Daily Morning Note – 4 May 2022

Wall Street stocks finished a choppy session modestly higher on Tuesday as markets await another interest rate hike in the Federal Reserve’s latest bid to counter inflation. Following a quarter-point increase of the benchmark lending rate in March, Federal Reserve Chair Jerome Powell and other central bankers have said a half-point increase could be announced when their two-day meeting concludes Wednesday. Analysts say the market reaction is difficult to predict, in part because of debate over the extent to which markets have already baked in the Fed shift. “There is a real uncertainty and people have different opinions about what the market is going to do after the Fed raises rates and announces quantitative tightening,” said LBBW’s Karl Haeling, pointing to a divergence between investors who predict a sell-off and those who anticipate a relief rally. The Dow Jones Industrial Average finished Tuesday up 0.2 per cent at 33,128.79. The broad-based S&P 500 climbed 0.5 per cent to 4,175.48, while the tech-rich Nasdaq Composite Index advanced 0.2 per cent to 12,563.76.

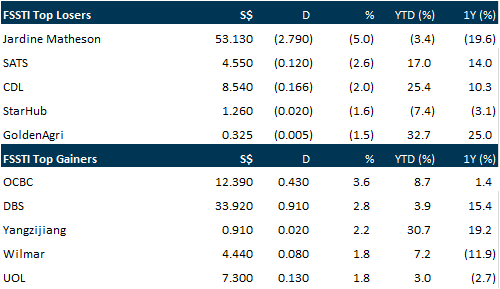

With 2 of the 3 banking heavyweights each notching over 3 per cent rise in their Friday (Apr 29) share price and as bullishness prevailed in the regional bourses, Singapore’s blue-chip benchmark Straits Times Index (STI) – which has over 40 per cent weightage from the banking trio – ended the day up 21.81 points or 0.65 per cent to 3,356.90 points. The barometer was up about 0.1 per cent over the week.

SG

Singapore’s largest bank DBS reported a net profit of S$1.8 billion for the first quarter ended Mar 31, 2022, down 10 per cent from the record S$2.1 billion posted a year ago. In a media conference on Friday (Apr 29), the bank’s top executives stressed the high base for wealth management and treasury markets activities it the year-ago period while noting that the Q1 earnings are still its second-highest on record. “Buoyant market sentiment and clear market momentum” had driven income from both activities to “exceptional levels” last year, the bank said. “As we are going into the second quarter, I think we’re tracking closer to last year’s levels. But relative to last year, overall there could prove to be a little bit of headwind,” DBS chief executive Piyush Gupta said. He also stressed that DBS is in good stead to reap gains from rising interest rates – a point banking analysts agreed on. The bank’s Q1 earnings were in line with a S$1.88 billion consensus estimate from analysts polled by Bloomberg. Total income for the quarter fell 3 per cent to S$3.75 billion, from S$3.85 billion a year ago.

OCBC chief executive Helen Wong has flagged a volatile investing environment as a headwind, and expects customers to be “not as active as last year”. This comes as the bank reported a 10 per cent dip in quarterly earnings, partly due to lower wealth management fees and trading income. OCBC generated S$1.36 billion in earnings for Q1 FY2022 to March, according to financial statements released on Friday (Apr 29). While this was lower year on year, it beat analysts’ expectation of S$1.2 billion. OCBC’s total income slid 9 per cent to S$2.64 billion in Q1 FY2022. Non-interest income declined 23 per cent to S$1.14 billion, amid a more volatile investing climate.

UOB’s Q1 net profit may have fallen in the first quarter amid lower trading and investment income but the bank expects improvements in the coming quarters. Speaking at a press briefing on Friday (Apr 29) morning, chief financial officer Lee Wai Fai noted that operating profit was lower mainly due to the “accounting asymmetry” impact from hedges and market-driven volatilities affecting trading and investment income. “The impact on hedges will be more than offset by increasing net interest income in the coming months,” he said, noting that core business drivers remain strong. The bank also expects higher margins from rising interest rates. UOB reported on Friday that Q1 net profit fell 10 per cent to S$906 million, as total income was impacted by market volatility. Its net profit for the 3 months ended Mar 31, 2022 was also 11 per cent lower quarter on quarter, and fell short of the S$1.037 billion average estimate from 5 analysts polled by Bloomberg. Total income for the first quarter fell 5 per cent on year to S$2.4 billion, dragged by lower net fee income and other non-interest income. Net fee and commission income declined 8 per cent to S$572 million largely due to lower wealth management and fund management as the market outlook this year is more subdued, UOB said.

The Singaporean shopping app Shopee, owned by Sea, received authorisation on Monday (May 2) from Brazil’s central bank to operate as a payment institution, according to a notice in the government’s official gazette. SHPP Brasil Payment Institution and Payment Services, controlled by SHPP Brasil Participacoes, will be able to “manage prepaid payment accounts, in which funds must be previously deposited”, the official gazette said. Shopee has become one of the most-downloaded e-commerce apps in Brazil, drawing users to its low-cost marketplace from other local companies. Singapore-headquartered Sea and its Sao Paulo-based company did not immediately respond to a request for comment.

US

Vacation rental firm Airbnb Inc projected second-quarter revenue above market estimates on Tuesday, betting on pent-up demand to drive a summer of strong travel after Covid-19 curbs were eased globally. The San Francisco-based firm expects revenue between US$2.03 billion and US$2.13 billion, compared with the average analyst expectation of US$1.96 billion, according to Refinitiv data. The rise of hybrid working has in recent months encouraged people to book longer and more frequent stays in destinations away from cities, giving a boost to rental providers. “We are going to continue to see continued and sustained growth for stays of longer than a month and stays of longer than a week,” chief executive Brian Chesky said on a call with analysts. Shares of the company rose more than 4 per cent in extended trading. Airbnb, which made a slew of changes to its service last year to take advantage of the post-pandemic travel surge, said it posted the strongest growth in gross nights booked in non-urban areas in the first three months of 2022.

Advanced Micro Devices gave a strong sales forecast for the current quarter, indicating that the chipmaker continues to make strides in its most lucrative market: data-centre processors. AMD predicted second-quarter sales on Tuesday of roughly US$6.5 billion, compared with an average analyst estimate of US$6.03 billion. That helped the shares up as much as 8.3 per cent in late trading. The outlook helped allay concerns that the chip market is slowing – and signalled that AMD is making further gains on Intel. The company, which for years lagged far behind Intel in computer processors, is on pace to end 2022 with almost 4 times as much revenue as in 2019. New products and better execution have helped AMD win over customers who were once sceptical about its capabilities.

Robust sales in North America were offset by weakness in China as Starbucks reported a modest profit increase on Tuesday as it boosts investment in US stores amid a unionisation campaign. The coffee giant scored a 12 per cent jump in comparable sales in North America, while suffering a 23 per cent slide in China amid that country’s latest Covid-19 outbreak. Interim chief executive Howard Schultz said the chain was ramping up investments in “high-returning” drive-thru stores and cafe renovations in its home market. “We are single-mindedly focused on enhancing our core US business through our partner, customer and store experiences,” Schultz said in a news release. “The investments we are making in our people and the company will add the capacity we need in our US stores today and position us ahead of the coming growth curve ahead.” Net income edged up 2.3 per cent to US$674.5 million in the quarter ending April 3 following an 14.5 per cent jump in revenues to US$7.6 billion.

Oil prices fell by more than 2 per cent on Tuesday as demand worries stemming from China’s prolonged Covid-19 lockdowns outweighed the prospect of a European embargo on Russian crude. Beijing is mass-testing residents to avert a lockdown similar to Shanghai’s over the past month. The capital’s restaurants were closed for dining in while some apartment blocks were sealed shut. Brent crude settled down US$2.61, or 2.4 per cent, at US$104.97 a barrel. US West Texas Intermediate (WTI) crude ended US$2.76, or 2.6 per cent, lower at US$102.41. “There are real concerns about whether Chinese demand, which is a huge factor in global demand, will remain strong in 2022,” said Gary Cunningham, director at Tradition Energy.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

StarHub Limited – Roaming tailwind vs near-term cost pressures

Recommendation: ACCUMULATE (Upgraded), Last close: S$1.26

TP S$1.35, Analyst Paul Chew

– 1Q22 revenue and EBITDA met our expectations at 23/27% of our FY22e estimates. We expect EBITDA margins to contract further in the remaining three quarters of the financial year due to upfront investments in IT and staff costs. EBITDA declined 11% YoY to S$109mn.

– Mobile revenue growth was softer than expected despite higher postpaid ARPU and subscribers. Weakness was from a deterioration in prepaid revenue of more than 20% YoY.

– We maintain our FY22e forecast. The return of high margin roaming revenue is a major earnings tailwind for the next several quarters as borders reopen. However, with upfront investments (IT and content) as part of the DARE+ transformation roadmap, EBITDA margins are expected to deteriorate over the next three quarters. We upgrade our recommendation to ACCUMULATE from NEUTRAL due to the recent share price weakness. Our target price of S$1.35 is maintained. Valuations are 8x FY22e EV/EBITDA, in-line with other mobile peers.

Venture Corporation Ltd – Earnings close to record levels

Recommendation: NEUTRAL (Maintained), Last close: S$17.15

TP S$20.00, Analyst Paul Chew

– 1Q22 PAT rose 28% YoY to S$84mn and beat our estimates by 10%. It was the 2nd highest Mar quarter for Venture. PAT was 23% of our FY22e forecast.

– Venture has coped well with supply chain challenges through a strong balance sheet to bulk up on inventories and re-design of products with new components.

– Outlook remains upbeat with customers committing to six to 12 months of visibility. We also believe new products especially life science are gaining more traction. Despite the earnings beat, we maintain our FY22e PATMI. We are incorporating a buffer as the slowing macro environment remains a concern. The target price of S$20.00 is unchanged and based on 16x PE FY22e, its 5-year average. Our recommendation is upgraded from ACCUMULATE to BUY. The current share price offers a 5% dividend yield with an attractive unlevered ROE of 13% and a net cash balance sheet of S$808mn.

Ascott Residence Trust – Pick-up in demand upon relaxation

Recommendation: ACCUMULATE (Maintained), Last Done: S$1.16

Target Price: S$1.24, Analyst: Natalie Ong

– No financials provided in this business update. 1Q22 RevPAU grew 22% YoY, currently at 65% of pre-pandemic levels, on the back of higher ADRs and occupancy.

– RevPAU declined 23% QoQ due to tightening of restrictions in Jan-Feb22 in several of ART’s key markets due to resurgence of Omicron cases, seasonal lull, as well as three properties transitioning out of government block bookings.

– Maintain ACCUMULATE, DDM-TP raised from S$1.23 to S$1.24. FY22e-26e DPUs raised by 0.3-0.9% as we pencil in acquisition of Japan portfolio of rental housing and student accommodation assets, resulting in a slight increase in our DDM-TP. Catalysts include faster than anticipated recovery, opportunistic divestments and acquisitions of extended stay assets.

Fortress Minerals Ltd – Lower ore production but outlook turning positive

Recommendation: BUY (Upgraded); Last Done: S$0.455

TP: S$0.66; Analyst: Vivian Ye

– 4Q22 results were below expectations. Revenue and PATMI were at 12%/6% of our FY22e forecasts.

– 4Q22 sales volume decreased 72.2% YoY due to lower operating capacity caused by the spread of the Omicron variant among workers and unfavourable weather conditions.

– Upgrade to BUY with a higher TP of S$0.66, up from S$0.50 as we roll over our 11x P/E target to FY23e, and remains pegged to the industry average, up from 10x previously. Our FY23e PATMI has been increased by 20.7% to US$22.3mn, as we increase our production forecast by 9.5% to 498,032 DMT. Iron ore prices are expected to remain resilient with higher infrastructure spending by the Chinese government, and slower than expected supply growth from Australia and Brazil.

Apple Inc – Bottlenecked by supply constraints

Recommendation: BUY (Maintained), Last close: US$159.48

TP: US$214.00, Analyst: Timothy Ang

– 1H22 revenue and PATMI were ahead of our FY22e forecasts at 56% and 60% respectively.

– Demand remains robust for iPhone, Mac and Services despite concerns of softening consumer confidence.

– Gross margins beat estimates, demonstrating Apple’s ability to pass on higher costs.

– We keep our forecasts unchanged despite the outperformance this quarter. COVID-19 shutdowns in China, ongoing semiconductor shortages and a stronger US$ will impact revenue growth by US$4bn-8bn in 3Q22. We maintain BUY and our unchanged target price of US$214.00 on DCF with a WACC of 6.2% and terminal growth of 3.0%.

Amazon.com Inc – Cost pressures to linger

Recommendation: BUY (Maintained), Last close: US$2,485.07

TP: US$3,130.00, Analyst: Timothy Ang

– 1Q22 revenue was in line at 21% of FY22e forecast, while adjusted PATMI came in at a mere 15%, excluding a pre-tax valuation loss of US$7.6bn from Rivian Automotive.

– US$6bn incremental cost from external factors: transport rates, higher fuel prices, wage inflation, and internal factors: productivity and overcapacity hurt margins. Internal factors (2/3) may ease next quarter while the external (1/3) will linger.

– Guidance was weaker than expected for both revenue and margins. The focus for the next few quarters will be to work down internal costs and pass on some external costs to sellers. This may take up to three quarters. Our FY22e revenue and adjusted PATMI are cut by 3% and 15% respectively. Maintain BUY with a lower target price of US$3,130.00 based on DCF with a WACC of 6.2% and terminal growth of 5.0%.

Microsoft Corp – Another strong quarter

Recommendation: BUY (Maintained), Last close: US$281.78

TP: US$410.00, Analyst: Timothy Ang

– 9M22 revenue was in line at 74% of FY22e forecasts, while PATMI outperformed at 79%.

– Virtually all segments beat on margins driven by higher volumes and prices for MS Office 365 licenses, and unabated corporate adoption of cloud services.

– Our FY22e PATMI is raised by 3.5% on stronger revenue guidance and a lower tax rate. We maintain BUY with an unchanged target price of US$410.00. Valuations are based on DCF with a WACC of 6.2% and terminal growth of 4.0%. MSFT enjoys tailwinds from businesses reopening, cybersecurity and cloud computing secular trends.

Alphabet Inc – Moderating growth, YouTube shorts usage surges

Recommendation: BUY (Maintained), Last close: US$2,346.68

TP US$3,493.00, Analyst: Jonathan Woo

– 1Q22 results beat on top line, misses on earnings. 1Q22 revenue/PATMI at 22/18% of our FY22e forecasts. Earnings miss due to unrealized loss in equity investments.

– Cloud still fastest growing segment with 44% YoY revenue growth, showing continued consumer demand in cybersecurity and productivity applications

– YouTube Shorts increasing in popularity with over 30 billion daily views, we believe there is huge potential with increased monetization

– YoY decline in PATMI largely due to an unrealized loss in equity investments of US$1.2bn for 1Q22 vs an unrealized gain of US$4.8bn in 1Q21

– We maintain a BUY recommendation with an unchanged DCF target price (WACC 6.6%, g 3.5%) of US$3493.00.

Company ESG Report – Tesla Inc

Author: Phillip Capital Management

Click the link to join: https://t.me/stocksbnb

Date: 25 April 2022

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.