Daily Morning Note – 4 March 2022

Stocks looked poised to fall in Asia Friday on concerns over global growth and inflation risks from the war in Ukraine and the isolation of Russia’s economy. Oil’s rally eased but crude prices were volatile.

Equity futures for Japan, Australia and Hong Kong dropped after technology stocks led U.S. equities lower in another choppy Wall Street session.

Crude eased back from a 14-year high on the prospect of a supply boost as talks toward an Iran nuclear deal make progress. Energy, metal and grain costs have soared as the world increasingly shuns Russia’s oil and other resources.

Traders are also evaluating the monetary policy outlook. Chair Jerome Powell reaffirmed the Federal Reserve is set to start a series of interest-rate hikes to curb inflation, while indicating it will move judiciously.

Longer-maturity Treasuries rose, lowering the 10-year yield to 1.84%. The gap between two-year and 10-year yields shrank to the least since March 2020. The flatter curve points to expectations for slowing economic expansion. Gold and a dollar gauge climbed.

Stocks to watch: Grab

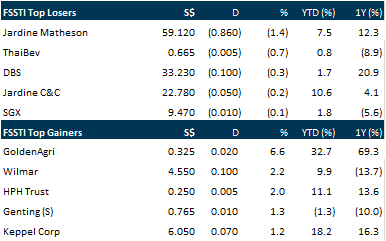

SG

New York-listed Grab sank deeper into the red for the fourth quarter ended Dec 31, chalking up a net loss of US$1.1 billion compared with US$576 million a year ago after its mobility business suffered from Covid-19 disruptions. Revenue plunged 44 per cent to US$122 million, with declines in mobility and delivery revenue but an improvement in financial services revenue. Shares in the company opened down 7.46 per cent after the results announcement. Revenue from mobility slipped 27 per cent to US$105 million, down 27 per cent, while gross merchandise value (GMV) fell 11 per cent to US$765 million.

Jardine Matheson Holdings (JMH) on Thursday reported a net profit of US$1.9 billion for the full year ended Dec 31, reversing from a loss of US$394 million a year ago. The group recorded a narrower decrease in fair value of investment properties, and an increase in fair value of investment properties from its share of the results of associates and joint ventures. Underlying profit, which excludes non-trading items, increased 39 per cent to US$1.5 billion. The group recorded earnings per share of US$6.01 for FY2021, compared with a loss per share of US$1.07 the year before.

Dairy Farm International (DFI) reported on Thursday (Mar 3) a decline in net profit for 2021 on the back of lower revenue, with the group’s operations continuing to be impacted by the pandemic. Net profit for the full year ended Dec 31, 2021, fell 62 per cent to US$102.9 million from US$271 million the year before. Sales fell to US$9 billion, down 12.2 per cent from US$10.3 billion a year earlier. Said chairman Ben Keswick in a statement: “Last year was another challenging year for DFI retail group, with the pandemic impacting the group’s operations and, as a result, its financial results.”

Hongkong Land, a member of the Jardine Matheson Group, narrowed its net loss to US$349.2 million for the year ended Dec 31, from US$2.6 billion a year ago. The loss included net losses of US$1.3 billion primarily from lower valuations of the group’s investment properties. The year before, full-year net loss included a US$3.6 billion reduction in property valuations. Underlying profit, which excludes non-trading items, was mostly flat at US$966 million, compared with US$963 million a year ago. Loss per share was 15 US cents, narrowing from US$1.1343.

The counter of Oiltek International rose as much as 23.9 per cent above its initial public offering (IPO) price of S$0.23 per share as the solutions provider in the oils and fats industry made its trading debut on the Singapore Exchange’s Catalist board on Thursday (March 3). Its shares traded as high as S$0.285 in the first 10 minutes before losing some steam, inching down to trade between S$0.255 and S$0.265 for the rest of the session. The counter eventually closed 13 per cent above the IPO price at S$0.26, with some 29.5 million shares changing hands, placing it among the day’s top 15 most active counters on the bourse.

