DAILY MORNING NOTE | 6 February 2023

Week 6 equity strategy: We expect near-term weakness in equity markets. Firstly, we are worried about the current bullish fervour. The Meme ETF is up 35% in a month and markets tend to peak when speculation is at its highest. Secondly, the January spike in US jobs raised expectations of more tightening by the Fed, with two more rate hikes in their playbook. There is a risk that Fed chief Powell could push a hawkish tone in the upcoming interview on Tuesday. On the theme of higher interest rates, SGX will be releasing its 1H23 results on 9th Feb. We are upbeat on its outlook. Volumes are expected to grow by mid- to high single digits, but we believe there is huge upside in their Treasury (interest) income. SGX collects collateral balances of S$14bn and it shares interest income with members. In FY22, Treasury income was only S$49mn (of 36bps), or 10% of net income. This compares with FY20’s S$135mn, or 98bps. We think there is room for Treasury income to more than triple with the spike in interest rates.

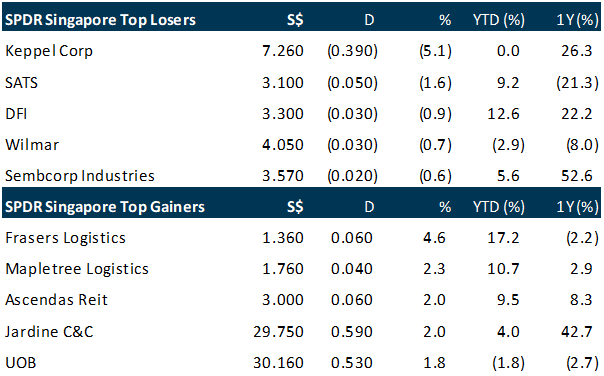

Singapore shares ended higher on Friday (Feb 3) with the Straits Times Index (STI) advancing 0.6 per cent or 20.61 points to close at 3,384.29 on Friday. The top gainers on the index were Frasers Logistics and Commercial Trust, which climbed 4.6 per cent to close at S$1.36; Mapletree Logistics Trust, which rose 2.3 per cent to S$1.76 and CapitaLand Ascendas Reit, which gained 2 per cent to S$3.00. Meanwhile, the top loser was Keppel Corp which fell 5.1 per cent to S$7.26. The trio of local banks all advanced on Friday. DBS gained 1.2 per cent to S$35.50, UOB rose 1.8 per cent to S$30.16, while OCBC put on 0.9 per cent to S$13.00.

Wall Street stocks declined on Friday (Feb 3) after a blowout January jobs reports raised fresh questions about the outlook for monetary policy as markets digested disappointing earnings. The United States added 517,000 jobs in January, nearly double the December figure, after a five-month slowdown in hiring, according to the data. The Dow Jones Industrial Average ended down 0.4 per cent at 33,926.01. The broad-based S&P 500 dropped 0.8 per cent to 4,136.48, while the tech-rich Nasdaq Composite Index tumbled 1.6 per cent to 12,006.95.

SG

Singapore’s retail sales rose 7.4 per cent year on year in December, extending the previous month’s 6.5 per cent growth, the latest data from the Department of Statistics (SingStat) showed on Friday (Feb 3). On a month-on-month seasonally adjusted basis, retail sales were up 1.3 per cent, reversing from the 3.6 per cent decline recorded in November. December’s estimated total retail sales value was S$4.7 billion, with online sales accounting for 12.9 per cent. This was lower than the 15 per cent recorded in the previous month, in which there were major online shopping events, said SingStat.

The Indonesian arm of OCBC Bank filed a police report against a billionaire owner of cigarette-maker PT Gudang Garam. PT Bank OCBC NISP filed the report against Susilo Wonowidjojo, an owner and president director of Gudang Garam, on fraud allegations relating to some 232 billion rupiah (S$20 million) in troubled loans, the lender’s lawyer Hasbi Setiawan said in a statement on Friday (Feb 3). The bank disbursed the loan in 2016 to a wig-making company owned by Wonowidjojo’s family, Setiawan added. The case involves a total of one trillion rupiah of funds when including loans from other lenders, he said.

Aspen Glove, a subsidiary of mainboard-listed Aspen Group, has on Feb 1, 2023 received a letter from Gas Malaysia Energy and Services to terminate a gas supply agreement made between the companies and to claim for payments, according to a Sunday (Feb 5) bourse filing. Aspen Glove denies the claim and the notice of termination and demand’s validity, and intends to contest them. The notice of termination and demand, dated Jan 31, 2023, sought an aggregate sum of about RM306.4 million (S$95.2 million) – RM838,756.77 for alleged outstanding payment, and about RM305.5 million for alleged payment for unused gas supply for the remaining contract period of the gas supply agreement. The agreement to be terminated was dated Jan 19, 2021.

China Hainan Rubber Industry Group said on Friday (Feb 3) that its wholly-owned subsidiary will be making a mandatory conditional cash offer for Halcyon Agri Corporation with an offer price of S$0.413 per share. The announcement follows the closing of an earlier acquisition, where the Chinese rubber producer acquired 36 per cent of Halcyon Agri’s shares or 574.2 million shares at US$0.315 apiece, from substantial shareholder Sinochem International (Overseas) which would trigger a mandatory conditional cash offer for all the shares in the Singapore-listed company.

Acesian Partners said on Friday (Feb 3) that the group is expected to report a ”significant improvement in profit before tax” for the 12 months ended Dec 31, 2022, as compared to the previous year. The Catalist-listed company said in a bourse filing that the expected rise in profit before tax was mainly attributable to an “increase in revenue recognised by the group due to, among others, improvement in business volume and pent-up demand”. The group said that it is still in the process of finalising its unaudited consolidated financial results for FY22 and will provide further details of its performance when it releases the results on or before Mar 1.

Catalist-listed Charisma Energy said on Friday (Feb 3) that the company and its wholly-owned subsidiary, Anchor Marine 3, have received notices of demand from one of the secured lending banks of the group. The bank said that since the maturity date of Jan 5 last year, Anchor Marine 3 has failed to make full payments under a facility agreement dated Dec 18, 2014, and the bank is declaring an event of default under the facility agreement. Anchor Marine 3 would be required to make payment and discharge the entirety of the secured obligations which amounted to US$8 million as at Feb 1, 2023. The payment is due by close of business on Feb 3. Meanwhile, Charisma Energy was issued a notice of demand, as it had guaranteed to pay on demand as principal debtor all sums due and owing from Anchor Marine 3 under the facility agreement.

US

The Labor Department’s closely watched employment report showed that nonfarm payrolls surged by 517,000 jobs last month. Data for December was revised higher to show 260,000 jobs added instead of the previously reported 223,000. Average hourly earnings rose 0.3 per cent after gaining 0.4 per cent in December. That lowered the year-on-year increase in wages to 4.4 per cent from 4.8 per cent in December. Economists had forecasted a gain of 185,000 jobs and a 4.3 per cent year-on-year jump in wages. The report also showed unemployment edging down to 3.4 per cent, the lowest level since 1969.

Taiwan’s Foxconn, the world’s largest contract electronics maker and major iPhone assembler for Apple, said on Sunday (Feb 5) that revenue in January jumped 48.2 per cent year-on-year, as it shook off Covid disruptions in China. Revenue in January reached a record high, at NT$660.4 billion (S$29.2 billion), with operations returning to normal and shipments increasing at its Zhengzhou campus in China, a centre for iPhone production, the company said in a statement. Compared to the previous month, revenue was up 4.93 per cent with smart consumer electronics products, which includes smartphones, and computing products showing strong double-digit growth, it said.

Alphabet’s Google has invested almost US$400 million in artificial intelligence (AI) startup Anthropic, which is testing a rival to OpenAI’s ChatGPT, according to a person familiar with the deal. Google and Anthropic declined to comment on the investment but separately announced a partnership in which Anthropic will use Google’s cloud computing services. The deal gives Google a stake in Anthropic but doesn’t require the startup to spend the funds buying cloud services from Google.

Walt Disney is exploring the sale of more of its films and television series to rival media outlets as pressure grows to curb the losses in its streaming TV business. The Burbank, California-based entertainment giant is seeking to earn more cash from its content library, according to people familiar with the discussions who asked not to be identified as the talks are private. The move would represent a shift in strategy, as Disney has in recent years tried to keep much of its original programming exclusively on its Disney+ and Hulu streaming services.

Twitter will start sharing revenue from advertisements with some of its content creators, chief executive Elon Musk said on Friday (Feb 3). Effective Friday, revenue from ads that appear on a creator’s reply threads, will be shared. The user must be a subscriber of Blue Verified, Musk said. Musk, however, did not give details about the portion of revenue that would be shared with users. Twitter has seen advertisers flee amid worries about Musk’s approach to content moderation rules, impacting its revenue.

Source: SGX Masnet, Bloomberg, Channel NewsAsia, Reuters, CNBC, WSJ, The Business Times, PSR

RESEARCH REPORTS

Meta Platforms Inc. – Getting a grip on expenses

Recommendation : NEUTRAL (Downgraded); TP: US$182.00, Last Close: US$186.53

TAnalyst: Jonathan Woo

– 4Q22 revenue beat expectations by 3%, with adj. earnings (excl. US$4.2bn restructuring charges) beating by 58%. FY22 revenue/adj. PATMI at 101%/114% of our FY22e forecasts.

– Committed to streamlining costs moving forward, and focusing on improving efficiencies with AI. FY23e total expense guidance reduced by US$5bn, 5% YoY growth.

– Digital advertising outlook weak, Meta guided 1Q23e revenue contraction of -2% YoY.

– We downgrade to NEUTRAL with a raised DCF target price of US$182.00 (prev. US$113.00) to account for an expected 9% increase in EBITDA margins over the next 2 years due to a sharp reduction in expenses. We cut FY23e revenue by 13% on continued uncertainty in digital advertising demand, but also reduce FY23e CAPEX by 15%, and total expenses by 9% to reflect a slowdown in expenses. As a result, FY23e net margin is reduced to 22% (FY22: 20%). We reduce our WACC to 7.1% to account for an increase in debt in relation to equity, and maintain our terminal growth rate of 3.5%.

Apple Inc. – Hurt by supply constraints and FX

Recommendation : BUY (Maintained); TP: US$186.00, Last Close: US$154.50

Analyst: Maximilian Koeswoyo

– 1Q23 revenue/PATMI was a modest miss to our expectations at 28%/29% of our FY23e forecasts.

– Services was the fastest growing segment with 6.4% YoY rise despite the ~7% currency headwinds. Gross margin expanded by 70 basis points.

– 2Q23 guidance is for revenue YoY decline of around 5% with stronger QoQ gross margin.

– We cut our FY23e revenue by 5% and PATMI by 1% to account for expected decline in hardware revenue. We maintain a BUY rating with a lowered target price of US$186.00 (prev. US$190.00), with a WACC of 6.5%, and a terminal growth rate of 3%. Apple is facing currency headwinds and weaker hardware sales, namely Mac and wearables, from a softening macroeconomic environment. iPhone sales are expected to recover with supply chain normalizing and services continues to build up its user base with 150mn new subscriptions in 2022.

Singapore Banking Monthly – Interest rates growth plateau

Recommendation: OVERWEIGHT (Maintained)

Analyst: Glenn Thum

– January’s 3M-SORA was down by 3bps MoM to 3.05%, the first decline since August 2021.

– Singapore domestic loans dipped 0.30% YoY in December, below our estimates, while Hong Kong’s domestic loans declined 2.99% YoY in December. CASA balance dipped slightly to 20.4%.

– Our 4Q22e PATMI estimates are: DBS (S$2.02bn); UOB (S$1.59bn) and OCBC (S$2.03bn). We expect bank NIMs to rise another 34bps in 4Q22. Valuations for OCBC are the most attractive and could offer largest upside surprise from dividends.

• Maintain OVERWEIGHT. We remain positive on banks. Bank dividend yields are attractive at 5% with possible upside surprise due to excess capital ratios and push towards higher ROEs. SGX is another major beneficiary of higher interest rates [SGX SP, BUY, TP S$11.71].

Phillip Macro Update – Key Points for February FOMC Meeting

Analyst: Shawn Sng

– Interest rates – The US Federal Reserve (Fed) has increased its benchmark interest rate yet again, but this time by a modest 25bps to a range of 4.5% – 4.75%. This was in line with market expectation and was also being flagged out in the previous few speeches given by the board members. There was no dot plot graph being provided as it is published every quarter. The next dot plot graph will be available in the March meeting.

– Inflation remains elevated – Despite welcome data illustrating that the growth in recent months is starting to taper off, inflation still remains well above the targeted goal of 2%. (December Total PCE rose by 5% Y.o.Y; 0.5% M.o.M while core PCE which excludes food and energy prices rose by 4.4% Y.o.Y; 0.3% M.o.M). The Fed will require more substantial evidence that inflation is trending down sustainably before it could be confident in making any changes to its polices.

– Guidance – In terms of guidance, Fed chairman Jerome Powell said that there will be a couple of more rate hikes before reaching a level which the central bank deems is sufficiently restrictive. This, coupled with the indication of shifting to a slower pace, means that we will be facing a couple more similar-scale hikes in upcoming meetings and interest rates could be reaching a peak soon.

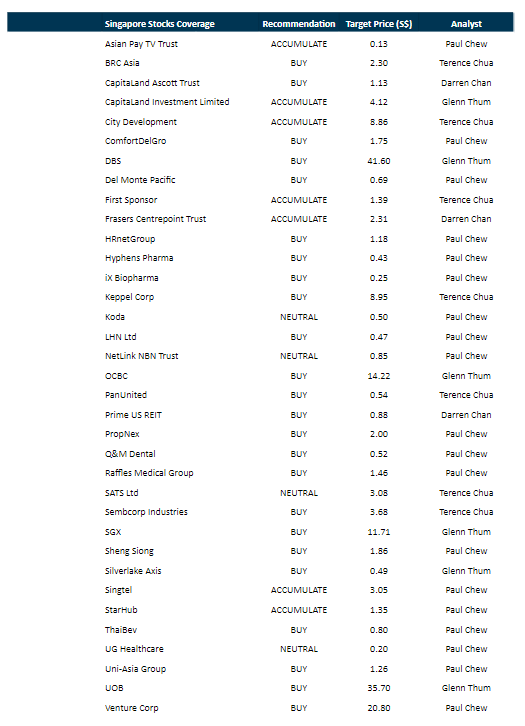

PSR Stocks Coverage

For more information, please visit:

Upcoming Webinars

Guest Presentation by LMS Compliance [NEW]

Date: 8 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3IX0pAr

Guest Presentation by Prime US REIT [NEW]

Date: 9 February 2023

Time: 1pm – 2pm

Register: http://bit.ly/3HmEzUI

Guest Presentation by Paragon REIT [NEW]

Date: 17 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3ZNn4W0

Guest Presentation by Keppel DC REIT [NEW]

Date: 17 February 2023

Time: 3pm – 4pm

Register: https://bit.ly/3CYgrGr

Guest Presentation by First REIT Management Limited [NEW]

Date: 23 February 2023

Time: 12pm – 1pm

Register: https://bit.ly/3GY2tp8

Research Videos

Weekly Market Outlook: Microsoft Corp, Netflix Inc, Technical Analysis, SG Weekly & More

Date: 30 January 2023

Click here for more on Market Outlook.

Sign up for our webinars here, and be among the first to receive economy and market updates.

PHILLIP RESEARCH IN 3 MINS

Phillip Research in 3 minutes: #29 Keppel Corporation; Initiation

Click here for more on Phillip in 3 mins.

Join our Singapore Equity Research Community on POEMS Mobile 3 App for the latest research reports, market updates, insights and more

Disclaimer

The information contained in this email and/or its attachment(s) is provided to you for information only and is not intended to or nor will it create/induce the creation of any binding legal relations. The information or opinions provided in this email do not constitute an investment advice, an offer or solicitation to subscribe for, purchase or sell the e investment product(s) mentioned herein. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise. You may wish to seek advice from an independent financial adviser before making a commitment to purchase or investing in the investment product(s) mentioned herein. In the event that you choose not to do so, you should consider whether the investment product(s) mentioned herein is suitable for you. PhillipCapital and any of its members will not, in any event, be liable to you for any direct/indirect or any other damages of any kind arising from or in connection with your reliance on any information in and/or materials attached to this email. The information and/or materials provided 揳s is?without warranty of any kind, either express or implied. In particular, no warranty regarding accuracy or fitness for a purpose is given in connection with such information and materials.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.

Follow our Socials