DAILY MORNING NOTE | 5 January 2023

Trade of the Day

Mapletree Pan Asia Commercial Trust (SGX: N2IU)

Analyst: Zane Aw

(Current Price: S$1.68) – TECHNICAL BUY

Buy price: $1.68 Stop loss: S$1.64 Take profit: S$1.78

Singapore shares extended a second day of flattish trading on Wednesday (Jan 4), amid a mixed showing across the region. The Straits Times Index (STI) shed 0.1 per cent, or 3.34 points to close at 3,242.46. Across the broader market, gainers beat losers 286 to 267, with 1.3 billion shares worth S$993.7 million traded. The top performer was DFI Retail Group, which gained 2.8 per cent or US$0.08 to close at US$2.94. Yangzijiang Shipbuilding was at the bottom of the table. The counter fell 6.3 per cent or S$0.08 to close at S$1.20. The trio of banks also ended the day mixed. DBS gained 0.4 per cent or S$0.14 to close at S$34.02, OCBC grew 0.4 per cent or S$0.05 to close at S$12.29 and UOB shed 0.8 per cent or S$0.24 to close at S$30.46.

Wall Street stocks closed higher on Wednesday (Jan 4), snapping a brief losing streak as markets shrugged off messaging from the Federal Reserve’s most recent meeting that stressed its commitment to lowering inflation. Fed policymakers do not expect it will be “appropriate” to start cutting interest rates this year. But this did not stop the Dow Jones Industrial Average from closing 0.4 percent higher at 33,269.77. The tech-rich Nasdaq Composite Index bounced 0.7 percent to 10,458.76, while the broad-based S&P 500 rose 0.8 percent to 3,852.97. The movements came on the back of survey data showing that US manufacturing activity remained in contraction for a second straight month, a sign that earlier Fed rate hikes may be biting. While interest-sensitive sectors are reeling, job openings data also released Wednesday continued showing minimal signs of labor market weakness. As they digest the figures, investors appear to be awaiting further data, including a key employment report due Friday, for more clues on the policy direction to come.

SG

Lian Beng Group Ltd announced that the wholly-owned subsidiary of the company, L.S. Construction Pte Ltd, has secured a new construction project. With the inclusion of this project, the group’s construction order book in Singapore stands at approximately S$1.9 billion, which will provide a sustainable flow of activity through FY2027.

The managers of ARA US Hospitality Trust (ARA H-Trust) have proposed to acquire a 119-room Hilton-branded hotel property in the US for US$29 million. The proposed acquisition is expected to be completed in the first quarter of 2023, subject to an independent valuation being commissioned. Including all fees and expenses, the total acquisition cost is estimated to be US$30 million. Managers of the stapled group expect the acquisition to be yield accretive. It will be funding the acquisition with cash, using net proceeds from its sale of five Hyatt Place properties in the third quarter of 2022, which were previously sold for some US$40.3 million.

Leverage ratios should remain below the mid-40 per cent levels at Keppel Pacific Oak US Reit (Kore) and Prime US Reit, according to market watchers. Both are Singapore-listed real estate investment trusts (S-Reits) with office assets in the United States, where occupancy ratios remain below pre-pandemic levels on average. Peer Manulife US Reit last week raised alarm bells, when it disclosed that its gearing level had hit 49 per cent. The Reit manager said the decline in valuation was mainly due to higher discount rates and capitalisation rates for certain properties, as well as continued weakening of occupational performance in submarkets where the properties are located. Manulife US Reit’s predicament has raised concerns about how asset valuations for the portfolios of Kore and Prime US Reit could affect their respective gearing levels.

Keppel Capital, through its China logistics property fund, has partnered Chinese logistic park developer and operator BLOGIS to acquire the fund’s first asset, a grade-A high-standard warehouse, located in Dongxihu, Wuhan, China. The Wuhan warehouse spans 70,000 sq m and serves e-commerce, third-party logistics and coldchain sectors. Managed by Keppel Capital China (SG), the fund, together with BLOGIS, has committed to a combined asset under management (AUM) of approximately RMB3,200 million ($634 million). The fund and BLOGIS will jointly continue to invest in a pipeline of investment opportunities in key logistics markets. Keppel Corporation does not expect the acquisition to have any material impact on its earnings per share and net tangible asset per share for the current financial year.

US

Federal Reserve officials offered uncharacteristically blunt words of warning to investors that cautioned against underestimating the central bank’s determination to hold interest rates at higher levels to bring down inflation. Minutes of the Fed’s policy meeting last month, released Wednesday, highlighted the tricky communications task that has vexed the central bank over the past six months. Despite some signs that inflation may have peaked last summer, officials indicated at last month’s meeting that they would continue raising interest rates in case price pressures prove more persistent this year. Fed officials are concerned, however, that labor markets are too tight, which could sustain strong wage growth that keeps inflation well above their 2% target. Officials projected somewhat higher rates in new projections released last month. Some 17 of 19 officials penciled in plans to raise the rate to a level above 5% in 2023 and hold it there until some time in 2024. No officials projected rate cuts next year, the minutes said. Several officials are shifting their focus from broad inflation readings to the labor market amid concerns that high inflation could persist if it leads workers to bid up wages. Job openings held nearly steady at historically high levels in November, adding to evidence the labor market remained strong heading into 2023. The minutes offered no insight about the debate over whether to raise rates by 0.5 point or a smaller 0.25 point at Fed policy makers’ next meeting, Jan. 31-Feb 1. Fed Chair Jerome Powell said in a news conference last month it was “broadly right” that the Fed’s best way to manage the risk of over-tightening would be to slow rate increases to more traditional 25-basis-point increments as soon as the central bank’s next meeting. But he said twice that the Fed hadn’t decided what to do at its coming meetings and that its actions would depend on the state of the economy and financial conditions.

Chinese regulators approved a plan by billionaire Jack Ma’s Ant Group to raise 10.5 billion yuan (S$1.5 billion) for its consumer unit, signalling progress in the government-ordered overhaul of the financial technology firm. The China Banking and Insurance Regulatory Commission division in Chongqing green-lit the company’s plan to lift its capital to 18.5 billion yuan. Ant, which contributed 5.25 billion yuan as part of the plan, will control half of its shares after the deal, while a unit owned by the city of Hangzhou will hold 10 per cent, becoming the second-biggest shareholder. Chinese regulators have reined in shadow banking over the past years to reduce economic risk and Ant is still waiting on obtaining a financial holding license that will regulate it more like a bank.

Salesforce Inc. is laying off 10% of its workforce and reducing its office space in certain markets. It said it will incur about $1.4 billion to $2.1 billion in charges from the restructuring plan, with up to $1 billion in the company’s current quarter. Co-Chief Executive Marc Benioff said that the cuts come as many of the company’s customers are taking a more cautious approach to spending. Mr. Benioff said the business-software provider hired too many people as revenue surged earlier in the Covid-19 pandemic and that most of the layoffs will occur over the coming weeks. Salesforce had nearly 80,000 global employees as of Oct. 31, up from more than 49,000 employees as of Jan. 31, 2020.

Shares of Rivian Automotive hit a new 52-week low on Wednesday after the company missed its 25,000-unit production target for last year. The EV startup late Tuesday said it produced 24,337 vehicles in 2022, of which 20,332 vehicles were delivered to customers during the year. The missed target caps off a difficult year for the company as well as Rivian investors. Shares of the automaker declined by more than 80% during 2022 amid production, parts and supply chain problems.

A top European Union privacy regulator ruled that Meta Platforms Inc. can’t use its contracts with Facebook and Instagram users to justify sending them ads based on their online activity. Meta said it disagrees with the ruling and plans to appeal it. Ireland’s Data Protection Commission imposed fines of 390 million euros, or $411 million, on Meta, saying that the company violated EU privacy laws. Litigation could take years, but if the decisions are upheld, they could mean that Meta will have to allow users to opt out of ads that are based on how individual users interact with its own apps—something that could hurt one of its core businesses.

Microsoft is in advanced talks to invest in Gatik, a California-based autonomous driving startup, under its cloud partnership with the company. Microsoft plans to invest over US$10 million in a financing round that values Gatik at more than US$700 million. As part of the deal, Gatik will use Microsoft’s cloud and edge computing platform Azure to develop autonomous delivery technology for trucks. The terms of the deal are said could still change.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

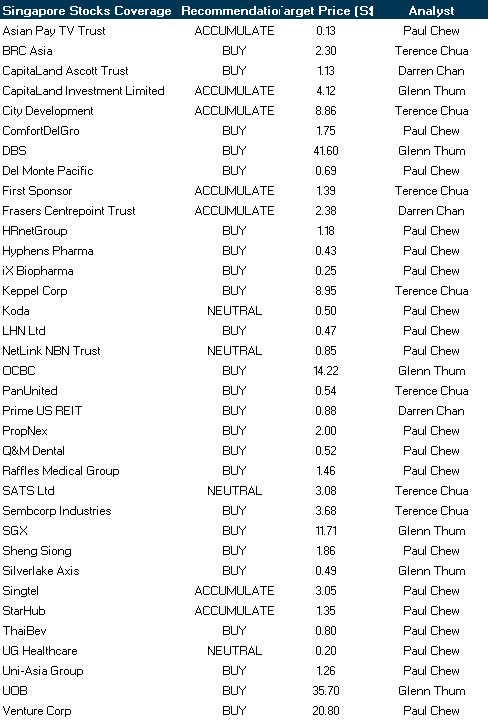

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Research Videos

Weekly Market Outlook: SGX, DelMonte, LHN, Zoom, City Developments, Zoom, Starhub, SG Weekly & More!

Date: 12 December 2022

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials