Daily Morning Note – 6 May 2022

Singapore shares finished the day lower on Thursday (May 5), after beginning the trading session on an upbeat note following the policy statement of the US Federal Open Market Committee (FOMC), which ruled out a jumbo 75 basis point rate hike in the coming meetings. The key Straits Times Index (STI) retreated 5.70 points or 0.17 per cent to 3,343.57, extending Wednesday’s marginal losses. Markets in Japan, South Korea and Indonesia were closed for holidays on Thursday. Key equity gauges in China, Taiwan and Australia made gains; Malaysia and Hong Kong finished lower.

Wall Street stocks suffered bruising losses on Thursday in a broad-based sell-off prompted by unease over shifting monetary policy and rising economic risks from inflation. The Dow Jones Industrial Average plunged more than 1,000 points, or 3.1 per cent, to 32,997.97, its worst day since June 2020. The broad-based S&P 500 slid 3.6 per cent to 4,146.87, while the tech-rich Nasdaq Composite Index tumbled 5.0 per cent to 12,317.69. The losses were a dramatic reversal from Wednesday, when stocks rallied after the Federal Reserve announced a half-point interest rate increase as expected, but ruled out a three-quarter point increase. While Wednesday’s outcome was not as hawkish as feared, the Fed’s announcement still embodies “one of the most aggressive tightening cycles that we have seen in decades,” said Angelo Kourkafas, investment strategist at Edward Jones. “It didn’t necessarily change the narrative that economic growth is slowing, while the Fed will tighten monetary policy at the at the fast pace,” Kourkafas said.

SG

Mainboard-listed AEM Holdings on Thursday (May 5) reported S$40.8 million in net profit for its first quarter ended Mar 31, 2022, more than tripling from its S$13.3 million profit recorded for the year-ago period. The increase in net profit comes on the back of a record quarterly revenue of S$261.9 million, which the electronic-services provider said was the highest in the group’s history, up from S$80.2 million a year ago. Revenue growth was mainly driven by the strong uptake in the group’s new-generation equipment and tools, and the consolidation of its subsidiary CEI, which the group acquired in H1 2021, AEM said. Earnings per share stood at 13.1 Singapore cents in Q1 2022, a 172.9 per cent year-on-year increase from 4.8 cents in Q1 2021. AEM said it has raised the group’s revenue guidance for the full financial year to between S$700 million and S$750 million.

Mainboard-listed SIA Engineering Co saw second-half earnings rebound on a writeback of associates’ tax provisions, its latest results showed on Thursday (May 5). But the maintenance, repair and overhaul service provider was still ringing up operating losses, with its full-year bottom line sustained only by what it called “substantial government wage support” – and the board warned of risks to its business outlook, despite early signs of recovery. Net profit surged to S$42.6 million for the 6 months to Mar 31, 2022, up from S$7.8 million before, as turnover grew by 37.5 per cent year on year, to S$302.6 million. The latest performance took SIAEC to a full-year net profit of S$67.6 million, reversing the loss of S$11.2 million in the year-ago period, as revenue rose by 27.8 per cent to S$566.1 million. Yet net profit was shored up by associate and joint venture contributions, which came to S$79.1 million for the 12 months. SIAEC had incurred a tax charge from its associates and joint ventures in the year-ago period, and an impairment provision on its base maintenance assets. SIAEC disclosed in its financial statements that the group would have recorded a full-year loss of S$25.9 million without the uplift from government wage support grants.

Mainboard-listed construction player Keong Hong Holdings is warning of an expected net loss for the 6 months to Mar 31, 2022, the board said in a profit guidance on Thursday (May 5). The expected first-half net loss was attributed “mainly to the continuation of labour shortages and rising business costs due to the Covid-19 pandemic”, according to the bourse filing. Keong Hong, which sank into the red in FY2020, had most recently reported a net loss of S$16.9 million for its financial year ended Sep 30, 2021. Still, the company said in a statement in March that it was “poised for recovery and ready for opportunities”, with an order book of S$482 million, after the close of a mandatory conditional cash offer by controlling shareholder LJHB Holdings. The board said that Keong Hong is finalising its first-half results, which will be out by May 15, 2022. Shareholders and potential investors are advised to exercise caution when dealing in its shares. Shares of Keong Hong last traded on May 4 at S$0.375, before the latest update.

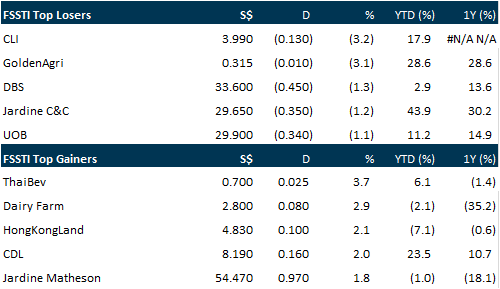

Thai Beverage is resuming the proposed spin-off and listing of its brewery unit BeerCo on the Singapore Exchange (SGX), which it had deferred due to the Covid-19 pandemic. Its wholly-owned subsidiary International Beverage Holdings, which holds all the issued ordinary shares of BeerCo, will conduct a public offering of up to 20 per cent of the total number of issued ordinary shares of BeerCo, the beer and liquor giant said. ThaiBev : Y92 +3.7% had in February 2021 received a no-objection letter from SGX for the proposed listing, but then deferred the proposed listing in April 2021 due to uncertain market conditions and a volatile outlook, exacerbated by the Covid-19 pandemic. In a bourse filing on Thursday (May 5), ThaiBev said it has received confirmation from SGX that the latter’s initial no-objection letter will continue to apply to the resumption of the proposed listing. BeerCo has 3 breweries in Thailand and a network of 26 breweries in Vietnam. Its business includes the production, distribution and sales of beer including the Chang and Bia Saigon brands. In its financial year ended Sep 30, 2021, BeerCo posted a profit after tax of S$342.5 million and revenue of S$4.2 billion.

US

Shopify missed analysts’ estimates for revenue and profit and announced a US$2.1 billion deal for startup Deliverr, the largest acquisition in its history. The Canadian e-commerce software firm reported adjusted earnings of 20 US cents per share, far short of analyst calls for 64 US cents, according to data compiled by Bloomberg. Revenue rose 22 per cent to US$1.2 billion from a year earlier, but could not meet analyst expectations of US$1.25 billion. The shares plunged 15 per cent to US$413 in premarket trading in New York as at 7.17 am. “While we’ve experienced massive macro shifts since the start of the pandemic, the one mainstay has been that Shopify is the commerce platform of choice for merchants in any environment, with the ability to support commerce on any surface,” said Shopify president Harley Finkelstein said in a statement. E-commerce stocks have been pummeled this earnings season, fuelling analyst concerns that online shopping is slowing from its torrid pace in the pandemic. Amazon.com suffered the biggest 1-day drop since July 2006 after it reported a weaker-than-expected revenue forecast. Etsy sunk in post-market trading on Wednesday (May 4) after reporting second quarter revenue that missed average analyst expectations. Gross merchandise volume, the value of merchant sales flowing through Shopify’s platform, grew 16 per cent in the first quarter from a year earlier to US$43.2 billion. Analysts, on average, expected US$46.5 billion.

Booking Holdings reported revenue in the first quarter that was better than analysts’ estimates, benefiting from pent-up demand for leisure travel. The US’s biggest online travel company reported revenue rose 136 per cent to US$2.7 billion in the 3 months ended Mar 31, while analysts projected US$2.54 billion. Gross bookings, which represent all travel services excluding cancellations, were US$27.3 billion, the highest quarterly amount ever for the company. That beat the average analyst estimate of US$25.39 billion, according to data compiled by Bloomberg. The shares jumped about 8 per cent in extended trading.

Oil prices edged up on Thursday on supply worries after the European Union (EU) laid out plans for new sanctions against Russia including an embargo on crude. Pressure from a stronger dollar and a drop in global stock markets, however, kept oil prices in check. Brent futures rose 76 cents, or 0.7 per cent, to settle at US$110.90 a barrel, while US West Texas Intermediate (WTI) crude rose 45 cents, or 0.4 per cent, to settle at US$108.26. That was the highest close for WTI since March 25 and the highest settle for Brent since April 18. US petrol futures, meanwhile, closed at their highest since settling at a record high on March 8. The US dollar rebounded to its highest since December 2002, a day after the Federal Reserve affirmed it would take aggressive steps to combat inflation.

Gold prices climbed on Thursday (May 5), as the Federal Reserve expectedly raised interest rates by 50 basis points to tackle inflation, which the US central bank highlighted as a risk to the economy while also ruling out larger hikes for the year. Spot gold was up 0.9 per cent at US$1,898.06 per ounce, as of 1.02 am GMT, after rising 1 per cent earlier in the session. US gold futures rose 1.4 per cent to US$1,894.20. The Federal Reserve on Wednesday raised its benchmark overnight interest rate by half a percentage point, the biggest jump in 22 years, and Fed Chair Jerome Powell made an appeal to Americans struggling with high inflation to be patient while officials take the hard measures to bring it under control. Gold is often perceived as a hedge against rising costs and jumped 1 per cent in the previous session on Powell’s statement. US Treasury yields fell sharply on Wednesday, supporting gold, after Powell said the central bank has ruled out, for now, a rate hike of three-quarters of a percentage point at upcoming monetary policy meetings. Higher short-term US interest rates and bond yields tend to increase the opportunity cost of holding bullion, which yields nothing.

Source: SGX Masnet, The Business Times, Bloomberg, Channel NewsAsia, Reuters, CNBC, PSR

Click the link to join: https://t.me/stocksbnb

Date: 25 April 2022

For any research-related matters, email: research@phillip.com.sg

For general enquiries, email: talktophillip@phillip.com.sg

or call 6531 1555.

Read the research report(s), available through the link(s) above, for complete information including important disclosures Important Information

Disclaimer

The information contained in this email is provided to you for general information only and is not intended to create any binding legal relation. The information or opinions provided in this email do not constitute investment advice, a recommendation, an offer or solicitation to subscribe for, purchase or sell any investment product. It does not have any regard to your specific investment objectives, financial situation and any of your particular needs. Accordingly, no warranty whatsoever is given and no liability whatsoever is accepted for any loss arising whether directly or indirectly as a result of this information. Investments are subject to investment risks including possible loss of the principal amount invested. The value of the product and the income from them may fall as well as rise.

You should obtain advice from a financial adviser before making a commitment to invest in any investment product or service. In the event that you choose not to obtain advice from a financial adviser, you should assess and consider whether the investment product or service is suitable for you before proceeding to invest.

Confidentiality Note

This e-mail and its attachment(s) may contain privileged or confidential information, which is intended only for the use of the recipient(s) named above. If you have received this message in error, please notify the sender immediately and delete all copies of it. If you are not the intended recipient, you must not read, use, copy, store, disseminate and/or disclose to any person this email and any of its attachment(s). PhillipCapital and its members will not accept legal responsibility for the contents of this message. Thank you for your cooperation.