Hotelier Mandarin Oriental International narrowed its net loss for FY2021 to US$141.4 million from US$680.1 million the year before. Revenue was up 72.5 per cent to US$316 million following relaxation of travel restrictions in most parts of the world in the second half of 2021, but the group cautioned that travel restrictions in most of East Asia remained in place throughout the year. Despite the challenging environment in that region, occupancy rose to 35 per cent from 27 per cent in 2020. Group results were lifted by pandemic-related receipts that included government support primarily in Europe, rent concessions in Tokyo, and business interruption insurance proceeds for hotels in the US. Loss per share was 11.19 US cents, compared with 53.84 US cents the year before. No dividend has been declared for 2021. Ebitda (earnings before interest, tax, depreciation and amortisation) from the group’s property interests in 2021 was US$24 million, compared to a loss of US$62 million in 2020.

US

Deutsche Bank is conducting an internal probe into the extent to which staff used private messaging channels such as WhatsApp, amid a crackdown from US regulators on banks who fail to store business-related communication. Many senior executives have long relied on smartphone messaging services to communicate with each other, clients and other stakeholders, people familiar with the matter said. Those exchanges are part of an internal investigation that the German lender has kicked off to see if staff communications were in compliance with company policies and banking regulation, the people said asking not to be identified discussing private information.

Cryptocurrency exchange Binance on Thursday (Mar 3) said cardholders of sanctioned Russian banks would not be able to use them on their platform and confirmed that sanctioned individuals have had their access restricted. Some of the world’s biggest cryptocurrency exchanges are staying put in Russia, breaking ranks with mainstream finance in a decision that experts say weakens Western attempts to isolate Moscow following the invasion of Ukraine.

The upending of markets by shifting central bank policy, war and the pandemic is convincing professional investors the time is ripe to put their often-maligned stock-picking skills to work. Hedge funds that make both bullish and bearish equity bets became big buyers of shares in individual companies in February for the first time in 4 months, prime broker data compiled by Goldman Sachs Group show. The amount of net purchases in single stocks reached the highest level in the past year.

The number of Americans filing new claims for unemployment benefits fell more than expected last week, while layoffs declined sharply in February, indicating that the labour market recovery was gaining steam. Initial claims for state unemployment benefits dropped 18,000 to a seasonally adjusted 215,000 for the week ended Feb 26, the Labour Department said on Thursday (Mar 3). Economists polled by Reuters had forecast 225,000 applications for the latest week. It was the second straight weekly decline in claims. With a near record 10.9 million job openings at the end of December, companies are holding on to their workers. Claims could soon fall back below 200,000. They were last below this level in early December.

Visa Inc will lower consumer credit interchange rates for small businesses in the United States by 10 per cent, effective next month, to help merchants recovering from the Covid-19 pandemic, according to a document seen by Reuters on Thursday. Visa, the world’s largest payment processor, is reducing interchange rates for both online and in-person consumer credit transactions for 90 per cent of US businesses, the document showed. An interchange fee is the charge a merchant pays to the card-issuing bank every time a consumer swipes their card. The changes will apply to merchants with US$250,000 or less in Visa consumer credit volumes, according to a source familiar with the matter who declined to be identified because the document is confidential.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

Sembcorp Industries – Conventional Energy drive improved operational performance

Recommendation: ACCUMULATE (Upgraded), Last Done: S$2.73

Target price: S$2.94, Analyst: Terence Chua

– FY21 net profit of $300mn was above our estimates, at 146% of FY21e. The beat came from higher revenue from Conventional Energy, which surpassed our expectations on the back of better spark and dark spreads particularly in 4Q21.

· 85% of SEIL’s thermal plant capacity now comprises mid- and long- term power purchase agreements (PPAs). We have penciled in a reversal of the losses from its SEIL 2 plant from FY23e.

· Net gearing declined by more than 20% of our FY21e forecasts. Free cash flow rose 71% YoY as better operating performance drove higher net cash from operating activities, which were used to amortise its loans.

· We upgrade to ACCUMULATE from NEUTRAL with higher target price of $2.94. We raise FY22e PATMI by 6.8% as we bake in higher profits from Conventional Energy for FY22. Our target price is raised to $2.94 as we roll forward our valuation to 1.2x FY22e P/BV, the average of its peers.

Click the link to join: https://t.me/stocksbnb

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.