wallet addresses drained approximately US$8 million from victims. “The root cause is still not clear,” Elliptic’s co-founder Tom Robinson said. “It appears to be due to a flaw in certain wallet software, rather than in the Solana blockchain itself.” The attack sent Solana’s SOL token down as much as 7.3 per cent to US$38.40 in early trading on Wednesday, its lowest in a week. Bitcoin rose 1.3 per cent to US$23,327. The exploit affected users of a digital crypto wallet made by Slope Finance, according to a tweet sent Wednesday afternoon by Solana Status, a Twitter account managed by the Solana Foundation. “There is no evidence the Solana protocol or its cryptography was compromised,” the tweet said. Slope confirmed in an official statement that a group of its wallets had been affected and said that its own founders and staff had lost funds. The startup, which raised US$8 million in February in a seed funding round led by Solana Ventures and Jump Crypto, is conducting its own investigation into the cause of the hack.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

RESEARCH REPORTS

Apple Inc – Managing supply chain and FX headwinds well

Recommendation : BUY (Maintained); TP: US$198.00, Last Close: US$160.01

Analyst: Jonathan Woo

• 3Q22 revenue and PATMI in line with expectations. 9M22 revenue/PATMI at 77/80% of our FY22e forecasts.

• Record iPhone revenue for June quarter, with growing installed base and increasing customer engagement driving Services growth.

• Gross margins slightly above forecasts, demonstrating Apple’s ability to better manage supply chain constraints.

• We adjust our FY22e earnings forecasts upwards slightly to reflect higher gross margins and PATMI outperformance YTD. We expect Apple to weather the supply chain constraints and 6% FX headwind. We maintain BUY recommendation with a higher target price of US$198.00 (prev. US$194.00) on DCF with a WACC of 6.1% and terminal growth of 3.0%.

Upcoming Webinars

Guest Presentation by SATS [NEW]

Date: 4 August 2022

Time: 2.30pm – 3.30pm

Register: https://bit.ly/3IXysX5

Guest Presentation by Prime US REIT

Date: 4 August 2022

Time: 3.30pm – 4.30pm

Register: https://bit.ly/3uYlNgS

Guest Presentation by Pan-United Corporation Limited

Date: 5 August 2022

Time: 11am – 12pm

Register: https://bit.ly/3OFbJ41

Guest Presentation by A-Sonic Group

Date: 11 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3PmoIrl

Guest Presentation by Marathon Digital Holdings

Date: 18 August 2022

Time: 10am – 11am

Register: https://bit.ly/3yNSfUu

Guest Presentation by First REIT

Date: 18 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3BqQe3q

Guest Presentation by Audience Analytics

Date: 23 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3P3eBYR

Guest Presentation by Meta Health Limited (META)

Date: 24 August 2022

Time: 12pm – 1pm

Register: https://bit.ly/3nYZXWx

Guest Presentation by United Hampshire US REIT [NEW]

Date: 7 September 2022

Time: 7pm – 8pm

Register: https://bit.ly/3SgiZFV

Research Videos

Weekly Market Outlook: Microsoft, Meta Platforms, Alphabet Inc, UOB, Keppel Corp, Sheng Siong & More

Date: 1 August 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials